Builder Deposit Average On New Multifamily

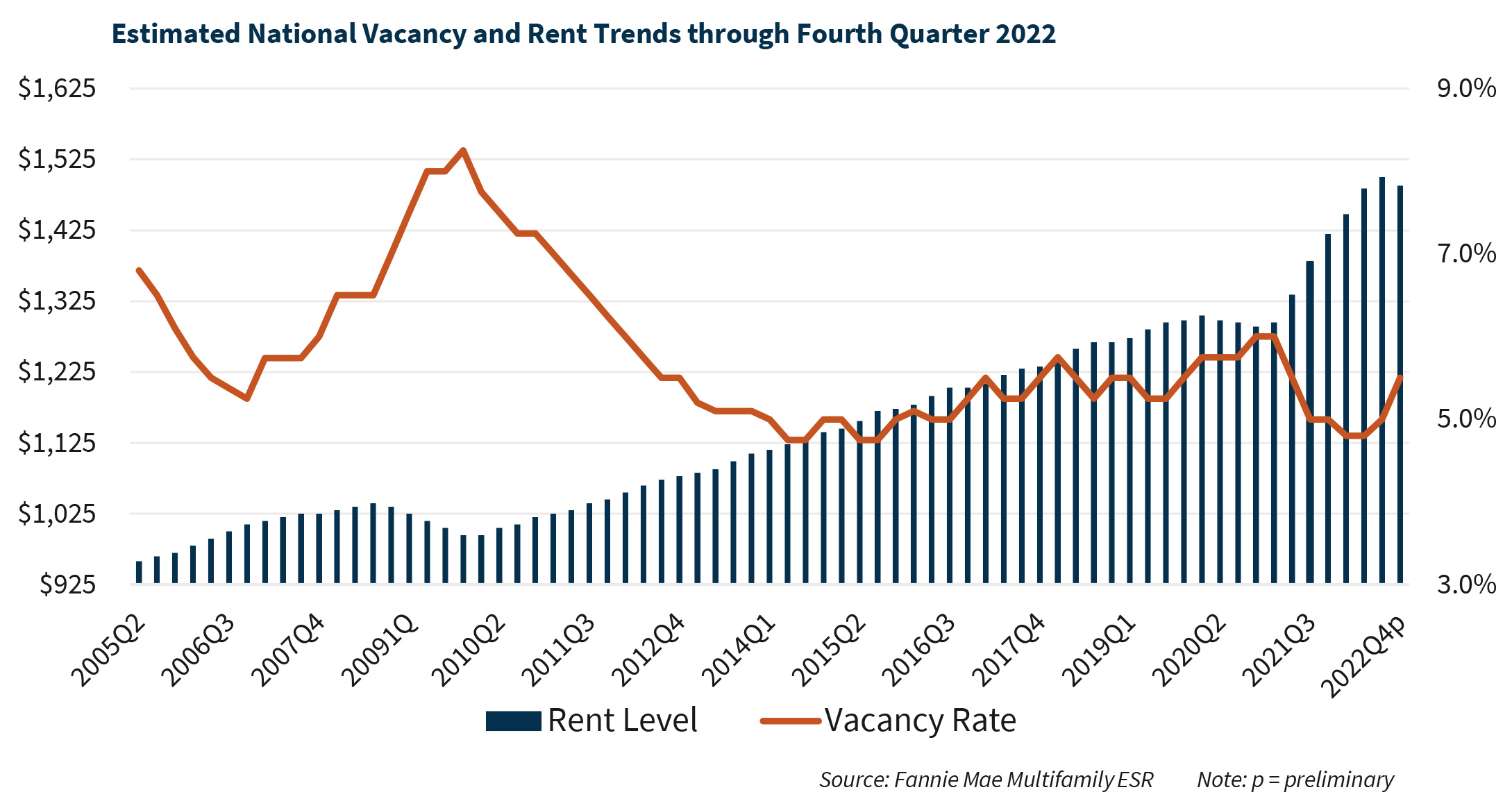

Builder Deposit Average On New Multifamily - The typical down payment for a new construction home ranges from 5% to 20% of the home’s purchase price. Generally, the builder deposit is 10% of the total construction costs before construction begins. A multifamily property is a residential building that contains two or more separate living units. Multifamily construction has dropped sharply, with starts down by half compared to last year, but extended completion timelines are keeping the development pipeline strong. Whether you want to invest passively or actively in multifamily properties, it is necessary to understand the construction costs. Here’s a quick overview of the similarities and differences between a. Today's report shows a bounce back to the highest levels since february. The amount will vary depending on the stage of the home’s construction at the time of purchase. With an average monthly rent as of february at $1,555, per apartments.com, based on the number. Although it varies from one area to another,. Here’s a quick overview of the similarities and differences between a. That deposit is generally five per cent of a home's total value for a. With each prediction worth 10 points, my accuracy for 2024 is 87%. Multifamily construction has dropped sharply, with starts down by half compared to last year, but extended completion timelines are keeping the development pipeline strong. Today's report shows a bounce back to the highest levels since february. Generally, the builder deposit is 10% of the total construction costs before construction begins. Although it varies from one area to another,. What is a typical down payment for a new construction home? The amount will vary depending on the stage of the home’s construction at the time of purchase. Cary home buyers offer earnest money on a resale home and a builders deposit on most new construction. Cary home buyers offer earnest money on a resale home and a builders deposit on most new construction. Once you’ve paid the builder deposit, you may have to pay the full cost of custom upgrades. What is a typical down payment for a new construction home? According to the 2021 survey of construction from the census bureau, the average length. With an average monthly rent as of february at $1,555, per apartments.com, based on the number. Here’s a quick overview of the similarities and differences between a. Whether you want to invest passively or actively in multifamily properties, it is necessary to understand the construction costs. Although it varies from one area to another,. Regulation imposed by all levels of. Once you’ve paid the builder deposit, you may have to pay the full cost of custom upgrades. The typical down payment for a new construction home ranges from 5% to 20% of the home’s purchase price. Last month's data showed housing starts closer to the low end of 2024's range. Regulation imposed by all levels of government accounts for an. Here’s a quick overview of the similarities and differences between a. Multifamily construction has dropped sharply, with starts down by half compared to last year, but extended completion timelines are keeping the development pipeline strong. What is a typical down payment for a new construction home? Cary home buyers offer earnest money on a resale home and a builders deposit. The typical down payment for a new construction home ranges from 5% to 20% of the home’s purchase price. Regulation imposed by all levels of government accounts for an average of 40.6 percent of multifamily development costs, according to research by nahb and nmhc. I entered this year with an average accuracy rate of 93%. That deposit is generally five. Multifamily construction has dropped sharply, with starts down by half compared to last year, but extended completion timelines are keeping the development pipeline strong. What is a typical down payment for a new construction home? The amount will vary depending on the stage of the home’s construction at the time of purchase. Generally, the builder deposit is 10% of the. The amount will vary depending on the stage of the home’s construction at the time of purchase. A multifamily property is a residential building that contains two or more separate living units. Regulation imposed by all levels of government accounts for an average of 40.6 percent of multifamily development costs, according to research by nahb and nmhc. Here’s a quick. The typical down payment for a new construction home ranges from 5% to 20% of the home’s purchase price. What is a typical down payment for a new construction home? Today's report shows a bounce back to the highest levels since february. I entered this year with an average accuracy rate of 93%. With an average monthly rent as of. The typical down payment for a new construction home ranges from 5% to 20% of the home’s purchase price. Although it varies from one area to another,. That deposit is generally five per cent of a home's total value for a. Generally, the builder deposit is 10% of the total construction costs before construction begins. Multifamily construction has dropped sharply,. Last month's data showed housing starts closer to the low end of 2024's range. According to the 2021 survey of construction from the census bureau, the average length of time to complete construction of a multifamily building — after obtaining authorization. With each prediction worth 10 points, my accuracy for 2024 is 87%. Regulation imposed by all levels of government. Last month's data showed housing starts closer to the low end of 2024's range. According to the 2021 survey of construction from the census bureau, the average length of time to complete construction of a multifamily building — after obtaining authorization. What is a typical down payment for a new construction home? Once you’ve paid the builder deposit, you may have to pay the full cost of custom upgrades. New multifamily development will come to a. With each prediction worth 10 points, my accuracy for 2024 is 87%. Multifamily construction has dropped sharply, with starts down by half compared to last year, but extended completion timelines are keeping the development pipeline strong. Although it varies from one area to another,. Cary home buyers offer earnest money on a resale home and a builders deposit on most new construction. Today's report shows a bounce back to the highest levels since february. Regulation imposed by all levels of government accounts for an average of 40.6 percent of multifamily development costs, according to research by nahb and nmhc. The typical down payment for a new construction home ranges from 5% to 20% of the home’s purchase price. Whether you want to invest passively or actively in multifamily properties, it is necessary to understand the construction costs. Here’s a quick overview of the similarities and differences between a. That deposit is generally five per cent of a home's total value for a. I entered this year with an average accuracy rate of 93%.2023 Multifamily Market Outlook Turbulence Ahead Fannie Mae Multifamily

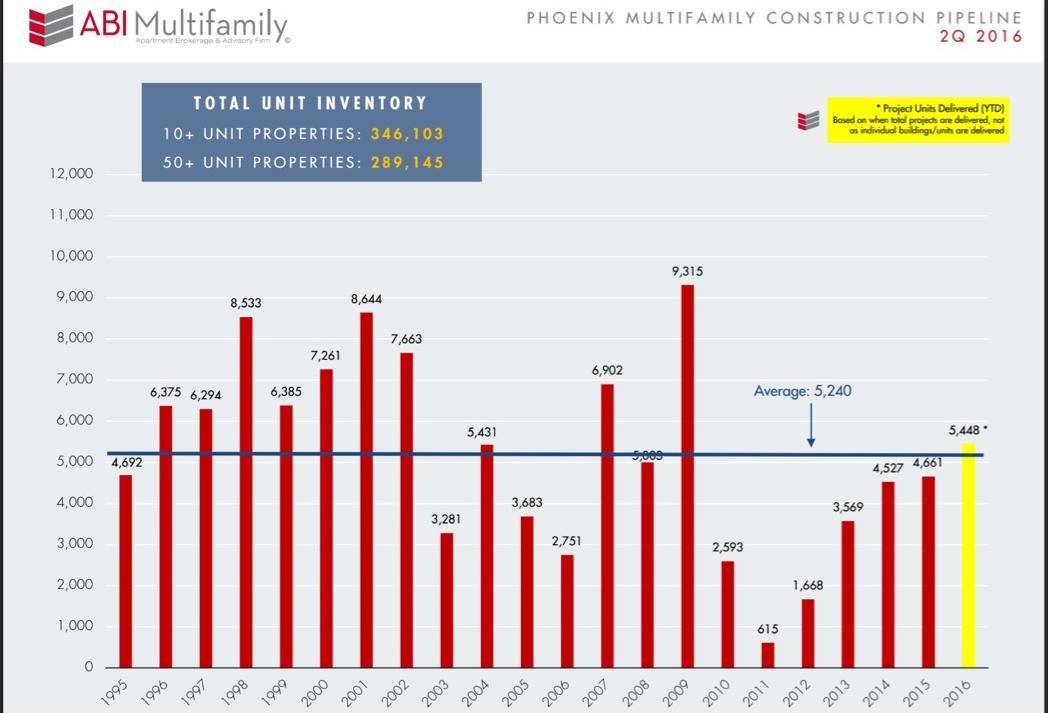

Multifamily New Construction In 2016 Has Already Beat 20Year Average

[Updated 2022] Despite turbulent 2020 home builder profit margins rose

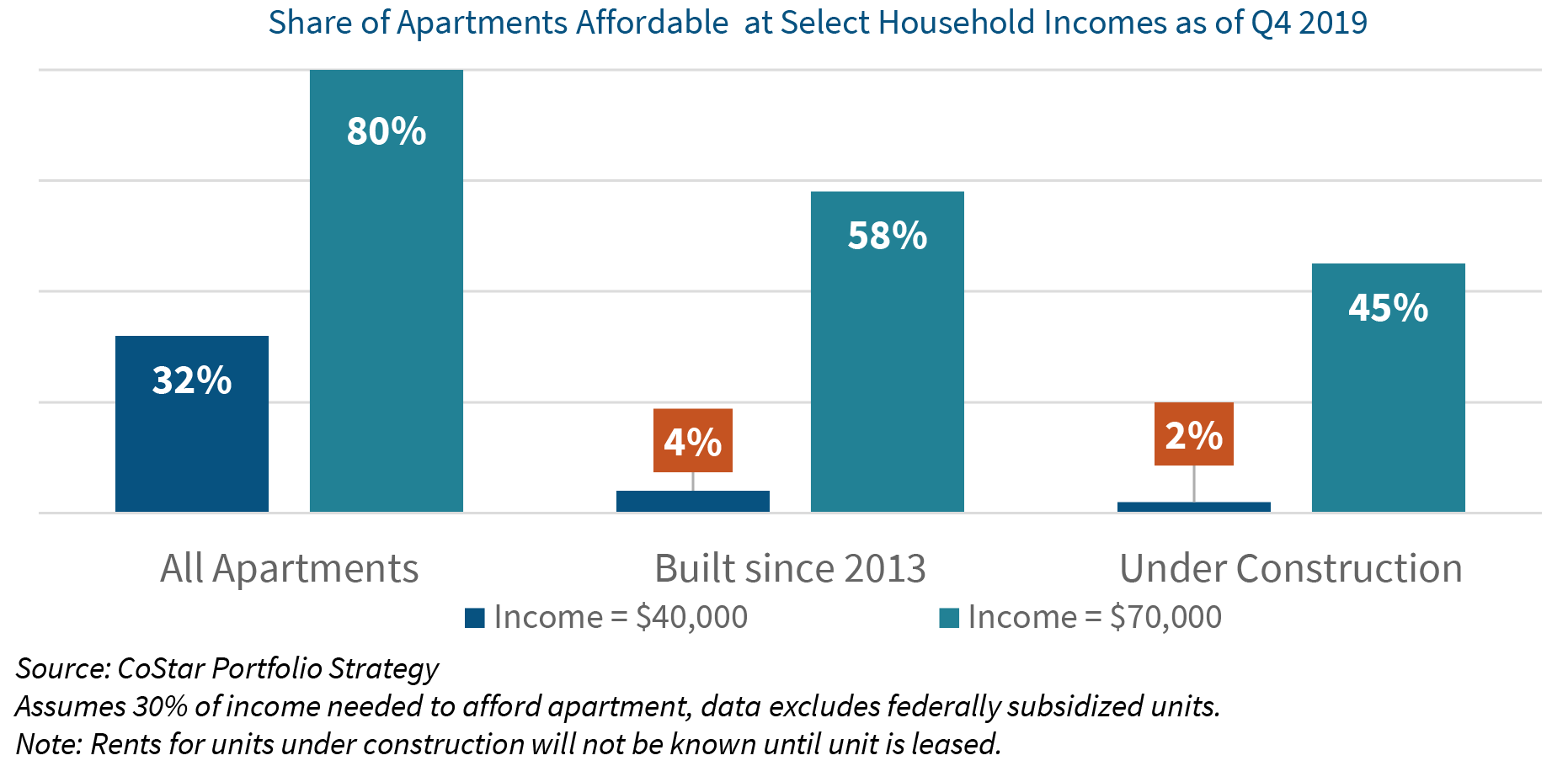

Growing Mismatch Between Multifamily Supply and Renter Needs Fannie

Multifamily Residential Construction Spending up 38.4 from One Year

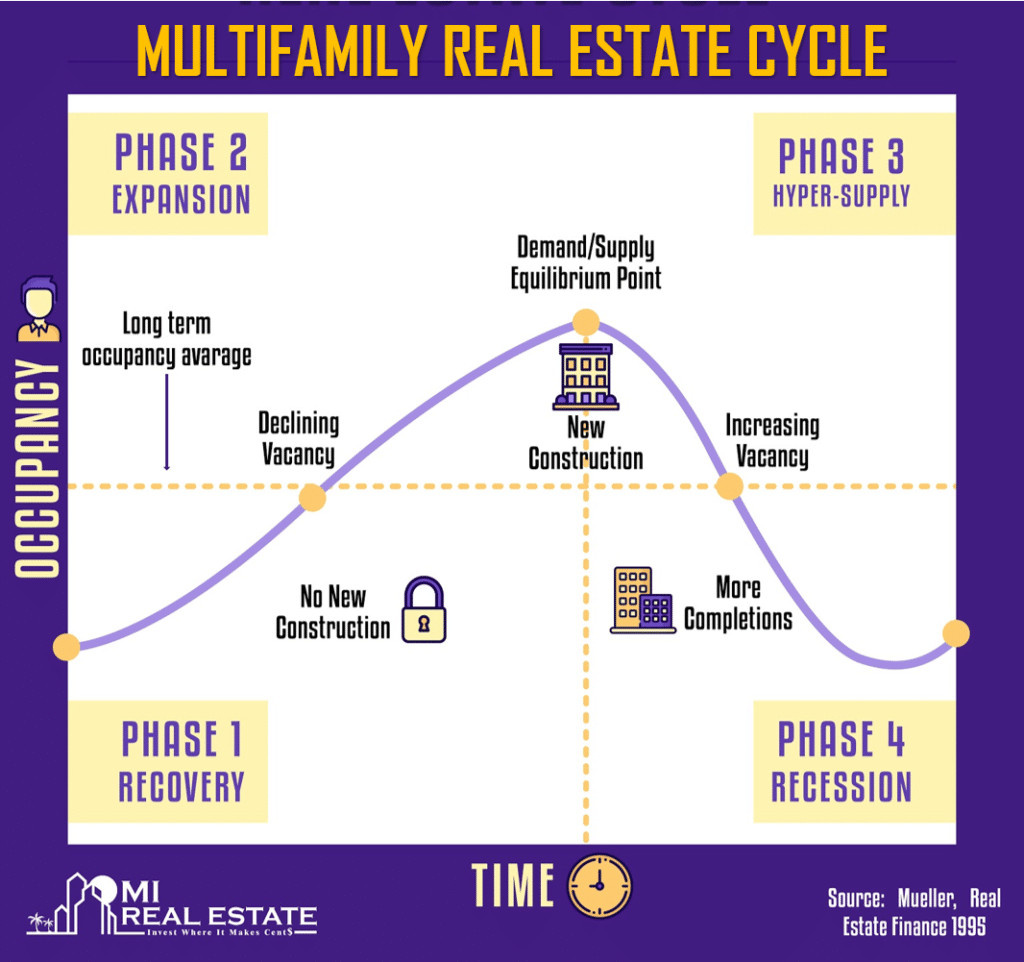

The Four Economic Multifamily Market Phases

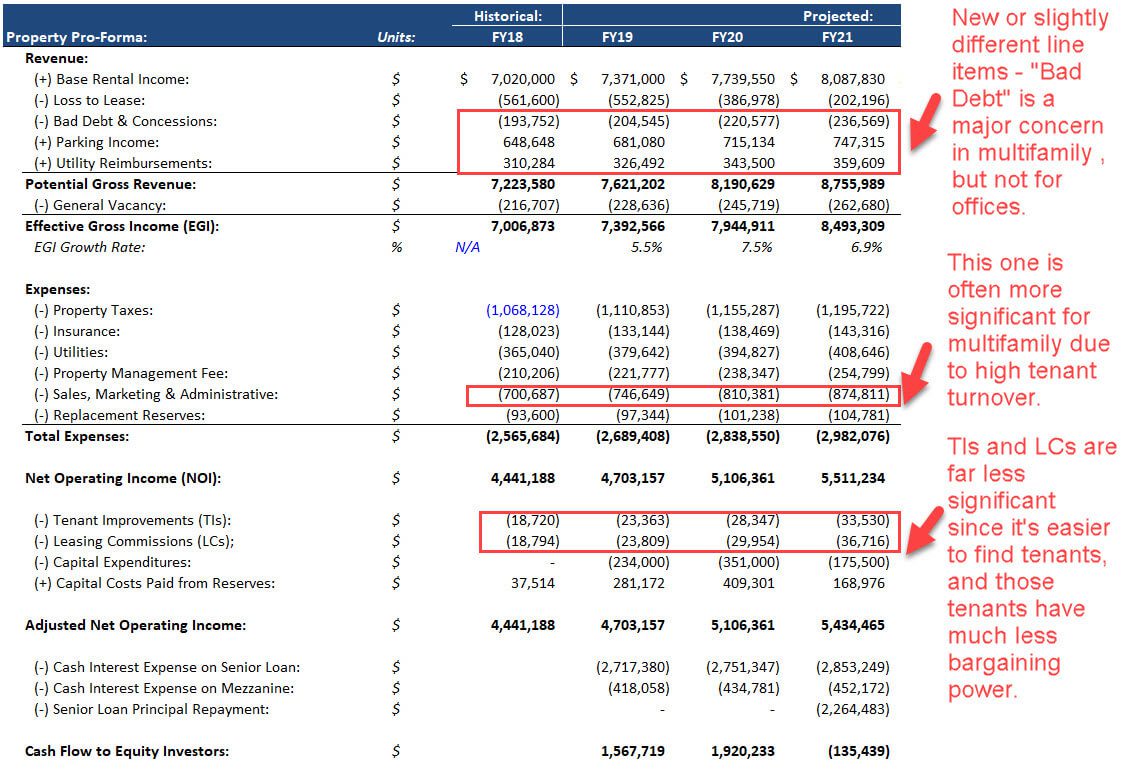

Real Estate ProForma Calculations, Examples, and Scenarios (Video)

New Construction Picks Up, Led by MultiFamily Economic

National Multifamily Report January 2021 MultiHousing News

Rising Share of New Multifamily Units in Large Buildings Eye On Housing

The Amount Will Vary Depending On The Stage Of The Home’s Construction At The Time Of Purchase.

A Multifamily Property Is A Residential Building That Contains Two Or More Separate Living Units.

With An Average Monthly Rent As Of February At $1,555, Per Apartments.com, Based On The Number.

In 2022, There Were 21.3 Million Multifamily Households In The United States.

Related Post:

![[Updated 2022] Despite turbulent 2020 home builder profit margins rose](https://assets-global.website-files.com/5dd697f7a930f962acbfc0ad/6228d09ba02a6342677d9d49_Avg PM %2B %25 Change (2) (1).png)