Agricultural Building Permit Exemption Michigan

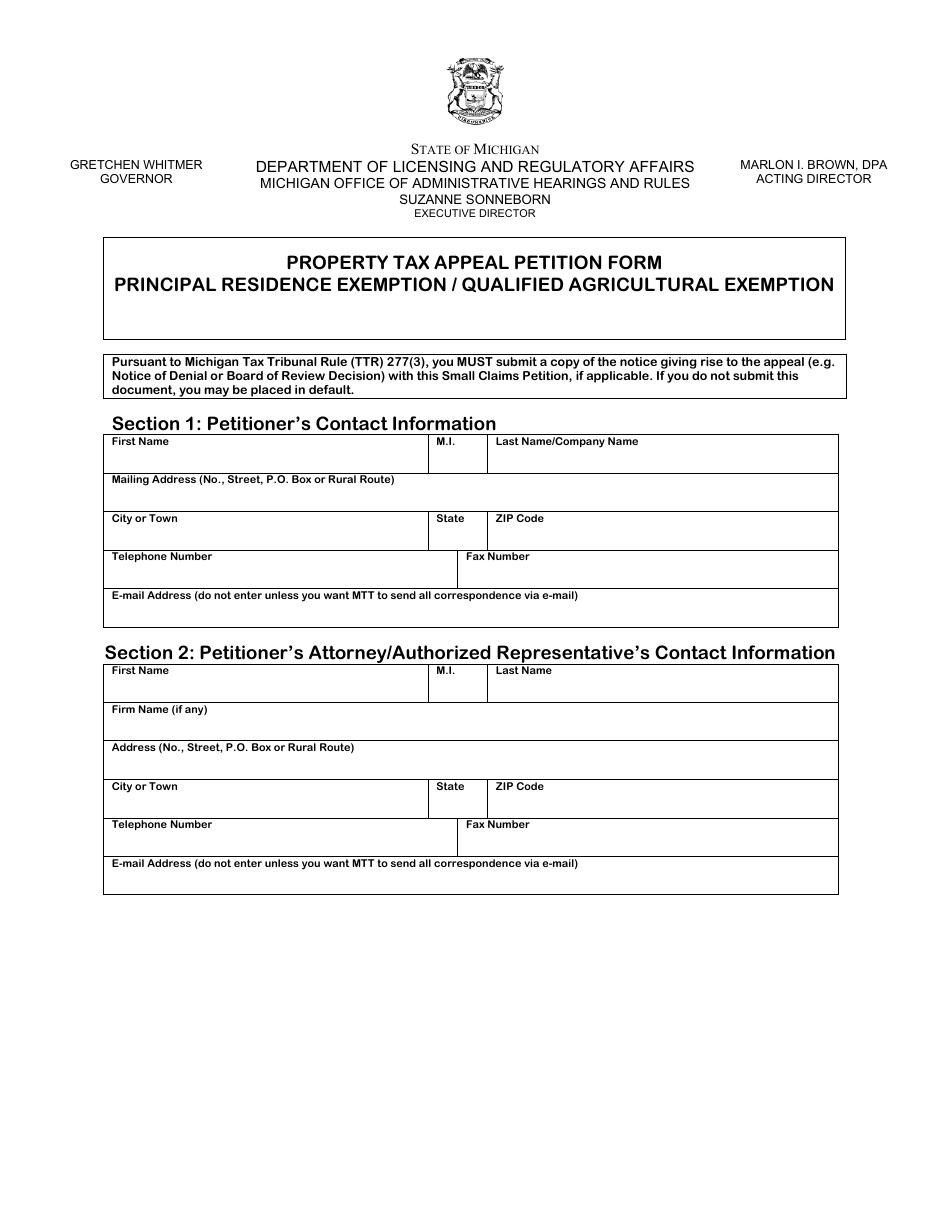

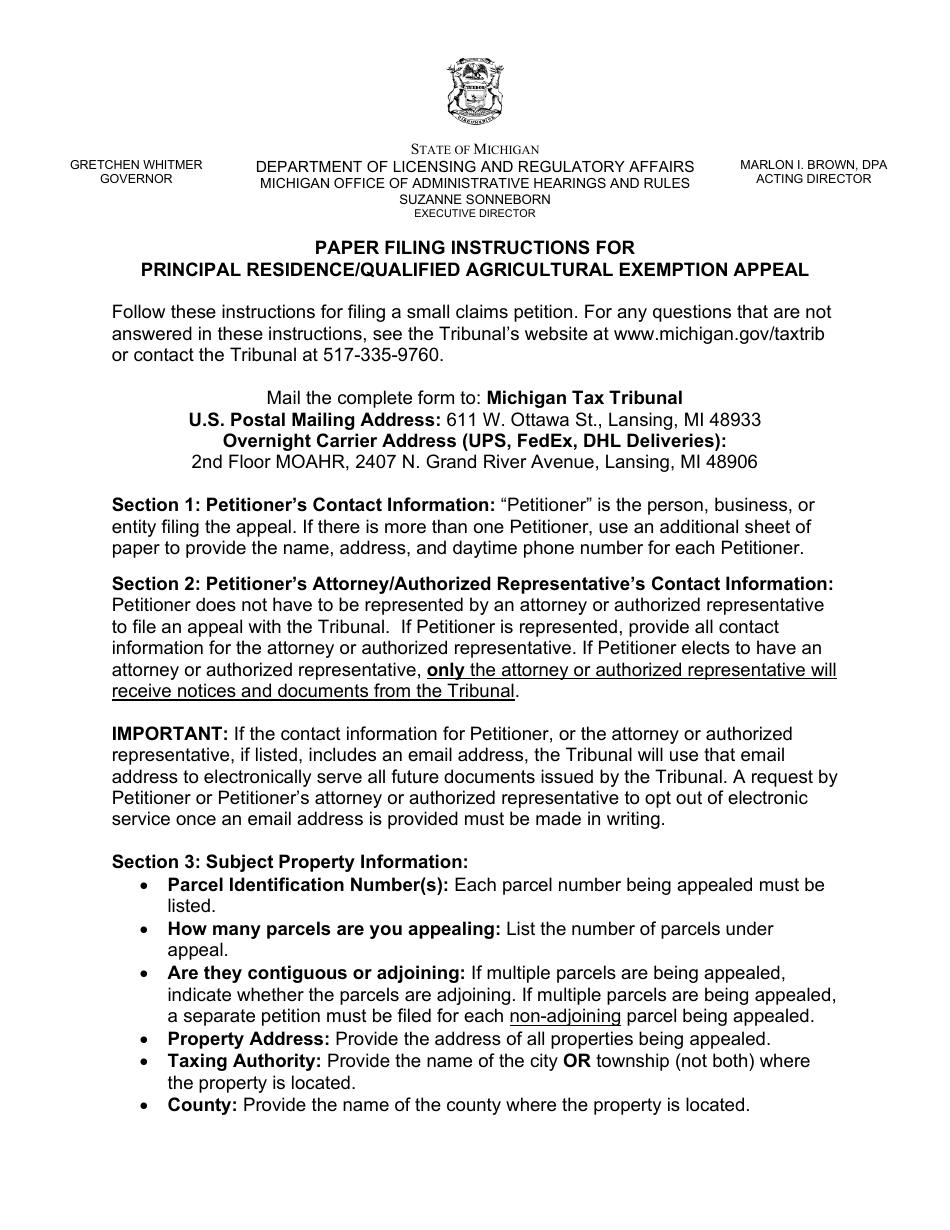

Agricultural Building Permit Exemption Michigan - If you do not meet the criterion, you will be required to obtain a building permit. I understand that, on the condition of signing this affidavit, clinton county will issue me a land use permit for the construction of a building on the property which will be used for agricultural. Agricultural/farm uses which justified an exemption (including cessation of the agricultural uses on the land where the building is located), one or more permits will have to be obtained at that. • what is the qualified agricultural property exemption? A building permit is not required for a building incidental to the use for agricultural purposes of the land on which the building is located if it is not used in the business of retail. These include detached residential accessory buildings that are 200 square feet and under in size. Only a couple of projects, being newly constructed, are exempt from building permits. All parcels containing ag worker housing, licensed by the michigan department of agriculture and rural development that is solely used as ag workforce housing, be eligible for the agricultural. The state construction code, not the michigan right to farm act, provides farmers this limited exemption. Agricultural buildings (barns) may also be. Farm buildings do not need permits, however, some. Many municipalities still require the farmer to complete an affidavit attesting that the building is solely. The qualified agricultural property exemption is an exemption from certain local school operating millages for parcels that meet the qualified agricultural property definition. These include detached residential accessory buildings that are 200 square feet and under in size. All parcels containing ag worker housing, licensed by the michigan department of agriculture and rural development that is solely used as ag workforce housing, be eligible for the agricultural. Depending on the use of the proposed barn, it may or may not 1) potentially qualify for rtf protection and 2) be subject to local zoning. The qualified agricultural property exemption is an exemption from certain local school operating millage provided by law for. Michigan building code 125.1510(8) states “a building permit is not required for a building incidental to the use for agriculture purposes of the land on which the building is. I understand that, on the condition of signing this affidavit, clinton county will issue me a land use permit for the construction of a building on the property which will be used for agricultural. If you do not meet the criterion, you will be required to obtain a building permit. Mcl 211.7ee provides for an exemption from certain local school operating taxes, typically up to 18 mills, for parcels that meet the qualified. This handout is designed to help determine whether a proposed building would be considered agricultural and exempt from building permit requirements. Farm buildings do not need permits, however, some. The state construction code, not the michigan right. • what is the qualified agricultural property exemption? The qualified agricultural property exemption is an exemption from certain local school operating millage provided by law for. Agricultural buildings frequently benefit from exemptions under the michigan right to farm act, which supports the state’s agricultural sector while ensuring safety through. A building permit is not required for a building incidental to. A building permit is not required for a building incidental to the use for agricultural purposes of the land on which the building is located if it is not used in the business of retail. Depending on the use of the proposed barn, it may or may not 1) potentially qualify for rtf protection and 2) be subject to local. What is the qualified agricultural exemption? The state construction code, not the michigan right to farm act, provides farmers this limited exemption. • what is the qualified agricultural property exemption? The qualified agricultural property exemption is an exemption from certain local school operating millage provided by law for. Michigan building code 125.1510(8) states “a building permit is not required for. Building does not include a building, whether temporary or permanent, incidental to the use for agricultural purposes of the land on which the building is located if it is not used in. What is the qualified agricultural exemption? • what is the qualified agricultural property exemption? Only a couple of projects, being newly constructed, are exempt from building permits. Depending. It's usually at the descretion of the zoning administrator/ building inspector as to if they consider it a farm building or not. The qualified agricultural property exemption is an exemption from certain local school operating millage provided by law for. If you do not meet the criterion, you will be required to obtain a building permit. A building permit is. The state construction code, not the michigan right to farm act, provides farmers this limited exemption. This handout is designed to help determine whether a proposed building would be considered agricultural and exempt from building permit requirements. Agricultural/farm uses which justified an exemption (including cessation of the agricultural uses on the land where the building is located), one or more. Building does not include a building, whether temporary or permanent, incidental to the use for agricultural purposes of the land on which the building is located if it is not used in. Property qualifies for the agricultural exemption if it is either classified agricultural by the local assessor, or, if 50% or more of the property’s acreage is used for. Building does not include a building, whether temporary or permanent, incidental to the use