Builder Buy Down Interest Rate

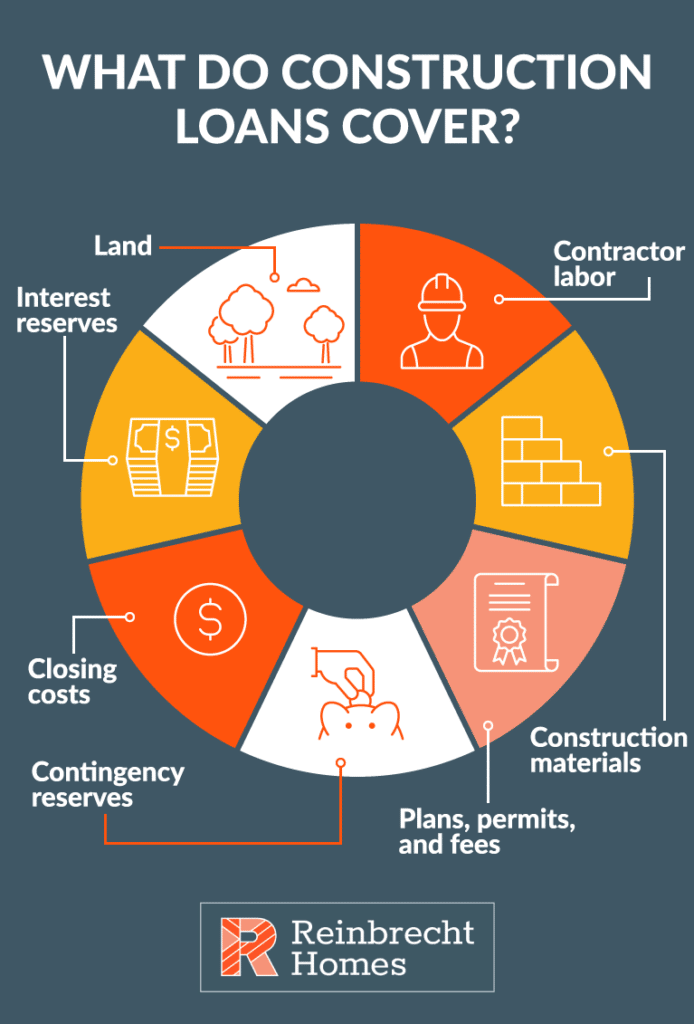

Builder Buy Down Interest Rate - Buyers have trouble affording new homes when mortgage rates are around 7%,” adds. Meanwhile, according to fannie mae's most recent home purchase sentiment index, buyers expect home prices and mortgage rates to go up for the foreseeable future. Mortgage rate buydowns—and education on their benefits—are becoming more prevalent as interest rates near 7%. Homebuilders are employing rate buydowns the most in areas where home. “builders continue to offer interest rate buydowns to get buyers to sign on the dotted line. Looking for new construction, though, may give you a leg up, as some builders are willing to buy down rates in order to get you into their new homes faster. With rate buydown options, m/i typically agrees to pay some portion of the mortgage interest for some time, meaning it effectively sells homes at a lower price point despite high. Mortgage rate buydowns are a home financing tool that provides buyers with a lower interest rate. An interest rate buy down is a way to reduce the interest rate on your mortgage. A buydown is usually offered. Mortgage rate buydowns are a home financing tool that provides buyers with a lower interest rate. Homebuilders are employing rate buydowns the most in areas where home. An interest rate buy down is a way to reduce the interest rate on your mortgage. “builders continue to offer interest rate buydowns to get buyers to sign on the dotted line. A buydown is usually offered. Looking for new construction, though, may give you a leg up, as some builders are willing to buy down rates in order to get you into their new homes faster. With rate buydown options, m/i typically agrees to pay some portion of the mortgage interest for some time, meaning it effectively sells homes at a lower price point despite high. A mortgage buydown is a financing technique in which a homebuyer pays for interest points upfront in exchange for a lower loan interest rate. This can be done by paying points upfront, which are then used to lower your interest rate over the life of your. Borrowers, lenders, sellers and builders all use buydowns as a way to temporarily, or permanently, lower the monthly interest payment on a mortgage loan. This can be done by paying points upfront, which are then used to lower your interest rate over the life of your. “builders continue to offer interest rate buydowns to get buyers to sign on the dotted line. Looking for new construction, though, may give you a leg up, as some builders are willing to buy down rates in order. Homebuilders are employing rate buydowns the most in areas where home. This can be done by paying points upfront, which are then used to lower your interest rate over the life of your. Mortgage rate buydowns—and education on their benefits—are becoming more prevalent as interest rates near 7%. Mortgage rate buydowns are a home financing tool that provides buyers with. Mortgage rate buydowns—and education on their benefits—are becoming more prevalent as interest rates near 7%. With rate buydown options, m/i typically agrees to pay some portion of the mortgage interest for some time, meaning it effectively sells homes at a lower price point despite high. “builders continue to offer interest rate buydowns to get buyers to sign on the dotted. This can be done by paying points upfront, which are then used to lower your interest rate over the life of your. “builders continue to offer interest rate buydowns to get buyers to sign on the dotted line. A buydown is usually offered. An interest rate buy down is a way to reduce the interest rate on your mortgage. A. Mortgage rate buydowns are a home financing tool that provides buyers with a lower interest rate. Looking for new construction, though, may give you a leg up, as some builders are willing to buy down rates in order to get you into their new homes faster. Buyers have trouble affording new homes when mortgage rates are around 7%,” adds. Borrowers,. “builders continue to offer interest rate buydowns to get buyers to sign on the dotted line. With rate buydown options, m/i typically agrees to pay some portion of the mortgage interest for some time, meaning it effectively sells homes at a lower price point despite high. This can be done by paying points upfront, which are then used to lower. “builders continue to offer interest rate buydowns to get buyers to sign on the dotted line. This can be done by paying points upfront, which are then used to lower your interest rate over the life of your. A buydown is usually offered. With rate buydown options, m/i typically agrees to pay some portion of the mortgage interest for some. Homebuilders are employing rate buydowns the most in areas where home. An interest rate buy down is a way to reduce the interest rate on your mortgage. A mortgage buydown is a financing technique in which a homebuyer pays for interest points upfront in exchange for a lower loan interest rate. This can be done by paying points upfront, which. This can be done by paying points upfront, which are then used to lower your interest rate over the life of your. Buyers have trouble affording new homes when mortgage rates are around 7%,” adds. Looking for new construction, though, may give you a leg up, as some builders are willing to buy down rates in order to get you. A buydown is usually offered. Homebuilders are employing rate buydowns the most in areas where home. Looking for new construction, though, may give you a leg up, as some builders are willing to buy down rates in order to get you into their new homes faster. Borrowers, lenders, sellers and builders all use buydowns as a way to temporarily, or. Mortgage rate buydowns are a home financing tool that provides buyers with a lower interest rate. “builders continue to offer interest rate buydowns to get buyers to sign on the dotted line. With rate buydown options, m/i typically agrees to pay some portion of the mortgage interest for some time, meaning it effectively sells homes at a lower price point despite high. An interest rate buy down is a way to reduce the interest rate on your mortgage. Borrowers, lenders, sellers and builders all use buydowns as a way to temporarily, or permanently, lower the monthly interest payment on a mortgage loan. A buydown is usually offered. This can be done by paying points upfront, which are then used to lower your interest rate over the life of your. Looking for new construction, though, may give you a leg up, as some builders are willing to buy down rates in order to get you into their new homes faster. Mortgage rate buydowns—and education on their benefits—are becoming more prevalent as interest rates near 7%. Homebuilders are employing rate buydowns the most in areas where home.Construction Loans 101 Everything You Need To Know

Interest Rate Buy Downs What Are They & How Do They Work? Interest

How Mortgage Rate BuyDowns and Builder Incentives Can Make New

How does a 21 buydown work? Mortgage Equity Partners

New Construction Homes What Is An Interest Rate Buy Down? Conner

Spokane Home Builder Promotions Lexar Homes of Spokane

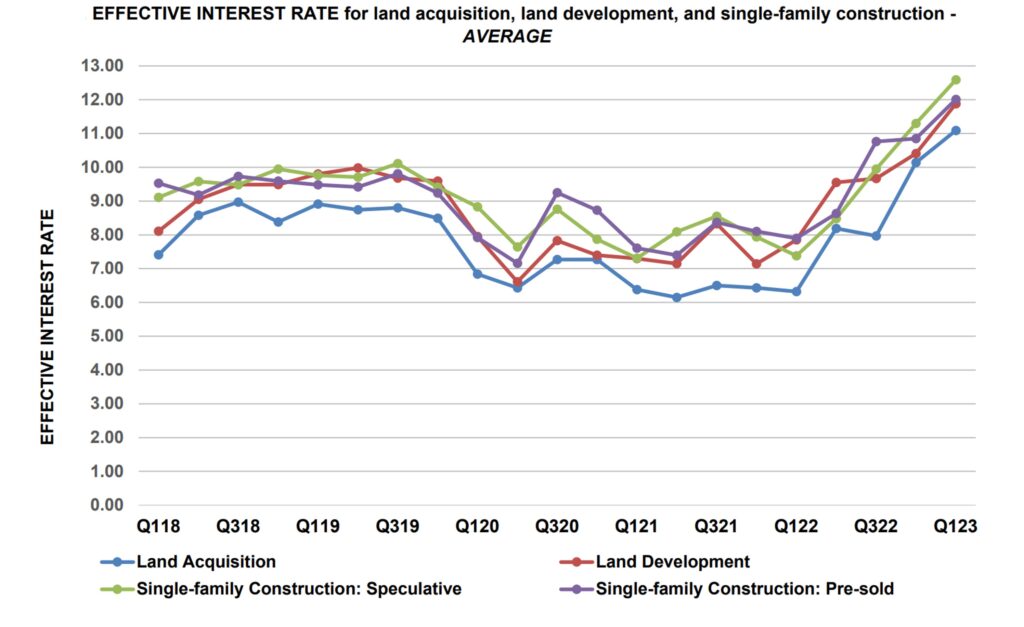

Rates on Development and Construction Loans Continue to Climb

Mortgage Rate Buydowns with Builders Marketplace Homes

Everything You Need to Know About Construction to Permanent Loan

Construction Loans 101 Everything You Need To Know

Meanwhile, According To Fannie Mae's Most Recent Home Purchase Sentiment Index, Buyers Expect Home Prices And Mortgage Rates To Go Up For The Foreseeable Future.

A Mortgage Buydown Is A Financing Technique In Which A Homebuyer Pays For Interest Points Upfront In Exchange For A Lower Loan Interest Rate.

Buyers Have Trouble Affording New Homes When Mortgage Rates Are Around 7%,” Adds.

Related Post: