Blaisdell V Home Building And Loan

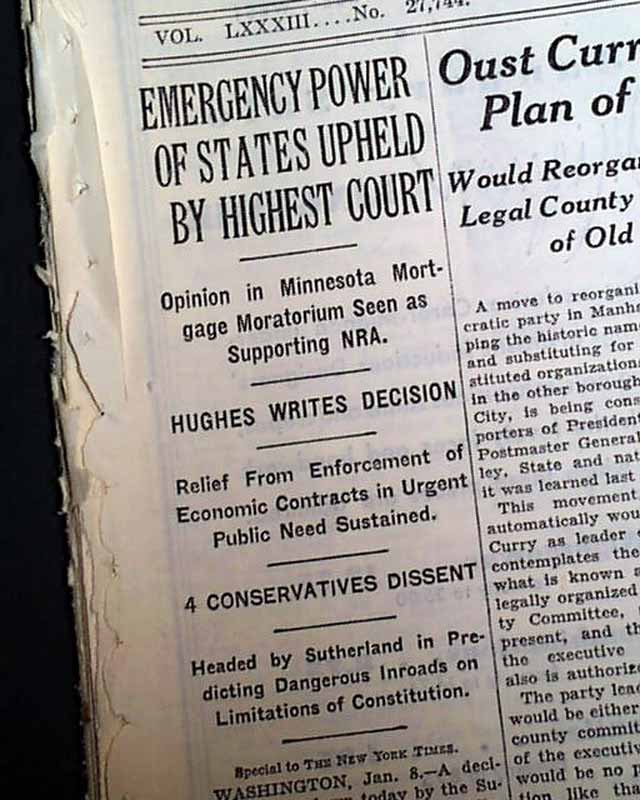

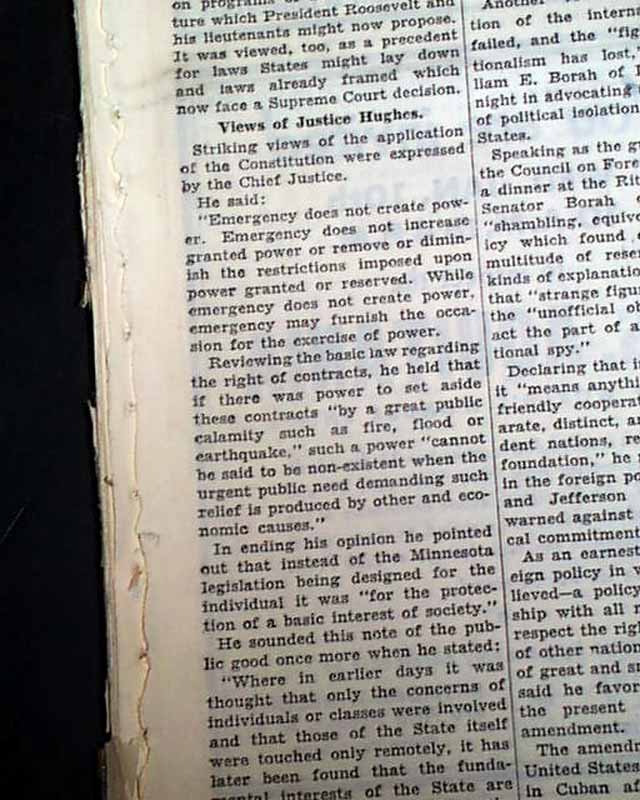

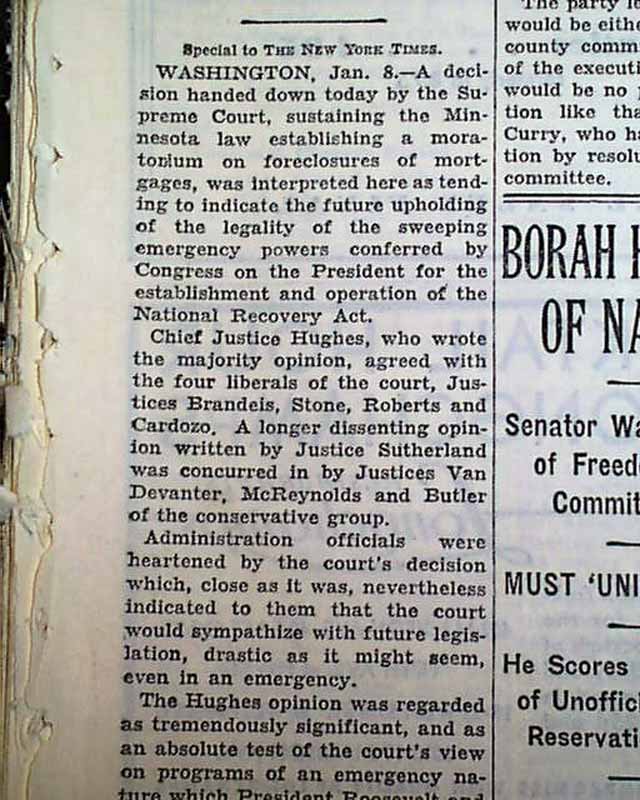

Blaisdell V Home Building And Loan - A court granted an extension to the blaisdells under this statute while also requiring them to pay $40 a month during the extended period to home building and loan association, which was. Blaisdell was important not only because it upheld a critical state law passed during the great depression but also because it. That they lived in part of. Blaisdell was decided during the depth of the great depression and has been criticized by modern conservative and libertarian commentators. In home building and loan association v. The court's decision in home building and loan association v. Home building & loan association v. As an emergency measure, during the great depression, minnesota passed a law that modified lender’s contractual rights of foreclosure with their debtors. 398 (1934), united states supreme court, case facts, key issues, and holdings and reasonings online today. Home bldg & (and) l. Home building & loan association v. Obtaining an online mortgage involves comparing offers from multiple online lenders. 398 (1934), also called the minnesota mortgage moratorium case, was a decision of the united states supreme court holding that minnesota's suspension of creditors' remedies was not in violation of the contract clause of the united states constitution. In a proceeding under the statute, it appeared that the applicants, man and wife, owned a lot in a closely built section of a large city on which were a house and garage; 398, see flags on bad law, and search casetext’s comprehensive legal database A court granted an extension to the blaisdells under this statute while also requiring them to pay $40 a month during the extended period to home building and loan association, which was. Appellant contests the validity of chapter 339 of the laws of minnesota of 1933, p. Supreme court upheld the minnesota mortgage moratorium act of 1933 over a charge that it was a violation of the. In home building and loan association v. The court's decision in home building and loan association v. Home building & loan association v. Supreme court upheld the minnesota mortgage moratorium act of 1933 over a charge that it was a violation of the. Home building & loan association v. In home building and loan association v. The constitutionality of the law was. As an emergency measure, during the great depression, minnesota passed a law that modified lender’s contractual rights of foreclosure with their debtors. Appellant contests the validity of the minnesota mortgage moratorium law, as being repugnant to the contract clause. That they lived in part of. The appellant, home building & loan assn. Home bldg & (and) l. The court's decision in home building and loan association v. Home building & loan association v. The defendants, the blaisdells, obtained a court order under the act extending the period of redemption on condition that they pay the association $40 per month, thus, the court modified. Home building & (and) loan. Appellant contests the validity of chapter 339 of the. In home building and loan association v. Appellant contests the validity of the minnesota mortgage moratorium law, as being repugnant to the contract clause. A court granted an extension to the blaisdells under this statute while also requiring them to pay $40 a month during the extended period to home building and loan association, which was. 398 (1934), also called. Supreme court upheld the minnesota mortgage moratorium act of 1933 over a charge that it was a violation of the. This paper argues that it was. In home building and loan association v. A court granted an extension to the blaisdells under this statute while also requiring them to pay $40 a month during the extended period to home building. Home building & loan association v. Borrowers should consider interest rates, loan terms, and fees to find the most favorable mortgage option. Home bldg & (and) l. A court granted an extension to the blaisdells under this statute while also requiring them to pay $40 a month during the extended period to home building and loan association, which was. Get. In home building and loan association v. That they lived in part of. Supreme court upheld the minnesota mortgage moratorium act of 1933 over a charge that it was a violation of the. A court granted an extension to the blaisdells under this statute while also requiring them to pay $40 a month during the extended period to home building. The defendants, the blaisdells, obtained a court order under the act extending the period of redemption on condition that they pay the association $40 per month, thus, the court modified. 398 (1934), was a decision of the united states supreme court holding that minnesota's suspension of creditors' remedies was not in. Home building & loan association v. Blaisdell was important. Supreme court upheld the minnesota mortgage moratorium act of 1933 over a charge that it was a violation of the. Home bldg & (and) l. Obtaining an online mortgage involves comparing offers from multiple online lenders. Appellant contests the validity of the minnesota mortgage moratorium law, as being repugnant to the contract clause. Home building & loan association v. That they lived in part of. As an emergency measure, during the great depression, minnesota passed a law that modified lender’s contractual rights of foreclosure with their debtors. A court granted an extension to the blaisdells under this statute while also requiring them to pay $40 a month during the extended period to home building and loan association, which was.. Get home building & loan association v. Obtaining an online mortgage involves comparing offers from multiple online lenders. Home building & loan association v. The appellant, home building & loan assn. 398 (1934) this was the most important contract clause case since charles river bridge v. The court's decision in home building and loan association v. Supreme court upheld the minnesota mortgage moratorium act of 1933 over a charge that it was a violation of the. Appellant contests the validity of chapter 339 of the laws of minnesota of 1933, p. 398 (1934), was a decision of the united states supreme court holding that minnesota's suspension of creditors' remedies was not in. The defendants, the blaisdells, obtained a court order under the act extending the period of redemption on condition that they pay the association $40 per month, thus, the court modified. In home building and loan association v. Borrowers should consider interest rates, loan terms, and fees to find the most favorable mortgage option. Home building & (and) loan. That they lived in part of. A court granted an extension to the blaisdells under this statute while also requiring them to pay $40 a month during the extended period to home building and loan association, which was. In a proceeding under the statute, it appeared that the applicants, man and wife, owned a lot in a closely built section of a large city on which were a house and garage;Home Building & Loan Ass'n v. Blaisdell (1934) Overview LSData Case

Home Building & Loan Ass'n v. Blaisdell...

604 House Building Loan Assoc. V Blaisdell (Alfaro) PDF

Home Building & Loan Ass'n v. Blaisdell...

Home Building & Loan Ass'n v. Blaisdell...

Home Building Loan Assn. v. Blaisdell PDF Mortgage Law Contract

PPT Elementos de Derecho Constitucional PowerPoint Presentation, free

Home Building & Loan Ass'n v. Blaisdell...

Home Building & Loan Ass'n v. Blaisdell...

Home Building & Loan Ass'n v. Blaisdell HOME BUILDING & LOAN ASS’N v

This Paper Argues That It Was.

Blaisdell Was Important Not Only Because It Upheld A Critical State Law Passed During The Great Depression But Also Because It.

Home Building & Loan Association V.

Home Building & Loan Association V.

Related Post: