Build Charts For Portfolio Performance In R

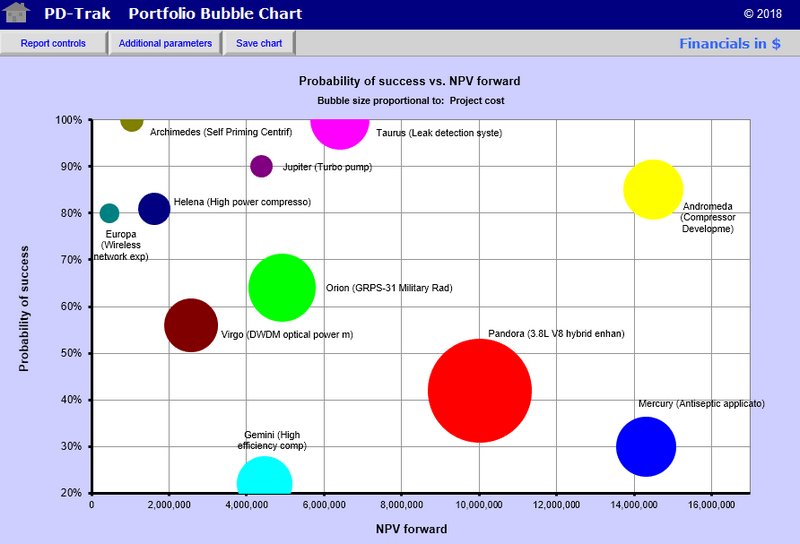

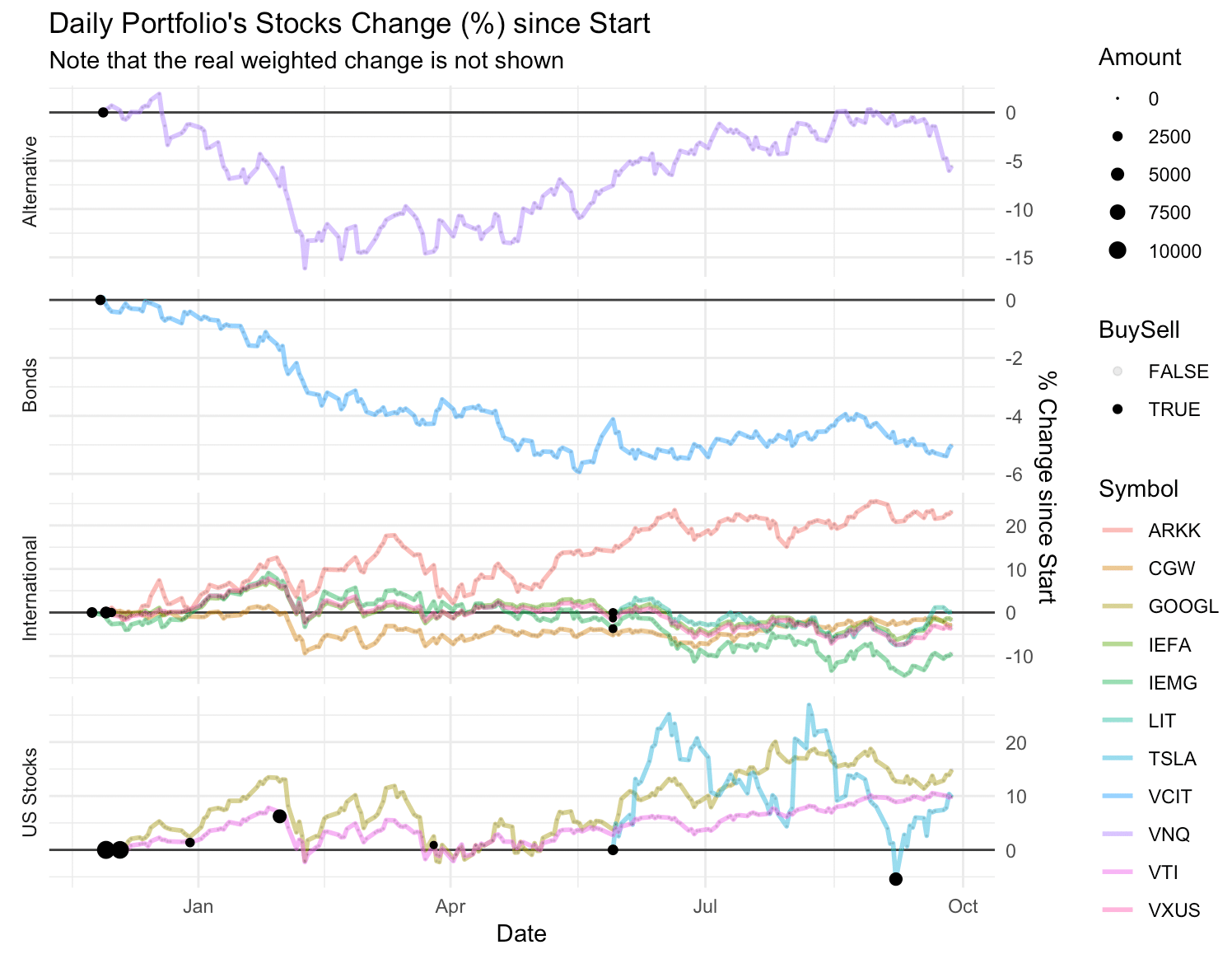

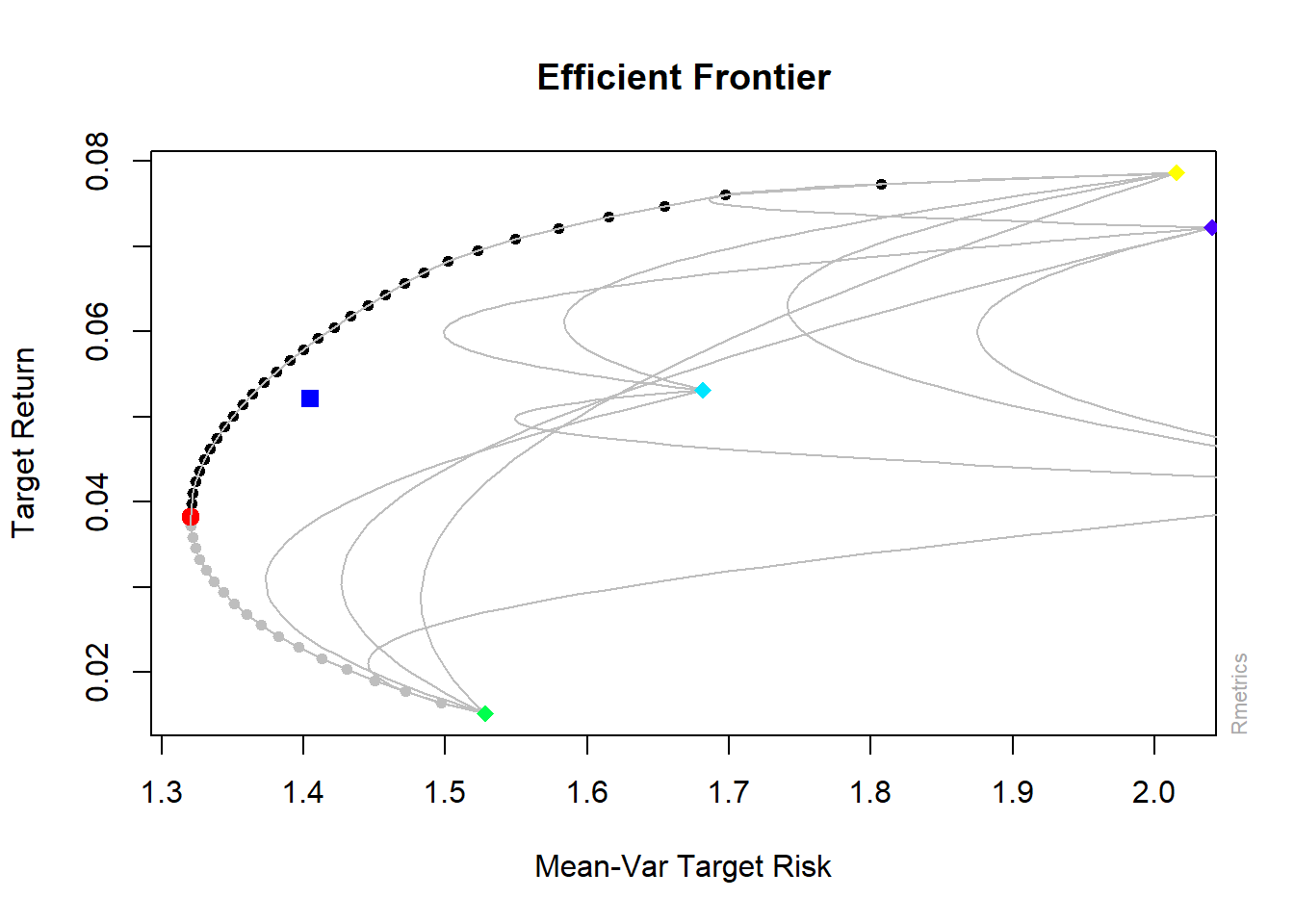

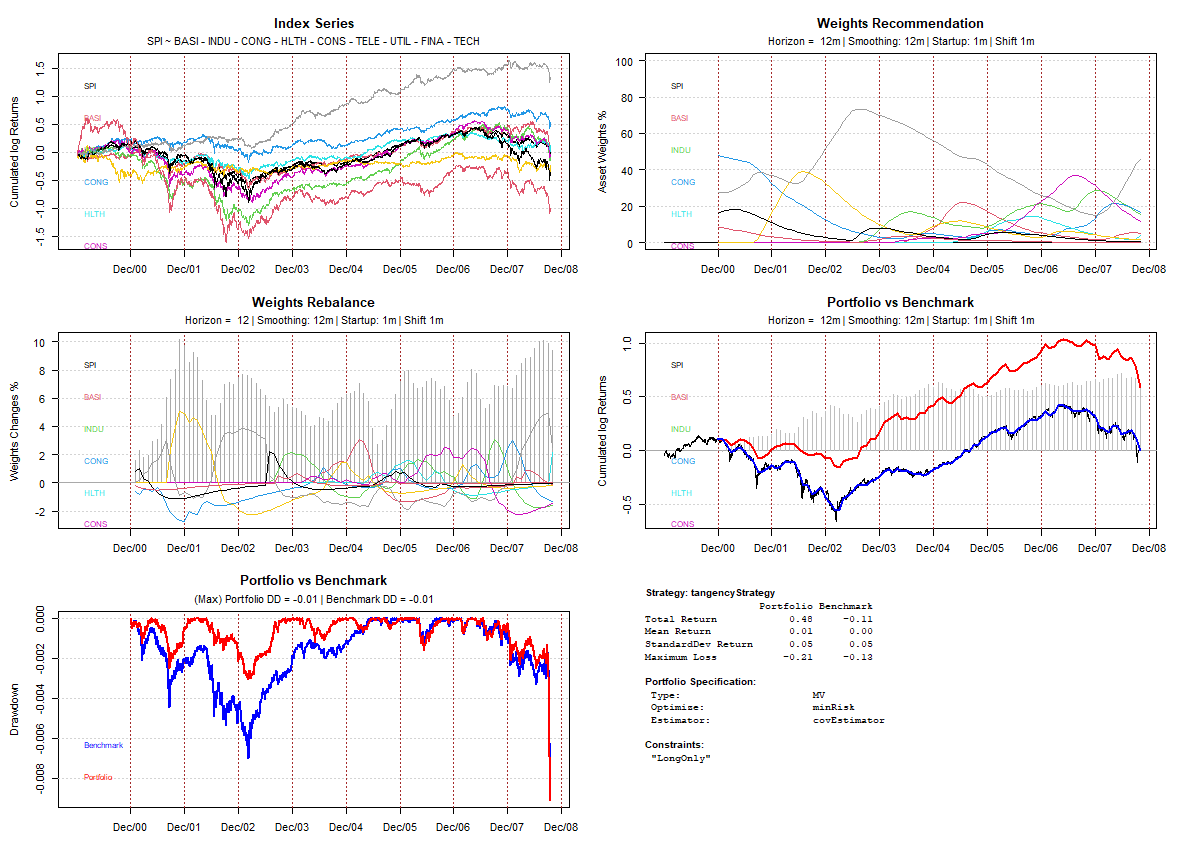

Build Charts For Portfolio Performance In R - The package is a generic portfolo optimization. Modern portfolio theory (mpt) states that investors are risk averse and given a level of risk, they will choose the. These metrics are important to analyse how effectively their. Collection of tools to calculate portfolio performance metrics. Portfolio performance is a key measure for investors. Doing so for the demo_cvxrportfolioanalytics.r will help you learn some portfolioanalytics basics, as well as learn how to use new capabilities in versions 2.0 and 2.1. We can generate a nice html report with our portfolio’s performance using another quick command. With the help of r and shiny, you can easily create and track a stock portfolio to see how individual stocks perform over time — all in one interactive visualization. Specify the investment horizon by choosing a start and end date. My goal is to apply what i’ve learned in portfolio theory using r as. So, we will learn how to optimize portfolios. Ggplot(data = df, aes(x = date, y = portfolio.returns)) +. Modern portfolio theory (mpt) states that investors are risk averse and given a level of risk, they will choose the. Doing so for the demo_cvxrportfolioanalytics.r will help you learn some portfolioanalytics basics, as well as learn how to use new capabilities in versions 2.0 and 2.1. In this post, we will explore some finance topics— portfolio optimization and computing portfolio returns. Portfolio optimization is an important topic in finance. In this chapter we show how to explore and analyze data using the dataset created in chapter @ref (#s_2data): Ggplot {ggplot2} can be used to make a line chart of the entire portfolio’s returns over the time period of analysis. Define portfolio strategies, including rebalancing. Specify the investment horizon by choosing a start and end date. Specify the investment horizon by choosing a start and end date. This section starts with a set of charts that provide a performance overview, some tables for presenting the data and basic statistics, and then discusses ways to compare distributions,. Portfolio optimization is an important topic in finance. These metrics are important to analyse how effectively their. Ggplot {ggplot2} can. Ggplot(data = df, aes(x = date, y = portfolio.returns)) +. This section starts with a set of charts that provide a performance overview, some tables for presenting the data and basic statistics, and then discusses ways to compare distributions,. With the help of r and shiny, you can easily create and track a stock portfolio to see how individual stocks. These metrics are important to analyse how effectively their. In this post we’ll focus on showcasing plotly’s webgl capabilities by charting financial portfolios using an r package called portfolioanalytics. In this post, we will explore some finance topics— portfolio optimization and computing portfolio returns. Portfolio performance is a key measure for investors. Portfolio optimization is an important topic in finance. We can generate a nice html report with our portfolio’s performance using another quick command. Portfolio optimization is an important topic in finance. My goal is to apply what i’ve learned in portfolio theory using r as. So, we will learn how to optimize portfolios. This section starts with a set of charts that provide a performance overview, some tables. In this post we’ll focus on showcasing plotly’s webgl capabilities by charting financial portfolios using an r package called portfolioanalytics. My goal is to apply what i’ve learned in portfolio theory using r as. Construct a portfolio by selecting assets and weights. In this post, we will explore some finance topics— portfolio optimization and computing portfolio returns. It uses rmarkdown. Modern portfolio theory (mpt) states that investors are risk averse and given a level of risk, they will choose the. It uses rmarkdown for rendering the plots and table into a single document. In this post, we will explore some finance topics— portfolio optimization and computing portfolio returns. Collection of tools to calculate portfolio performance metrics. Portfolio performance is a. Construct a portfolio by selecting assets and weights. Portfolio optimization is an important topic in finance. It uses rmarkdown for rendering the plots and table into a single document. Define portfolio strategies, including rebalancing. Portfolio performance is a key measure for investors. Portfolio performance is a key measure for investors. In this post we’ll focus on showcasing plotly’s webgl capabilities by charting financial portfolios using an r package called portfolioanalytics. These metrics are important to analyse how effectively their. It uses rmarkdown for rendering the plots and table into a single document. Portfolio optimization is an important topic in finance. So, we will learn how to optimize portfolios. Specify the investment horizon by choosing a start and end date. Portfolio optimization is an important topic in finance. Modern portfolio theory (mpt) states that investors are risk averse and given a level of risk, they will choose the. Doing so for the demo_cvxrportfolioanalytics.r will help you learn some portfolioanalytics basics, as. My goal is to apply what i’ve learned in portfolio theory using r as. With the help of r and shiny, you can easily create and track a stock portfolio to see how individual stocks perform over time — all in one interactive visualization. Modern portfolio theory (mpt) states that investors are risk averse and given a level of risk,. Specify the investment horizon by choosing a start and end date. So, we will learn how to optimize portfolios. Doing so for the demo_cvxrportfolioanalytics.r will help you learn some portfolioanalytics basics, as well as learn how to use new capabilities in versions 2.0 and 2.1. We can generate a nice html report with our portfolio’s performance using another quick command. Collection of tools to calculate portfolio performance metrics. Ggplot {ggplot2} can be used to make a line chart of the entire portfolio’s returns over the time period of analysis. Construct a portfolio by selecting assets and weights. This section starts with a set of charts that provide a performance overview, some tables for presenting the data and basic statistics, and then discusses ways to compare distributions,. Ggplot(data = df, aes(x = date, y = portfolio.returns)) +. With the help of r and shiny, you can easily create and track a stock portfolio to see how individual stocks perform over time — all in one interactive visualization. It uses rmarkdown for rendering the plots and table into a single document. In this post we’ll focus on showcasing plotly’s webgl capabilities by charting financial portfolios using an r package called portfolioanalytics. My goal is to apply what i’ve learned in portfolio theory using r as. The package is a generic portfolo optimization. Portfolio performance is a key measure for investors. Modern portfolio theory (mpt) states that investors are risk averse and given a level of risk, they will choose the.Product Portfolio Management Portfolio Charts PDTrak

Portfolio Construction using R YouTube

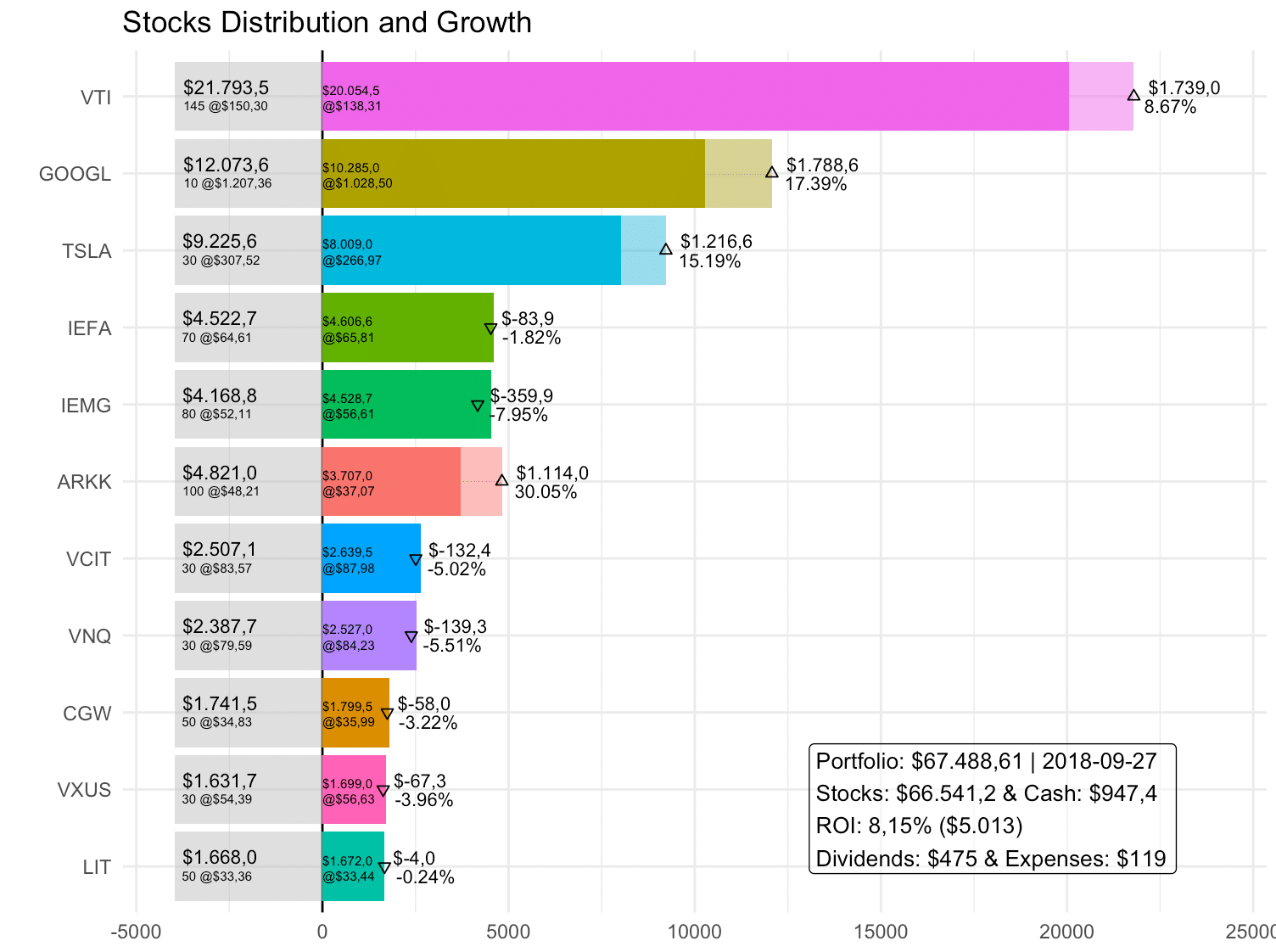

Visualize your Portfolio’s Performance and Generate a Nice Report with

Topic 12 Portfolio Modelling using R R for Data Analytics

GitHub jarvijaakko/Portfolio_analysis_dashboard

The Complete Guide to Portfolio Optimization in R PART2

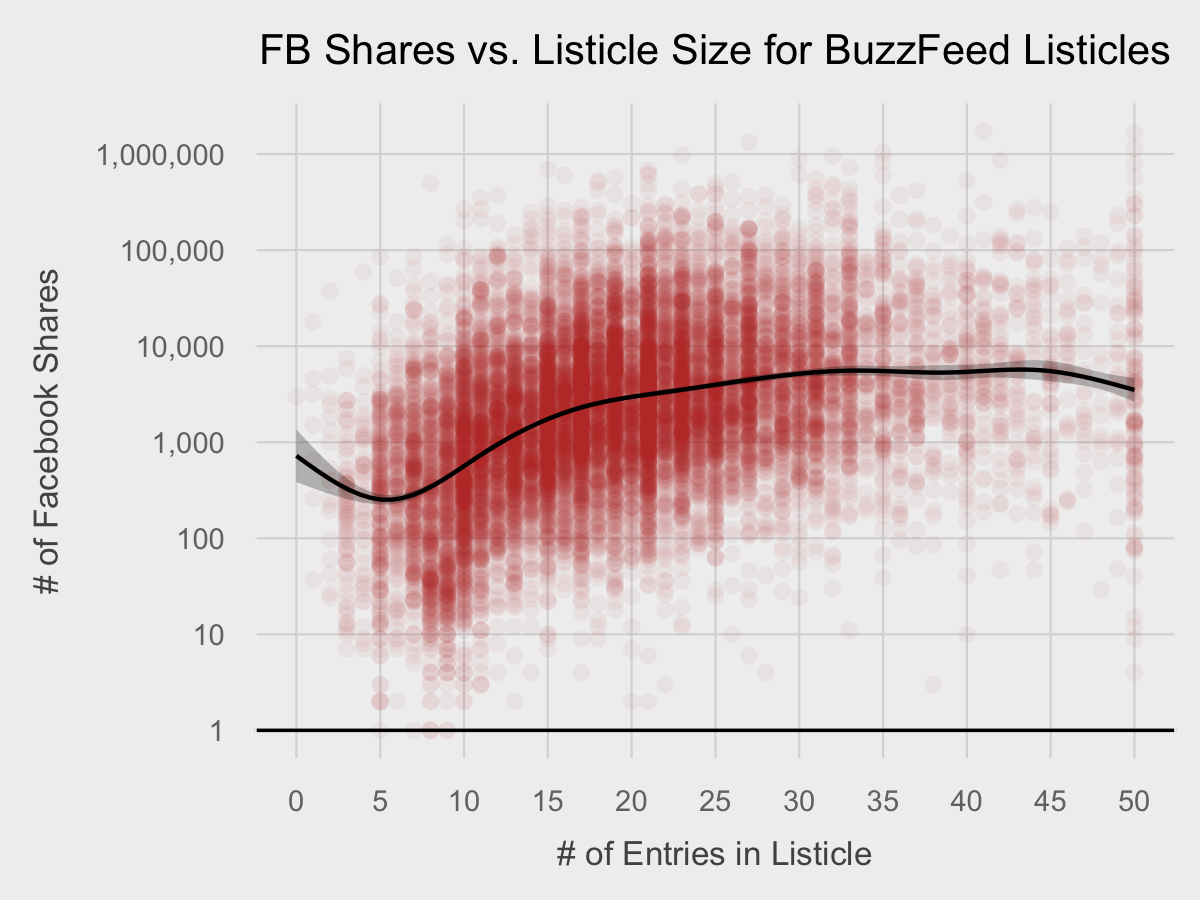

An Introduction on How to Make Beautiful Charts With R and ggplot2

r How to Create comparison bar graph Stack Overflow

Making a portfolio with a pie chart r/excel

Visualize your Portfolio’s Performance and Generate a Nice Report with

In This Post, We Will Explore Some Finance Topics— Portfolio Optimization And Computing Portfolio Returns.

Portfolio Optimization Is An Important Topic In Finance.

Define Portfolio Strategies, Including Rebalancing.

In This Chapter We Show How To Explore And Analyze Data Using The Dataset Created In Chapter @Ref (#S_2Data):

Related Post: