Build My Business Credit

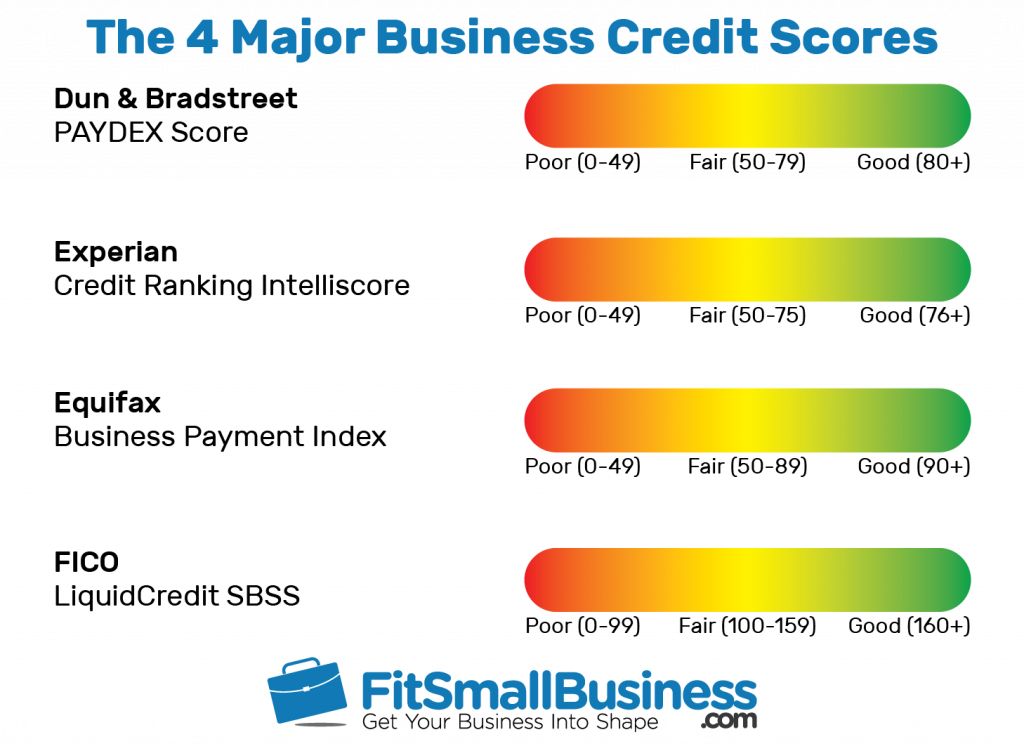

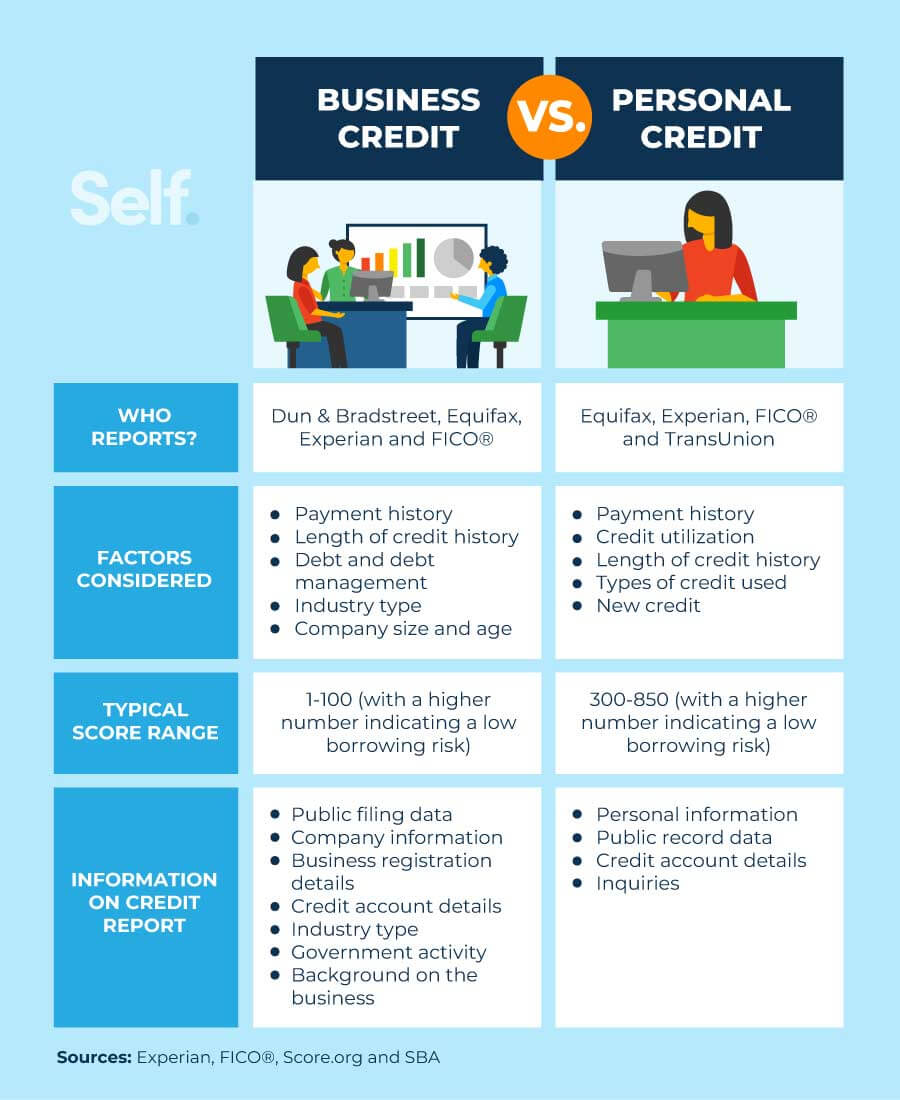

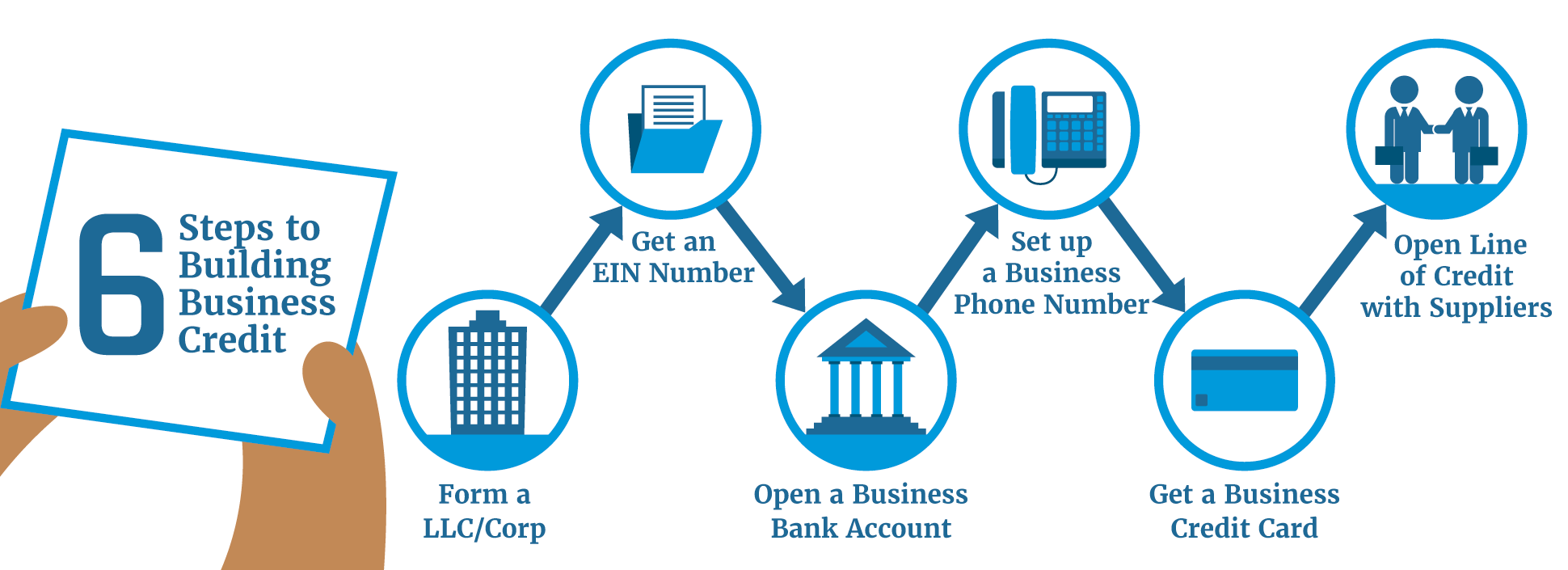

Build My Business Credit - Establish a business address and phone number. Key steps to building business credit involve choosing the right business structure, obtaining a federal tax id number, opening a business bank account, establishing credit with. Business credit is a term that describes several tools lenders, creditors and vendors use to measure the creditworthiness of your business. Whether you’re in the early stages of building a business or you’re at a point where you could use more funding, building your business credit score can unlock your company’s. Knowing how to build business credit will make it easier to get small business loans and convince suppliers to extend credit. A solid business credit profile can open doors to. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Compare options and learn more. A solid score (usually 650 or higher) signals that your business is financially healthy and has a good repayment history. This information can show others how you have managed. Your business credit score is important for many reasons, including maintaining a good financial reputation, demonstrating good. Take these steps to establish and build a solid credit rating for your company. From understanding how business credit scores and reports are originated, to employing best practices for building up a strong business credit report, the experian blueprint is here to. The first step toward building business credit is to establish your business legally as a. Let’s look at the ten essential steps to setting. Why is your business credit score important? Monitor your business credit score. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Understanding how to build business credit is vital as it can be used to secure loans, lines of credit, and other financial assistance to help your business grow. Establish a business address and phone number. These contain your company’s credit history. This information can show others how you have managed. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them. A solid score (usually 650 or higher) signals that your business is financially healthy and has a good repayment history. Some. Some cards offer preset limits based on your business credit score and business financials, while others provide flexible spending power that adjusts with your usage patterns. New businesses don’t have an established financial history that lenders can use to verify their risk. Monitor your business credit score. Take these steps to establish and build a solid credit rating for your. From understanding how business credit scores and reports are originated, to employing best practices for building up a strong business credit report, the experian blueprint is here to. Building business credit is like laying the groundwork for future success. Establishing an llc and building strong business credit can help your business qualify for a wider range of small business loan. Knowing how to build business credit will make it easier to get small business loans and convince suppliers to extend credit. In this article, we’ll explore how to. These contain your company’s credit history. Understanding how to build business credit is vital as it can be used to secure loans, lines of credit, and other financial assistance to help your. It can also help you negotiate supply. Building business credit plays a crucial role in your company’s funding ability. A solid score (usually 650 or higher) signals that your business is financially healthy and has a good repayment history. Whether you operate as a limited liability company or corporation, your business has the ability. Apply for a business duns number. Understanding how to build business credit is vital as it can be used to secure loans, lines of credit, and other financial assistance to help your business grow. Apply for a business duns number. The first step toward building business credit is to establish your business legally as a. Your business credit score is important for many reasons, including maintaining. These contain your company’s credit history. Why is your business credit score important? Here’s everything you need to know. Why business credit matters for your llc. Monitoring your business credit helps you: Whether you’re in the early stages of building a business or you’re at a point where you could use more funding, building your business credit score can unlock your company’s. Apply for a business duns number. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Compare options and learn more.. It’s not just about getting a loan when you’re in a pinch. Whether you operate as a limited liability company or corporation, your business has the ability. Knowing how to build business credit will make it easier to get small business loans and convince suppliers to extend credit. Some cards offer preset limits based on your business credit score and. Establishing an llc and building strong business credit can help your business qualify for a wider range of small business loan options. The first step toward building business credit is to establish your business legally as a. It can also help you negotiate supply. Some cards offer preset limits based on your business credit score and business financials, while others. Lenders will likely check your business credit score. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. Just like personal credit, your business credit score changes over time. Knowing how to build business credit will make it easier to get small business loans and convince suppliers to extend credit. Establishing an llc and building strong business credit can help your business qualify for a wider range of small business loan options. These contain your company’s credit history. Whether you operate as a limited liability company or corporation, your business has the ability. Some cards offer preset limits based on your business credit score and business financials, while others provide flexible spending power that adjusts with your usage patterns. New businesses don’t have an established financial history that lenders can use to verify their risk. Your business credit score is important for many reasons, including maintaining a good financial reputation, demonstrating good. Business credit is a term that describes several tools lenders, creditors and vendors use to measure the creditworthiness of your business. Establishing and managing business credit can help your company secure financing when you need it and with better terms. Boosting your business credit can help open doors for more funding opportunities, such as increasing your eligibility for small business loans, working capital loans (like business. Establish a business address and phone number. The first step in effectively building your business credit is understanding the factors that impact credit scores and how to manage and improve them.How to build my business credit?

How to Build Business Credit in 7 Steps

How do I build my business credit ASAP? Leia aqui How fast can you

How Long Does It Take To Build Business Credit? Self. Credit Builder.

How Long Does It Take To Build Business Credit? Self. Credit Builder.

7 Easy steps to build the business credit you need in 30 days Top

5 Tips to Build Your Business Credit

How to Build Business Credit (StepbyStep Guide) WealthFit

How to Build Business Credit for a Small Business

Best Ways To Build Business Credit Updated September 2024

Understanding How To Build Business Credit Is Vital As It Can Be Used To Secure Loans, Lines Of Credit, And Other Financial Assistance To Help Your Business Grow.

It Can Also Help You Negotiate Supply.

Why Is Your Business Credit Score Important?

Whether You’re In The Early Stages Of Building A Business Or You’re At A Point Where You Could Use More Funding, Building Your Business Credit Score Can Unlock Your Company’s.

Related Post: