Banks That Offer Credit Builder Loans

Banks That Offer Credit Builder Loans - There are ways you can build your credit up to earn better interest rates and qualify for bigger loans. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. However, credit builder loans are commonly offered by local credit unions or community banks, plus companies that specialize in credit building. If you are looking to safely establish or improve your credit score, consider a north shore bank credit builder loan. At republic bank, our credit builder program may help you improve your credit score in as little as 12 months.* credit builder is a combination loan and savings program that may help you. Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. Here are some of the most. These products are often offered by fintech companies, small banks or credit. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. Taking another loan out might. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. As an added bonus, you earn dividends as you pay off the loan. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. However, credit builder loans are commonly offered by local credit unions or community banks, plus companies that specialize in credit building. If you are looking to safely establish or improve your credit score, consider a north shore bank credit builder loan. Once you apply and are approved for a credit builder loan, the amount. There are ways you can build your credit up to earn better interest rates and qualify for bigger loans. Here are some of the most. At republic bank, our credit builder program may help you improve your credit score in as little as 12 months.* credit builder is a combination loan and savings program that may help you. As an added bonus, you earn dividends as you pay off the loan. These products are often offered by fintech companies, small banks or credit. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. Taking another loan out might. However, credit builder loans are commonly offered by local. Credit building loans can help you do just that. However, credit builder loans are commonly offered by local credit unions or community banks, plus companies that specialize in credit building. There are ways you can build your credit up to earn better interest rates and qualify for bigger loans. Our fresh start loan can help you establish new credit or. Credit building loans can help you do just that. Taking another loan out might. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. Here are some of the most. As an added bonus, you earn dividends as you pay off the loan. Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. These products are often offered by fintech companies, small banks or credit. Credit building loans can help you do just that. There are ways you can build your credit up to earn better interest rates and qualify for bigger loans.. Taking another loan out might. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. Once you apply and are approved for a credit builder loan, the amount. Credit building loans can help you do just that. Here are some of the most. Credit building loans can help you do just that. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. These products are often offered by fintech companies, small banks or credit. As an added bonus, you earn dividends as you pay off the loan. If you are looking. These products are often offered by fintech companies, small banks or credit. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. At republic bank, our credit builder program may help you improve your credit score in as little as 12 months.* credit builder is a combination loan and. Here are some of the most. Once you apply and are approved for a credit builder loan, the amount. If you are looking to safely establish or improve your credit score, consider a north shore bank credit builder loan. As an added bonus, you earn dividends as you pay off the loan. This financial product is designed to help people. However, credit builder loans are commonly offered by local credit unions or community banks, plus companies that specialize in credit building. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. There are ways you can build your credit up to earn better interest rates and qualify for bigger. Taking another loan out might. As an added bonus, you earn dividends as you pay off the loan. If you are looking to safely establish or improve your credit score, consider a north shore bank credit builder loan. This financial product is designed to help people with limited or poor credit histories access a modest loan amount and increase. Our. Credit building loans can help you do just that. However, credit builder loans are commonly offered by local credit unions or community banks, plus companies that specialize in credit building. Once you apply and are approved for a credit builder loan, the amount. If you are looking to safely establish or improve your credit score, consider a north shore bank credit builder loan. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. These products are often offered by fintech companies, small banks or credit. Here are some of the most. At republic bank, our credit builder program may help you improve your credit score in as little as 12 months.* credit builder is a combination loan and savings program that may help you. Our fresh start loan can help you establish new credit or add a positive record to your existing credit history. As an added bonus, you earn dividends as you pay off the loan.What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

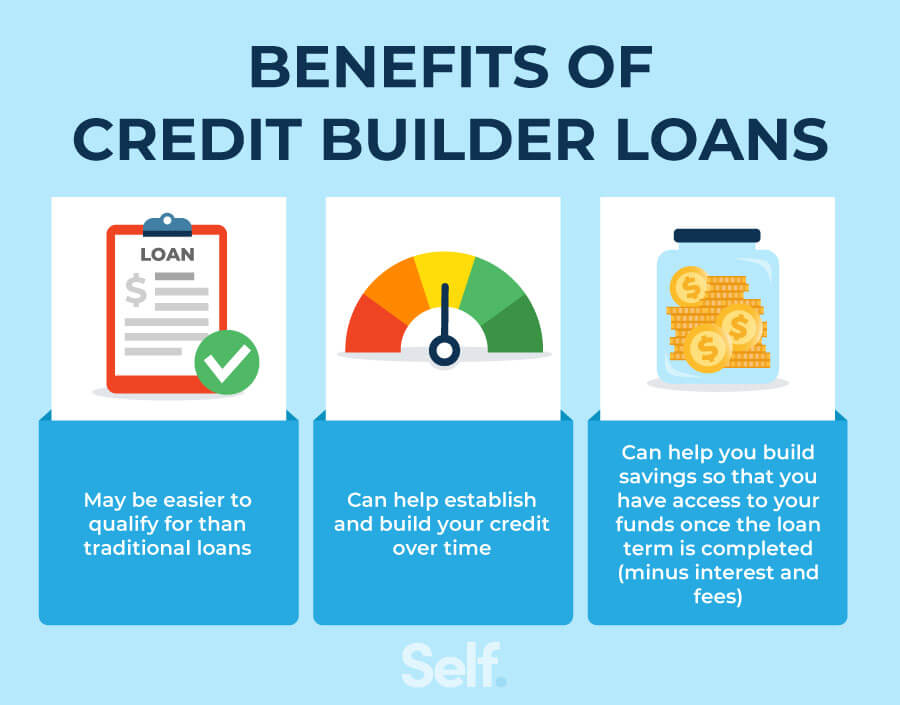

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

Credit Builder Loans Why you should apply for it?

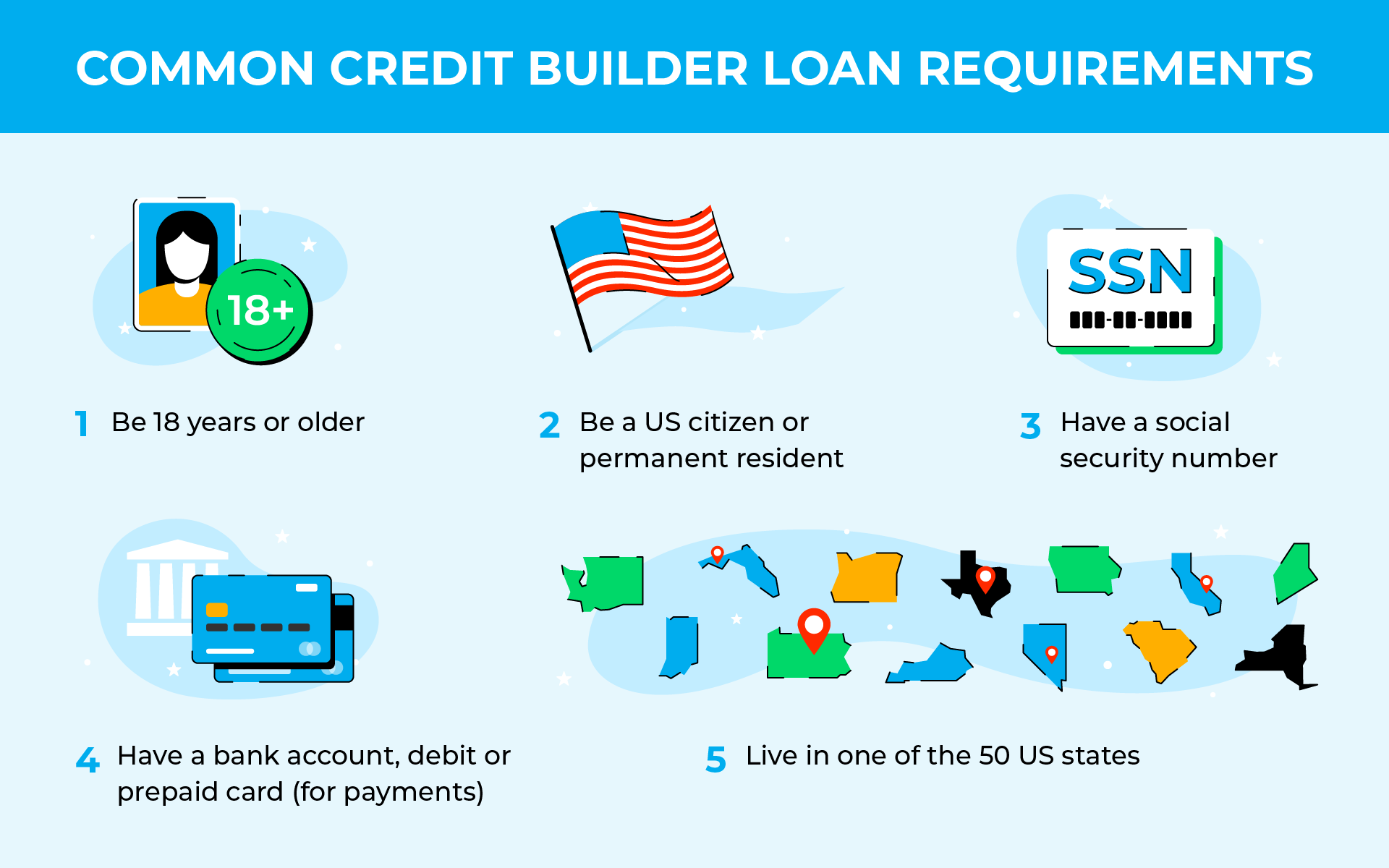

What is a Credit Builder Loan and How Does it Work?

The Credit Builder Loans Now Available Through Bank of America

10 Best CreditBuilder Loans of October 2023 to Boost Your Credit Score

5 Best Credit Builder Loans in 2023 No Credit Check

Self Offers Credit Builder Accounts and Secured Cards that Help Users

10 BEST Banks for BUSINESS Loans in 2023! Get BUSINESS Credit! EIN

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

This Financial Product Is Designed To Help People With Limited Or Poor Credit Histories Access A Modest Loan Amount And Increase.

There Are Ways You Can Build Your Credit Up To Earn Better Interest Rates And Qualify For Bigger Loans.

Taking Another Loan Out Might.

Related Post: