Build Business Credit

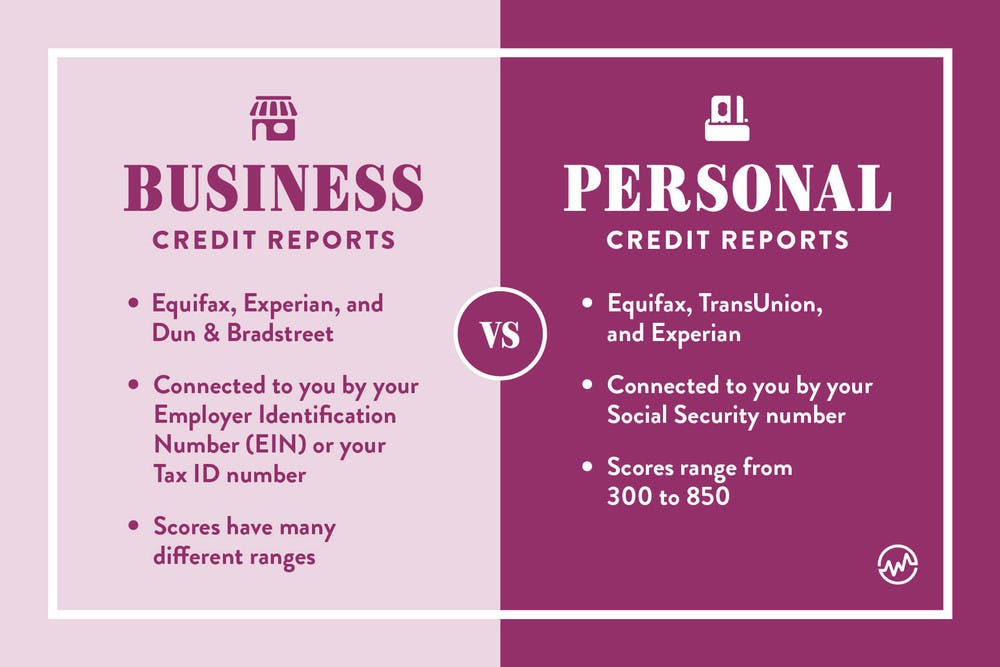

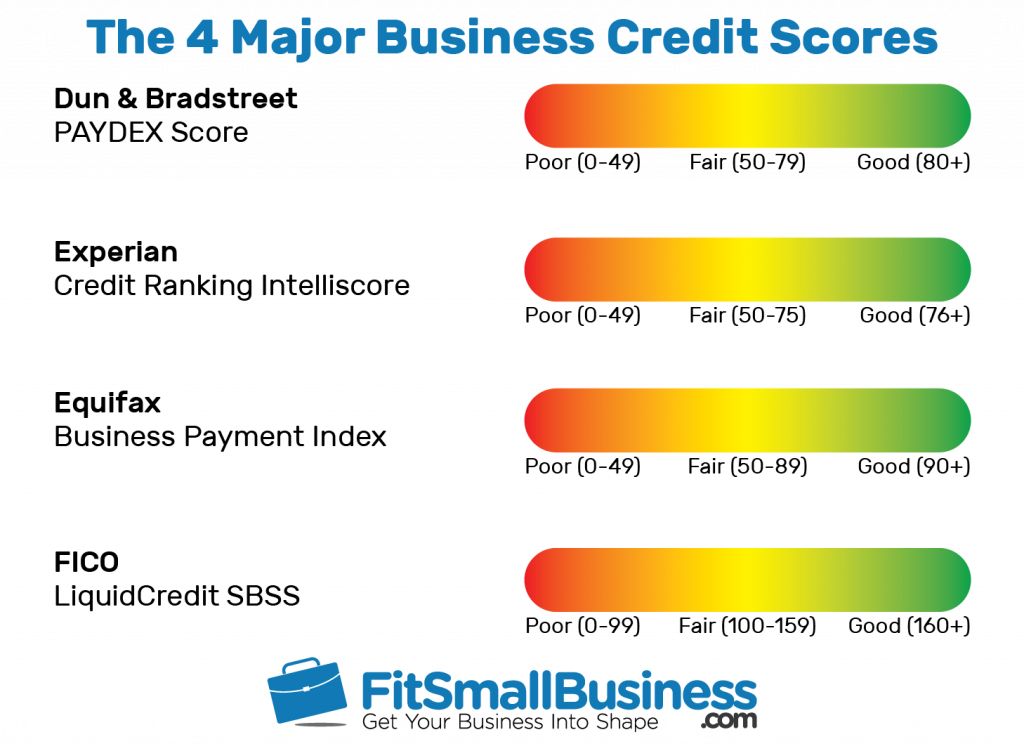

Build Business Credit - New businesses don’t have an established financial history that lenders can use to verify their risk. Let’s look at the ten essential steps to setting. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. Some focus on helping new. Each business credit card type serves a distinct purpose in the market, offering unique combinations of benefits, requirements, and limitations. Building good business credit entails consistently paying bills on time, maintaining healthy relationships with vendors and managing credit responsibly. • opening a business bank account and establishing credit. Knowing how to build business credit is crucial for helping your company grow and prosper. Take these steps to establish and build a solid credit rating for your company. Taking on debt and managing credit comes with risks. By doing so, you not only. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. Knowing how to build business credit will make it easier to get small business loans and convince suppliers to extend credit. The money basics guides are a series of learning. Let’s look at the ten essential steps to setting. Building good business credit entails consistently paying bills on time, maintaining healthy relationships with vendors and managing credit responsibly. • building business credit starts with choosing the right business structure and obtaining a federal tax id number. Following the 11 steps below will position your business for credit success. Common mistakes to avoid when building business credit. To build business credit effectively, follow these steps: Knowing how to build business credit is crucial for helping your company grow and prosper. • opening a business bank account and establishing credit. By doing so, you not only. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Knowing how to build business credit will make it easier to. Take these steps to establish and build a solid credit rating for your company. Let’s look at the ten essential steps to setting. Here’s everything you need to know. Boosting your business credit can help open doors for more funding opportunities, such as increasing your eligibility for small business loans, working capital loans (like business. Some focus on helping new. Each business credit card type serves a distinct purpose in the market, offering unique combinations of benefits, requirements, and limitations. Following the 11 steps below will position your business for credit success. Strong business credit can make it easier or less expensive to get certain types of financing, business. Establishing and managing business credit can help your company secure financing. It can also help you negotiate supply. Business credit card activity is usually reported to business credit bureaus, and responsible usage can help build a business credit profile. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. Knowing how. Common mistakes to avoid when building business credit. By doing so, you not only. Whether you’re in the early stages of building a business or you’re at a point where you could use more funding, building your business credit score can unlock your company’s. Building up your business credit works in a similar fashion to your personal credit score, but. Register your business with the irs (to obtain an ein) and. Taking on debt and managing credit comes with risks. