Builder Earnings

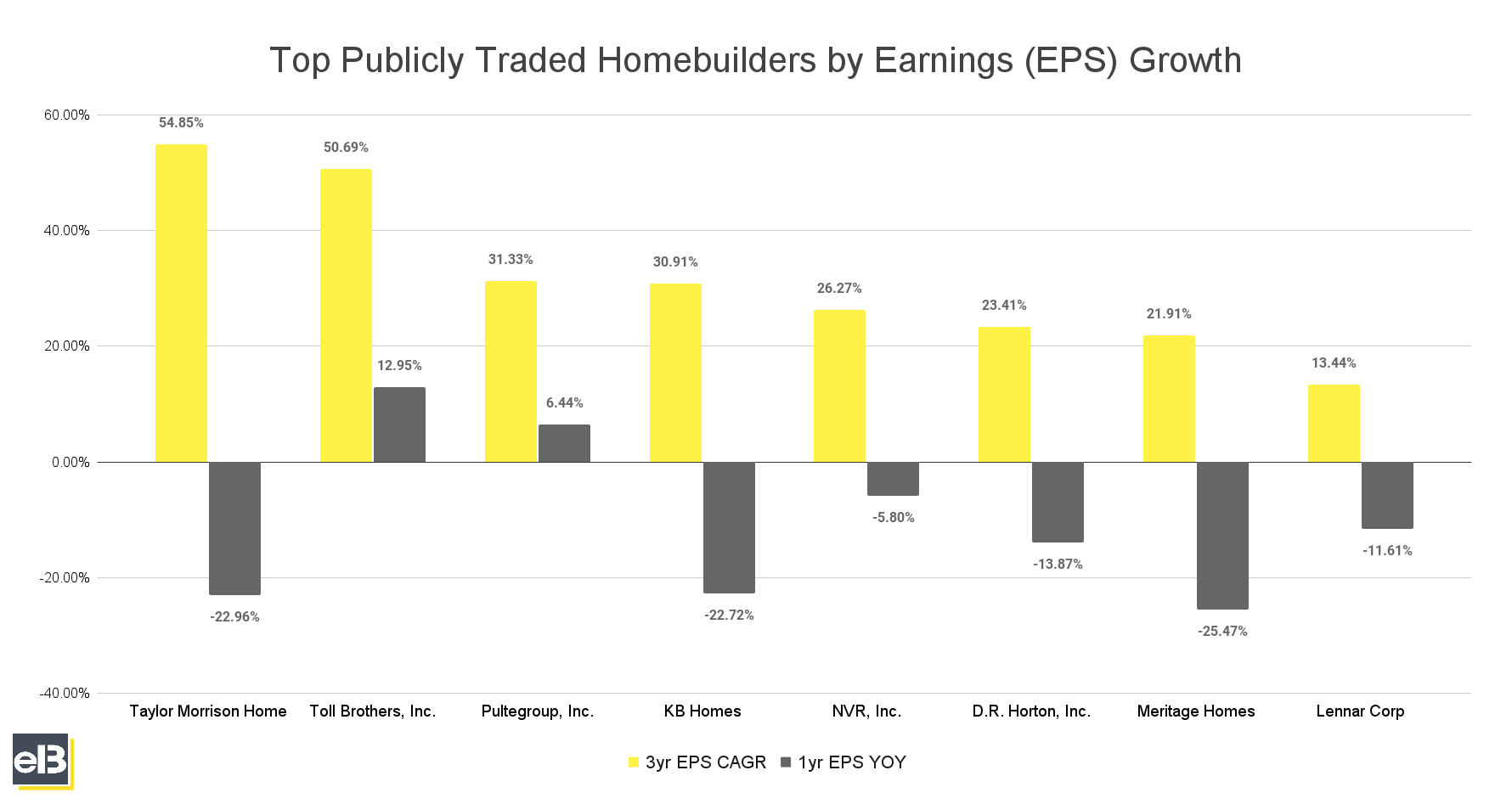

Builder Earnings - First quarter adjusted ebitda of $23.0 million was down $15.0 million, or. (nyse:tol) (tollbrothers.com), the nation’s leading builder of luxury homes, today. Net income from continuing operations was $3.1 million, generating diluted earnings per share of $0.10. Home closing revenue was $2.2 billion, up 12%. The builder said sales orders increased 11% to 2,621 in the fourth quarter compared with the prior year. The 11 home builders stocks we track reported a mixed q3. Builders firstsource released q3 2024 earnings on november 5, 2024, reporting an eps of $3.07, which missed the consensus estimate of $3.09 by $0.02. However, the average net profit margin is closer to 10%. For the full year, the home builder generated home sales revenue of $17.3. Builder stocks have been stuck in a rut even as a surge of buyers continues to fuel a robust housing market. Builders firstsource reported revenues of $4.23 billion, down 6.7% year on year. (nyse:tol) (tollbrothers.com), the nation’s leading builder of luxury homes, today. First quarter results are in for the large publicly traded builders, and investors who were long on the stocks into the quarter were rewarded as the s&p homebuilders etf (xhb). Nvr, century communities, m/i homes, beazer homes by vincent salandro record levels of deliveries, orders, and revenues characterize quarterly. The 11 home builders stocks we track reported a mixed q3. Net income from continuing operations was $3.1 million, generating diluted earnings per share of $0.10. Profitability, demand elasticity, consumer spending expectations, and weather impacts all things to watch. Builder stocks have been stuck in a rut even as a surge of buyers continues to fuel a robust housing market. Builders firstsource released q3 2024 earnings on november 5, 2024, reporting an eps of $3.07, which missed the consensus estimate of $3.09 by $0.02. First quarter adjusted ebitda of $23.0 million was down $15.0 million, or. Builder stocks have been stuck in a rut even as a surge of buyers continues to fuel a robust housing market. Headwinds will continue for the sector, but analysts are optimistic ahead of. For the last reported quarter, it was expected that builders firstsource would post earnings of $3.09 per share when it actually produced earnings of $3.07, delivering a. The quarterly earnings season for public builders kicks off this. Net income from continuing operations was $3.1 million, generating diluted earnings per share of $0.10. Based on the national sales price in 2021, that means a. First quarter results are in for the large publicly traded builders, and investors who were long on the stocks into the quarter were rewarded. (nyse:tol) (tollbrothers.com), the nation’s leading builder of luxury homes, today. Nvr, century communities, m/i homes, beazer homes by vincent salandro record levels of deliveries, orders, and revenues characterize quarterly. A string of earnings beats sent homebuilder stocks surging on tuesday as the results show that there is still demand from consumers to buy a home. This print fell short of. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was below. Builders firstsource released q3 2024 earnings on november 5, 2024, reporting an eps of $3.07, which missed the consensus estimate of $3.09 by $0.02. First quarter adjusted ebitda of $23.0 million was down $15.0 million, or. Nvr, century communities, m/i homes, beazer homes. Profitability, demand elasticity, consumer spending expectations, and weather impacts all things to watch. Net income from continuing operations was $3.1 million, generating diluted earnings per share of $0.10. Nvr, century communities, m/i homes, beazer homes by vincent salandro record levels of deliveries, orders, and revenues characterize quarterly. This print fell short of analysts’ expectations by 4.8%. For the last reported. Builders firstsource released q3 2024 earnings on november 5, 2024, reporting an eps of $3.07, which missed the consensus estimate of $3.09 by $0.02. Net income from continuing operations was $3.1 million, generating diluted earnings per share of $0.10. First quarter adjusted ebitda of $23.0 million was down $15.0 million, or. As a group, revenues beat analysts’ consensus estimates by. Based on the national sales price in 2021, that means a. For the full year, the home builder generated home sales revenue of $17.3. First quarter adjusted ebitda of $23.0 million was down $15.0 million, or. Builder stocks have been stuck in a rut even as a surge of buyers continues to fuel a robust housing market. As a group,. Profitability, demand elasticity, consumer spending expectations, and weather impacts all things to watch. Home closing revenue was $2.2 billion, up 12%. For the full year, the home builder generated home sales revenue of $17.3. However, the average net profit margin is closer to 10%. (nyse:tol) (tollbrothers.com), the nation’s leading builder of luxury homes, today. For the last reported quarter, it was expected that builders firstsource would post earnings of $3.09 per share when it actually produced earnings of $3.07, delivering a surprise. Based on the national sales price in 2021, that means a. Builder stocks have been stuck in a rut even as a surge of buyers continues to fuel a robust housing market.. Builder stocks have been stuck in a rut even as a surge of buyers continues to fuel a robust housing market. The 11 home builders stocks we track reported a mixed q3. The run of strong earnings for public builders continued with nvr, century. Record levels of deliveries, orders, and revenues characterize quarterly results for four public home builders. Headwinds. This print fell short of analysts’ expectations by 4.8%. However, the average net profit margin is closer to 10%. The builder said sales orders increased 11% to 2,621 in the fourth quarter compared with the prior year. The average gross profit margin for a home builder is 15%. Profitability, demand elasticity, consumer spending expectations, and weather impacts all things to watch. Overall, it was a slower quarter for the company with a. The run of strong earnings for public builders continued with nvr, century. First quarter results are in for the large publicly traded builders, and investors who were long on the stocks into the quarter were rewarded as the s&p homebuilders etf (xhb). Home closing revenue was $2.2 billion, up 12%. Builder stocks have been stuck in a rut even as a surge of buyers continues to fuel a robust housing market. Builders firstsource reported revenues of $4.23 billion, down 6.7% year on year. Based on the national sales price in 2021, that means a. A string of earnings beats sent homebuilder stocks surging on tuesday as the results show that there is still demand from consumers to buy a home. Headwinds will continue for the sector, but analysts are optimistic ahead of. Nvr, century communities, m/i homes, beazer homes by vincent salandro record levels of deliveries, orders, and revenues characterize quarterly. (nyse:tol) (tollbrothers.com), the nation’s leading builder of luxury homes, today.Home builder earnings a strong foundation should yield benefits

[Updated 2022] Despite turbulent 2020 home builder profit margins rose

Public Homebuilder Earnings Summary John Burns

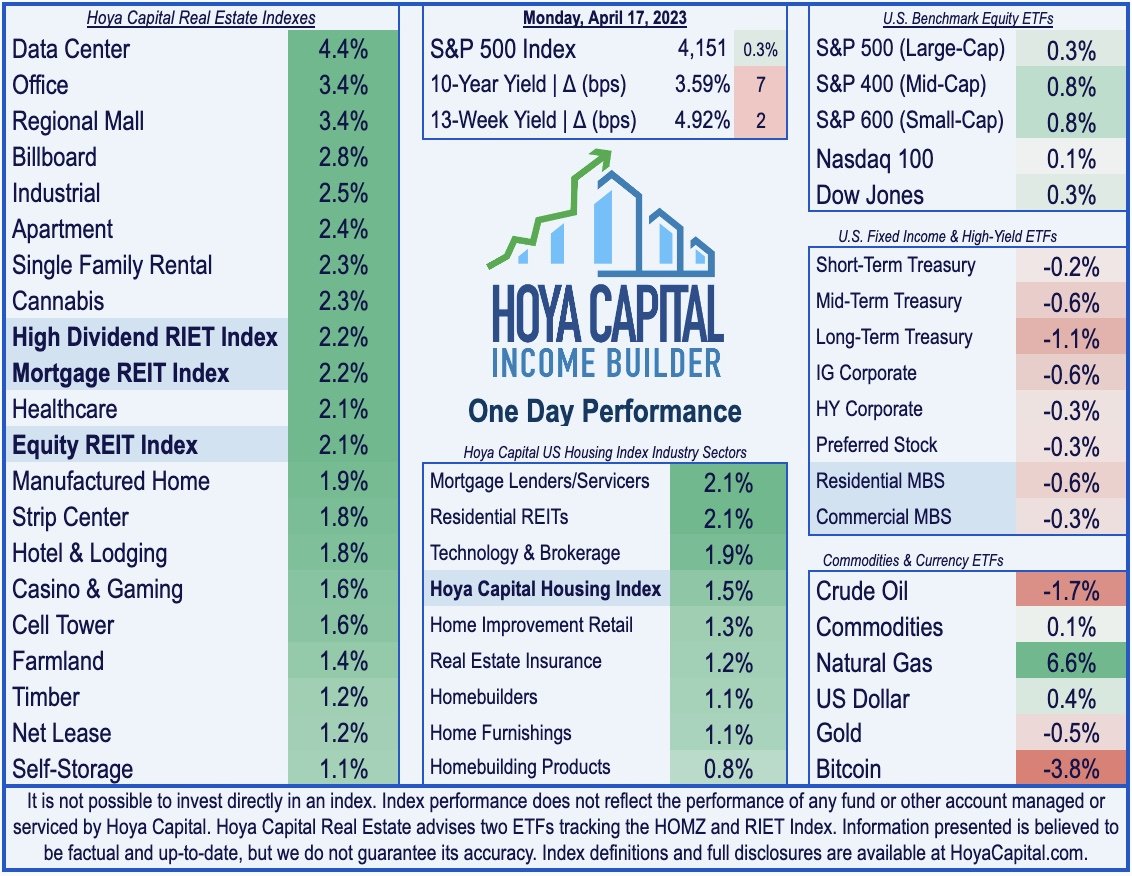

Earnings Begin • REITs Rebound • Week Ahead — Hoya Capital

Publicly Traded Home Builders Report Winter 2023 Results

Earnings Begin • REITs Rebound • Week Ahead — Hoya Capital

Earnings In Focus • Office REITs Stabilize • Logistics Rents Soar

Website Builder Earnings Top Performers in 2022

Key Home Builder Earnings Spring 2023 YouTube

》Printable Construction Profit And Loss Statement Template

As A Group, Revenues Beat Analysts’ Consensus Estimates By 1.9% While Next Quarter’s Revenue Guidance Was Below.

The Quarterly Earnings Season For Public Builders Kicks Off This.

First Quarter Adjusted Ebitda Of $23.0 Million Was Down $15.0 Million, Or.

For The Last Reported Quarter, It Was Expected That Builders Firstsource Would Post Earnings Of $3.09 Per Share When It Actually Produced Earnings Of $3.07, Delivering A Surprise.

Related Post:

![[Updated 2022] Despite turbulent 2020 home builder profit margins rose](https://assets-global.website-files.com/5dd697f7a930f962acbfc0ad/6228d09ba02a6342677d9d49_Avg PM %2B %25 Change (2) (1).png)