5 Credit Builder

5 Credit Builder - Recommended by 99% of reviewers. Make small purchases on your business credit card and pay them off in full every month to build a solid credit history. Credit builder programs are designed to help individuals build their credit by providing them with a loan (or secured credit card) and utilizing the payments on that loan to. In this article, review how a credit builder loan works, the pros and cons, and. With piñata, you can build your credit score and earn monthly points to redeem from our curated rewards—all for just $5 a month. The best credit builder loans allow people with poor credit to improve their score at minimal cost. Use it everywhere visa® credit cards are accepted. It offers long repayment terms and a variety of loan options. Read on for our reviews of the best credit builder loans, along with a comprehensive guide to how they work and how to apply for one. Key selling points include its unusually high borrowing limits and wide variety of loan and credit line. Use it everywhere visa® credit cards are accepted. In this article, review how a credit builder loan works, the pros and cons, and. Save money every month in your creditup account while at the same time building a solid credit history. Credit builder programs are designed to help individuals build their credit by providing them with a loan (or secured credit card) and utilizing the payments on that loan to. Build all your credit scores at all 4 credit bureaus. Make small purchases on your business credit card and pay them off in full every month to build a solid credit history. Credit builder plus membership ($19.99/mo) unlocks eligibility for credit builder loans and other exclusive services. Apply for a business line of credit or loan. Read on for our reviews of the best credit builder loans, along with a comprehensive guide to how they work and how to apply for one. Ideally, you want to have very. Building or repairing credit takes time, but our credit builder loan can help you get started while also boosting your savings. Credit builder loans have an annual percentage rate (apr) ranging from. Recommended by 99% of reviewers. A strong credit score means better deals on car leases, credit. What’s important is how much debt you have to available credit. Creditstrong is our choice for best credit builder loan provider. Credit builder programs are designed to help individuals build their credit by providing them with a loan (or secured credit card) and utilizing the payments on that loan to. It offers long repayment terms and a variety of loan options. Use it everywhere visa® credit cards are accepted. Rated 4.9. Creditstrong is our choice for best credit builder loan provider. Save money every month in your creditup account while at the same time building a solid credit history. Here are 7 easy credit builders to improve your credit score fast. Build all your credit scores at all 4 credit bureaus. Key selling points include its unusually high borrowing limits and. The best credit builder loans allow people with poor credit to improve their score at minimal cost. Ideally, you want to have very. Key selling points include its unusually high borrowing limits and wide variety of loan and credit line. Apply for a business line of credit or loan. In this article, review how a credit builder loan works, the. As soon as we have everything we need from both of you, we'll transfer the money. Building or repairing credit takes time, but our credit builder loan can help you get started while also boosting your savings. Recommended by 99% of reviewers. In this article, review how a credit builder loan works, the pros and cons, and. With piñata, you. Building or repairing credit takes time, but our credit builder loan can help you get started while also boosting your savings. Build all your credit scores at all 4 credit bureaus. Read on for our reviews of the best credit builder loans, along with a comprehensive guide to how they work and how to apply for one. Key selling points. Save money every month in your creditup account while at the same time building a solid credit history. Rated 4.9 stars by customers. A strong credit score means better deals on car leases, credit. Recommended by 99% of reviewers. Make small purchases on your business credit card and pay them off in full every month to build a solid credit. Use it everywhere visa® credit cards are accepted. The best credit builder loans allow people with poor credit to improve their score at minimal cost. It offers long repayment terms and a variety of loan options. Creditstrong is our choice for best credit builder loan provider. We send you a unique link for your cosigner to register. Building or repairing credit takes time, but our credit builder loan can help you get started while also boosting your savings. What’s important is how much debt you have to available credit. Credit builder loans have an annual percentage rate (apr) ranging from. A strong credit score means better deals on car leases, credit. Read on for our reviews of. It offers long repayment terms and a variety of loan options. Apply for a business line of credit or loan. The best credit builder loans allow people with poor credit to improve their score at minimal cost. With piñata, you can build your credit score and earn monthly points to redeem from our curated rewards—all for just $5 a month.. Credit builder loans have an annual percentage rate (apr) ranging from. Creditstrong is our choice for best credit builder loan provider. Building or repairing credit takes time, but our credit builder loan can help you get started while also boosting your savings. It offers long repayment terms and a variety of loan options. In this article, review how a credit builder loan works, the pros and cons, and. Use it everywhere visa® credit cards are accepted. Build all your credit scores at all 4 credit bureaus. We send you a unique link for your cosigner to register. Rated 4.9 stars by customers. Apply for a business line of credit or loan. Read on for our reviews of the best credit builder loans, along with a comprehensive guide to how they work and how to apply for one. The best credit builder loans allow people with poor credit to improve their score at minimal cost. A strong credit score means better deals on car leases, credit. Key selling points include its unusually high borrowing limits and wide variety of loan and credit line. What’s important is how much debt you have to available credit. Make small purchases on your business credit card and pay them off in full every month to build a solid credit history.Top 5+ Best Business Credit Builder Programs And Services raymond

FREE Credit Builder List

BOOST Your Credit Score! 50+ Points! 5 "Credit Builder" Accounts You

What a Credit Builder Card is, and Why You Need One — Grow Credit Blog

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

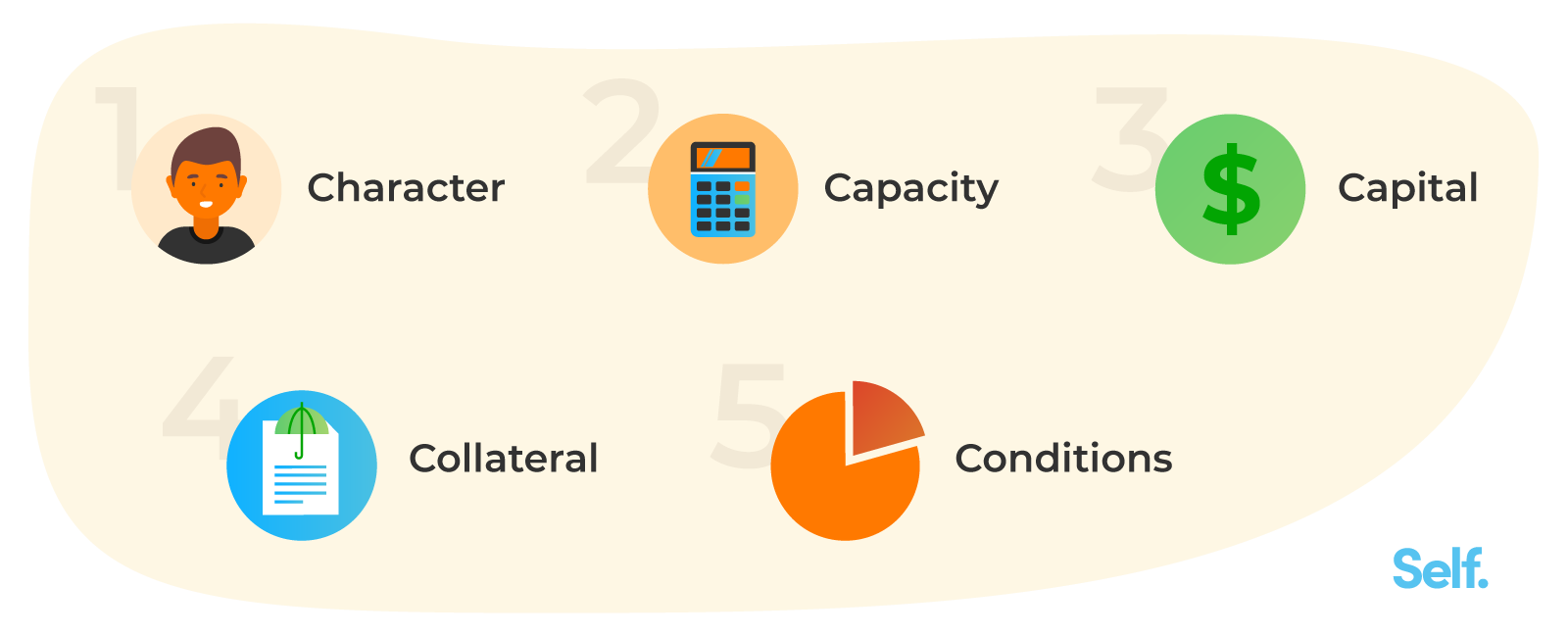

What are the 5 C's of Credit? Self. Credit Builder.

What a Credit Builder Card is, and Why You Need One — Grow Credit Blog

How to Build Credit Self. Credit Builder. (2024)

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

DIY Credit Builder Beginners' Guide to Building Credit by Kendyl

Credit Builder Programs Are Designed To Help Individuals Build Their Credit By Providing Them With A Loan (Or Secured Credit Card) And Utilizing The Payments On That Loan To.

Credit Builder Plus Membership ($19.99/Mo) Unlocks Eligibility For Credit Builder Loans And Other Exclusive Services.

Save Money Every Month In Your Creditup Account While At The Same Time Building A Solid Credit History.

As Soon As We Have Everything We Need From Both Of You, We'll Transfer The Money.

Related Post: