Builder Bailout Meaning

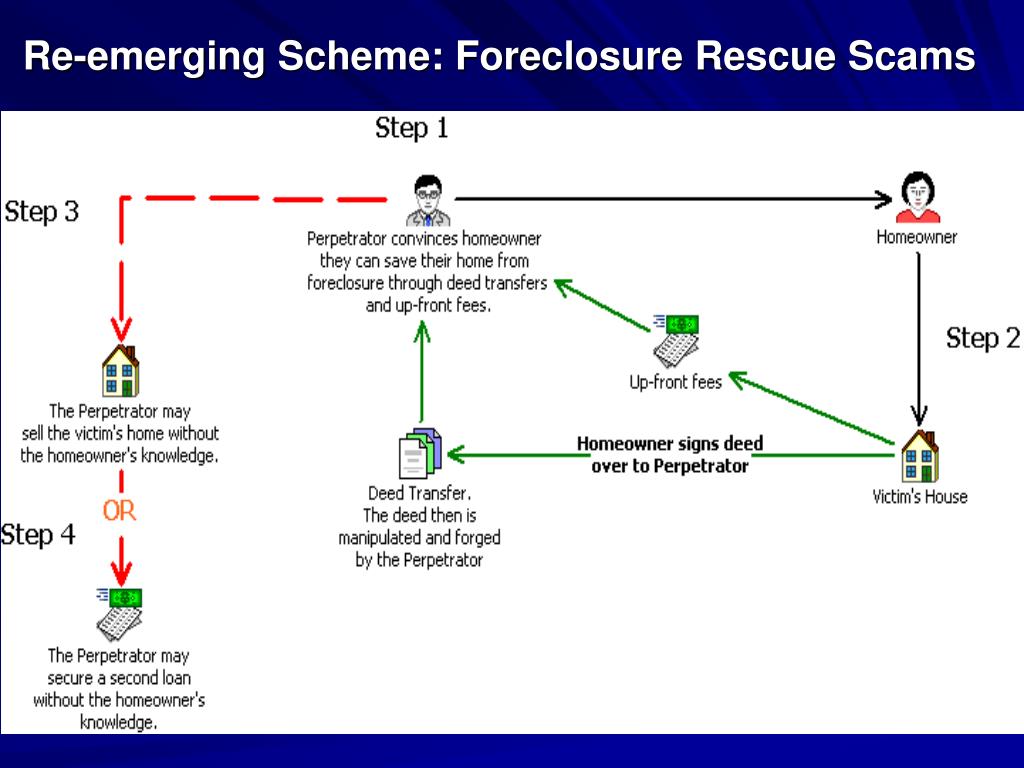

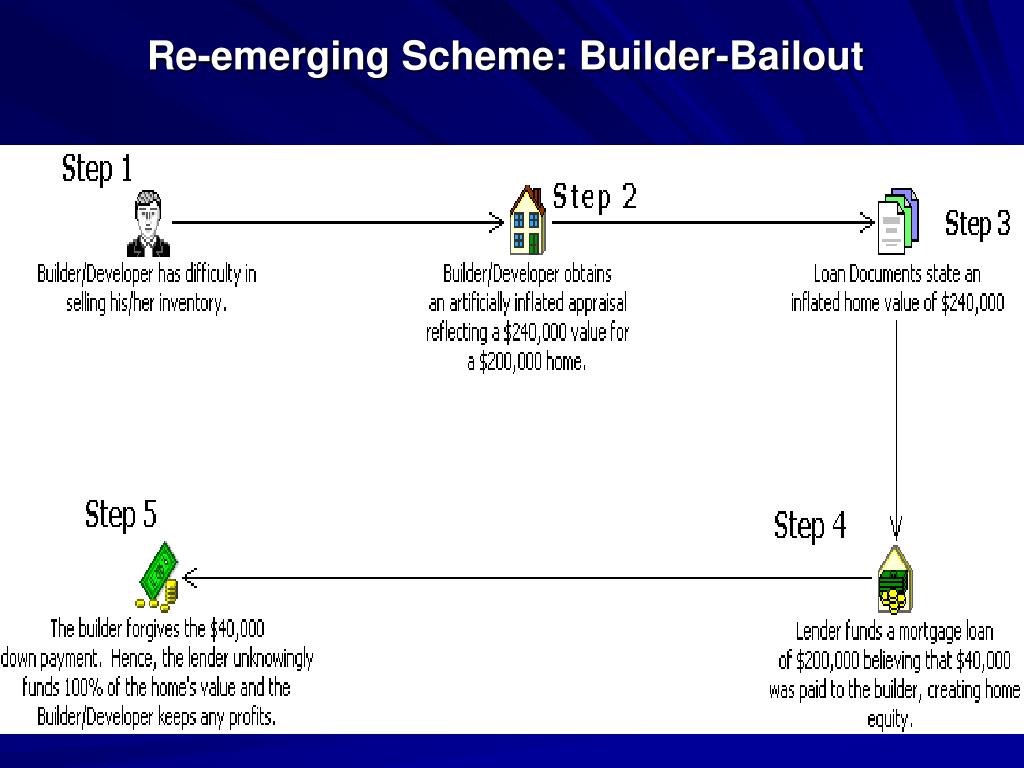

Builder Bailout Meaning - Builders find buyers who obtain. A mortgage fraud scheme utilized by a builder or contractor in order to relieve itself of the burden of high interest construction loans. A builder who can’t refinance a loan may turn to a builder bailout. Study with quizlet and memorize flashcards containing terms like who investigates mortgage fraud?, what are two distinct areas of mortgage fraud?, what is illegal property flipping? It provides a temporary solution. This is what has become known as a “builder bailout” scheme. Builder bailouts occur when the builder or developer is motivated to move property quickly in a depressed or slow real estate market. What does foreclosure bailout mean? What are the different ways a builder bailout can occur? The builder may not want to bother with these. Builder bailouts become prevalent during declining real. Learn from a nyc defense lawyer about builder bailouts & when they’re considered crimes. A builder bailout usually occurs when a builder has sold the majority of homes in a tract or subdivision, but is left with some unsold homes. Builder bailouts occur when the builder or developer is motivated to move property quickly in a depressed or slow real estate market. Riting standards, and declining housing values contributed to the increased level of fraud. The builder inflates the purchase price by offering fake down payment. A foreclosure bailout is a type of loan that helps stop a foreclosure by refinancing or reinstating a defaulted mortgage. This often happens during declining real estate markets when. A builder who can’t refinance a loan may turn to a builder bailout. What does foreclosure bailout mean? Builder bailout/excessive sales incentives • in this situation, a builder with several unsold units in a subdivision, condominium complex or other development utilizes various fraudulent schemes. A mortgage fraud scheme utilized by a builder or contractor in order to relieve itself of the burden of high interest construction loans. Builder bailouts become prevalent during declining real. This often happens during. Builder bailouts occur when the builder or developer is motivated to move property quickly in a depressed or slow real estate market. Builder bailout/condo conversion builders facing rising inventory and declining demand for newly constructed homes employ bailout schemes to offset losses. This is what has become known as a “builder bailout” scheme. What does foreclosure bailout mean? A mortgage. Builder bailouts occur when the builder or developer is motivated to move property quickly in a depressed or slow real estate market. Some of the following red flags may occur in. It provides a temporary solution. Riting standards, and declining housing values contributed to the increased level of fraud. It can take the form of loans, cash, bonds, or stock. A foreclosure bailout is a type of loan that helps stop a foreclosure by refinancing or reinstating a defaulted mortgage. Builder bailouts occur when the builder or developer is motivated to move property quickly in a depressed or slow real estate market. A builder bailout usually occurs when a builder has sold the majority of homes in a tract or. A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive, and using a. The builder may not want to bother with these. These schemes are perpetrated by builders that are unable to sell newly constructed properties. A builder who can’t refinance a. It can take the form of loans, cash, bonds, or stock purchases. What are the different ways a builder bailout can occur? Builder bailout is a type of mortgage fraud that builders or contractors use to get out of high interest construction loans. Riting standards, and declining housing values contributed to the increased level of fraud. What does foreclosure bailout. Shahid’s plea agreement explains that dsi made loans that were secured by homes that were in some. Builder bailouts occur when the builder or developer is motivated to move property quickly in a depressed or slow real estate market. This is what has become known as a “builder bailout” scheme. Some of the following red flags may occur in. What. Builder bailout is a type of mortgage fraud that builders or contractors use to get out of high interest construction loans. Riting standards, and declining housing values contributed to the increased level of fraud. What does foreclosure bailout mean? It can take the form of loans, cash, bonds, or stock purchases. Study with quizlet and memorize flashcards containing terms like. It provides a temporary solution. Bailout is a general term for extending financial support to a company or a country facing a potential bankruptcy threat. Market participants are perpetrating mortgage fraud by modifying old schemes, such as property flip,. Shahid’s plea agreement explains that dsi made loans that were secured by homes that were in some. The builder may not. Riting standards, and declining housing values contributed to the increased level of fraud. A foreclosure bailout is a type of loan that helps stop a foreclosure by refinancing or reinstating a defaulted mortgage. A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the. The builder inflates the purchase price by offering fake down payment. There are several different proposals being circulated, but the basic story is the same. A foreclosure bailout is a type of loan that helps stop a foreclosure by refinancing or reinstating a defaulted mortgage. A builder who can’t refinance a loan may turn to a builder bailout. Market participants are perpetrating mortgage fraud by modifying old schemes, such as property flip,. What are the different ways a builder bailout can occur? A builder bailout usually occurs when a builder has sold the majority of homes in a tract or subdivision, but is left with some unsold homes. Bailout is a general term for extending financial support to a company or a country facing a potential bankruptcy threat. A mortgage fraud scheme utilized by a builder or contractor in order to relieve itself of the burden of high interest construction loans. This is what has become known as a “builder bailout” scheme. Builder bailout/excessive sales incentives • in this situation, a builder with several unsold units in a subdivision, condominium complex or other development utilizes various fraudulent schemes. Some of the following red flags may occur in. Shahid’s plea agreement explains that dsi made loans that were secured by homes that were in some. It can take the form of loans, cash, bonds, or stock purchases. Riting standards, and declining housing values contributed to the increased level of fraud. Builder bailout/condo conversion builders facing rising inventory and declining demand for newly constructed homes employ bailout schemes to offset losses.Meaning Of Bailout

PPT Reemerging Scheme BuilderBailout Example PowerPoint

Bailout Meaning Definition of Bailout YouTube

PPT Reemerging Scheme BuilderBailout Example PowerPoint

Meaning Of Bailout

PPT Reemerging Scheme BuilderBailout Example PowerPoint

Meaning Of Bailout

MORTGAGE FRAUD. What is Mortgage Fraud? A material misstatement

PPT Reemerging Scheme BuilderBailout Example PowerPoint

PPT Reemerging Scheme BuilderBailout Example PowerPoint

A Builder Bailout Is When A Seller Pays Large Financial Incentives To The Buyer And Facilitates An Inflated Loan Amount By Increasing The Sales Price, Concealing The Incentive, And Using A.

Perpetrators Of This Fraud Scheme May Include A Builder With An Appraiser, Mortgage Loan Officers, And Sometimes A Title Or Settlement.

It Provides A Temporary Solution.

Study With Quizlet And Memorize Flashcards Containing Terms Like Who Investigates Mortgage Fraud?, What Are Two Distinct Areas Of Mortgage Fraud?, What Is Illegal Property Flipping?

Related Post:

:max_bytes(150000):strip_icc()/bailin.asp_Final-a0fb7a93f6ad4bfeb354e50b6820ee50.png)

:max_bytes(150000):strip_icc()/tglp.asp-final-97f8f22381e64c7d851ea2145064cca0.png)