for agricultural purposes of the land on which the building is located if it is not used in. Property qualifies for the agricultural exemption if it is either classified agricultural by the local assessor, or, if 50% or more of the property’s acreage is used for. Michigan building code 125.1510(8) states “a building permit is not required for a building incidental to the use for agriculture purposes of the land on which the building is. The qualified agricultural property exemption is an exemption from certain local school operating millages for parcels that meet the qualified agricultural property definition. If you do not meet the criterion, you. You must meet both criterion to be eligible for the agricultural building code exemption. Michigan building code 125.1510(8) states “a building permit is not required for a building incidental to the use for agriculture purposes of the land on which the building is. Property qualifies for the agricultural exemption if it is either classified agricultural by the local assessor, or, if 50% or more of the property’s acreage is used for agricultural. Only a couple of projects, being newly constructed, are exempt from building permits. If you do not meet the criterion, you will be required to obtain a building permit. Depending on the use of the proposed barn, it may or may not 1) potentially qualify for rtf protection and 2) be subject to local zoning. • what is the qualified agricultural property exemption? A building permit is not required for a building incidental to the use for agricultural purposes of the land on which the building is located if it is not used in the business of retail. Building does not include a building, whether temporary or permanent, incidental to the use for agricultural purposes of the land on which the building is located if it is not used in. The state construction code, not the michigan right to farm act, provides farmers this limited exemption. These include detached residential accessory buildings that are 200 square feet and under in size. The qualified agricultural property exemption is an exemption from certain local school operating millages for parcels that meet the qualified agricultural property definition. I understand that, on the condition of signing this affidavit, clinton county will issue me a land use permit for the construction of a building on the property which will be used for agricultural. The qualified agricultural property exemption is an exemption from certain local school operating millage provided by law for. Agricultural/farm uses which justified an exemption (including cessation of the agricultural uses on the land where the building is located), one or more permits will have to be obtained at that. Agricultural buildings used exclusively for farming purposes can also be exempt from permit requirements, recognizing the unique nature of agricultural operations.Michigan Property Tax Appeal Petition Form Principal Residence

Fillable Online Agricultural Buildings Building Permit Exemption

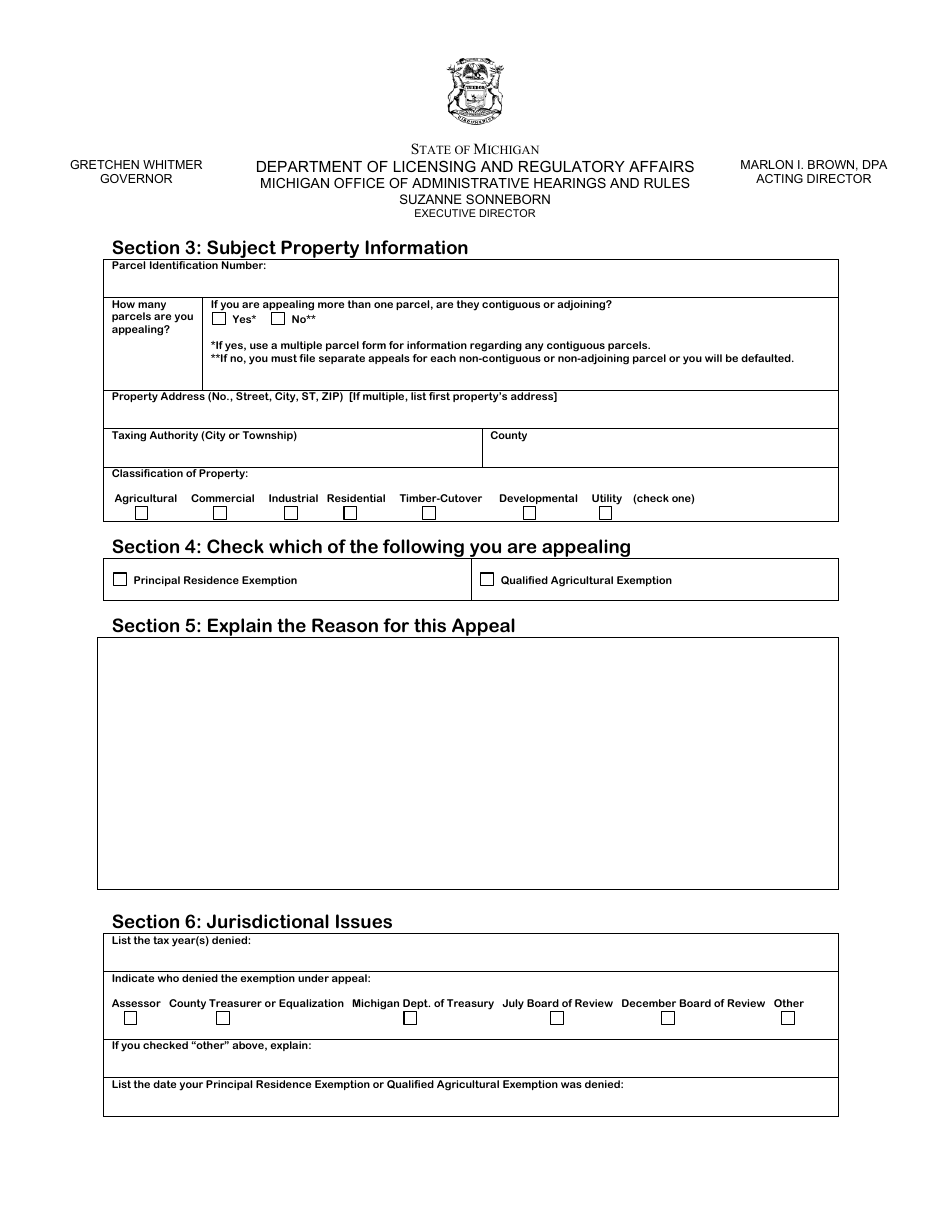

Michigan Property Tax Appeal Petition Form Principal Residence

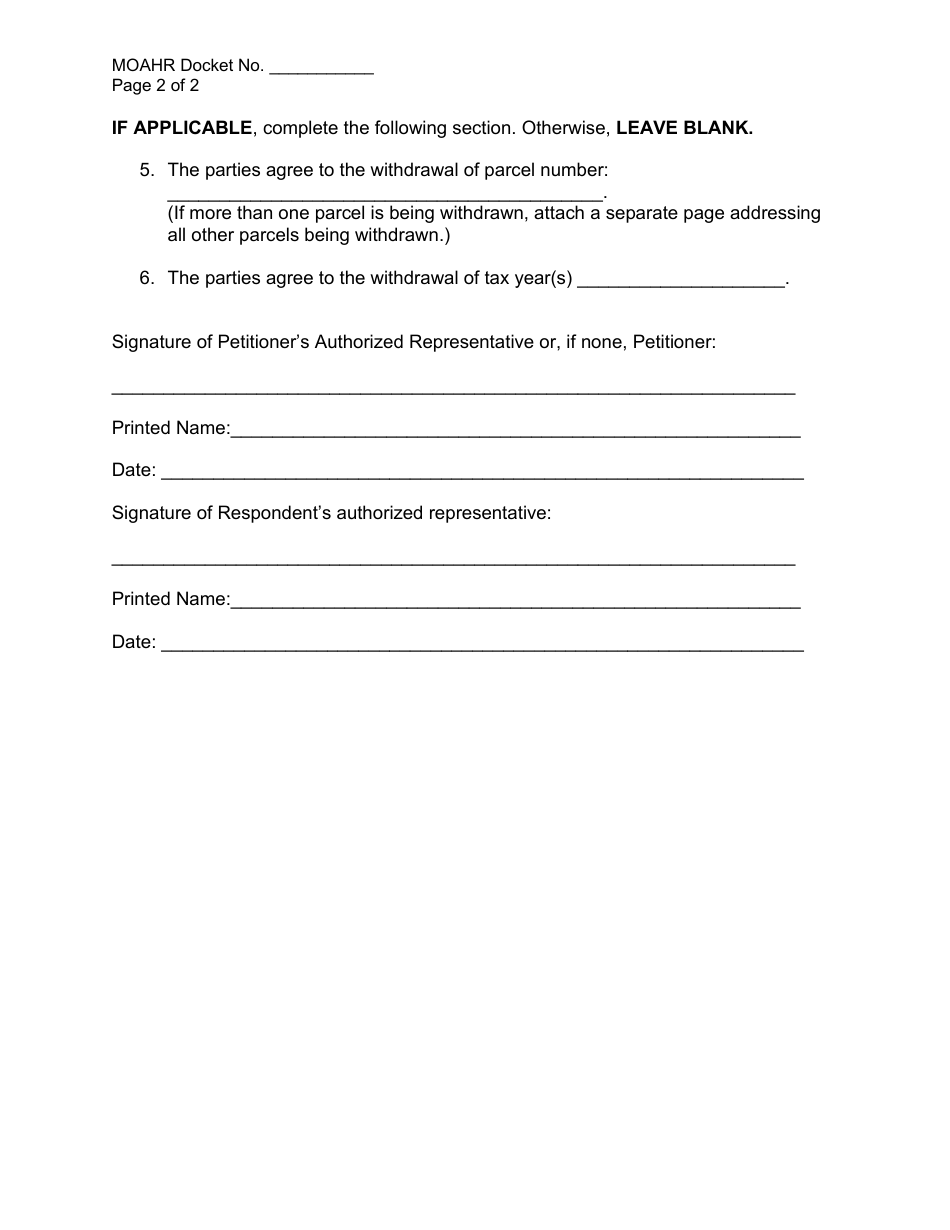

Michigan Stipulation for Entry of Consent Judgment (Qualified

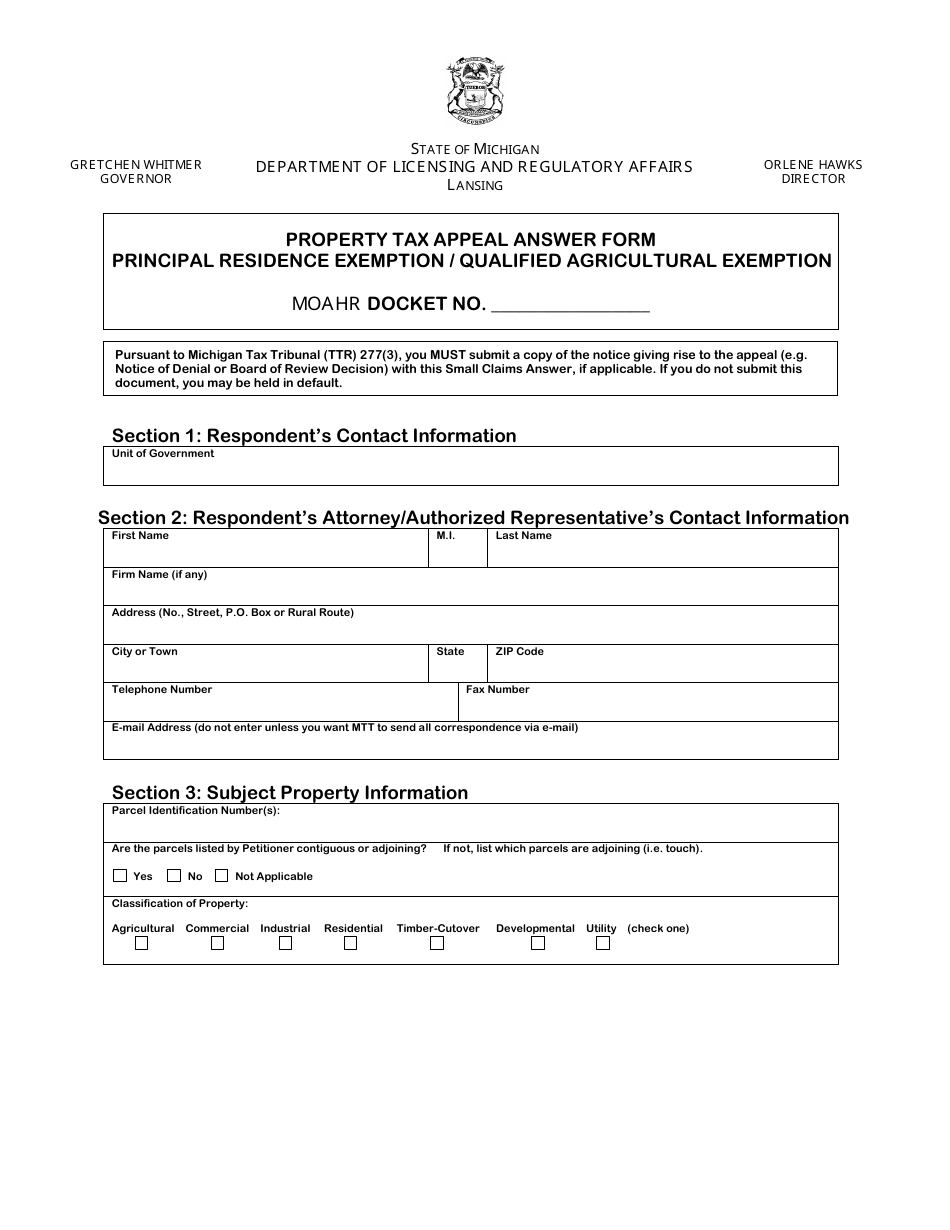

Michigan Property Tax Appeal Answer Form Principal Residence

Fillable Online agriculture & equine permit exemption Yamhill County

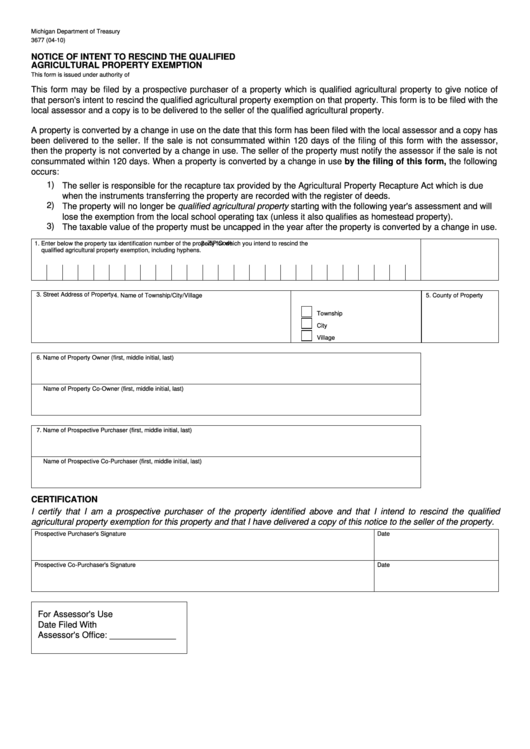

Form 3677 Notice Of Intent To Rescind The Qualified Agricultural

Michigan Property Tax Appeal Petition Form Principal Residence

Fillable Online www.fill.ioAgriculturalUseExemptionSubmittalFill

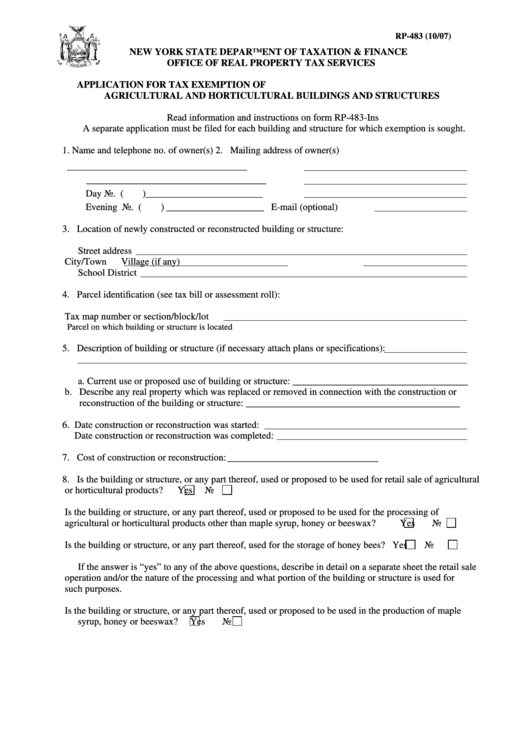

Fillable Form Rp483 Application For Tax Exemption Of Agricultural

All Parcels Containing Ag Worker Housing, Licensed By The Michigan Department Of Agriculture And Rural Development That Is Solely Used As Ag Workforce Housing, Be Eligible For The Agricultural.

Farm Buildings Do Not Need Permits, However, Some.

This Handout Is Designed To Help Determine Whether A Proposed Building Would Be Considered Agricultural And Exempt From Building Permit Requirements.

Under That Exemption, Agricultural Buildings Do Not Need To Receive A Permit.

Related Post: