Builder Fee In Closing Cost

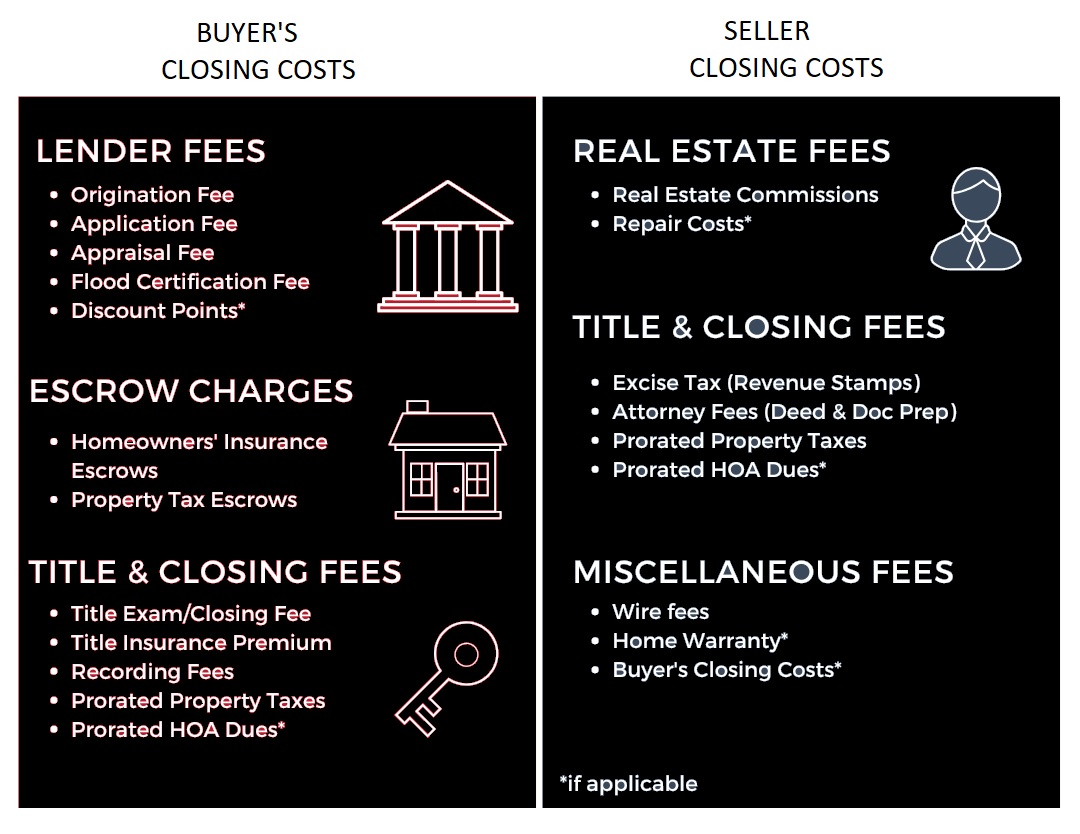

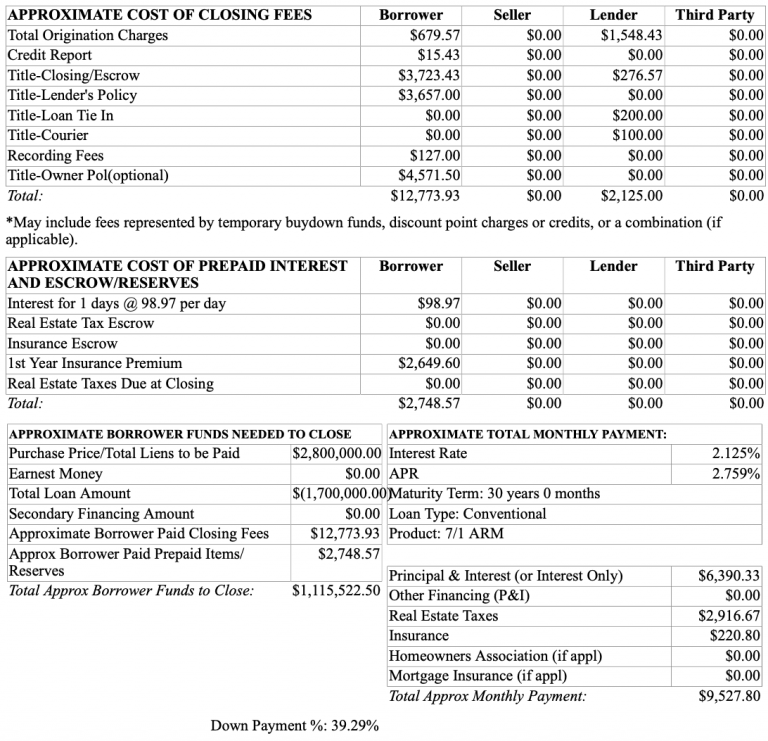

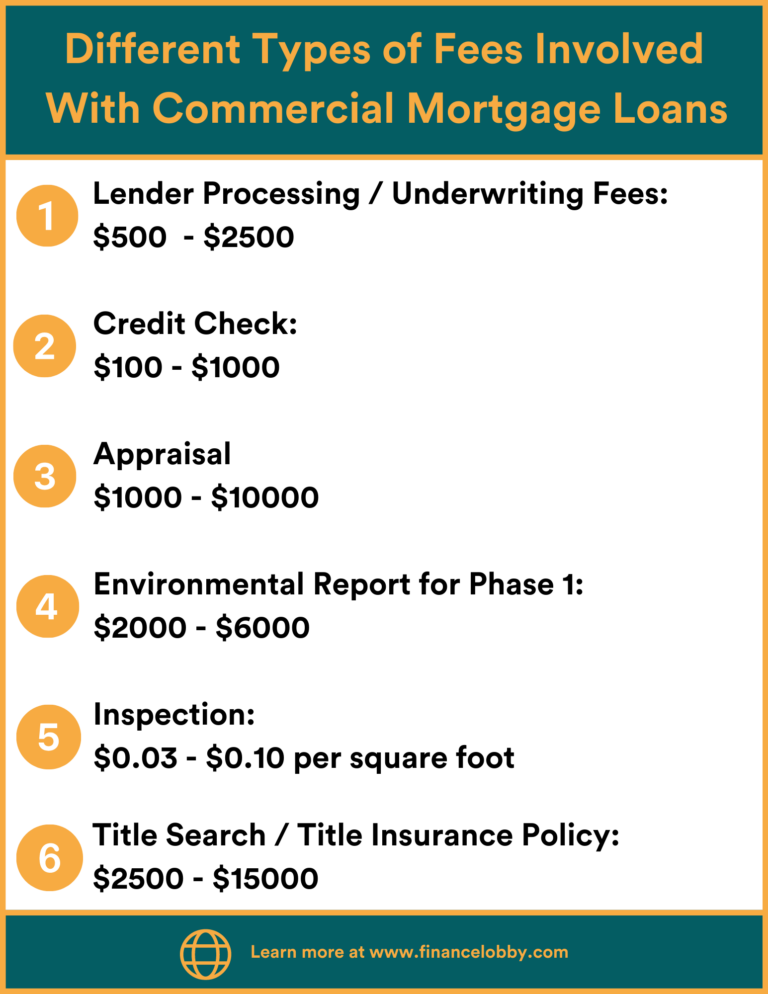

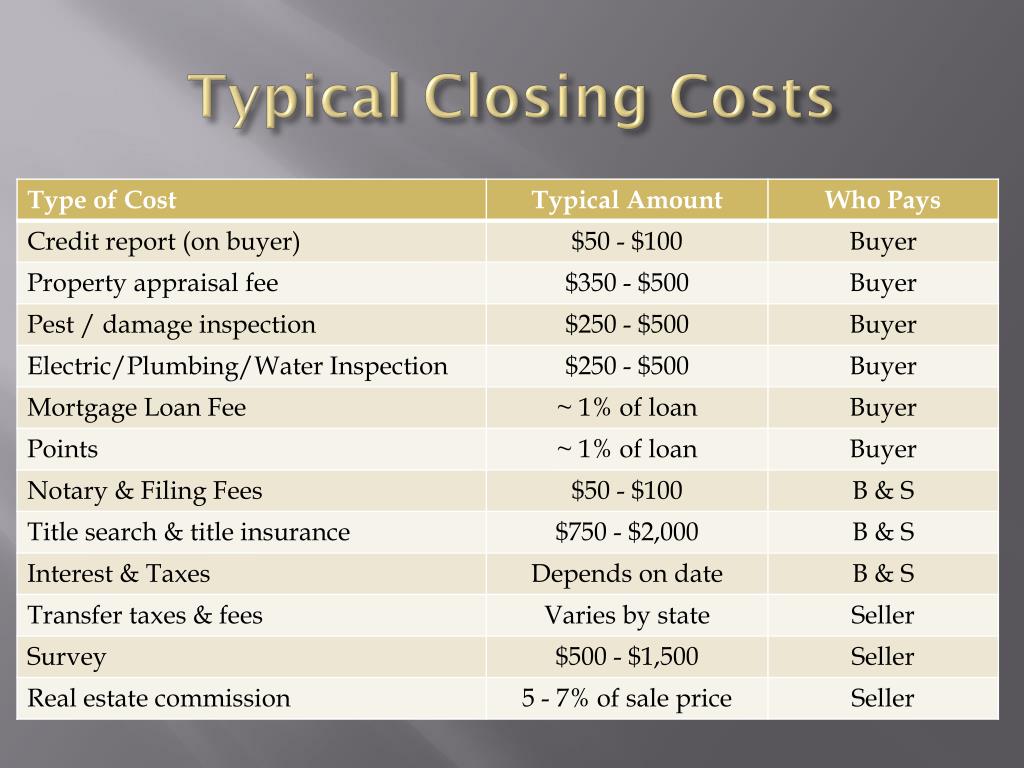

Builder Fee In Closing Cost - Main differences earnest money can be refundable (under certain conditions), while due diligence money and. When you buy a new home, it is important to consider the closing costs required to go under contract and take ownership of the property. As a buyer, you can anticipate closing costs to be between 2% to 6% of the purchase price of your new home. One of the most popular incentives is builder closing cost incentives, which promise to cover some or all of the closing costs associated with purchasing your new home. Closing costs typically range from 2 to 5 percent of the total loan. Closing costs on new construction homes typically include a few additional fees not found with existing homes. For example, on a $400,000 home, closing costs might range from. Builders typically charge fees for items and services, such as architectural services, land surveying, engineering, and construction management. In texas, however, option fees are usually applied to closing costs. Unlike sellers, who pay closing costs based on the home’s sale price, buyers’ expenses are primarily. Builders typically charge fees for items and services, such as architectural services, land surveying, engineering, and construction management. According to recent statistics, closing costs typically range from 2% to 5% of the home’s purchase price. As a new construction buyer, you'll want to know the costs and fees associated with your mortgage and how they are calculated. Here’s a breakdown of what you might expect: Main differences earnest money can be refundable (under certain conditions), while due diligence money and. Mortgage closing costs are the fees associated with buying a home, most which you must pay on closing day. These costs could include things like. Unlike sellers, who pay closing costs based on the home’s sale price, buyers’ expenses are primarily. When you buy a new home, it is important to consider the closing costs required to go under contract and take ownership of the property. These costs typically include a variety of fees such as credit. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. When you buy a new home, it is important to consider the closing costs required to go under contract and take ownership of the property. The national association of home builders recently released the results of a survey of 4,000 home builders, breaking down exactly. Builders typically charge fees for items and services, such as architectural services, land surveying, engineering, and construction management. These fees are not typically included in. What are the biggest closing costs usually paid by buyers? Closing costs on new construction homes typically include a few additional fees not found with existing homes. According to recent statistics, closing costs typically range. But who foots the bill? According to recent statistics, closing costs typically range from 2% to 5% of the home’s purchase price. One of the most popular incentives is builder closing cost incentives, which promise to cover some or all of the closing costs associated with purchasing your new home. Dive into this detailed breakdown to uncover. These fees are. Closing costs are the fees and expenses you pay when you close on your home, beyond the down payment. For example, on a $400,000 home, closing costs might range from. When you finish buying a house, there are extra fees you have to pay. Buyer closing costs typically range from 2% to 5% of the loan amount. These costs typically. Closing costs are the fees and expenses you pay when you close on your home, beyond the down payment. You'll want to see if you can reduce or negotiate them. The national association of home builders recently released the results of a survey of 4,000 home builders, breaking down exactly how much each stage of construction on a new. For. When purchasing a newly constructed home, buyers often encounter higher closing costs compared to buying an existing home. When you buy a new home, it is important to consider the closing costs required to go under contract and take ownership of the property. They include things like paying the bank for your loan and. Unlike sellers, who pay closing costs. Unlike sellers, who pay closing costs based on the home’s sale price, buyers’ expenses are primarily. According to recent statistics, closing costs typically range from 2% to 5% of the home’s purchase price. These are called closing costs. The national association of home builders recently released the results of a survey of 4,000 home builders, breaking down exactly how much. Closing costs average 45 days the standard costs of the home sale transaction, paid at. These costs typically include a variety of fees such as credit. Closing costs on new construction homes typically include a few additional fees not found with existing homes. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. How much. Here’s a breakdown of what you might expect: Builders typically charge fees for items and services, such as architectural services, land surveying, engineering, and construction management. Mortgage closing costs are the fees associated with buying a home, most which you must pay on closing day. When purchasing a newly constructed home, buyers often encounter higher closing costs compared to buying. These costs typically include a variety of fees such as credit. You'll want to see if you can reduce or negotiate them. For buyers, the biggest closing costs typically include: When you finish buying a house, there are extra fees you have to pay. Dive into this detailed breakdown to uncover. These costs could include things like. Main differences earnest money can be refundable (under certain conditions), while due diligence money and. Charged by the lender to process. The national association of home builders recently released the results of a survey of 4,000 home builders, breaking down exactly how much each stage of construction on a new. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. Closing costs are the fees and expenses you pay when you close on your home, beyond the down payment. These fees are not typically included in. Closing costs average 45 days the standard costs of the home sale transaction, paid at. Buyer closing costs typically range from 2% to 5% of the loan amount. How much are closing costs? They include things like paying the bank for your loan and. These additional costs arise due to factors specific to. Here’s a breakdown of what you might expect: These are called closing costs. But who foots the bill? These costs typically include a variety of fees such as credit.Closing Costs in Florida What You Need to Know

Mortgage Closing Costs When Buying A Property You Should Know

First Time Home Buyers Understanding Closing Cost

Fha loan closing costs calculator JreenBhavik

Do Home Builders Pay Closing Costs and What Are They?

Pin on Homebuyer tips

Buyers Estimated Closing Costrealtor Cost Real Estate Etsy Realtor

How to Estimate Closing Costs Assurance Financial

Commercial Property Closing Costs What to Know Finance Lobby

PPT Buying a house PowerPoint Presentation, free download ID1543981

This Often Covers Certain Builder Fees That You Won’t Find With Existing Homes.

What Are The Biggest Closing Costs Usually Paid By Buyers?

Closing Costs Typically Range From 2 To 5 Percent Of The Total Loan.

One Of The Most Popular Incentives Is Builder Closing Cost Incentives, Which Promise To Cover Some Or All Of The Closing Costs Associated With Purchasing Your New Home.

Related Post: