Apply Chime Credit Builder Card Vs First Progress Card

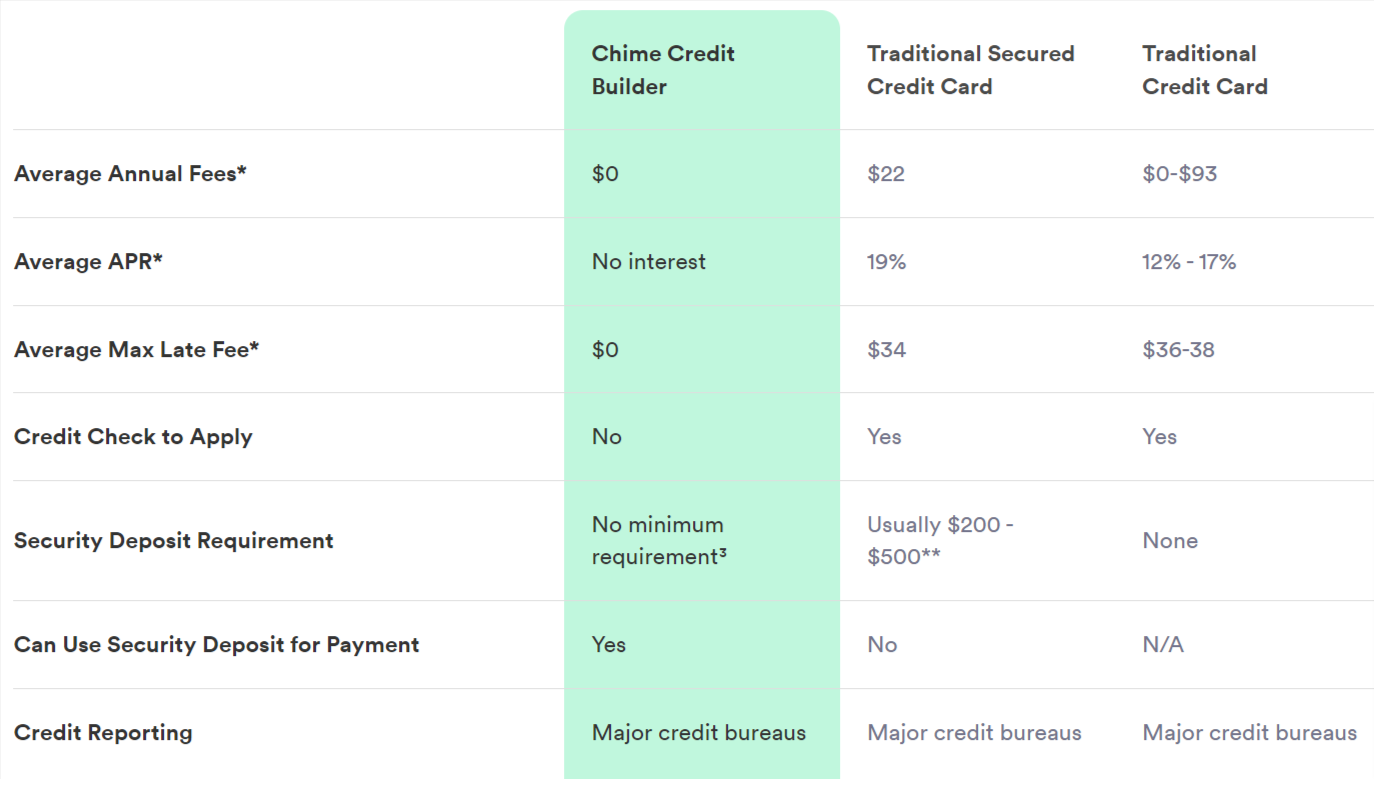

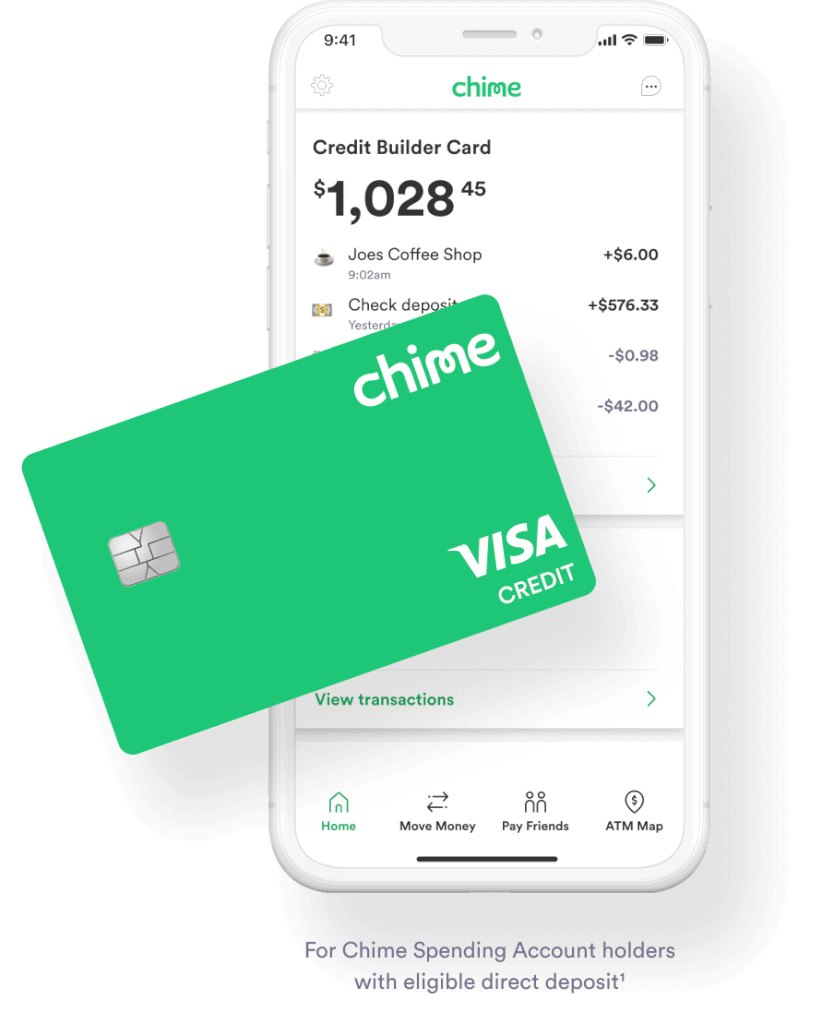

Apply Chime Credit Builder Card Vs First Progress Card - The best credit card for first timers. In this article, we will delve into the essential details of the chime credit builder card, including its benefits, how it works, and the application process. Here are some of the things that make chime credit. This card stands out for its lack of fees and. How do i apply for credit builder? You can enroll in credit builder in your chime app: Review all the benefits of this free credit card, and apply in just a few steps. You’ll need to have a chime account to be able to apply for. There are significant differences between the chime credit builder visa® card and a conventional secured credit card. What is the chime credit builder visa®. Review all the benefits of this free credit card, and apply in just a few steps. With no annual fees, no interest charges, and no. How do i apply for credit builder? The chime credit builder visa® offers several advantages that make it an attractive option for those looking to build or improve their credit. What is the chime credit builder visa®. You can enroll in credit builder in your chime app: The best credit card for first timers. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. This card stands out for its lack of fees and. 1 there’s also no credit check to apply! Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. The chime credit builder visa® offers several advantages that make it an attractive option for those looking to build or improve their credit. Here are some of the things that make chime credit. How to apply for. You’ll need to have a chime account to be able to apply for. The best credit card for first timers. With no annual fees, no interest charges, and no. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. How to apply for the chime credit builder. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. Chime checking accounts feature no monthly service fees, no overdraft fees, and no minimum balance. This card stands out for its lack of fees and. 1 there’s also no credit check to apply! With no annual fees,. What is the chime credit builder visa®. This card stands out for its lack of fees and. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. There are significant differences between the chime credit builder visa® card and a conventional secured credit card. The best credit. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. Here are some of the things that make chime credit. Review all the benefits of this free credit card, and apply in just a few steps. A chime checking account is required to apply for credit builder.. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. You can enroll in credit builder in your chime app: Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. What is the. With no annual fees, no interest charges, and no. How to apply for the chime credit builder card. You’ll need to have a chime account to be able to apply for. Chime checking accounts feature no monthly service fees, no overdraft fees, and no minimum balance. The chime credit builder card is a great way to help build your credit. How do i apply for credit builder? The chime credit builder card is a great way to help build your credit. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. What is the chime credit builder visa®. With no annual fees, no interest charges, and no. This card stands out for its lack of fees and. You’ll need to have a chime account to be able to apply for. How to apply for the chime credit builder card. The chime credit builder visa ® credit card is our no annual fee, no interest, secured credit card that helps you build your credit. The best credit card. The chime credit builder visa® offers several advantages that make it an attractive option for those looking to build or improve their credit. You can enroll in credit builder in your chime app: Review all the benefits of this free credit card, and apply in just a few steps. In this article, we will delve into the essential details of. Chime checking accounts feature no monthly service fees, no overdraft fees, and no minimum balance. How to apply for the chime credit builder card. What is the chime credit builder visa®. How do i apply for credit builder? Consistent use of credit builder can build your payment history, increase the length of. With no annual fees, no interest charges, and no. 1 there’s also no credit check to apply! You can enroll in credit builder in your chime app: The chime credit builder card is a great way to help build your credit. You’ll need to have a chime account to be able to apply for. In this article, we will delve into the essential details of the chime credit builder card, including its benefits, how it works, and the application process. There are significant differences between the chime credit builder visa® card and a conventional secured credit card. This card stands out for its lack of fees and. Unlike traditional credit cards, credit builder is a secured card that helps you build credit history with no annual fees and no interest. Review all the benefits of this free credit card, and apply in just a few steps. A chime checking account is required to apply for credit builder.Chime Credit Builder Considered Secured Credit Card

Apply for a Credit Card Online Learn How No Credit Check

How to Apply for the Chime Credit Card

Credit Builder Card Chime

Chime Card vs Upgrade Card More Than Building Your Credit?

Chime Credit Builder Card vs Extra Debit Card Build Credit Fast 2022

Chime Credit Builder Card Review A Secured Card With Guardrails

Credit Builder Card Chime

Comprehensive Chime Credit Builder Card Review

SoFi Credit Card vs. Chime Credit Builder Which Card is BEST? YouTube

Follow The Steps To Enroll.

The Chime Credit Builder Visa® Offers Several Advantages That Make It An Attractive Option For Those Looking To Build Or Improve Their Credit.

The Best Credit Card For First Timers.

The Chime Credit Builder Visa ® Credit Card Is Our No Annual Fee, No Interest, Secured Credit Card That Helps You Build Your Credit.

Related Post: