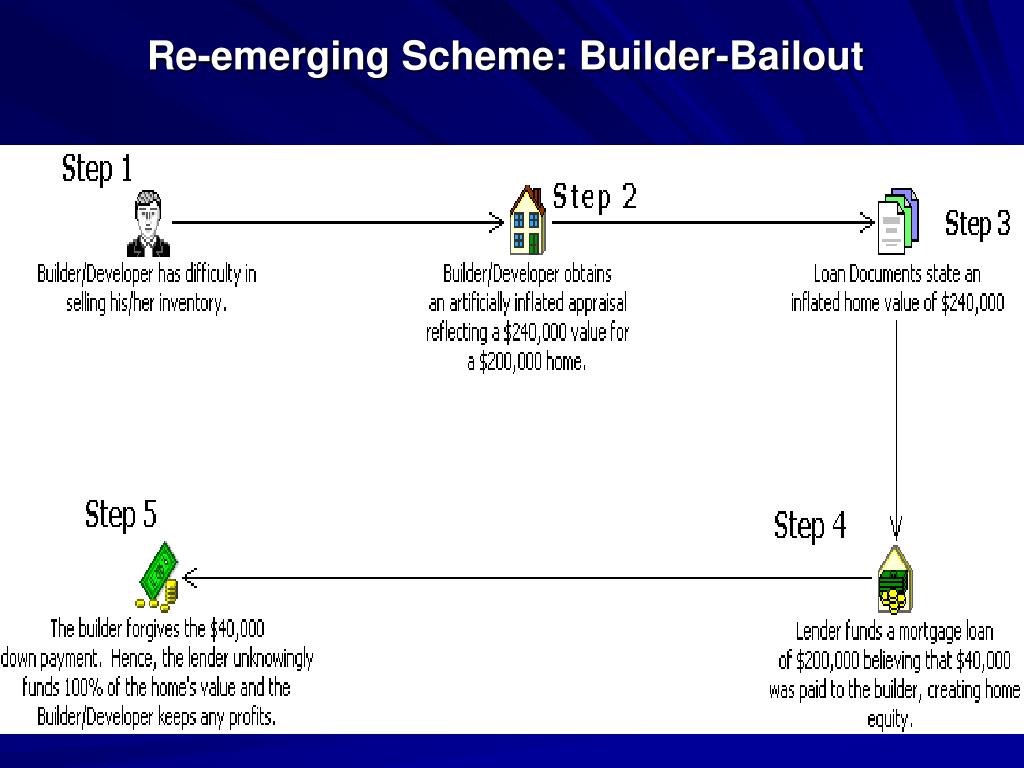

Builder Bailout

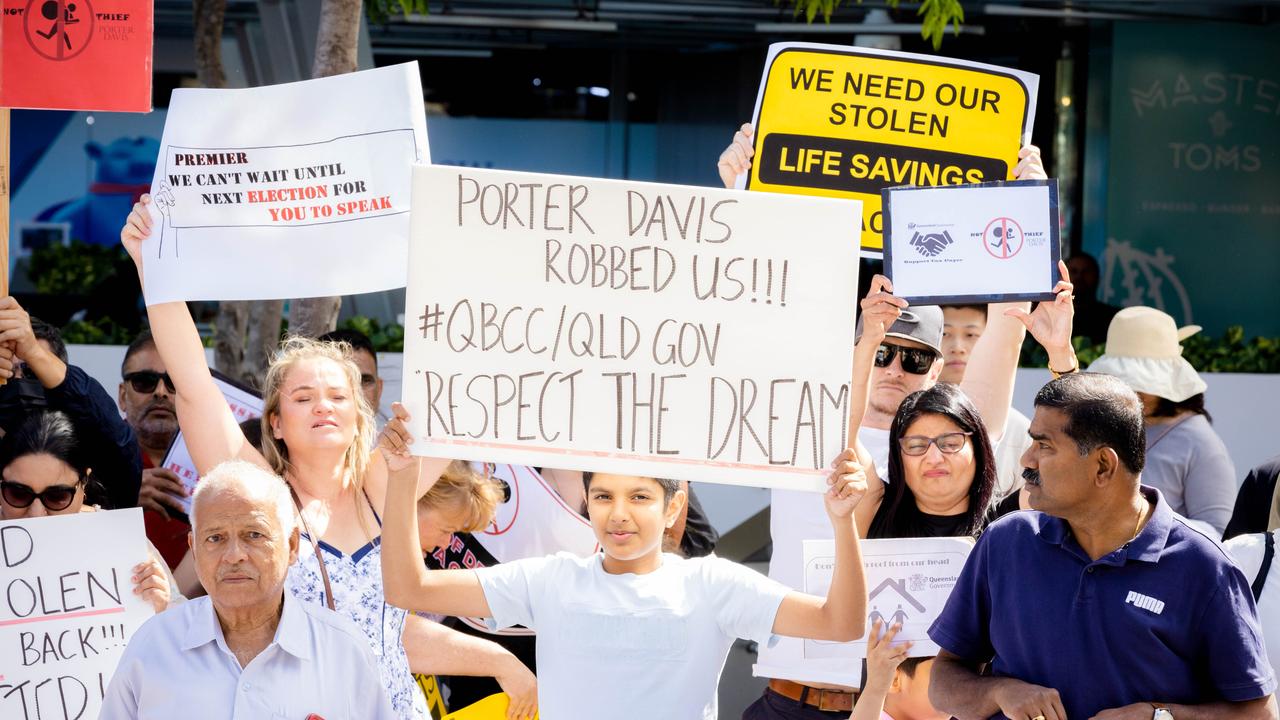

Builder Bailout - Over the next ten days, the. A federal jury convicted a huntington beach man for leading a “builder bailout” real estate scheme that resulted in the fraudulent purchase of more than 100 condos around the. Market participants are perpetrating mortgage fraud by modifying old schemes, such as property flip,. Two men from california have been sentenced to federal prison for their roles in a mortgage fraud scheme that resulted in losses of $10 million for mortgage lenders and at least. The fdic put $4.5 billion in new capital into the bank, assumed liability for the bulk of continental’s bad loans and. Until the seizure of washington mutual in 2008, the bailout of continental illinois under ronald reagan was the largest bank failure in american history. This is a business listing for nations home bailout (1636 n bosworth avenue, chicago, il 60642) from the home builders directory, under chicago, il home builders, provided by. Builder bailout/condo conversion builders facing rising inventory and declining demand for newly constructed homes employ bailout schemes to offset losses. Perpetrators of this fraud scheme may include a builder with an appraiser, mortgage loan officers, and sometimes a title or settlement. Riting standards, and declining housing values contributed to the increased level of fraud. A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive, and using a. This is what has become known as a. What are the different ways a builder bailout can occur? A bloomberg index tracking chinese builder shares fell as much as 3.3%. That was a reversal after an 8.6% jump wednesday, the biggest in four months, which was sparked. The term too big to fail was. Builders find buyers who obtain. Builder bailout/condo conversion builders facing rising inventory and declining demand for newly constructed homes employ bailout schemes to offset losses. Over the next ten days, the. Momoud aref abaji, 37, huntington beach, california was sentenced to federal prison for his leadership role in a “builder bailout” mortgage fraud scheme. A bloomberg index tracking chinese builder shares fell as much as 3.3%. Builder bailout/condo conversion builders facing rising inventory and declining demand for newly constructed homes employ bailout schemes to offset losses. A federal jury convicted a huntington beach man for leading a “builder bailout” real estate scheme that resulted in the fraudulent purchase of more than 100 condos around. Momoud aref abaji, 37, huntington beach, california was sentenced to federal prison for his leadership role in a “builder bailout” mortgage fraud scheme. Over the next ten days, the. A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive, and using a.. The fdic put $4.5 billion in new capital into the bank, assumed liability for the bulk of continental’s bad loans and. Perpetrators of this fraud scheme may include a builder with an appraiser, mortgage loan officers, and sometimes a title or settlement. Riting standards, and declining housing values contributed to the increased level of fraud. What are the different ways. What are the different ways a builder bailout can occur? Perpetrators of this fraud scheme may include a builder with an appraiser, mortgage loan officers, and sometimes a title or settlement. Momoud aref abaji, 37, huntington beach, california was sentenced to federal prison for his leadership role in a “builder bailout” mortgage fraud scheme. That was a reversal after an. Builders find buyers who obtain. What are the different ways a builder bailout can occur? Market participants are perpetrating mortgage fraud by modifying old schemes, such as property flip,. Perpetrators of this fraud scheme may include a builder with an appraiser, mortgage loan officers, and sometimes a title or settlement. A federal jury convicted a huntington beach man for leading. Eight days after the run began, regulators announced a bailout. A bloomberg index tracking chinese builder shares fell as much as 3.3%. Builders find buyers who obtain. Momoud aref abaji, 37, of. Until the seizure of washington mutual in 2008, the bailout of continental illinois under ronald reagan was the largest bank failure in american history. Builders find buyers who obtain. Perpetrators of this fraud scheme may include a builder with an appraiser, mortgage loan officers, and sometimes a title or settlement. A bloomberg index tracking chinese builder shares fell as much as 3.3%. That was a reversal after an 8.6% jump wednesday, the biggest in four months, which was sparked. What are the different ways. Santa ana, ca—federal authorities have arrested five people allegedly involved in a “builder bailout” real estate scheme that fraudulently purchased more than 100 condominium units. A federal jury convicted a huntington beach man for leading a “builder bailout” real estate scheme that resulted in the fraudulent purchase of more than 100 condos around the. Riting standards, and declining housing values. Specifically, the line of credit could be reduced or terminated, or additional collateral would be required to secure the line of credit. What are the different ways a builder bailout can occur? A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive,. Two men from california have been sentenced to federal prison for their roles in a mortgage fraud scheme that resulted in losses of $10 million for mortgage lenders and at least. Market participants are perpetrating mortgage fraud by modifying old schemes, such as property flip,. Eight days after the run began, regulators announced a bailout. The fdic put $4.5 billion. Builders find buyers who obtain. The term too big to fail was. Two men from california have been sentenced to federal prison for their roles in a mortgage fraud scheme that resulted in losses of $10 million for mortgage lenders and at least. Perpetrators of this fraud scheme may include a builder with an appraiser, mortgage loan officers, and sometimes a title or settlement. The fdic put $4.5 billion in new capital into the bank, assumed liability for the bulk of continental’s bad loans and. Eight days after the run began, regulators announced a bailout. Specifically, the line of credit could be reduced or terminated, or additional collateral would be required to secure the line of credit. Momoud aref abaji, 37, of. A bloomberg index tracking chinese builder shares fell as much as 3.3%. Until the seizure of washington mutual in 2008, the bailout of continental illinois under ronald reagan was the largest bank failure in american history. Riting standards, and declining housing values contributed to the increased level of fraud. A builder bailout is when a seller pays large financial incentives to the buyer and facilitates an inflated loan amount by increasing the sales price, concealing the incentive, and using a. A federal jury convicted a huntington beach man for leading a “builder bailout” real estate scheme that resulted in the fraudulent purchase of more than 100 condos around the. What are the different ways a builder bailout can occur? This is what has become known as a. Santa ana, ca—federal authorities have arrested five people allegedly involved in a “builder bailout” real estate scheme that fraudulently purchased more than 100 condominium units.Porter Davis owes 147m after collapse, unsecured creditors expected to

PPT Reemerging Scheme BuilderBailout Example PowerPoint

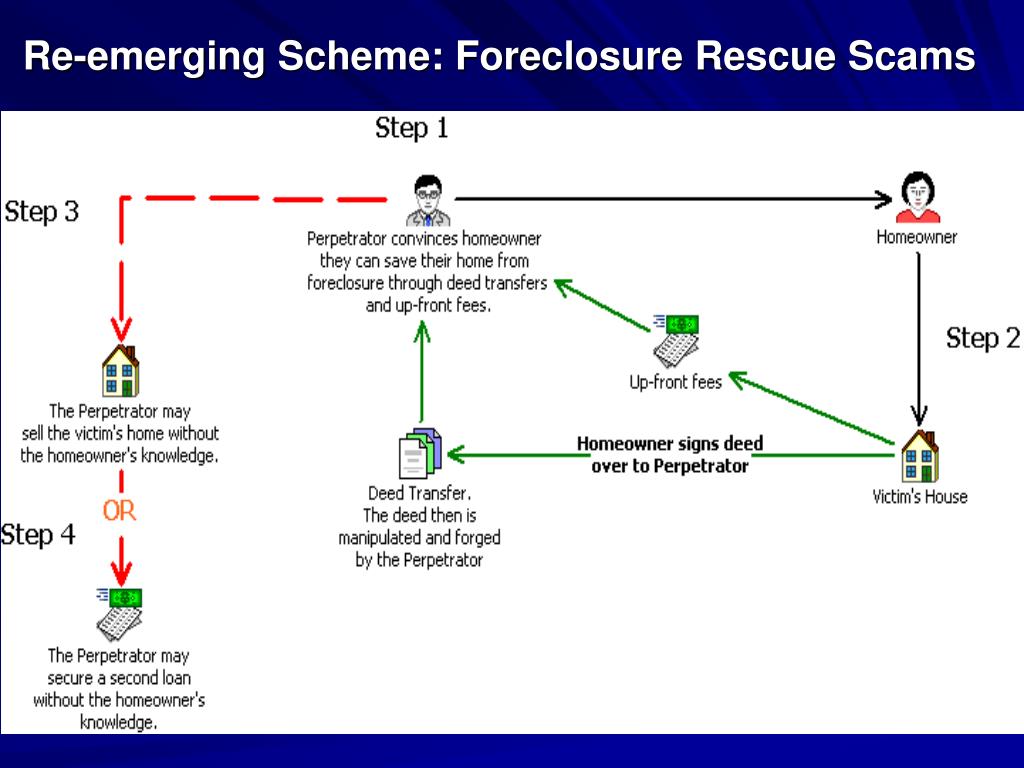

MORTGAGE FRAUD. What is Mortgage Fraud? A material misstatement

PPT Reemerging Scheme BuilderBailout Example PowerPoint

PPT Reemerging Scheme BuilderBailout Example PowerPoint

PPT Reemerging Scheme BuilderBailout Example PowerPoint

PPT Reemerging Scheme BuilderBailout Example PowerPoint

Mortgage Fraud The Lender’s Perspective. Where you “might” know me from

Homebuilder Albert Seeno III ordered to pay 11 million for “builder

Porter Davis collapse sees tradies owed 40,000, Victorian government

Market Participants Are Perpetrating Mortgage Fraud By Modifying Old Schemes, Such As Property Flip,.

This Is A Business Listing For Nations Home Bailout (1636 N Bosworth Avenue, Chicago, Il 60642) From The Home Builders Directory, Under Chicago, Il Home Builders, Provided By.

Momoud Aref Abaji, 37, Huntington Beach, California Was Sentenced To Federal Prison For His Leadership Role In A “Builder Bailout” Mortgage Fraud Scheme.

Builder Bailout/Condo Conversion Builders Facing Rising Inventory And Declining Demand For Newly Constructed Homes Employ Bailout Schemes To Offset Losses.

Related Post: