6 Month Credit Builder Loan

6 Month Credit Builder Loan - Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. Make your payments on time. Once you have paid off the loan, the funds are yours to spend as needed (or continue to save!) loan details. These funds can be deposited into your account or rolled over into our. These lenders offer competitive interest rates, loan amounts ranging. If you need help building, rebuilding or establishing credit, applying for a credit builder cd loan can help. After the 6 months, you'll have saved $500! A 6 month credit builder loan is a type of installment loan designed to help consumers with limited credit or poor credit scores. Our credit building options are a safe. Compare 13 options to improve your credit score in 6 months or less, including credit builder loans, buy now, pay later plans, and credit lines. Learn the pros and cons of each option,. Our credit building options are a safe. Find out how they work, their interest rates, fees, terms and benefits for your credit score. You apply for a small. A 6 month credit builder loan is a type of installment loan designed to help consumers with limited credit or poor credit scores. If you need help building, rebuilding or establishing credit, applying for a credit builder cd loan can help. Make monthly payments on time to build your credit history; You make payments before you receive your funds, versus receiving funds and making payments like you would. Most loans are $300 to $1,000 with a term of. Credit builder loans have an annual percentage rate. Find out how they work, their interest rates, fees, terms and benefits for your credit score. Our credit building options are a safe. Here’s a breakdown of how they. Compare 13 options to improve your credit score in 6 months or less, including credit builder loans, buy now, pay later plans, and credit lines. Make your payments on time. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. You apply for a small. Learn the pros and cons of each option,. You make payments before you receive your funds, versus receiving funds and making payments like you would. A 6 month credit builder loan is a. In other words, it’s a personal loan to build credit. Compare 13 options to improve your credit score in 6 months or less, including credit builder loans, buy now, pay later plans, and credit lines. These lenders offer competitive interest rates, loan amounts ranging. Learn the pros and cons of each option,. Build your payment history with our credit building. In other words, it’s a personal loan to build credit. If you need help building, rebuilding or establishing credit, applying for a credit builder cd loan can help. Our credit building options are a safe. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. These funds can. Compare 13 options to improve your credit score in 6 months or less, including credit builder loans, buy now, pay later plans, and credit lines. Most loans are $300 to $1,000 with a term of. Apply for the credit builder cd loan, up to $2,000, from fccu. After the 6 months, you'll have saved $500! Make monthly payments on time. These funds can be deposited into your account or rolled over into our. Apply for the credit builder cd loan, up to $2,000, from fccu. After the 6 months, you'll have saved $500! Find out how they work, their interest rates, fees, terms and benefits for your credit score. Once you have paid off the loan, the funds are yours. Find out how they work, their interest rates, fees, terms and benefits for your credit score. Credit builder loans have an annual percentage rate. After the 6 months, you'll have saved $500! These funds can be deposited into your account or rolled over into our. Here’s a breakdown of how they. Learn the pros and cons of each option,. These funds can be deposited into your account or rolled over into our. Make monthly payments on time to build your credit history; Our credit building options are a safe. Find out how they work, their interest rates, fees, terms and benefits for your credit score. Apply for the credit builder cd loan, up to $2,000, from fccu. Our credit building options are a safe. A 6 month credit builder loan is a type of installment loan designed to help consumers with limited credit or poor credit scores. Compare 13 options to improve your credit score in 6 months or less, including credit builder loans, buy. Find out how they work, their interest rates, fees, terms and benefits for your credit score. Apply for the credit builder cd loan, up to $2,000, from fccu. These lenders offer competitive interest rates, loan amounts ranging. After the 6 months, you'll have saved $500! You apply for a small. If you need help building, rebuilding or establishing credit, applying for a credit builder cd loan can help. Once you have paid off the loan, the funds are yours to spend as needed (or continue to save!) loan details. You make payments before you receive your funds, versus receiving funds and making payments like you would. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. Find out how they work, their interest rates, fees, terms and benefits for your credit score. Make your payments on time. Compare 13 options to improve your credit score in 6 months or less, including credit builder loans, buy now, pay later plans, and credit lines. These lenders offer competitive interest rates, loan amounts ranging. Most loans are $300 to $1,000 with a term of. A 6 month credit builder loan is a type of installment loan designed to help consumers with limited credit or poor credit scores. Build your payment history with our credit building loans or credit cards, or use your savings to secure a loan while you make payments each month. You apply for a small. Our credit building options are a safe. Apply for the credit builder cd loan, up to $2,000, from fccu. Make monthly payments on time to build your credit history; In other words, it’s a personal loan to build credit.What is a Credit Builder Loan and Do They Work? Lexington Law

CreditBuilder Loan A Loan Designed to Build, Improve, or Rebuild Your

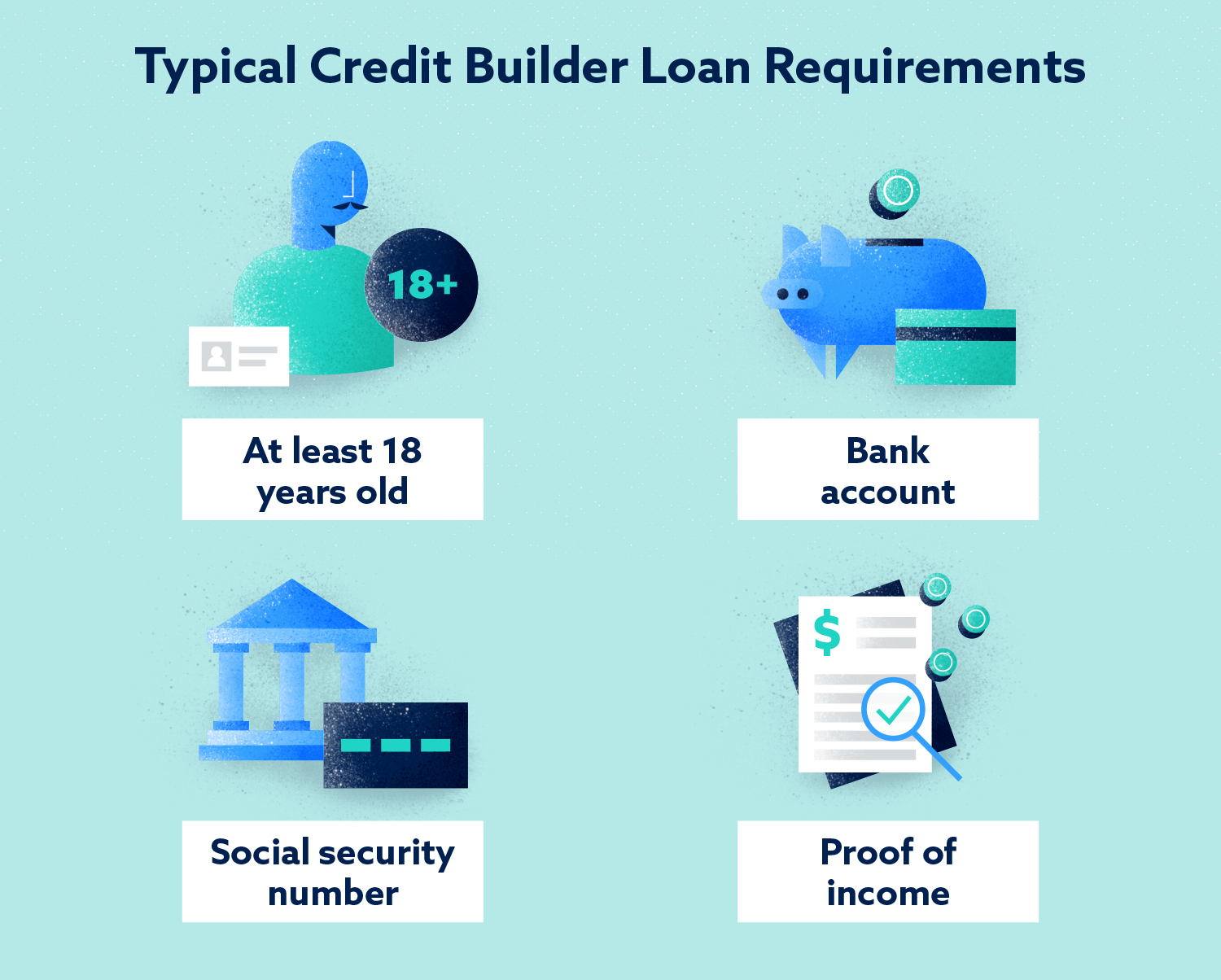

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

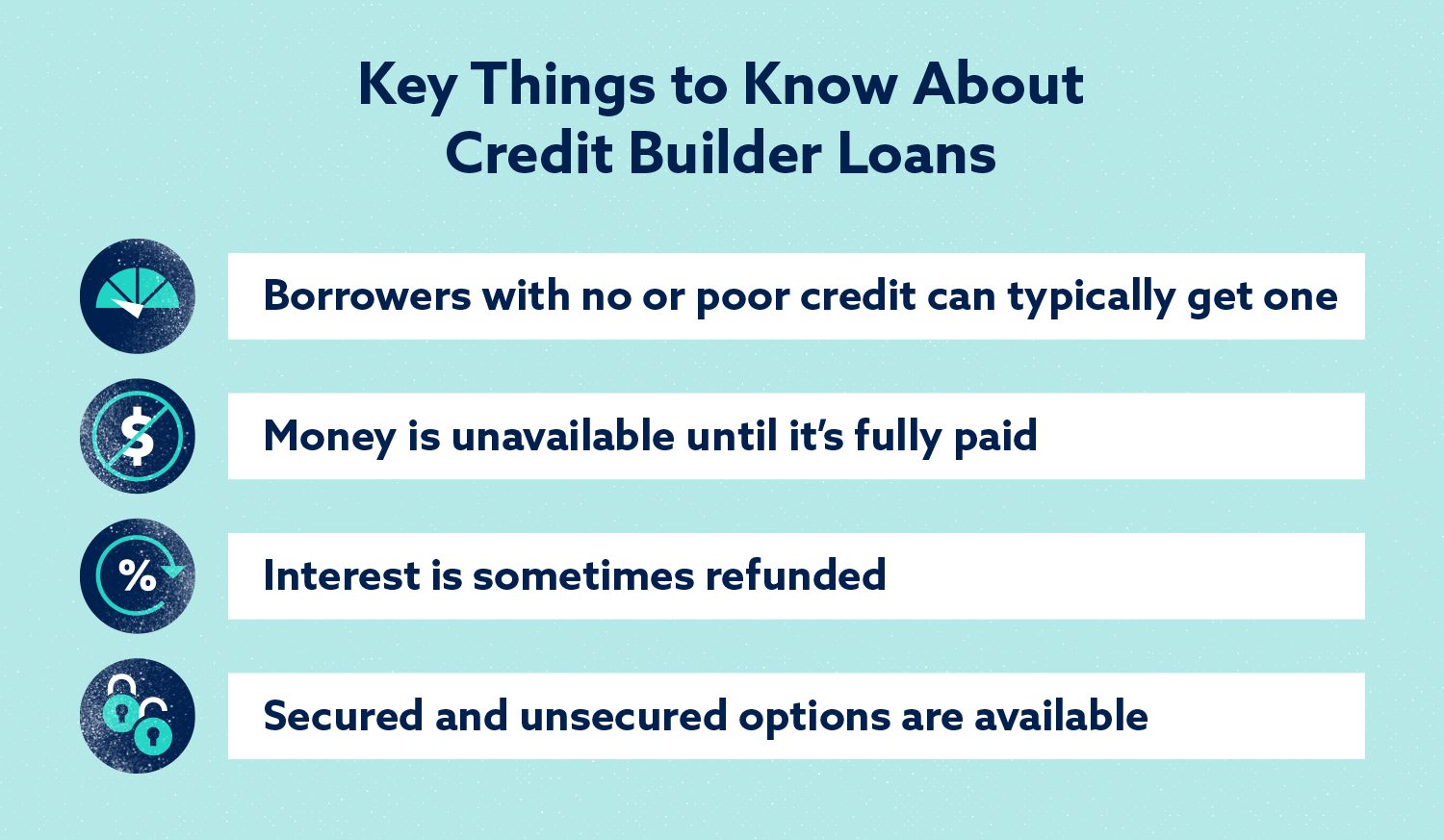

Credit Builder Loan What They Are and How They Work

5 Best Credit Builder Loans in 2023 No Credit Check

Self Credit Builder Loan Review for 2022 No Credit Check

6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

What is a Credit Builder Loan and Do They Work? Lexington Law

Learn The Pros And Cons Of Each Option,.

After The 6 Months, You'll Have Saved $500!

Here’s A Breakdown Of How They.

Credit Builder Loans Have An Annual Percentage Rate.

Related Post:

![6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]](https://digitalhoney.money/wp-content/uploads/2021/08/image-4-1536x852.png)