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! To build business credit effectively, follow these steps: Establishing business credit is a pretty straightforward process of following steps to create a business. Let’s look at the ten essential steps to setting. It can also help you negotiate supply. Whether you’re in the early stages of building a business or you’re at a point where you could use more funding, building your business credit score can unlock your company’s. New businesses don’t have an established financial history that lenders can use to verify. Establish your business with a unique name, address, and phone number. Register your business with the irs (to obtain an ein) and. • opening a business bank account and establishing credit. To build business credit effectively, follow these steps: Take these steps to establish and build a solid credit rating for your company. Building good business credit entails consistently paying bills on time, maintaining healthy relationships with vendors and managing credit responsibly. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Discover how to lay the foundation for a good business credit score and get approved for new lines of credit.. Take these steps to establish and build a solid credit rating for your company. Building business credit is like laying the groundwork for future success. Boosting your business credit can help open doors for more funding opportunities, such as increasing your eligibility for small business loans, working capital loans (like business. The money basics guides are a series of learning.. Whether you’re in the early stages of building a business or you’re at a point where you could use more funding, building your business credit score can unlock your company’s. Building business credit can benefit your small business in many ways. Building business credit is like laying the groundwork for future success. Each business credit card type serves a distinct purpose in the market, offering unique combinations of benefits, requirements, and limitations. Business credit card activity is usually reported to business credit bureaus, and responsible usage can help build a business credit profile. Taking on debt and managing credit comes with risks. Discover how to lay the foundation for a good business credit score and get approved for new lines of credit. Knowing how to build business credit will make it easier to get small business loans and convince suppliers to extend credit. Knowing how to build business credit is crucial for helping your company grow and prosper. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. It’s not just about getting a loan when you’re in a pinch. Strong business credit can make it easier or less expensive to get certain types of financing, business. New businesses don’t have an established financial history that lenders can use to verify their risk. To build business credit effectively, follow these steps: Some focus on helping new. Register your business with the irs (to obtain an ein) and.How to build business credit in 10 steps QuickBooks

Best Ways To Build Business Credit Updated September 2024

5 Tips to Build Your Business Credit

How to Build Business Credit (StepbyStep Guide) WealthFit

How to Build Business Credit in 7 Steps

How to Build Business Credit (StepbyStep Guide) WealthFit

How to Build Business Credit Fast The 10 Best Ways AMP Advance

"How to Build Business Credit" — 7 Expert to Build

How Long Does It Take To Build Business Credit? Self. Credit Builder.

How to Build Business Credit CreditDonkey

It Can Also Help You Negotiate Supply.

Best Vendor Accounts To Build Business Credit Fast.

Take These Steps To Establish And Build A Solid Credit Rating For Your Company.

Here’s Everything You Need To Know.

Related Post: