500 Credit Builder Loan Online

500 Credit Builder Loan Online - Our credit builder loan holds the amount that you. The average cost of an online management information systems (mis) program varies significantly depending on the institution and location. With a traditional loan, you receive the money you borrowed upfront and pay it back over time. We provide the money from $500 to $2,000, also known as collateral, to you. Loan amount of $500 to $3,000 is held in a secured savings account as you make payments. $500 loans are almost guaranteed for people with little debt, a solid income, and pristine credit. These borrowers will also receive the best terms and the lowest interest rate on. You choose a monthly payment of either $25, $35, $48 or $150. In this article, review how a credit builder loan works, the pros and cons, and. Build or rebuild your credit score and save while you borrow.1. In this article, review how a credit builder loan works, the pros and cons, and. The sunrise banks credit builder program can help you build your credit while establishing a strong payment history. Don’t worry about having little to no. We provide the money from $500 to $2,000, also known as collateral, to you. Credit builder loans have an annual percentage rate (apr) ranging from 5.99% apr to 29.99% apr, are offered by affiliates of moneylion and subject to approval. We can help you kickstart your journey to better credit with our creditbuilder program. The best credit builder loans allow people with poor credit to improve their score at minimal cost. $500 loans are almost guaranteed for people with little debt, a solid income, and pristine credit. Start or rewrite your credit story with the credit builder loan. Our credit builder loan holds the amount that you. Loans up from $500 to $2,000. Apply for a credit builder loan. With a traditional loan, you receive the money you borrowed upfront and pay it back over time. You choose a monthly payment of either $25, $35, $48 or $150. The average cost of an online management information systems (mis) program varies significantly depending on the institution and location. The average cost of an online management information systems (mis) program varies significantly depending on the institution and location. Don’t worry about having little to no. We provide the money from $500 to $2,000, also known as collateral, to you. Loans up from $500 to $2,000. Build or rebuild your credit score and save while you borrow.1. Start or rewrite your credit story with the credit builder loan. Loan terms up to 24 months. Turning a bad credit profile into a good one doesn’t happen overnight, but it is possible with a credit builder loan from usalliance! Credit builder loans have an annual percentage rate (apr) ranging from 5.99% apr to 29.99% apr, are offered by affiliates. As you make monthly loan payments, you build your credit history and we release the money to you to use. In this article, review how a credit builder loan works, the pros and cons, and. We provide the money from $500 to $2,000, also known as collateral, to you. Start or rewrite your credit story with the credit builder loan.. These borrowers will also receive the best terms and the lowest interest rate on. Start or rewrite your credit story with the credit builder loan. Loan amount of $500 to $3,000 is held in a secured savings account as you make payments. In this article, review how a credit builder loan works, the pros and cons, and. You choose a. Credit builder offers can help you turn things around, giving you the chance to build the solid credit history you need for bigger financial moves. Loans up from $500 to $2,000. Turning a bad credit profile into a good one doesn’t happen overnight, but it is possible with a credit builder loan from usalliance! These borrowers will also receive the. The average cost of an online management information systems (mis) program varies significantly depending on the institution and location. In this article, review how a credit builder loan works, the pros and cons, and. Loan terms up to 24 months. Loans up from $500 to $2,000. Loan amount of $500 to $3,000 is held in a secured savings account as. Start or rewrite your credit story with the credit builder loan. Apply for a credit builder loan. You choose a monthly payment of either $25, $35, $48 or $150. Ready to take control of your financial future? We provide the money from $500 to $2,000, also known as collateral, to you. These borrowers will also receive the best terms and the lowest interest rate on. The best credit builder loans allow people with poor credit to improve their score at minimal cost. The average cost of an online management information systems (mis) program varies significantly depending on the institution and location. Start or rewrite your credit story with the credit builder. With a traditional loan, you receive the money you borrowed upfront and pay it back over time. $500 loans are almost guaranteed for people with little debt, a solid income, and pristine credit. You choose a monthly payment of either $25, $35, $48 or $150. Don’t worry about having little to no. In this article, review how a credit builder. Don’t worry about having little to no. These borrowers will also receive the best terms and the lowest interest rate on. Start or rewrite your credit story with the credit builder loan. We can help you kickstart your journey to better credit with our creditbuilder program. Whether you have no credit or low credit, we’ve created. Credit builder offers can help you turn things around, giving you the chance to build the solid credit history you need for bigger financial moves. In this article, review how a credit builder loan works, the pros and cons, and. Loan terms up to 24 months. We provide the money from $500 to $2,000, also known as collateral, to you. As you make monthly loan payments, you build your credit history and we release the money to you to use. The sunrise banks credit builder program can help you build your credit while establishing a strong payment history. $500 loans are almost guaranteed for people with little debt, a solid income, and pristine credit. The best credit builder loans allow people with poor credit to improve their score at minimal cost. The average cost of an online management information systems (mis) program varies significantly depending on the institution and location. Turning a bad credit profile into a good one doesn’t happen overnight, but it is possible with a credit builder loan from usalliance! You choose a monthly payment of either $25, $35, $48 or $150.How long does credit builder take to work? Leia aqui How fast can you

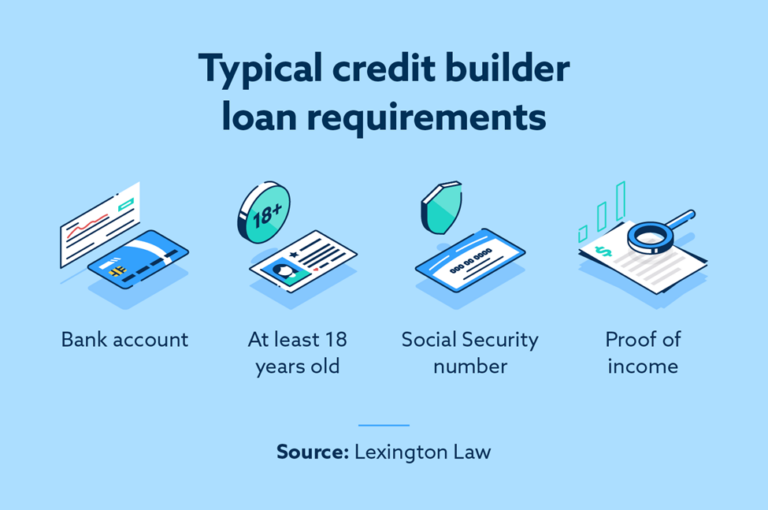

What Is a Credit Builder Loan and Is It for You? Lexington Law

500 Credit Builder Loans for Small Business Owners Now Available from

6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]

5 Best Credit Builder Loans in 2023 No Credit Check

9 Loans & Credit Cards 450 to 500 Credit Score (2024)

What is a Credit Builder Loan and How Does it Work?

6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]

Boosting Job Prospects with a 500 Credit Builder Loan

Credit Builder Loan What They Are and How They Work

Our Credit Builder Loan Holds The Amount That You.

Build Or Rebuild Your Credit Score And Save While You Borrow.1.

Credit Builder Loans Have An Annual Percentage Rate (Apr) Ranging From 5.99% Apr To 29.99% Apr, Are Offered By Affiliates Of Moneylion And Subject To Approval.

Loan Amount Of $500 To $3,000 Is Held In A Secured Savings Account As You Make Payments.

Related Post:

![6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]](https://digitalhoney.money/wp-content/uploads/2021/08/image-1-1024x727.png)

![6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]](https://digitalhoney.money/wp-content/uploads/2021/08/image.png)