Book Value Of Building

Book Value Of Building - In simpler terms, it's the value of what the company owns,. In accounting, book value (or carrying value) is the value of an asset [1] according to its balance sheet account balance. When we talk about a company's book value, we're referring to the total value of its assets minus its liabilities and intangible assets. For assets, the value is based on the original cost of the asset less. Tangible assets, liabilities, and shareholder equity. Book value is not the same as carrying. The book value of a business is the total amount a company would generate if it was liquidated without selling any assets at a loss. Book value, or net book value, is the value a company attributes to assets on their balance sheets. Book value is an asset's original cost, less any accumulated depreciation and impairment charges that have been subsequently incurred. Besides, a real estate’s book value. It gives you an idea of your company’s net asset value (which refers to assets compared to. The amount of depreciation may be calculated by using different. Book value is not the same as carrying. Book value is the amount shown in the account book after allowing necessary depreciations. Book value helps understand your company’s value, even if it’s not the same as its market value. Book value is the value of the company that will be posted on the balance sheet. Book value provides a baseline, while market value shows how much confidence investors have in a company’s assets and future growth. The book value of a property at a particular year is the original cost. By understanding how to calculate and interpret book value, investors. In accounting, book value (or carrying value) is the value of an asset [1] according to its balance sheet account balance. Book value, or net book value, is the value a company attributes to assets on their balance sheets. It is calculated over time by taking the fair value of the property less any. Introduction to the book building process. Factors affecting book value and. To find the book value of a company, you need to subtract its total liabilities from. To find the book value of a company, you need to subtract its total liabilities from its total assets: When we talk about a company's book value, we're referring to the total value of its assets minus its liabilities and intangible assets. It gives you an idea of your company’s net asset value (which refers to assets compared to. Factors. In other words, book value defines a property’s net worth as shown on the balance sheet or statement of net worth until the final sale takes place. The book value of the building today is $667,000 ($1 million minus $333,000 in depreciation). Book value is not the same as carrying. The book values of assets are. Book value is an. Book value provides a baseline, while market value shows how much confidence investors have in a company’s assets and future growth. Book value is an asset's original cost, less any accumulated depreciation and impairment charges that have been subsequently incurred. Introduction to the book building process. The book value of property and equipment is the cost that was paid for. It is calculated over time by taking the fair value of the property less any. Book value helps understand your company’s value, even if it’s not the same as its market value. Book value, or net book value, is the value a company attributes to assets on their balance sheets. Book value is an asset's original cost, less any accumulated. To find the book value of a company, you need to subtract its total liabilities from its total assets: Book value helps understand your company’s value, even if it’s not the same as its market value. Book value is an asset's original cost, less any accumulated depreciation and impairment charges that have been subsequently incurred. The book value formula accounting. The book value formula accounting is. Book value provides a baseline, while market value shows how much confidence investors have in a company’s assets and future growth. The book value of a company is the total value of the company's assets, minus the company's. It gives you an idea of your company’s net asset value (which refers to assets compared. Book value is the amount shown in the account book after allowing necessary depreciations. Book value, or net book value, is the value a company attributes to assets on their balance sheets. Book value is a key measure that investors use to gauge a stock's valuation. To calculate book value, it is necessary to determine the components of a company’s. Book value is not the same as carrying. The book value of the building today is $667,000 ($1 million minus $333,000 in depreciation). In simpler terms, it's the value of what the company owns,. Book value, or net book value, is the value a company attributes to assets on their balance sheets. Book value helps understand your company’s value, even. Book value is the value of the company that will be posted on the balance sheet. The amount of depreciation may be calculated by using different. In simpler terms, it's the value of what the company owns,. By understanding how to calculate and interpret book value, investors. The book value of a business is the total amount a company would. For assets, the value is based on the original cost of the asset less. Book value is the amount shown in the account book after allowing necessary depreciations. Book value is the value of the company that will be posted on the balance sheet. Book value provides a baseline, while market value shows how much confidence investors have in a company’s assets and future growth. The book value of property and equipment is the cost that was paid for the individual piece of property and equipment, less the accumulated depreciation to date, on that. When we talk about a company's book value, we're referring to the total value of its assets minus its liabilities and intangible assets. Book value, or net book value, is the value a company attributes to assets on their balance sheets. Book value is a crucial metric that provides insight into a company’s net worth based on its financial statements. It's helpful to gather at least five years. Besides, a real estate’s book value. To calculate book value, it is necessary to determine the components of a company’s net asset value: Factors affecting book value and. The book value of a business is the total amount a company would generate if it was liquidated without selling any assets at a loss. Book value is an asset's original cost, less any accumulated depreciation and impairment charges that have been subsequently incurred. You can analyze and compare companies by checking their book value. Book value is a key measure that investors use to gauge a stock's valuation.Value(s) Building a Better World for All Signed Copy Booka

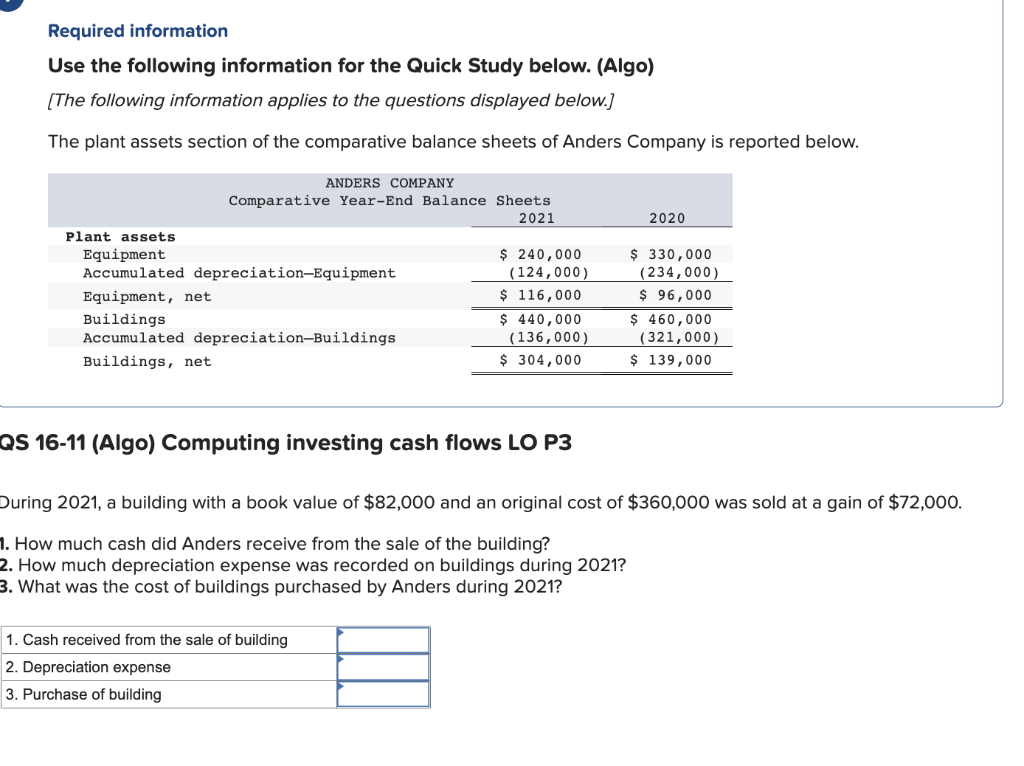

Solved During 2021, a building with a book value of 82,000

What is Book Value? YouTube

General Principles for Valuation of Building

Building Value through Marketing Taylor & Francis Group

[Solved] A building is acquired on January 1, at a cost of 1,010,000

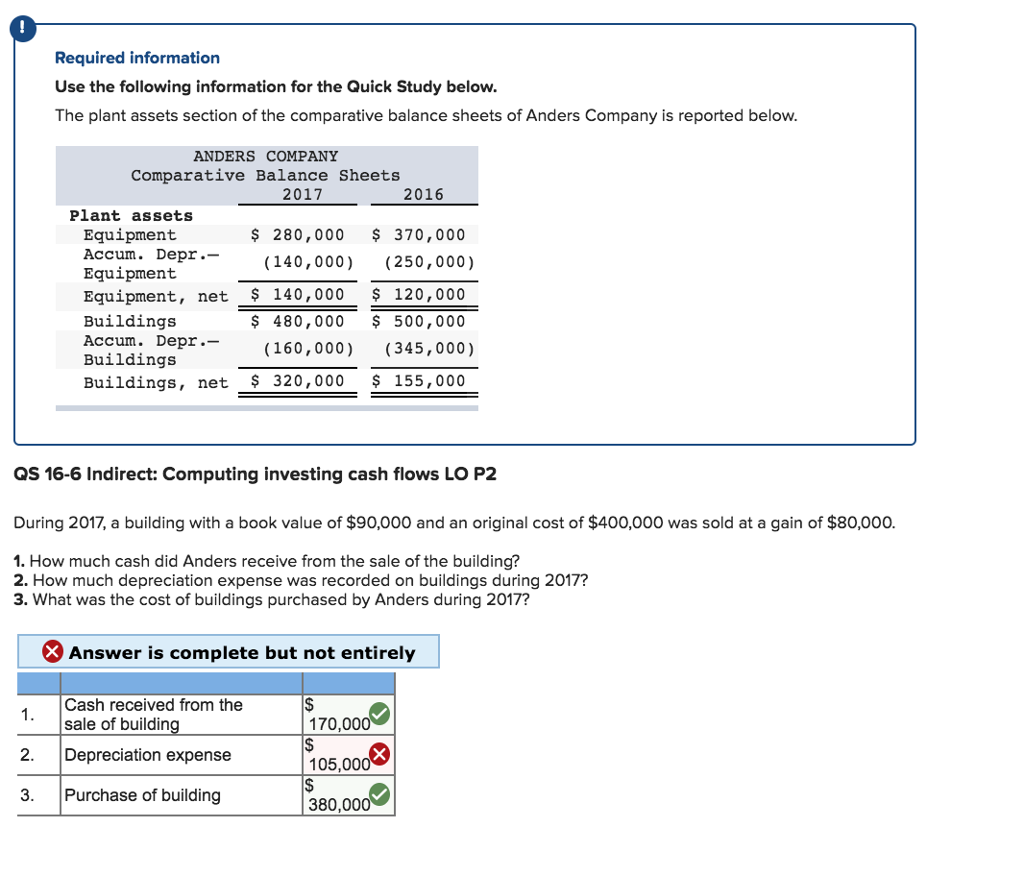

Solved During 2017, a building with a book value of 90,000

What Is Building Valuation Purposes of Building Valuation Building

Book Design and Construction Building in Value by Rick Best

The Australian House Building Manual + The Australian Decks and

Book Value Is Not The Same As Carrying.

It Gives You An Idea Of Your Company’s Net Asset Value (Which Refers To Assets Compared To.

Book Value Helps Understand Your Company’s Value, Even If It’s Not The Same As Its Market Value.

The Book Value Of A Company Is The Total Value Of The Company's Assets, Minus The Company's.

Related Post: