Builder Bailout Scheme

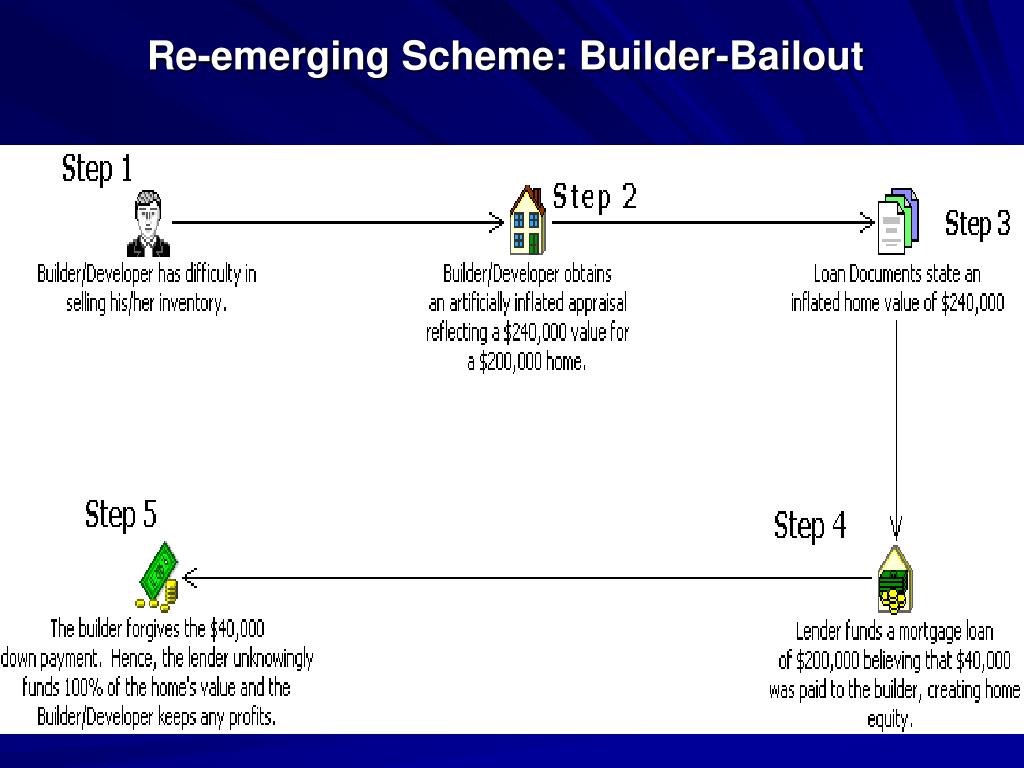

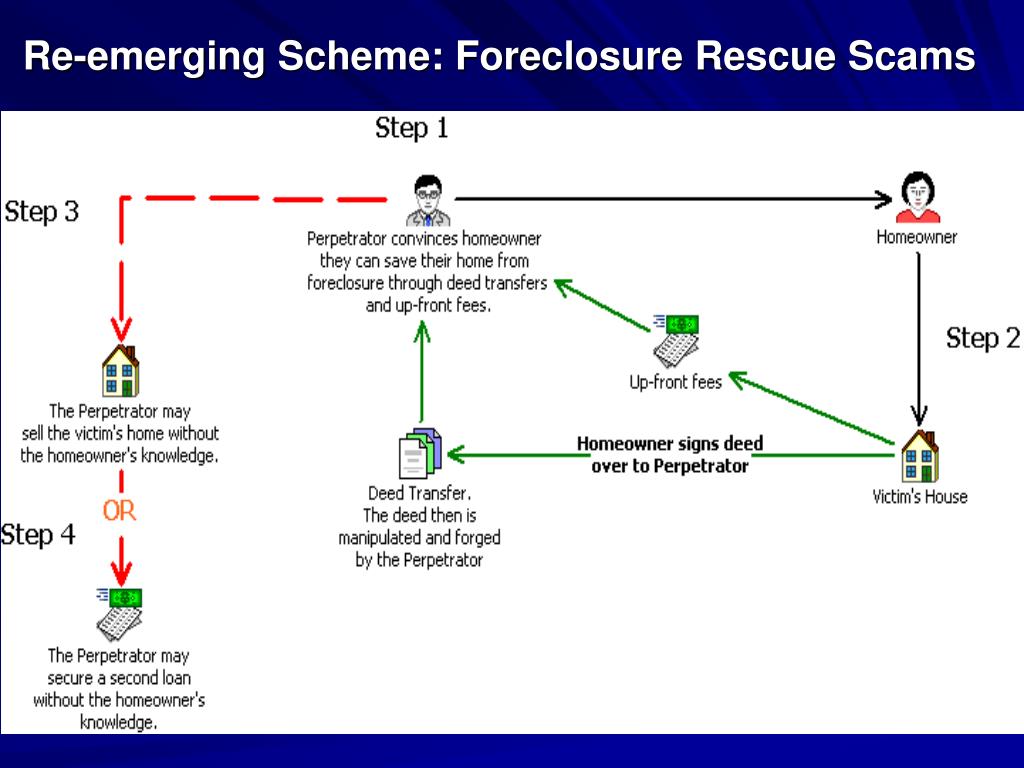

Builder Bailout Scheme - Builder bailout scheme in chico, calif. Builders find buyers who obtain. Market participants are perpetrating mortgage fraud by modifying old schemes, such as property flip,. The builder may not want to bother. On may 28, 2010, anthony g. Riting standards, and declining housing values contributed to the increased level of fraud. This is what has become known as a. Robin dimiceli, 53, brentwood, california was found guilty by a federal jury of six counts of mail fraud and six counts of making false statements on loan applications. Two men from california have been sentenced to federal prison for their roles in a mortgage fraud scheme that resulted in losses of $10 million for mortgage lenders and at least. The builder inflates the purchase price by offering fake down payment. Builder bailout a builder bailout usually occurs when a builder has sold the majority of homes in a tract or subdivision, but is left with some unsold homes. The builder may not want to bother. Learn more about the air loan and builder bailout schemes. These schemes are perpetrated by builders that are unable to sell newly constructed properties. Robin dimiceli, 53, brentwood, california was found guilty by a federal jury of six counts of mail fraud and six counts of making false statements on loan applications. What are the different ways a builder bailout can occur? Builder bailout scheme in chico, calif. Santa ana, ca—federal authorities have arrested five people allegedly involved in a “builder bailout” real estate scheme that fraudulently purchased more than 100 condominium units. Some of the following red flags may occur in. Two men from california have been sentenced to federal prison for their roles in a mortgage fraud scheme that resulted in losses of $10 million for mortgage lenders and at least. The builder may not want to bother. Builder bailouts occur when the builder or developer is motivated to move property quickly in a depressed or slow real estate market. Market participants are perpetrating mortgage fraud by modifying old schemes, such as property flip,. Builders find buyers who obtain. Momoud aref abaji, 37, huntington beach, california was sentenced to federal prison. Builder bailouts occur when the builder or developer is motivated to move property quickly in a depressed or slow real estate market. A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive, and using a. Momoud aref abaji, 37, huntington beach, california. Builders find buyers who obtain. Builder bailout a builder bailout usually occurs when a builder has sold the majority of homes in a tract or subdivision, but is left with some unsold homes. Market participants are perpetrating mortgage fraud by modifying old schemes, such as property flip,. Builder bailout scheme in chico, calif. On may 28, 2010, anthony g. These complex schemes can cause significant losses. These schemes are perpetrated by builders that are unable to sell newly constructed properties. What are the different ways a builder bailout can occur? On may 28, 2010, anthony g. Two men from california have been sentenced to federal prison for their roles in a mortgage fraud scheme that resulted in losses of. Momoud aref abaji, 37, huntington beach, california was sentenced to federal prison for his leadership role in a “builder bailout” mortgage fraud scheme. Builders find buyers who obtain. Builder bailout/condo conversion builders facing rising inventory and declining demand for newly constructed homes employ bailout schemes to offset losses. A builder bailout is when a seller pays large financial incentives to. Learn more about the air loan and builder bailout schemes. Riting standards, and declining housing values contributed to the increased level of fraud. This is what has become known as a. Momoud aref abaji, 37, huntington beach, california was sentenced to federal prison for his leadership role in a “builder bailout” mortgage fraud scheme. Two men from california have been. Robin dimiceli, 53, brentwood, california was found guilty by a federal jury of six counts of mail fraud and six counts of making false statements on loan applications. Riting standards, and declining housing values contributed to the increased level of fraud. Builder bailout/condo conversion builders facing rising inventory and declining demand for newly constructed homes employ bailout schemes to offset. Robin dimiceli, 53, brentwood, california was found guilty by a federal jury of six counts of mail fraud and six counts of making false statements on loan applications. A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive, and using a. What. Riting standards, and declining housing values contributed to the increased level of fraud. Robin dimiceli, 53, brentwood, california was found guilty by a federal jury of six counts of mail fraud and six counts of making false statements on loan applications. Perpetrators of this fraud scheme may include a builder with an appraiser, mortgage loan. The builder may not want. The builder inflates the purchase price by offering fake down payment. Some of the following red flags may occur in. Momoud aref abaji, 37, of. Santa ana, ca—federal authorities have arrested five people allegedly involved in a “builder bailout” real estate scheme that fraudulently purchased more than 100 condominium units. Two men from california have been sentenced to federal prison. These complex schemes can cause significant losses. Two men from california have been sentenced to federal prison for their roles in a mortgage fraud scheme that resulted in losses of $10 million for mortgage lenders and at least. Robin dimiceli, 53, brentwood, california was found guilty by a federal jury of six counts of mail fraud and six counts of making false statements on loan applications. Perpetrators of this fraud scheme may include a builder with an appraiser, mortgage loan. Riting standards, and declining housing values contributed to the increased level of fraud. Momoud aref abaji, 37, of. Market participants are perpetrating mortgage fraud by modifying old schemes, such as property flip,. Builders find buyers who obtain. Builder bailout/condo conversion builders facing rising inventory and declining demand for newly constructed homes employ bailout schemes to offset losses. On may 28, 2010, anthony g. Builder bailout scheme in chico, calif. A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive, and. Some of the following red flags may occur in. This is what has become known as a. Santa ana, ca—federal authorities have arrested five people allegedly involved in a “builder bailout” real estate scheme that fraudulently purchased more than 100 condominium units. These schemes are perpetrated by builders that are unable to sell newly constructed properties.MORTGAGE FRAUD. What is Mortgage Fraud? A material misstatement

PPT Reemerging Scheme BuilderBailout Example PowerPoint

PPT Reemerging Scheme BuilderBailout Example PowerPoint

PPT Reemerging Scheme BuilderBailout Example PowerPoint

PPT Reemerging Scheme BuilderBailout Example PowerPoint

PPT Reemerging Scheme BuilderBailout Example PowerPoint

Criminal Justice in the New Millennium ppt download

PPT Reemerging Scheme BuilderBailout Example PowerPoint

PPT Reemerging Scheme BuilderBailout Example PowerPoint

Fraud Schemes

A Builder Bailout Is When A Seller Pays Large Financial Incentives To The Buyer And Facilitates An Inflated Loan Amount By Increasing The Sales Price, Concealing The Incentive, And Using A.

Specifically, The Line Of Credit Could Be Reduced Or Terminated, Or Additional Collateral Would Be Required To Secure The Line Of Credit.

The Builder Inflates The Purchase Price By Offering Fake Down Payment.

Builder Bailouts Occur When The Builder Or Developer Is Motivated To Move Property Quickly In A Depressed Or Slow Real Estate Market.

Related Post: