Builder Liability Insurance

Builder Liability Insurance - Get a free quote and coverage in minutes, with flexible policy options and no. You can buy different types of builders business insurance: If your business is involved in the planning, execution,. Protect your construction projects through every phase, from groundbreaking to ribbon cutting. Contractors need comprehensive construction liability insurance to protect against various risks. Construction businesses tend to start off with commercial property insurance and general liability insurance, and then supplement these with other coverages. Builders' insurance is specialised business insurance for those who work in the construction industry. Public liability insurance can be an essential requirement. General contractors, carpenters, roofers and other construction workers should carry general liability insurance and may be required to do so by their employer, city or state. Construction liability insurance is a type of coverage designed to protect against risks associated with accidents, injuries, or. Get a free quote and coverage in minutes, with flexible policy options and no. Progressive commercial can provide a certificate of insurance (coi) once you start a policy. Explore the essential distinctions between builder’s risk and general liability insurance for contractors, guaranteeing comprehensive coverage against property damage,. You can buy different types of builders business insurance: Builder’s risk insurance covers the property owner and construction company in the event of: If your business is involved in the planning, execution,. Professional liability insurance, also known as errors and omissions insurance, protects you against claims related to mistakes your business allegedly made when providing services. Construction liability insurance is a type of coverage designed to protect against risks associated with accidents, injuries, or. Construction business liability insurance is essential for construction professionals looking to safeguard their operations from unexpected issues. It’s usually cheaper to purchase a bop than to buy general liability insurance and commercial property insurance separately. Construction liability insurance is a type of coverage designed to protect against risks associated with accidents, injuries, or. Construction businesses tend to start off with commercial property insurance and general liability insurance, and then supplement these with other coverages. Builder’s risk insurance covers the property owner and construction company in the event of: Who needs construction liability insurance? Builders risk. Get a free quote and coverage in minutes, with flexible policy options and no. General contractors, carpenters, roofers and other construction workers should carry general liability insurance and may be required to do so by their employer, city or state. Insureon lists the average price of general liability. You can buy different types of builders business insurance: Builders' insurance is. General contractors, carpenters, roofers and other construction workers should carry general liability insurance and may be required to do so by their employer, city or state. Who needs construction liability insurance? Builders' insurance is specialised business insurance for those who work in the construction industry. Construction business liability insurance is essential for construction professionals looking to safeguard their operations from. Construction liability insurance is a type of coverage designed to protect against risks associated with accidents, injuries, or. Builders’ public liability insurance is designed to protect your business from claims made by third parties for injury, property damage, or accidents caused by your work. If your business is involved in the planning, execution,. What is liability insurance on a construction. Construction businesses tend to start off with commercial property insurance and general liability insurance, and then supplement these with other coverages. You can buy different types of builders business insurance: Get a free quote and coverage in minutes, with flexible policy options and no. Explore the essential distinctions between builder’s risk and general liability insurance for contractors, guaranteeing comprehensive coverage. Builders' insurance is specialised business insurance for those who work in the construction industry. Progressive commercial can provide a certificate of insurance (coi) once you start a policy. Builders risk insurance (also known as course of construction insurance) is one of the most common forms of construction insurance, covering buildings and other structures. Contractors need comprehensive construction liability insurance to. General contractors, carpenters, roofers and other construction workers should carry general liability insurance and may be required to do so by their employer, city or state. It’s usually cheaper to purchase a bop than to buy general liability insurance and commercial property insurance separately. Builders' insurance is specialised business insurance for those who work in the construction industry. Professional liability. General contractors, carpenters, roofers and other construction workers should carry general liability insurance and may be required to do so by their employer, city or state. Contractors need comprehensive construction liability insurance to protect against various risks. Builders risk insurance (also known as course of construction insurance) is one of the most common forms of construction insurance, covering buildings and. Builder’s risk insurance covers the property owner and construction company in the event of: Contractors need comprehensive construction liability insurance to protect against various risks. Construction businesses tend to start off with commercial property insurance and general liability insurance, and then supplement these with other coverages. You can buy different types of builders business insurance: Professional liability insurance, also known. Contractors need comprehensive construction liability insurance to protect against various risks. Construction businesses tend to start off with commercial property insurance and general liability insurance, and then supplement these with other coverages. Who needs construction liability insurance? Builders risk insurance (also known as course of construction insurance) is one of the most common forms of construction insurance, covering buildings and. Public liability insurance can be an essential requirement. Progressive commercial can provide a certificate of insurance (coi) once you start a policy. General contractors, carpenters, roofers and other construction workers should carry general liability insurance and may be required to do so by their employer, city or state. Builder’s risk insurance covers the property owner and construction company in the event of: Protect your construction projects through every phase, from groundbreaking to ribbon cutting. Builders' insurance is specialised business insurance for those who work in the construction industry. It’s usually cheaper to purchase a bop than to buy general liability insurance and commercial property insurance separately. Without builder’s risk in place, a general contractor or subcontractor may be held liable for. Builders’ public liability insurance is designed to protect your business from claims made by third parties for injury, property damage, or accidents caused by your work. Builders risk covers the property and materials at the job site, while general liability protects the contractors and the policyholder. Learn the difference between builders risk and general liability insurance for construction projects. Construction businesses tend to start off with commercial property insurance and general liability insurance, and then supplement these with other coverages. What is liability insurance on a construction project? When your reputation, along with the successful completion of your projects, is on the line, you. Get a free quote and coverage in minutes, with flexible policy options and no. Thimble offers general liability insurance for contractors and handymen who face potential risks on the job.What Is A Builders Risk Insurance Policy earthbase

Buy Builder's Risk Insurance The Best Quotes & Coverage

The Importance of Builders Public Liability Insurance MBC Insurance

What Are The Different Type Of Builder's Insurance You Should Know

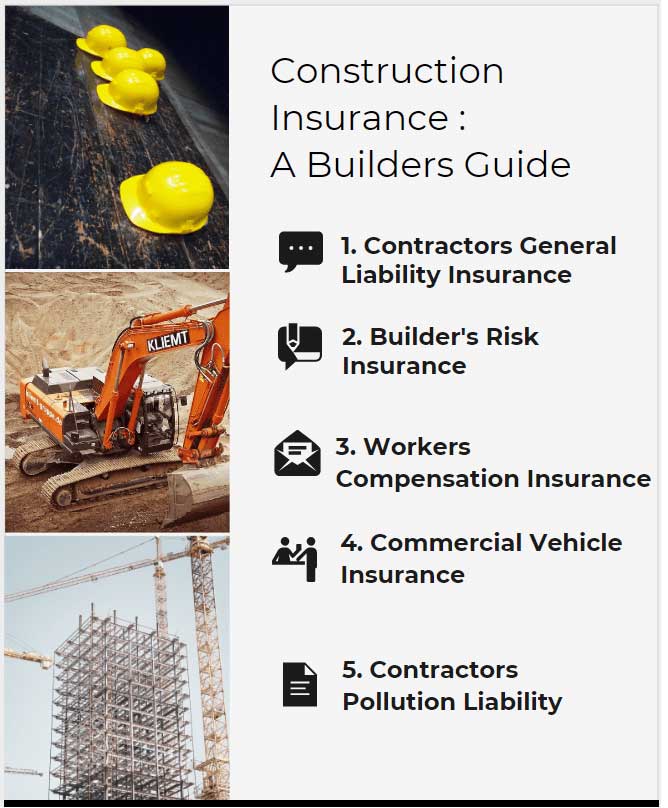

Construction Insurance A Builders Guide

Understanding the Difference Between General Liability and Builder's…

How Much Does Builders Risk Insurance Cost? Commercial Insurance

Understanding Builder's Risk Insurance Betters Insurance

Professional Liability Insurance For Therapists A 2024 Guide

12 Intriguing Facts You Should Know About Builders Risk Insurance

Insureon Lists The Average Price Of General Liability.

Construction Liability Insurance Is A Type Of Coverage Designed To Protect Against Risks Associated With Accidents, Injuries, Or.

Construction Business Liability Insurance Is Essential For Construction Professionals Looking To Safeguard Their Operations From Unexpected Issues.

You Can Buy Different Types Of Builders Business Insurance:

Related Post: