A Way To Build Good Credit Is Brainly

A Way To Build Good Credit Is Brainly - To build credit, it’s important to practice good financial habits and monitor your credit routinely. Creating good credit habits is the foundation of building and maintaining a strong credit score. To build good credit, the most effective method is to consistently pay bills when they are due (option c). Your credit score will decline if your credit limit is decreased. Among the options provided, the best way to build good credit is by paying bills when they are. The correct way to build good credit is by paying bills on time, which establishes a positive payment history and shows reliability to lenders. Keeping your credit utilization low and managing credit. Study with quizlet and memorize flashcards containing terms like 10 ways that'll help build good credit, why is becoming an authorized user on your parents' account good, how old do you. Paying bills when they are due. Spend money and settle the balance each month. Paying bills on time is the most effective way to build good credit. Study with quizlet and memorize flashcards containing terms like a credit score is based in part on, what is a benefit of obtaining a personal loan?, which describes an example of using. Using secured loans and managing credit cards wisely can also contribute to a positive credit history. Here are nine things you can do to keep your credit in good standing as the months turn to years. Spend money and settle the balance each month. Your credit score will decline if your credit limit is decreased. Keeping credit utilization low is equally important for maintaining a strong credit score. A way to build good credit is: Paying bills when they are due. Creating good credit habits is the foundation of building and maintaining a strong credit score. Taking out many lines of credit. Taking out many lines of credit. This demonstrates financial responsibility, which positively influences. Here are nine things you can do to keep your credit in good standing as the months turn to years. Paying all bills on time is paramount for maintaining good. A way to build good credit is: Keep your balance to limit ratio. Study with quizlet and memorize flashcards containing terms like what is a benefit of obtaining a personal loan?, which describes the difference between secured and unsecured credit?,. The correct way to build good credit is by paying bills on time, which establishes a positive payment history and. To build credit, it’s important to practice good financial habits and monitor your credit routinely. A way to build good credit is. Taking out many lines of credit. Paying bills when they are due. Taking out many lines of credit. The best way to build good credit is by paying bills on time, which significantly influences your credit score. Paying bills when they are due. Keep your balance to limit ratio. Paying all bills on time is paramount for maintaining good. Keeping your credit utilization low and managing credit. Study with quizlet and memorize flashcards containing terms like a credit score is based in part on, what is a benefit of obtaining a personal loan?, which describes an example of using. Keeping your credit utilization low and managing credit. Paying bills when they are due. Using secured loans and managing credit cards wisely can also contribute to a positive. Here are a few tips on how to establish those habits. A way to build good credit is. Building good credit is crucial for financial health and future borrowing potential. Taking out many lines of credit. Taking out many lines of credit. Among the options provided, the best way to build good credit is by paying bills when they are. Building good credit is crucial for financial health and future borrowing potential. A way to build good credit is: The best way to build good credit is by paying bills on time, which significantly influences your credit score. Keeping credit utilization low. Taking out many lines of credit. Among the options provided, the best way to build good credit is by paying bills when they are. This demonstrates financial responsibility, which positively influences. Paying all bills on time is paramount for maintaining good. Using secured loans and managing credit cards wisely can also contribute to a positive credit history. The correct way to build good credit is by paying bills on time, which establishes a positive payment history and shows reliability to lenders. Here are a few tips on how to establish those habits. Paying bills when they are due. Building good credit is crucial for financial health and future borrowing potential. This demonstrates financial responsibility, which positively influences. Paying bills when they are due. A way to build good credit is. Your credit score will decline if your credit limit is decreased. To build good credit, the most effective method is to consistently pay bills when they are due (option c). This demonstrates financial responsibility, which positively influences. Taking out many lines of credit. The correct way to build good credit is by paying bills on time, which establishes a positive payment history and shows reliability to lenders. A way to build good credit is using only secured loans. Study with quizlet and memorize flashcards containing terms like what is a benefit of obtaining a personal loan?, which describes the difference between secured and unsecured credit?,. Keeping credit utilization low is equally important for maintaining a strong credit score. A way to build good credit is: Building good credit is crucial for financial health and future borrowing potential. To build good credit, the most effective method is to consistently pay bills when they are due (option c). One way to build credit is to use a credit card responsibly by doing things like paying your. Using secured loans and managing credit cards wisely can also contribute to a positive credit history. Study with quizlet and memorize flashcards containing terms like 10 ways that'll help build good credit, why is becoming an authorized user on your parents' account good, how old do you. The best way to build good credit is by paying bills on time, which significantly influences your credit score. Paying bills when they are due. Your credit score will decline if your credit limit is decreased. Taking out many lines of credit. Paying bills when they are due.7 Ways to Establish Good Credit — Post Office Employees Credit Union

Great Ways to Build Your Credit — Nonprofit Financial Services

7 smart ways to Build Good Credit Ways to build credit, Build credit

Five Ways to Establish Good Credit New York School of Career and

7 Ways to Establish Good Credit

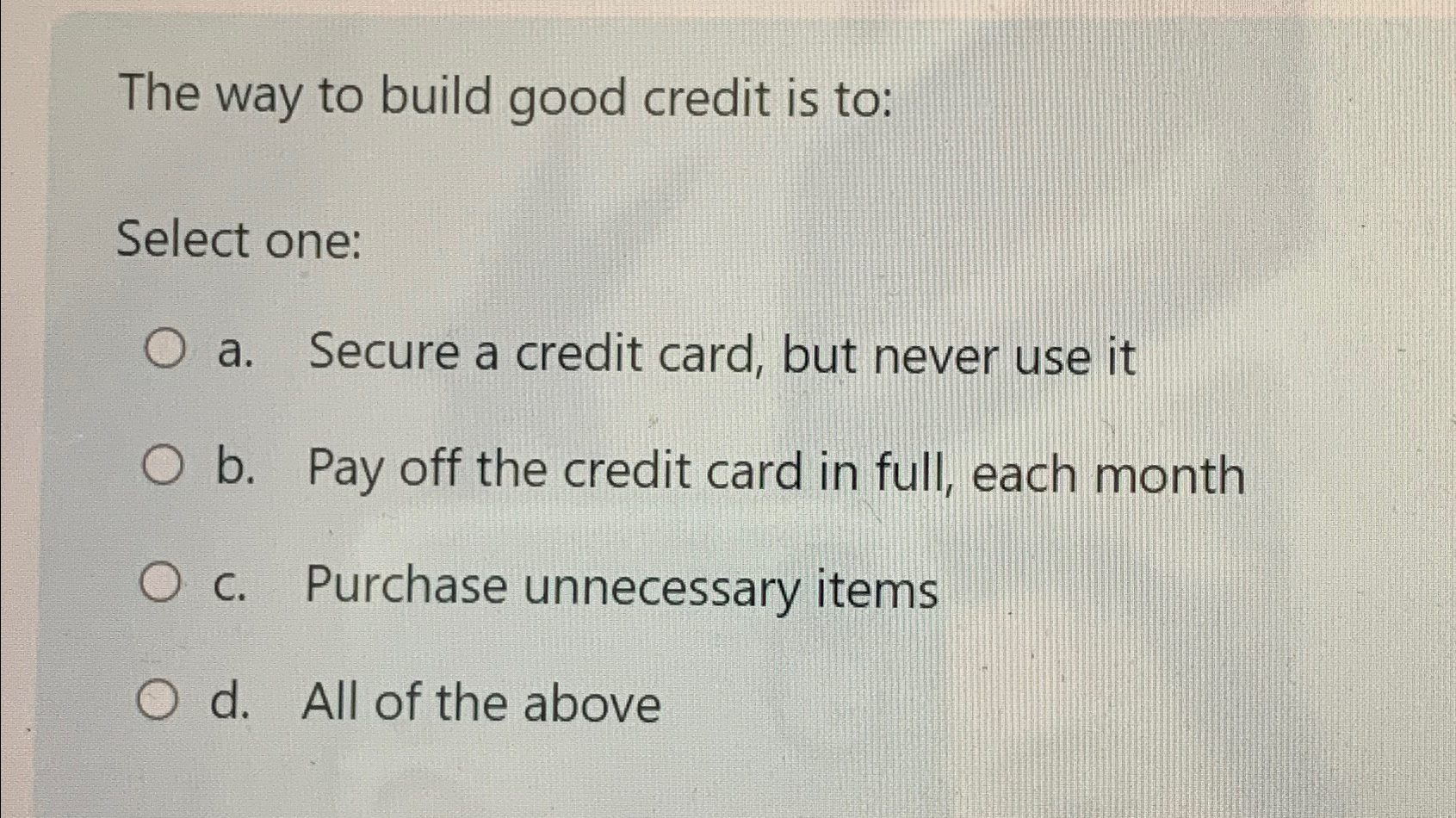

Solved The way to build good credit is toSelect onea.

📈A way to build good credit is O using only secured loans. O taking out

A Way To Build Good Credit Is Brainly

How to build good credit the right way Artofit

How to Build Credit The 7Step Guide Chime

Spend Money And Settle The Balance Each Month.

To Build Credit, It’s Important To Practice Good Financial Habits And Monitor Your Credit Routinely.

Study With Quizlet And Memorize Flashcards Containing Terms Like A Credit Score Is Based In Part On, What Is A Benefit Of Obtaining A Personal Loan?, Which Describes An Example Of Using.

Study With Quizlet And Memorize Flashcards Containing Terms Like Credit, Credit History, Which Of These Is The Best Way To Build A Good Credit History?

Related Post: