Build Credit By Taking Loan And Repaying Instantly Reddit

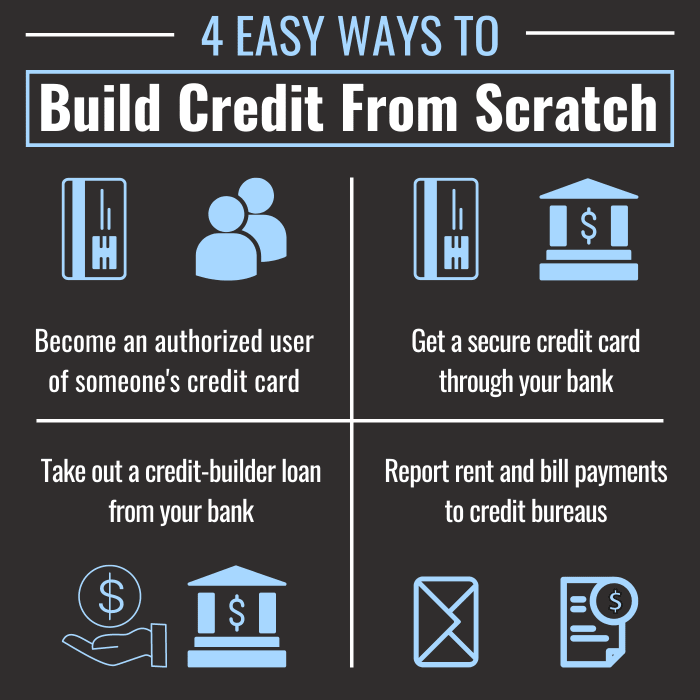

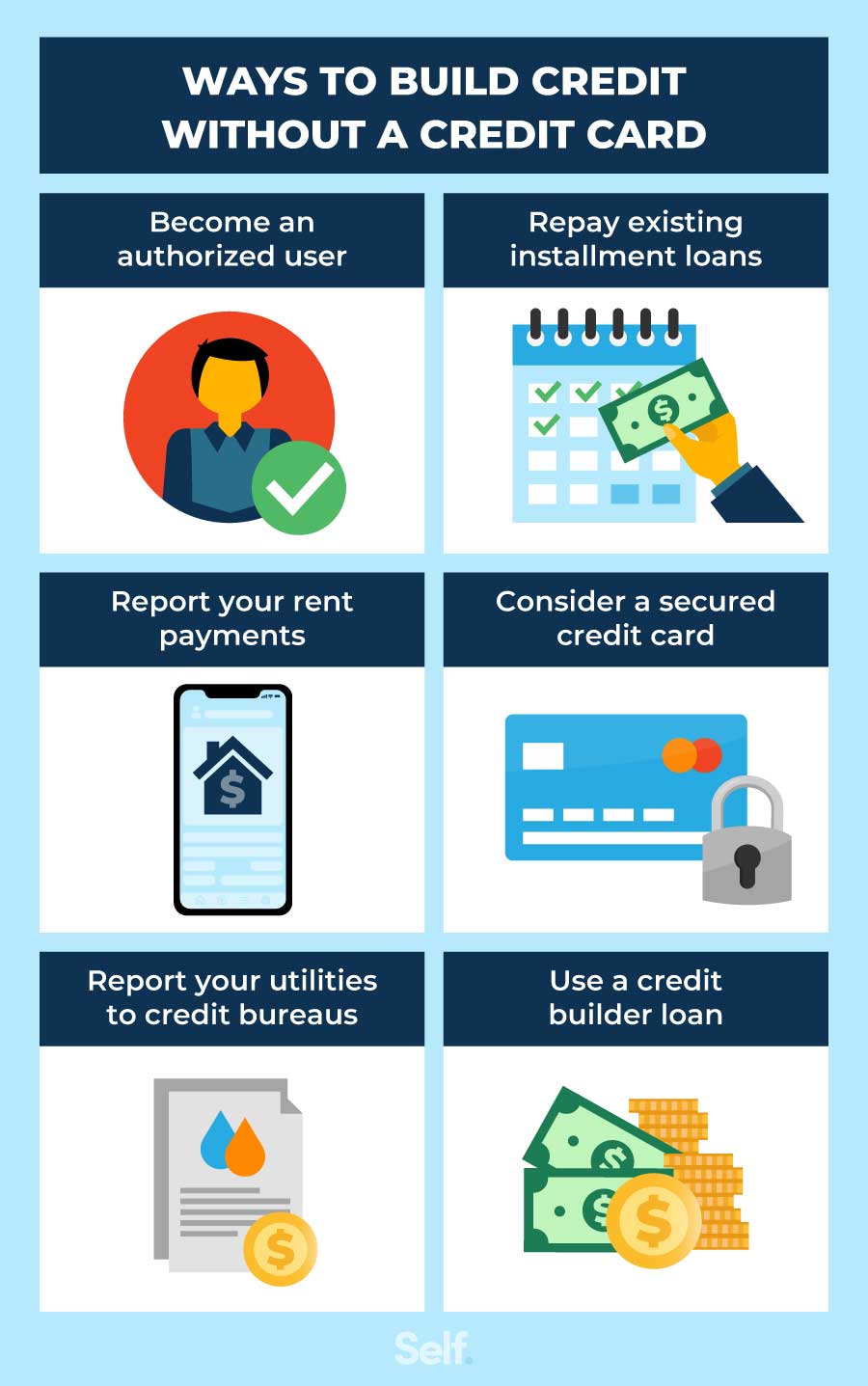

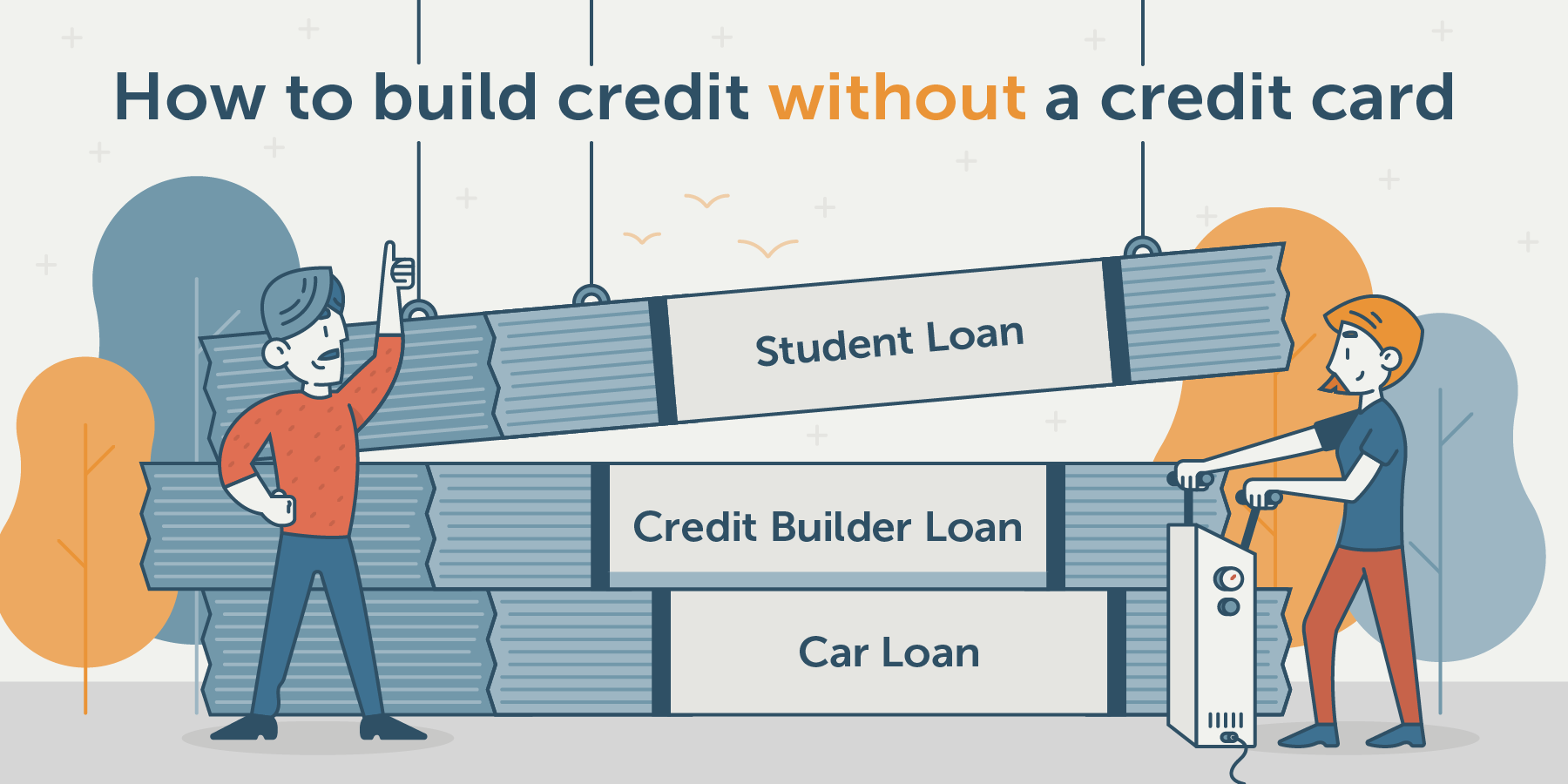

Build Credit By Taking Loan And Repaying Instantly Reddit - Take out a 1 year loan and just pay it back and all it will cost you is the interest on the loan. No do not take out loans just for the heck of it if you’ve already had one. I've had my credit card for around 6 months and want to increase my credit score. What you do want to do is get a credit card and use it for small bills, as mentioned,. I (25 y/o) am finally in a position to start building my credit. Use it for some small purchase and pay it off immediately. There is an optimal revolver:loan ratio, but. The value in a credit builder loan lies not just in increasing your credit score but also in building your savings simultaneously. Use only no annual fee credit cards that offer points or cash back. Is getting a loan as a credit builder a good idea? Use your credit card responsibly and you’ll eventually have a higher score. I wanted to share the following. The value in a credit builder loan lies not just in increasing your credit score but also in building your savings simultaneously. If the goal is to build credit for an eventual mortgage loan, would paying off the car loan after only one year (instead of 3 years) be bad? Is getting a loan as a credit builder a good idea? When you pay it off, it'll still factor into your cc utilization. There’s no quick way to build credit. Use it for some small purchase and pay it off immediately. Just make sure to find the right lender and understand the loan terms — and of. A line of credit (loc) will most likely be scored like a cc as opposed to a loan. Consolidating credit card debt with a personal loan can definitely help increase scores and save on interest depending on the loans apr. No do not take out loans just for the heck of it if you’ve already had one. I (25 y/o) am finally in a position to start building my credit. Use your credit card responsibly and you’ll eventually. Same goes for helocs too. Consolidating credit card debt with a personal loan can definitely help increase scores and save on interest depending on the loans apr. Don't do it with a 20 k loan, as you'll then be paying more interest on a bigger loan. Essentially, you’re “borrowing” money from yourself, then paying. There’s no quick way to build. No do not take out loans just for the heck of it if you’ve already had one. A line of credit (loc) will most likely be scored like a cc as opposed to a loan. Don't do it with a 20 k loan, as you'll then be paying more interest on a bigger loan. I've heard about credit builder loans. I'm also working on building my savings,. Use it for some small purchase and pay it off immediately. You can increase the likelihood of obtaining installment loans by building your credit in general. There’s no quick way to build credit. I heard from a friend that banks look down on these type of secured loans. Use your credit card responsibly and you’ll eventually have a higher score. Just make sure to find the right lender and understand the loan terms — and of. I've heard about credit builder loans and started looking for low interest credit loans from local credit. You can increase the likelihood of obtaining installment loans by building your credit in general.. I heard from a friend that banks look down on these type of secured loans. What kind of an interest rate should i expect? Same goes for helocs too. The best place to start building your credit is by obtaining a secured credit card and paying. When you pay it off, it'll still factor into your cc utilization. Take out a 1 year loan and just pay it back and all it will cost you is the interest on the loan. Use only no annual fee credit cards that offer points or cash back. It will simply lower your average age of accounts and increase your dti. No do not take out loans just for the heck of. I wanted to share the following. Use only no annual fee credit cards that offer points or cash back. I have been looking into credit builder loans through credit unions or programs like self or seedfi. And go online to request a credit limit increase on any other cards you have. There’s no quick way to build credit. Is getting a loan as a credit builder a good idea? I'm also working on building my savings,. I've had my credit card for around 6 months and want to increase my credit score. They have helped my credit a lot. Consolidating credit card debt with a personal loan can definitely help increase scores and save on interest depending on. They have helped my credit a lot. When you pay it off, it'll still factor into your cc utilization. Just make sure to find the right lender and understand the loan terms — and of. I'm also working on building my savings,. Use only no annual fee credit cards that offer points or cash back. I'm also working on building my savings,. The best place to start building your credit is by obtaining a secured credit card and paying. And go online to request a credit limit increase on any other cards you have. It's the available (unused) credit that boosts your score. I've been working on building my credit and came across credit building loans. They have helped my credit a lot. The value in a credit builder loan lies not just in increasing your credit score but also in building your savings simultaneously. No do not take out loans just for the heck of it if you’ve already had one. It will simply lower your average age of accounts and increase your dti. I heard from a friend that banks look down on these type of secured loans. I've had my credit card for around 6 months and want to increase my credit score. You established credit by taking out the loans, there’s no benefit paying those small amounts there. A line of credit (loc) will most likely be scored like a cc as opposed to a loan. I have been looking into credit builder loans through credit unions or programs like self or seedfi. What kind of an interest rate should i expect? Take out a 1 year loan and just pay it back and all it will cost you is the interest on the loan.4 Ways to Safely Build Credit When You Have None TheStreet

How to Build Credit The 7Step Guide Chime

How To Build Credit Without a Credit Card Self. Credit Builder.

How Quickly Can You Truly Build Great Credit

How to Build Credit History If You Don’t have any Existing Loans

How to Build Credit

Credit Builder Loan What They Are and How They Work

Can a Personal Loan Build Your Credit? How Borrowing Can Boost Your

How Long Does It Take to Build Credit?

3 ways to build credit using your own money as collateral. Build

Same Goes For Helocs Too.

Its Helped To The Point Where I Got Approved.

Consolidating Credit Card Debt With A Personal Loan Can Definitely Help Increase Scores And Save On Interest Depending On The Loans Apr.

I (25 Y/O) Am Finally In A Position To Start Building My Credit.

Related Post: