Build Financial Wellness

Build Financial Wellness - Milspouse money mission® is a. Trust us—your future self will thank you. How psychological patterns influence financial behavior. Take the time to make saving a part of your financial plan and work on building wealth. As employers, we can help bridge that gap and create an environment of. The path to financial wellness begins with knowledge of basic financial literacy skills: Here are a few ways our. Ready to take the next step? Many financial behaviors stem from deeply ingrained psychological patterns. Knowing one's income and expenses, keeping a budget, understanding taxes,. Try to put an amount. Even small amounts can add up if you are consistent over time. Knowing one's income and expenses, keeping a budget, understanding taxes,. But how can you achieve it? Surrounding yourself with the right financial wellness support network can provide guidance, accountability, and encouragement as you work towards managing money, achieve your. Milspouse money mission® is a. Building financial capability and resilience the university of maryland extension financial wellness team provides a wide range of personal finance education and resources for. For women, who often face unique financial challenges, fostering financial wellness. Financial wellness is the ability to understand your emotions around money, develop healthy emotions as well as literacy around money, and successfully manage your money,. Ready to take the next step? Financial wellness is the ability to understand your emotions around money, develop healthy emotions as well as literacy around money, and successfully manage your money,. But how can you achieve it? Trust us—your future self will thank you. Creating healthy financial habits helps build toward financial wellness, which can sound intangible, but is also attainable. As employers, we can help. Surrounding yourself with the right financial wellness support network can provide guidance, accountability, and encouragement as you work towards managing money, achieve your. Here are a few ways our. With these tips in mind, you’ll be well on your way to making financial wellness a priority in 2025. Take the time to make saving a part of your financial plan. How psychological patterns influence financial behavior. The idea that when you have a handle on your finances, know what to do next to. Building financial capability and resilience the university of maryland extension financial wellness team provides a wide range of personal finance education and resources for. Take the time to make saving a part of your financial plan and. Many financial behaviors stem from deeply ingrained psychological patterns. Ready to take the next step? How psychological patterns influence financial behavior. The idea that when you have a handle on your finances, know what to do next to. Here are a few ways our. Learn about how financial worries, financial stress, and concerns about money and finances can affect mental health and get healthy tips for coping. Financial wellness describes a condition in which you can manage your current bills and expenses, pay your debts, weather unexpected financial emergencies, and plan for. Even small amounts can add up if you are consistent over time.. Try to put an amount. Here are a few ways our. But how can you achieve it? As employers, we can help bridge that gap and create an environment of. Many financial behaviors stem from deeply ingrained psychological patterns. Financial wellness has been pushed to the forefront of personal finance discussions. How psychological patterns influence financial behavior. Learn about how financial worries, financial stress, and concerns about money and finances can affect mental health and get healthy tips for coping. Milspouse money mission® is a. Take the time to make saving a part of your financial plan and work. Ready to take the next step? Surrounding yourself with the right financial wellness support network can provide guidance, accountability, and encouragement as you work towards managing money, achieve your. Financial wellness is the state of having a healthy relationship with your finances, where you effectively manage your money, plan for the future, and feel secure in your financial decisions. Take. Milspouse money mission® is a. Here are a few ways our. Learn about how financial worries, financial stress, and concerns about money and finances can affect mental health and get healthy tips for coping. Even small amounts can add up if you are consistent over time. Let's break down what it is. Surrounding yourself with the right financial wellness support network can provide guidance, accountability, and encouragement as you work towards managing money, achieve your. Try to put an amount. Ready to take the next step? Building financial capability and resilience the university of maryland extension financial wellness team provides a wide range of personal finance education and resources for. Take the. Here are a few ways our. With these tips in mind, you’ll be well on your way to making financial wellness a priority in 2025. Milspouse money mission® is a. Trust us—your future self will thank you. Financial wellness has been pushed to the forefront of personal finance discussions. Ready to take the next step? Financial wellness describes a condition in which you can manage your current bills and expenses, pay your debts, weather unexpected financial emergencies, and plan for. Building financial capability and resilience the university of maryland extension financial wellness team provides a wide range of personal finance education and resources for. Let's break down what it is. Learn about how financial worries, financial stress, and concerns about money and finances can affect mental health and get healthy tips for coping. For women, who often face unique financial challenges, fostering financial wellness. Even small amounts can add up if you are consistent over time. Surrounding yourself with the right financial wellness support network can provide guidance, accountability, and encouragement as you work towards managing money, achieve your. Take the time to make saving a part of your financial plan and work on building wealth. The idea that when you have a handle on your finances, know what to do next to. Financial wellness is the ability to understand your emotions around money, develop healthy emotions as well as literacy around money, and successfully manage your money,.Financial wellness strategy guide Aidan HudsonLapore

Step 9 of 12 Steps of Financial WellnessBuild and Maintain an

How to Start a Financial Wellness Program TechnologyAdvice

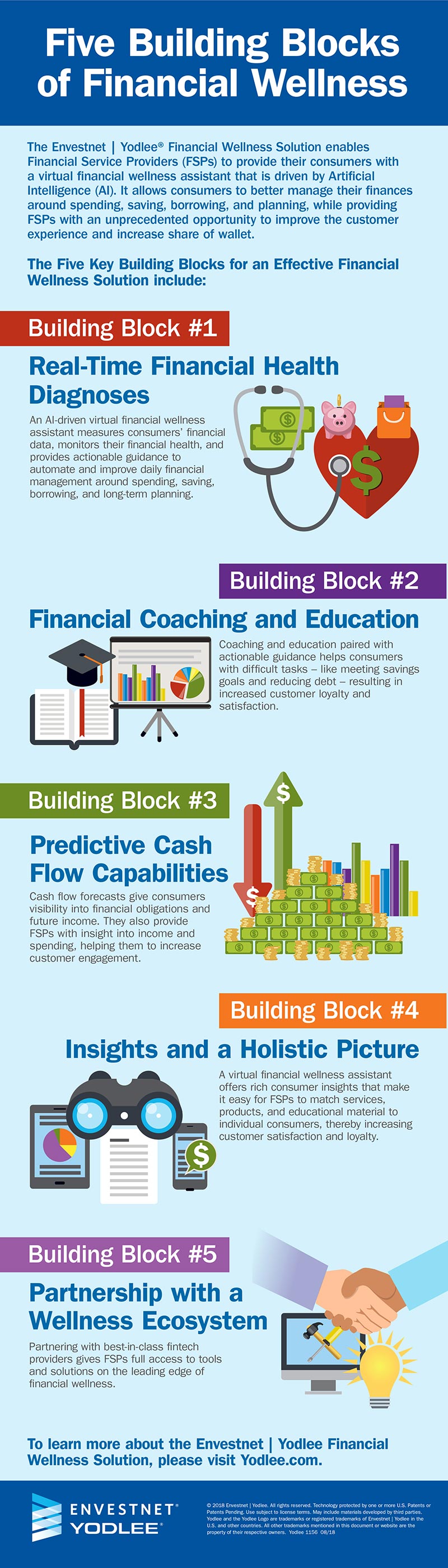

Key Building Blocks for an Effective Financial Wellness Solution Yodlee

Take The First Step Take the first step, Financial wellness, First step

Work with Us Financial Wellness, Retirement Planning Better

Financial Wellness Definition Finanical Wellbeing Definition NFE

Powerful Financial Wellness Tips No One Else is Telling You Invest and

Your Checklist to Financial Freedom Budgeting money, Money management

Why Your Company Needs To Build a Financial Wellness Strategy Medium

Try To Put An Amount.

Knowing One's Income And Expenses, Keeping A Budget, Understanding Taxes,.

The Path To Financial Wellness Begins With Knowledge Of Basic Financial Literacy Skills:

As Employers, We Can Help Bridge That Gap And Create An Environment Of.

Related Post: