1031 Exchange Land For Building

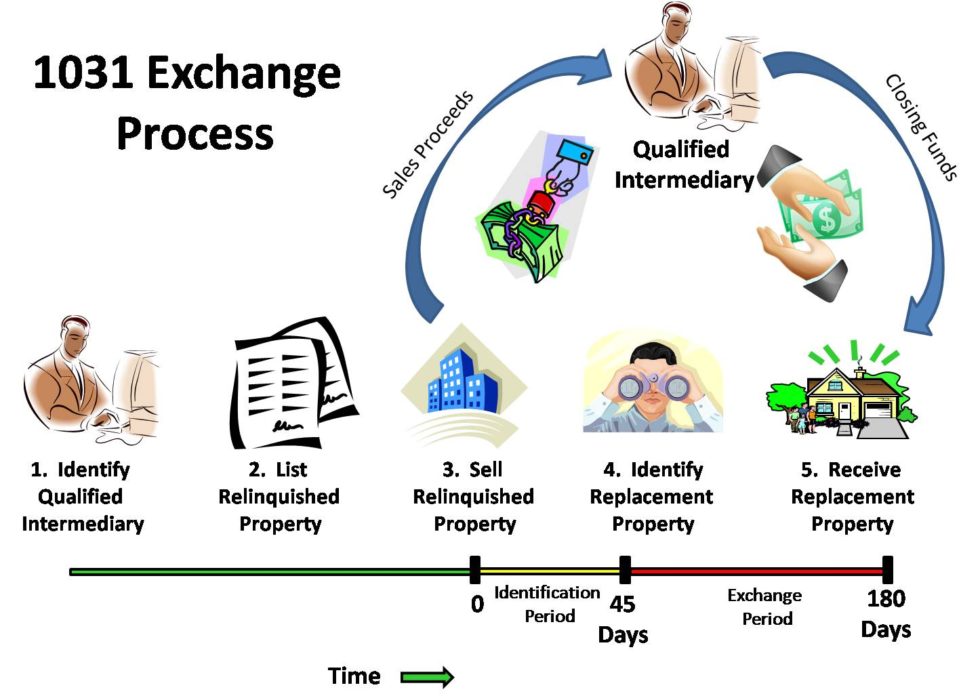

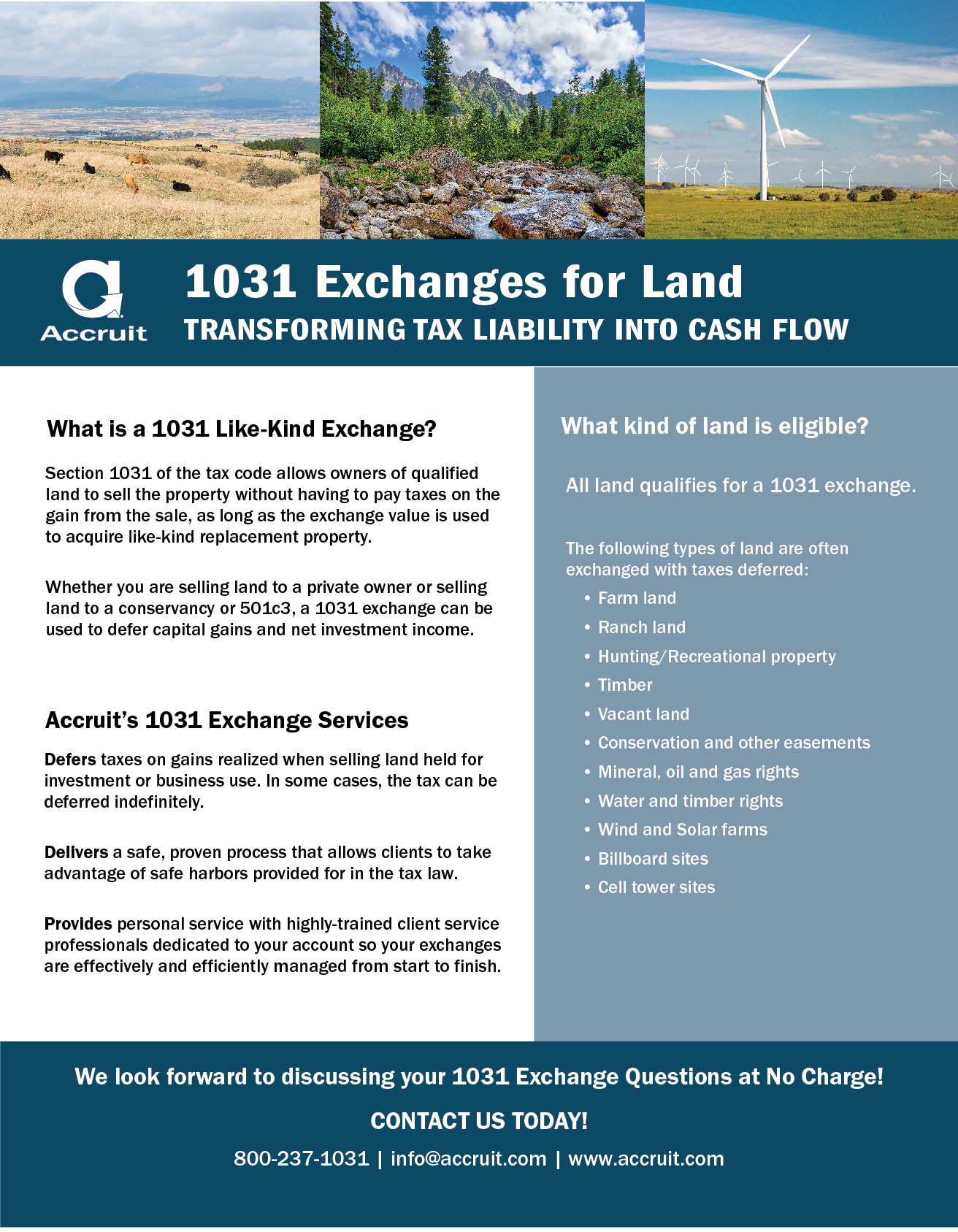

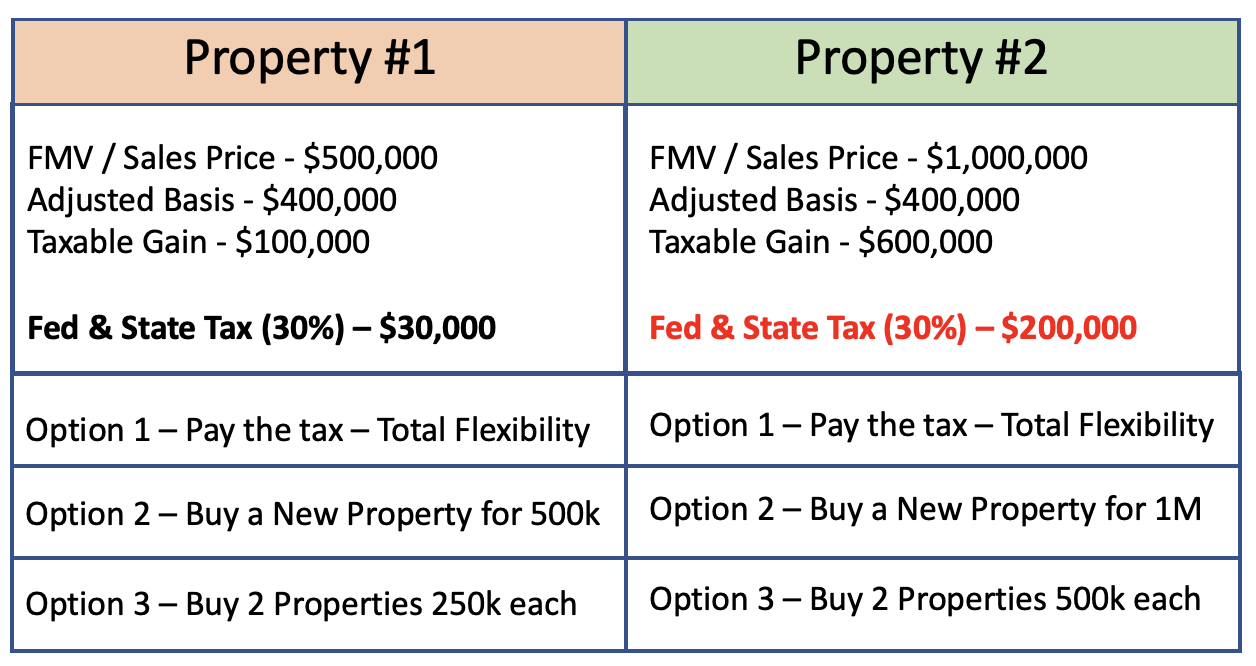

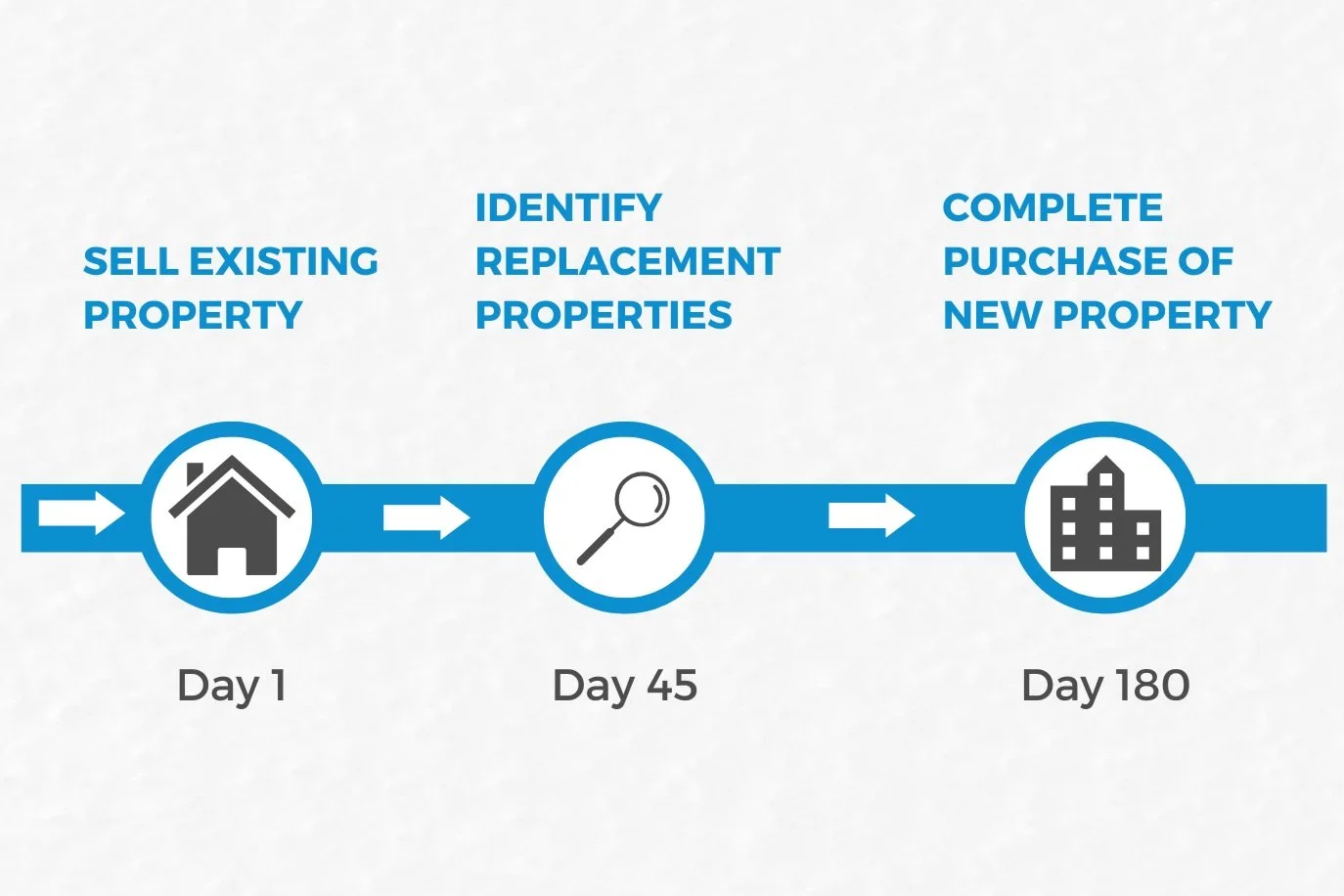

1031 Exchange Land For Building - Tax law that allows an investor to defer capital gains taxes when they sell a property and. To qualify as a section 1031 exchange, a deferred exchange must be distinguished from the case of a taxpayer simply selling one property and using the proceeds to purchase another property. If the value of the replacement asset is less, you could create a tax liability. In a typical build to suit tax deferred exchange, the taxpayer seeks to acquire replacement property owned by a third party and the eat acquires title to the replacement property and. It’s used by investors who are selling one property and reinvesting the proceeds in one or more other properties. Section 1031 is a provision in the united states internal revenue code that allows business owners of investment property to defer federal taxes on some exchange of real estate. A spectrum of investment properties, when leveraged properly, can benefit. What is a 1031 exchange? Preparing for a 1031 exchange with a primary residence involves careful planning. First, sell your current investment property—whether it’s a rental, commercial building, or anything held for. In order to qualify for a full benefit of section 1031, the new real estate purchase must have a value of at least $1,000,000, and carry at least $800,000 in mortgage. It’s used by investors who are selling one property and reinvesting the proceeds in one or more other properties. People with investment properties qualify for a 1031 exchange. What is a 1031 exchange? Alignment with illinois 1031 exchange rules is key to successfully deferring capital gains taxes on property sales. First, sell your current investment property—whether it’s a rental, commercial building, or anything held for. Section 1031 is a provision in the united states internal revenue code that allows business owners of investment property to defer federal taxes on some exchange of real estate. In a typical build to suit tax deferred exchange, the taxpayer seeks to acquire replacement property owned by a third party and the eat acquires title to the replacement property and. To qualify as a section 1031 exchange, a deferred exchange must be distinguished from the case of a taxpayer simply selling one property and using the proceeds to purchase another property. A 1031 exchange is an irc provision that allows real estate investors to exchange an investment or business property for another property of equal or greater value and defer paying capital. In a typical build to suit tax deferred exchange, the taxpayer seeks to acquire replacement property owned by a third party and the eat acquires title to the replacement property and. First, sell your current investment property—whether it’s a rental, commercial building, or anything held for. In order to qualify for a full benefit of section 1031, the new real. Tax law that allows an investor to defer capital gains taxes when they sell a property and. Checklist for a 1031 exchange involving a primary residence. In a typical build to suit tax deferred exchange, the taxpayer seeks to acquire replacement property owned by a third party and the eat acquires title to the replacement property and. Exchange of property. A spectrum of investment properties, when leveraged properly, can benefit. It’s used by investors who are selling one property and reinvesting the proceeds in one or more other properties. You could swap a small office building for a piece of land or an apartment complex for a retail store. If you’re looking to 1031 exchange into land, here’s an overview. Preparing for a 1031 exchange with a primary residence involves careful planning. To qualify for a 1031, the exchanged properties must be “held for productive use in a trade, or business, or for investment.” here’s a closer look at what this means: First, sell your current investment property—whether it’s a rental, commercial building, or anything held for. A 1031 exchange. What is a 1031 exchange? People with investment properties qualify for a 1031 exchange. Preparing for a 1031 exchange with a primary residence involves careful planning. A 1031 exchange is an irc provision that allows real estate investors to exchange an investment or business property for another property of equal or greater value and defer paying capital. To qualify for. First, sell your current investment property—whether it’s a rental, commercial building, or anything held for. To qualify as a section 1031 exchange, a deferred exchange must be distinguished from the case of a taxpayer simply selling one property and using the proceeds to purchase another property. Exchange of property held for productive use or investment text contains those laws in. If the value of the replacement asset is less, you could create a tax liability. Exchange of property held for productive use or investment text contains those laws in effect on january 8, 2008. In a typical build to suit tax deferred exchange, the taxpayer seeks to acquire replacement property owned by a third party and the eat acquires title. What is a 1031 exchange? You could swap a small office building for a piece of land or an apartment complex for a retail store. In order to qualify for a full benefit of section 1031, the new real estate purchase must have a value of at least $1,000,000, and carry at least $800,000 in mortgage. To qualify as a. In a typical build to suit tax deferred exchange, the taxpayer seeks to acquire replacement property owned by a third party and the eat acquires title to the replacement property and. Preparing for a 1031 exchange with a primary residence involves careful planning. It’s used by investors who are selling one property and reinvesting the proceeds in one or more. Alignment with illinois 1031 exchange rules is key to successfully deferring capital gains taxes on property sales. Tax law that allows an investor to defer capital gains taxes when they sell a property and. A 1031 exchange is an irc provision that allows real estate investors to exchange an investment or business property for another property of equal or greater. In a typical build to suit tax deferred exchange, the taxpayer seeks to acquire replacement property owned by a third party and the eat acquires title to the replacement property and. Preparing for a 1031 exchange with a primary residence involves careful planning. If you’re looking to 1031 exchange into land, here’s an overview of the process. Alignment with illinois 1031 exchange rules is key to successfully deferring capital gains taxes on property sales. Section 1031 is a provision in the united states internal revenue code that allows business owners of investment property to defer federal taxes on some exchange of real estate. A spectrum of investment properties, when leveraged properly, can benefit. In order to qualify for a full benefit of section 1031, the new real estate purchase must have a value of at least $1,000,000, and carry at least $800,000 in mortgage. To qualify as a section 1031 exchange, a deferred exchange must be distinguished from the case of a taxpayer simply selling one property and using the proceeds to purchase another property. It’s used by investors who are selling one property and reinvesting the proceeds in one or more other properties. What is a 1031 exchange? To qualify for a 1031, the exchanged properties must be “held for productive use in a trade, or business, or for investment.” here’s a closer look at what this means: People with investment properties qualify for a 1031 exchange. Exchange of property held for productive use or investment text contains those laws in effect on january 8, 2008. If the value of the replacement asset is less, you could create a tax liability. A 1031 exchange is an irc provision that allows real estate investors to exchange an investment or business property for another property of equal or greater value and defer paying capital.What Is A 1031 Exchange? (in Real Estate) — The Cauble Group

1031 Exchanges for Rental Investment Properties

1031 Exchange What You Need to Know Stu Simone's Rock Real Estate

1031 Exchanges for Land

What's Behind IRC Section 1031 Exchanges

1031 Exchanges Fuel for Real Estate and the Economy

What Does a 1031 Exchange Mean and How is it Beneficial for Landlords?

BuildtoSuit 1031 Exchanges

1031 Exchange Rules How Does 1031 Exchange Work?

When and How to use the 1031 Exchange Mark J. Kohler

First, Sell Your Current Investment Property—Whether It’s A Rental, Commercial Building, Or Anything Held For.

Checklist For A 1031 Exchange Involving A Primary Residence.

You Could Swap A Small Office Building For A Piece Of Land Or An Apartment Complex For A Retail Store.

Tax Law That Allows An Investor To Defer Capital Gains Taxes When They Sell A Property And.

Related Post:

.jpg)