Build Up Approach Cfa

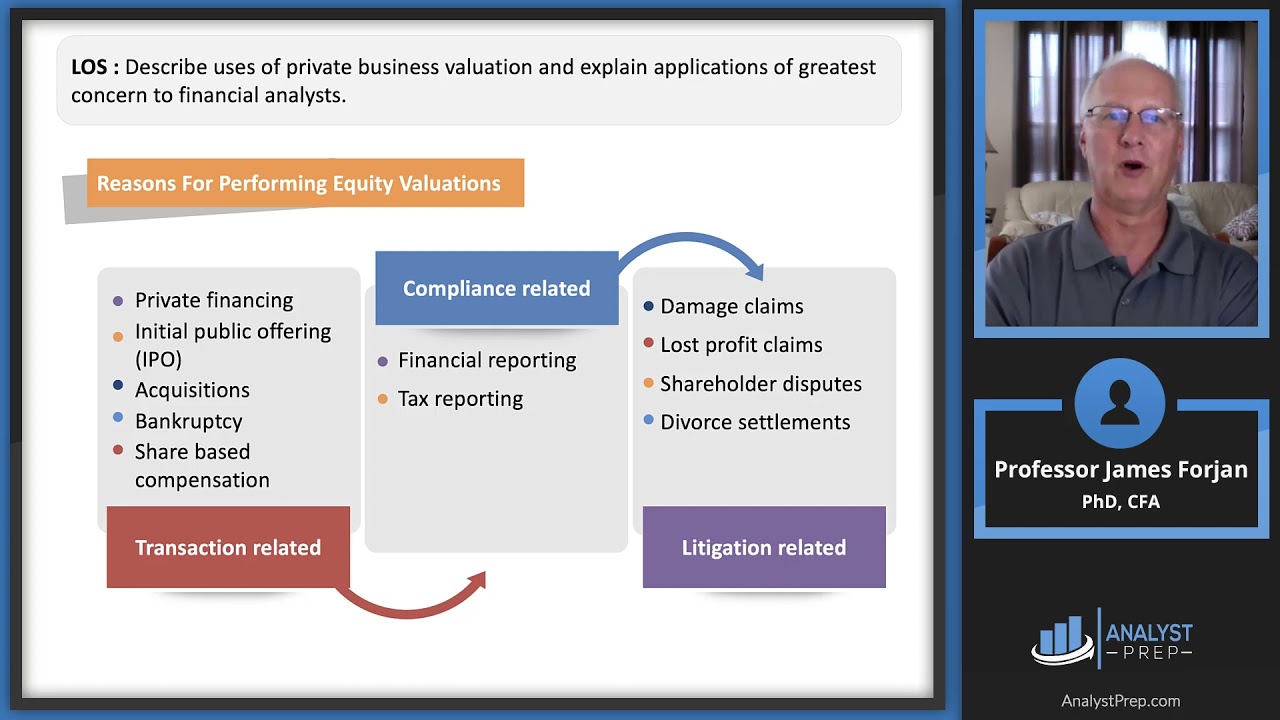

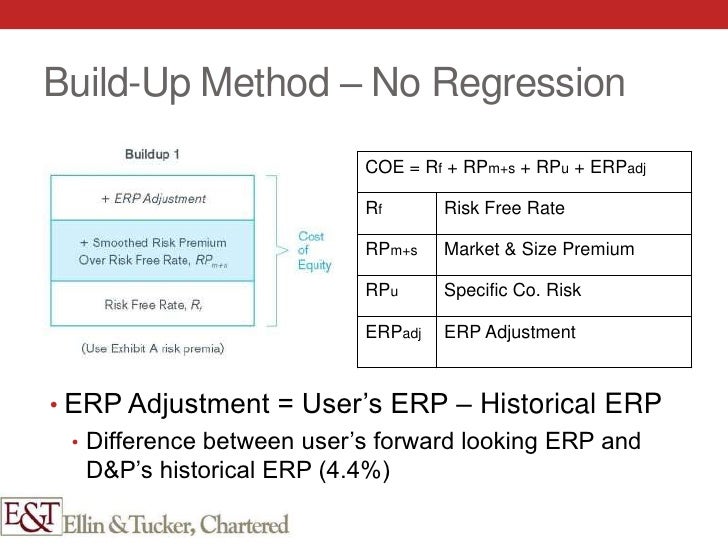

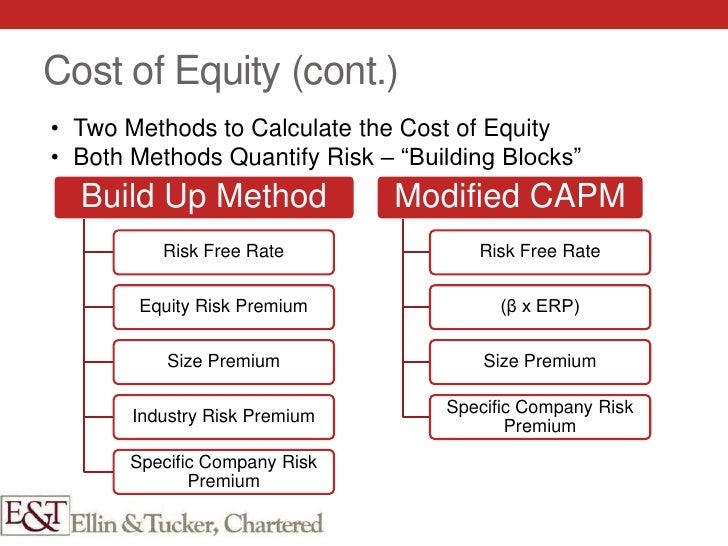

Build Up Approach Cfa - A place for discussion and study tips for the chartered financial analyst® (cfa®) program. The required return is simply the sum of the risk free. Over 3,100 practice questions that cover the entire cfa curriculum. In this method, the required rate of return is estimated by essentially assuming a. According to capm, investors evaluate the risk of assets based on the systematic risk they contribute to their total portfolio. In the corporate finance reading, they switch it around and use the industry. Check out q16 in the private company valuation reading, along with page 294 of the same chapter 4th bullet. Yes, the point of the build up method is to assign a required return to a company that doesn’t have a “market”. Check out our faq, linkedin networking group and discord! The expected return on an asset is calculated as: Check out our faq, linkedin networking group and discord! Yes, the point of the build up method is to assign a required return to a company that doesn’t have a “market”. The main difference with multifactor models. The required return is simply the sum of the risk free. This method is essential for determining the discount rate (aka required rate of return or. The expected return on an asset is calculated as: Check out q16 in the private company valuation reading, along with page 294 of the same chapter 4th bullet. Therefore you add relevant risk premiums to the rf to estimate. The corporate issuers section says: Can someone please help me build up a list of different build up methods and their uses? A place for discussion and study tips for the chartered financial analyst® (cfa®) program. The expected return on an asset is calculated as: Yes, the point of the build up method is to assign a required return to a company that doesn’t have a “market”. Check out our faq, linkedin networking group and discord! In the corporate finance reading, they. In this method, the required rate of return is estimated by essentially assuming a. This method is essential for determining the discount rate (aka required rate of return or. Over 3,100 practice questions that cover the entire cfa curriculum. A place for discussion and study tips for the chartered financial analyst® (cfa®) program. The required return is simply the sum. Over 3,100 practice questions that cover the entire cfa curriculum. In the corporate finance reading, they switch it around and use the industry. This method is essential for determining the discount rate (aka required rate of return or. The required return is simply the sum of the risk free. In this method, the required rate of return is estimated by. This method is essential for determining the discount rate (aka required rate of return or. The expected return on an asset is calculated as: The main difference with multifactor models. Comprehensive study notes that are based on the cfa institute's study guide for the 2025 cfa level ii exam. Over 3,100 practice questions that cover the entire cfa curriculum. This method is essential for determining the discount rate (aka required rate of return or. The required return is simply the sum of the risk free. Yes, the point of the build up method is to assign a required return to a company that doesn’t have a “market”. According to capm, investors evaluate the risk of assets based on the. Over 3,100 practice questions that cover the entire cfa curriculum. This method is essential for determining the discount rate (aka required rate of return or. A place for discussion and study tips for the chartered financial analyst® (cfa®) program. According to capm, investors evaluate the risk of assets based on the systematic risk they contribute to their total portfolio. The. A place for discussion and study tips for the chartered financial analyst® (cfa®) program. Can someone please help me build up a list of different build up methods and their uses? The corporate issuers section says: Check out our faq, linkedin networking group and discord! Therefore you add relevant risk premiums to the rf to estimate. The required return is simply the sum of the risk free. Can someone please help me build up a list of different build up methods and their uses? Over 3,100 practice questions that cover the entire cfa curriculum. Therefore you add relevant risk premiums to the rf to estimate. According to capm, investors evaluate the risk of assets based on. The corporate issuers section says: Therefore you add relevant risk premiums to the rf to estimate. Over 3,100 practice questions that cover the entire cfa curriculum. The required return is simply the sum of the risk free. The main difference with multifactor models. Yes, the point of the build up method is to assign a required return to a company that doesn’t have a “market”. The main difference with multifactor models. According to capm, investors evaluate the risk of assets based on the systematic risk they contribute to their total portfolio. It is similar to the extended capm but excludes. Can someone please. Over 3,100 practice questions that cover the entire cfa curriculum. In the corporate finance reading, they switch it around and use the industry. The main difference with multifactor models. Yes, the point of the build up method is to assign a required return to a company that doesn’t have a “market”. In this method, the required rate of return is estimated by essentially assuming a. Comprehensive study notes that are based on the cfa institute's study guide for the 2025 cfa level ii exam. The expected return on an asset is calculated as: The required return is simply the sum of the risk free. The corporate issuers section says: Therefore you add relevant risk premiums to the rf to estimate. Can someone please help me build up a list of different build up methods and their uses? This method is essential for determining the discount rate (aka required rate of return or. According to capm, investors evaluate the risk of assets based on the systematic risk they contribute to their total portfolio.AssetBased Approach (Cost Approach) CFA, FRM, and Actuarial Exams

Build up method and expanded CAPM SSEI QForum

Create Personalized CFA® Exam Study PLAN

Required Rate On Equity CAPM, FamaFrench & BuildUp Model Equity

Nine Valuation Mistakes for Business Owners to Avoid The CPA Journal

Dissecting Risk Premiums

Conceptual Framework for Assessing the Financial Reporting Quality

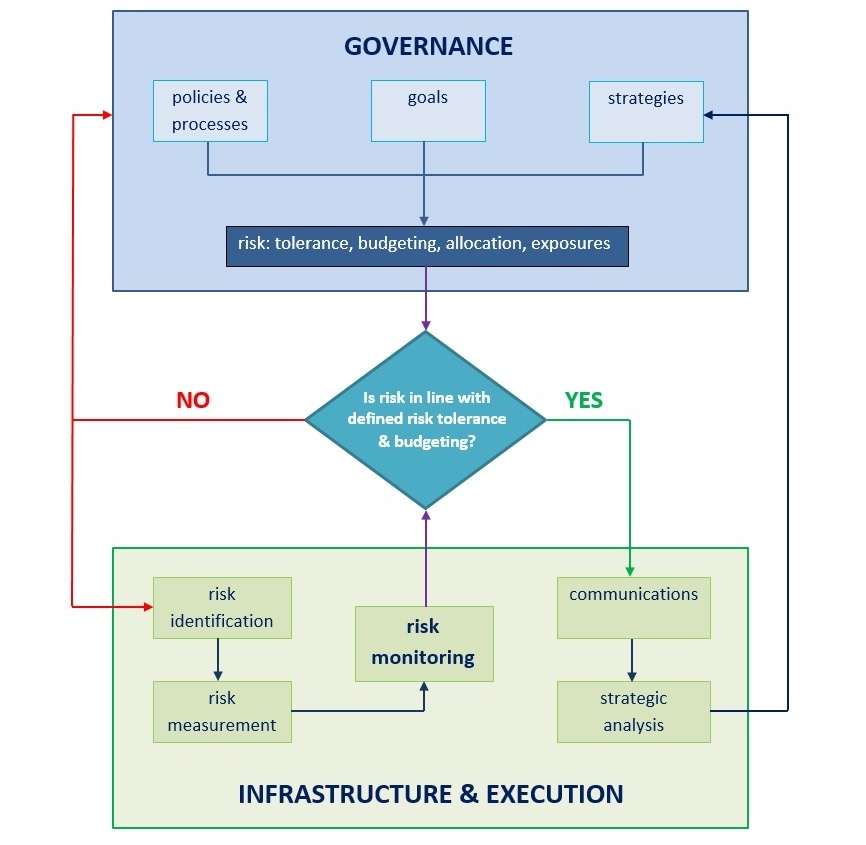

CFA Level 1 Risk Management Framework

Dissecting Risk Premiums

Top 10 Buildup PowerPoint Presentation Templates in 2024

Check Out Q16 In The Private Company Valuation Reading, Along With Page 294 Of The Same Chapter 4Th Bullet.

It Is Similar To The Extended Capm But Excludes.

A Place For Discussion And Study Tips For The Chartered Financial Analyst® (Cfa®) Program.

Check Out Our Faq, Linkedin Networking Group And Discord!

Related Post: