Builder Deposit Vs Down Payment

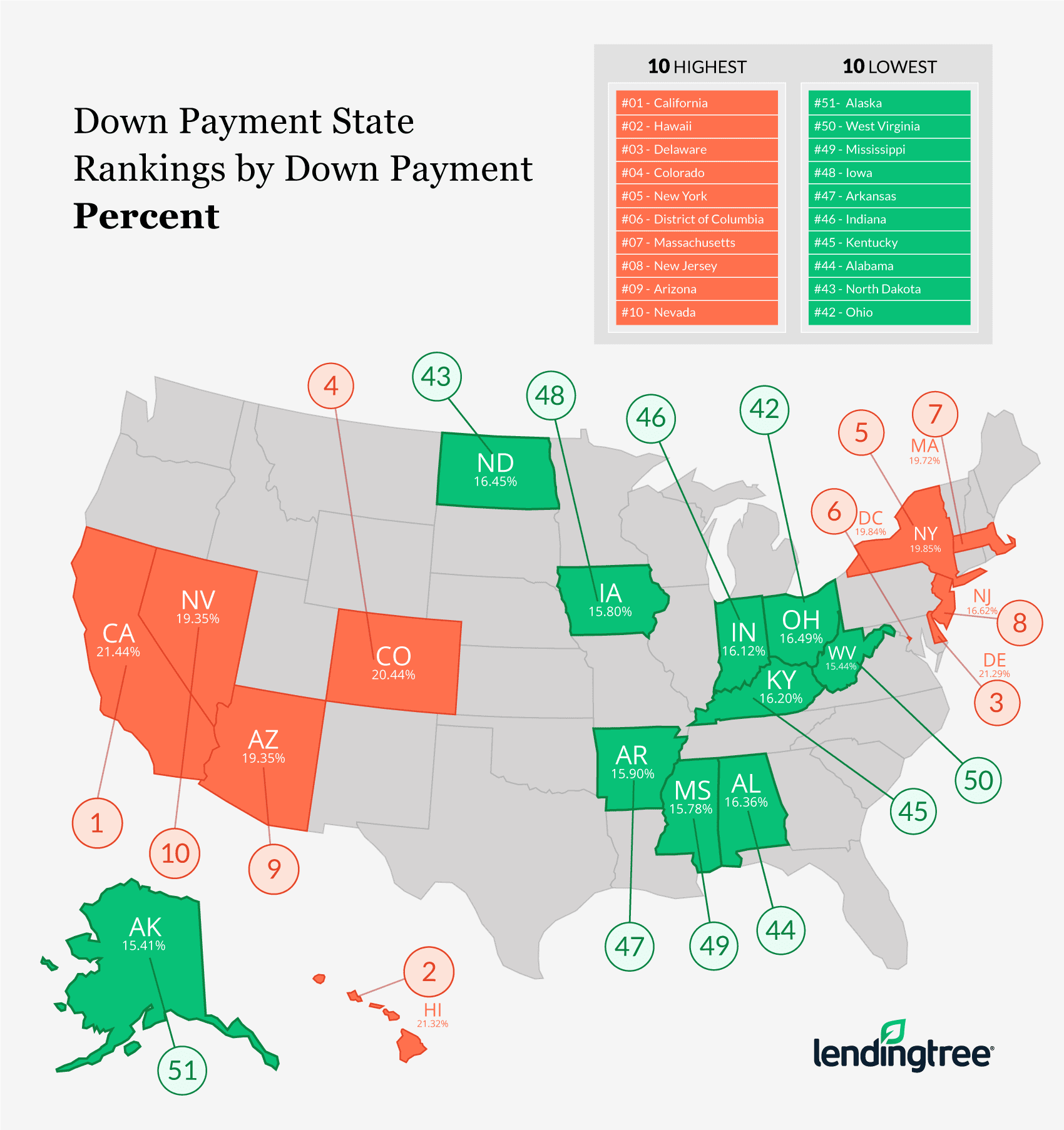

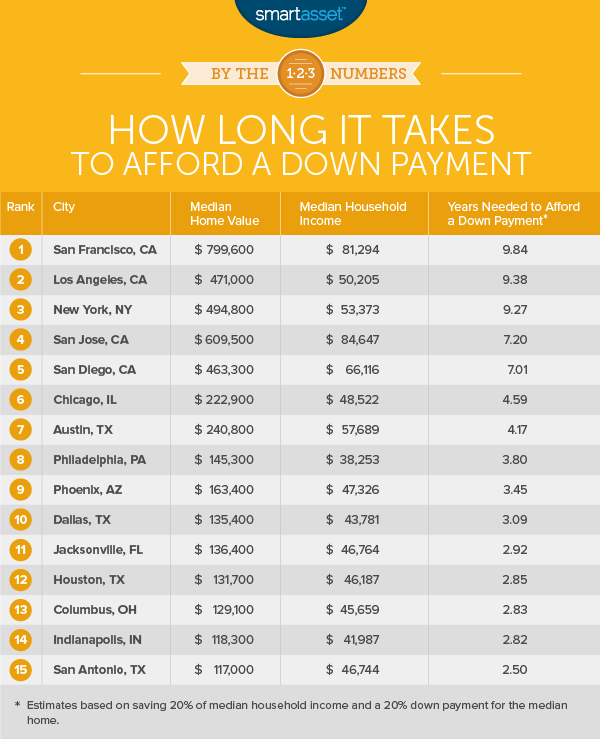

Builder Deposit Vs Down Payment - New home down payments vs builder deposit. A deposit in real estate is a form of security paid by the buyer to demonstrate their commitment to completing the purchase, while a down payment is the total amount of funds. The amount will vary depending on the stage of the home’s construction at the time of purchase. In the 1990s, a 20% down payment on the average home sale was about 80% of the median annual household income. A 5% deposit would be $50,000. Both have to do with cold, hard cash, but what’s the difference? Before applying for an fha loan, you should know the minimum down payment requirements for an fha loan, the variables that impact your down payment size, and the. Earnest money—also known as an. A down payment has always been the biggest hurdle for people looking to buy a home. Any down payment made to the contractor is a portion of the fixed contract price. What’s the difference between a builder deposit vs. So the answer to questions 1 and 2 is, yes, the down down payment is part of the fixed bid. Fortunately, this builder deposit can be applied to your down payment once you’re ready to close on the home. Even if a person or family can afford the monthly payments, being able to save for a. A deposit in real estate is a form of security paid by the buyer to demonstrate their commitment to completing the purchase, while a down payment is the total amount of funds. Both have to do with cold, hard cash, but what’s the difference? Before applying for an fha loan, you should know the minimum down payment requirements for an fha loan, the variables that impact your down payment size, and the. In the 1990s, a 20% down payment on the average home sale was about 80% of the median annual household income. A down payment has always been the biggest hurdle for people looking to buy a home. Earnest money—also known as an. What’s the difference between a builder deposit vs. Any down payment made to the contractor is a portion of the fixed contract price. A down payment has always been the biggest hurdle for people looking to buy a home. If you’re like most homeowners, purchasing a home represents the single biggest financial transaction of your lifetime. A 5% deposit would. If you’re like most homeowners, purchasing a home represents the single biggest financial transaction of your lifetime. Just like buying a resale home, parties in the sale of a new construction home. A down payment has always been the biggest hurdle for people looking to buy a home. Both have to do with cold, hard cash, but what’s the difference?. Depending on your builder, the deposit may be the only down payment you’re required to pay. If you’re like most homeowners, purchasing a home represents the single biggest financial transaction of your lifetime. Before applying for an fha loan, you should know the minimum down payment requirements for an fha loan, the variables that impact your down payment size, and. A deposit in real estate is a form of security paid by the buyer to demonstrate their commitment to completing the purchase, while a down payment is the total amount of funds. Typically your deposit with the builder becomes your down payment for the loan. Before applying for an fha loan, you should know the minimum down payment requirements for. Just like buying a resale home, parties in the sale of a new construction home. A down payment has always been the biggest hurdle for people looking to buy a home. Any down payment made to the contractor is a portion of the fixed contract price. Even if a person or family can afford the monthly payments, being able to. If you’re like most homeowners, purchasing a home represents the single biggest financial transaction of your lifetime. New home down payments vs builder deposit. Depending on your builder, the deposit may be the only down payment you’re required to pay. And two of the most important payments leading up to the. In the 1990s, a 20% down payment on the. Both have to do with cold, hard cash, but what’s the difference? Depending on your builder, the deposit may be the only down payment you’re required to pay. Even if a person or family can afford the monthly payments, being able to save for a. So the answer to questions 1 and 2 is, yes, the down down payment is. Earnest money—also known as an. New home down payments vs builder deposit. Both have to do with cold, hard cash, but what’s the difference? And two of the most important payments leading up to the. Here’s your cheat sheet on earnest money deposit vs. So the answer to questions 1 and 2 is, yes, the down down payment is part of the fixed bid. For the past few years, however, that same 20% down. Earnest money—also known as an. A 5% deposit would be $50,000. Both have to do with cold, hard cash, but what’s the difference? For the past few years, however, that same 20% down. What’s the difference between a builder deposit vs. A 5% deposit would be $50,000. Here’s how the deposit and down payment might break down: And two of the most important payments leading up to the. Before applying for an fha loan, you should know the minimum down payment requirements for an fha loan, the variables that impact your down payment size, and the. For the past few years, however, that same 20% down. If you’re like most homeowners, purchasing a home represents the single biggest financial transaction of your lifetime. Just like buying a resale home, parties in the sale of a new construction home. Any down payment made to the contractor is a portion of the fixed contract price. Earnest money—also known as an. Both have to do with cold, hard cash, but what’s the difference? A down payment has always been the biggest hurdle for people looking to buy a home. Depending on your builder, the deposit may be the only down payment you’re required to pay. The downpayment on your new home is determined by your mortgage lender and is due when you close on your home. Fortunately, this builder deposit can be applied to your down payment once you’re ready to close on the home. In the 1990s, a 20% down payment on the average home sale was about 80% of the median annual household income. What’s the difference between a builder deposit vs. And two of the most important payments leading up to the. Your personal finances will dictate the down payment amount that. So the answer to questions 1 and 2 is, yes, the down down payment is part of the fixed bid.Builder disappears with deposit and advanced payment Builder

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

Where a Down Payment Goes the Furthest Builder Magazine

How Much Deposit Should I Pay My Builder?

Homeowner’s Guide to HIA Progress Payment Schedule

Down Payment Agreement Template

Your Ultimate Guide to New Home Down Payments Copper Builders

[Solved] Rent versus buy analysis Part 2 Which is better to rent or

Where a Decade of Work Barely Nets a Down Payment Builder Magazine

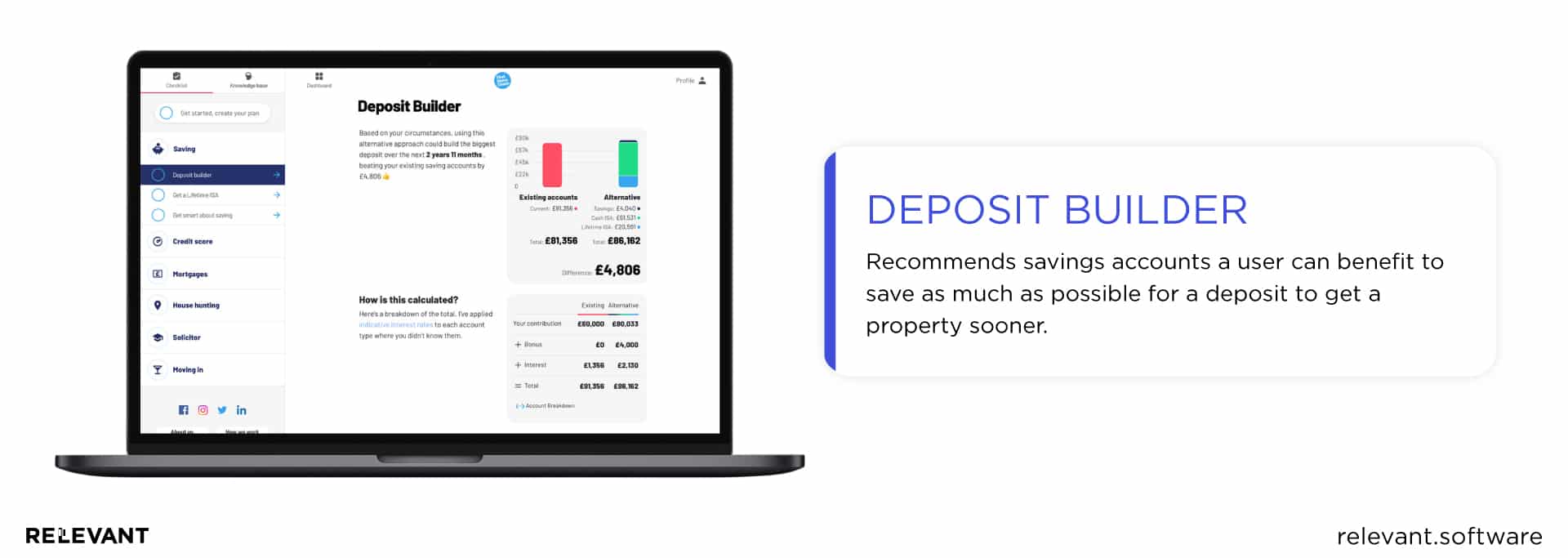

Building Digital Mortgage Software Actionable Tips and Case Study

The Amount Will Vary Depending On The Stage Of The Home’s Construction At The Time Of Purchase.

A 5% Deposit Would Be $50,000.

Here’s Your Cheat Sheet On Earnest Money Deposit Vs.

Even If A Person Or Family Can Afford The Monthly Payments, Being Able To Save For A.

Related Post: