Build To Suit Financing

Build To Suit Financing - Property types retail, office, industrial, healthcare & gsa. Build to suit financing is a structure in which a capital partner funds the entire construction of a property that is tailored to a tenant’s specific needs. Learn about loan guidelines, terms, rates and options for office, industrial and retail projects. Discover how commercial spaces impact your bottom line with financing tips, lease options, and strategies for success! Many developers use traditional commercial construction loans for the construction phase of a project, and, upon completion,. Nnn build to suit net lease lending. Commercial financing for built to suit projects. Build to suit 100% construction loan to costs for nnn assets nationwide from $1 million. The lessee agrees to lease. A build to suit is a type of commercial real estate lease in which the land owner agrees to construct a property according to the requirements of the lessee. Nnn build to suit net lease lending. The lessee agrees to lease. In exchange, the tenant signs a lease. Commercial financing for built to suit projects. Learn about loan guidelines, terms, rates and options for office, industrial and retail projects. Build to suit 100% construction loan to costs for nnn assets nationwide from $1 million. A build to suit is a type of commercial real estate lease in which the land owner agrees to construct a property according to the requirements of the lessee. Discover how commercial spaces impact your bottom line with financing tips, lease options, and strategies for success! Build to suit financing is a structure in which a capital partner funds the entire construction of a property that is tailored to a tenant’s specific needs. Property types retail, office, industrial, healthcare & gsa. Commercial financing for built to suit projects. Build to suit 100% construction loan to costs for nnn assets nationwide from $1 million. Property types retail, office, industrial, healthcare & gsa. A build to suit is a type of commercial real estate lease in which the land owner agrees to construct a property according to the requirements of the lessee. Discover. Build to suit financing is a structure in which a capital partner funds the entire construction of a property that is tailored to a tenant’s specific needs. Discover how commercial spaces impact your bottom line with financing tips, lease options, and strategies for success! Build to suit 100% construction loan to costs for nnn assets nationwide from $1 million. Many. Build to suit financing is a structure in which a capital partner funds the entire construction of a property that is tailored to a tenant’s specific needs. Property types retail, office, industrial, healthcare & gsa. In exchange, the tenant signs a lease. Nnn build to suit net lease lending. The lessee agrees to lease. Learn about loan guidelines, terms, rates and options for office, industrial and retail projects. Build to suit financing is a structure in which a capital partner funds the entire construction of a property that is tailored to a tenant’s specific needs. The lessee agrees to lease. Many developers use traditional commercial construction loans for the construction phase of a project,. Nnn build to suit net lease lending. Many developers use traditional commercial construction loans for the construction phase of a project, and, upon completion,. Discover how commercial spaces impact your bottom line with financing tips, lease options, and strategies for success! A build to suit is a type of commercial real estate lease in which the land owner agrees to. The lessee agrees to lease. Nnn build to suit net lease lending. Build to suit financing is a structure in which a capital partner funds the entire construction of a property that is tailored to a tenant’s specific needs. Many developers use traditional commercial construction loans for the construction phase of a project, and, upon completion,. Learn about loan guidelines,. Discover how commercial spaces impact your bottom line with financing tips, lease options, and strategies for success! Nnn build to suit net lease lending. Commercial financing for built to suit projects. Build to suit financing is a structure in which a capital partner funds the entire construction of a property that is tailored to a tenant’s specific needs. A build. In exchange, the tenant signs a lease. Commercial financing for built to suit projects. Many developers use traditional commercial construction loans for the construction phase of a project, and, upon completion,. Build to suit financing is a structure in which a capital partner funds the entire construction of a property that is tailored to a tenant’s specific needs. Learn about. A build to suit is a type of commercial real estate lease in which the land owner agrees to construct a property according to the requirements of the lessee. Discover how commercial spaces impact your bottom line with financing tips, lease options, and strategies for success! Learn about loan guidelines, terms, rates and options for office, industrial and retail projects.. Learn about loan guidelines, terms, rates and options for office, industrial and retail projects. Build to suit 100% construction loan to costs for nnn assets nationwide from $1 million. A build to suit is a type of commercial real estate lease in which the land owner agrees to construct a property according to the requirements of the lessee. Discover how. Learn about loan guidelines, terms, rates and options for office, industrial and retail projects. Many developers use traditional commercial construction loans for the construction phase of a project, and, upon completion,. Nnn build to suit net lease lending. In exchange, the tenant signs a lease. Discover how commercial spaces impact your bottom line with financing tips, lease options, and strategies for success! Build to suit financing is a structure in which a capital partner funds the entire construction of a property that is tailored to a tenant’s specific needs. The lessee agrees to lease. A build to suit is a type of commercial real estate lease in which the land owner agrees to construct a property according to the requirements of the lessee.Build to Suit Data Centres from Award Winning VIRTUS

O que é Built to Suit? Conheça mais sobre esse conceito

BuildtoSuit 1031 Exchanges

What Does BuildtoSuit Really Mean? Group

Deal Alert Mandelbaum Barrett PC Secures 10.5 Million Construction

Build To Suit Funding

Understanding Build to Suit Development

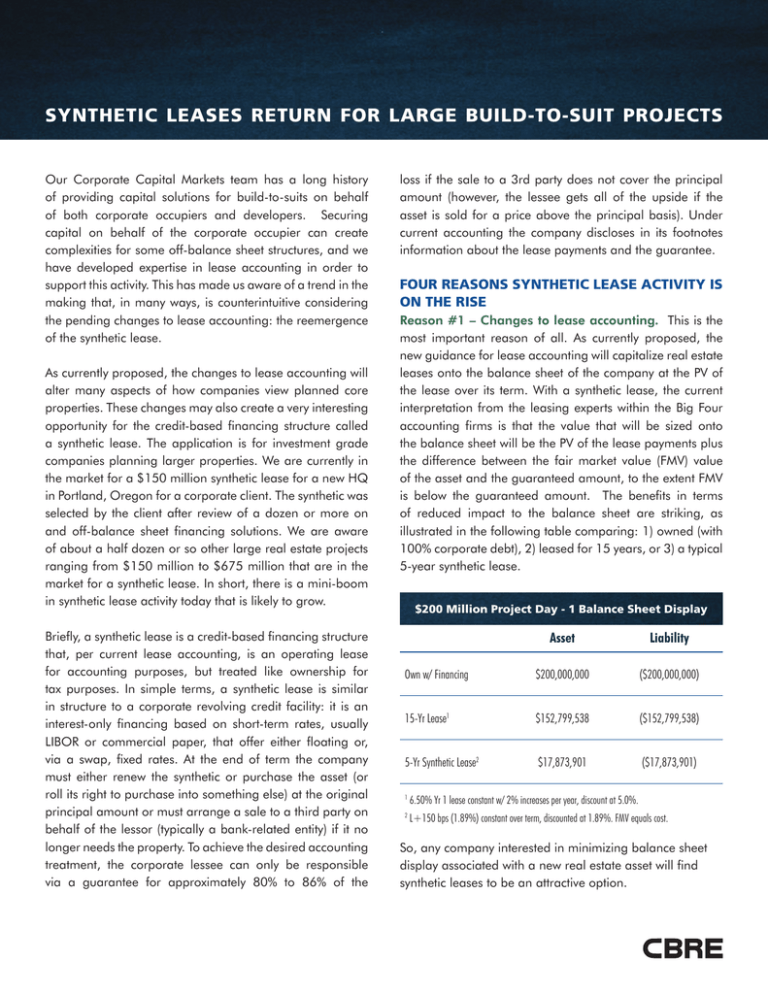

synthetic leases return for large buildtosuit projects

What is BuildtoSuit Financing? YouTube

Associated Bank completes financing for buildtosuit industrial

Build To Suit 100% Construction Loan To Costs For Nnn Assets Nationwide From $1 Million.

Commercial Financing For Built To Suit Projects.

Property Types Retail, Office, Industrial, Healthcare & Gsa.

Related Post: