Builder Line Of Credit

Builder Line Of Credit - It’s similar to a credit card in that you have access to a. Qualified borrowers benefit from lower interest rates, a lower down payment and more flexible credit standards than with conventional construction loans. If you’re ready to build multiple spec homes or expand into larger developments, a builder line of credit is a smart solution. Optimize your working capital with customized services and products. Spec construction loans for builders, investors, developers. Spec builder line of credit is the ultimate way for builders and developers to fund spec ground up construction. Learn the benefits and risks of using a line of credit to grow a construction business — and best practices when financing project costs. What is a construction line of credit? Establish a preferred lender mortgage program and warehouse line of credit. You can use it to secure the. Optimize your working capital with customized services and products. Use for a broad range of residential real estate, including houses, duplexes, triplex, quads, and 5+ unit multifamily residential buildings. Spec construction loans for builders, investors, developers. What is a construction line of credit? Called home builder financing or preferred lending, getting a mortgage this way can mean a speedier closing, discounts and special perks for borrowers. Qualified borrowers benefit from lower interest rates, a lower down payment and more flexible credit standards than with conventional construction loans. A construction line of credit is a flexible financial tool that provides contractors with access to a predetermined amount of funds. Establish a preferred lender mortgage program and warehouse line of credit. If you’re ready to build multiple spec homes or expand into larger developments, a builder line of credit is a smart solution. Contractor financing with a business line of credit can solve the problems arising from unpaid invoices by providing a ready source of working capital. If you’re ready to build multiple spec homes or expand into larger developments, a builder line of credit is a smart solution. What is a construction line of credit? Spec construction loans for builders, investors, developers. Establish a preferred lender mortgage program and warehouse line of credit. A construction line of credit or a general business line of credit is. Contractor financing with a business line of credit can solve the problems arising from unpaid invoices by providing a ready source of working capital. It’s similar to a credit card in that you have access to a. What is a construction line of credit? Optimize your working capital with customized services and products. You can use it to secure the. What is a construction line of credit? Businesses can use a construction. A construction line of credit or a general business line of credit is a valuable financial tool that can help you build and grow your business. If you’re ready to build multiple spec homes or expand into larger developments, a builder line of credit is a smart solution.. By acting as an additional reservoir of funds, a construction business line of credit can help alleviate some of the most pressing financial bottlenecks. Establish a preferred lender mortgage program and warehouse line of credit. Kikoff is designed for those who need to establish or reestablish credit. What is a construction line of credit? It’s similar to a credit card. What is a construction line of credit? A construction line of credit is a flexible financial tool that provides contractors with access to a predetermined amount of funds. Optimize your working capital with customized services and products. Learn the benefits and risks of using a line of credit to grow a construction business — and best practices when financing project. A construction line of credit mirrors a credit card's functionality, offering ongoing access to capital for construction companies to execute projects. A line of credit is designed to be a relatively long term lending arrangement that enables a builder’s goal to make a profit by completing and selling properties. What is a construction line of credit? Learn the benefits and. Businesses can use a construction. Optimize your working capital with customized services and products. It’s similar to a credit card in that you have access to a. What is a construction line of credit? If you’re ready to build multiple spec homes or expand into larger developments, a builder line of credit is a smart solution. You can use it to secure the. Establish a preferred lender mortgage program and warehouse line of credit. Spec construction loans for builders, investors, developers. Contractor financing with a business line of credit can solve the problems arising from unpaid invoices by providing a ready source of working capital. Spec builder line of credit is the ultimate way for builders. Spec construction loans for builders, investors, developers. Optimize your working capital with customized services and products. Establish a preferred lender mortgage program and warehouse line of credit. You can use it to secure the. Called home builder financing or preferred lending, getting a mortgage this way can mean a speedier closing, discounts and special perks for borrowers. Qualified borrowers benefit from lower interest rates, a lower down payment and more flexible credit standards than with conventional construction loans. Use for a broad range of residential real estate, including houses, duplexes, triplex, quads, and 5+ unit multifamily residential buildings. A line of credit is designed to be a relatively long term lending arrangement that enables a builder’s goal. Spec builder line of credit is the ultimate way for builders and developers to fund spec ground up construction. Establish a preferred lender mortgage program and warehouse line of credit. Contractor financing with a business line of credit can solve the problems arising from unpaid invoices by providing a ready source of working capital. If you’re ready to build multiple spec homes or expand into larger developments, a builder line of credit is a smart solution. What is a construction line of credit? Called home builder financing or preferred lending, getting a mortgage this way can mean a speedier closing, discounts and special perks for borrowers. Kikoff is designed for those who need to establish or reestablish credit. Optimize your working capital with customized services and products. Qualified borrowers benefit from lower interest rates, a lower down payment and more flexible credit standards than with conventional construction loans. You can use it to secure the. By acting as an additional reservoir of funds, a construction business line of credit can help alleviate some of the most pressing financial bottlenecks. Spec construction loans for builders, investors, developers. Use for a broad range of residential real estate, including houses, duplexes, triplex, quads, and 5+ unit multifamily residential buildings. Learn the benefits and risks of using a line of credit to grow a construction business — and best practices when financing project costs. What is a construction line of credit? It’s similar to a credit card in that you have access to a.How to Get a Construction Business Line of Credit

Dustin Lauer on LinkedIn Recently funded Builder Line of Credit

How to Get a Construction Business Line of Credit

Kikoff Credit Builder Line of Credit Review Pros and Cons of KickOff

Spec Builders Revolving Line of Credit up to 5 Million Investor

Construction Loans 101 Everything You Need To Know

What Is A Credit Builder Loan & How Does It Work? Self. Credit Builder.

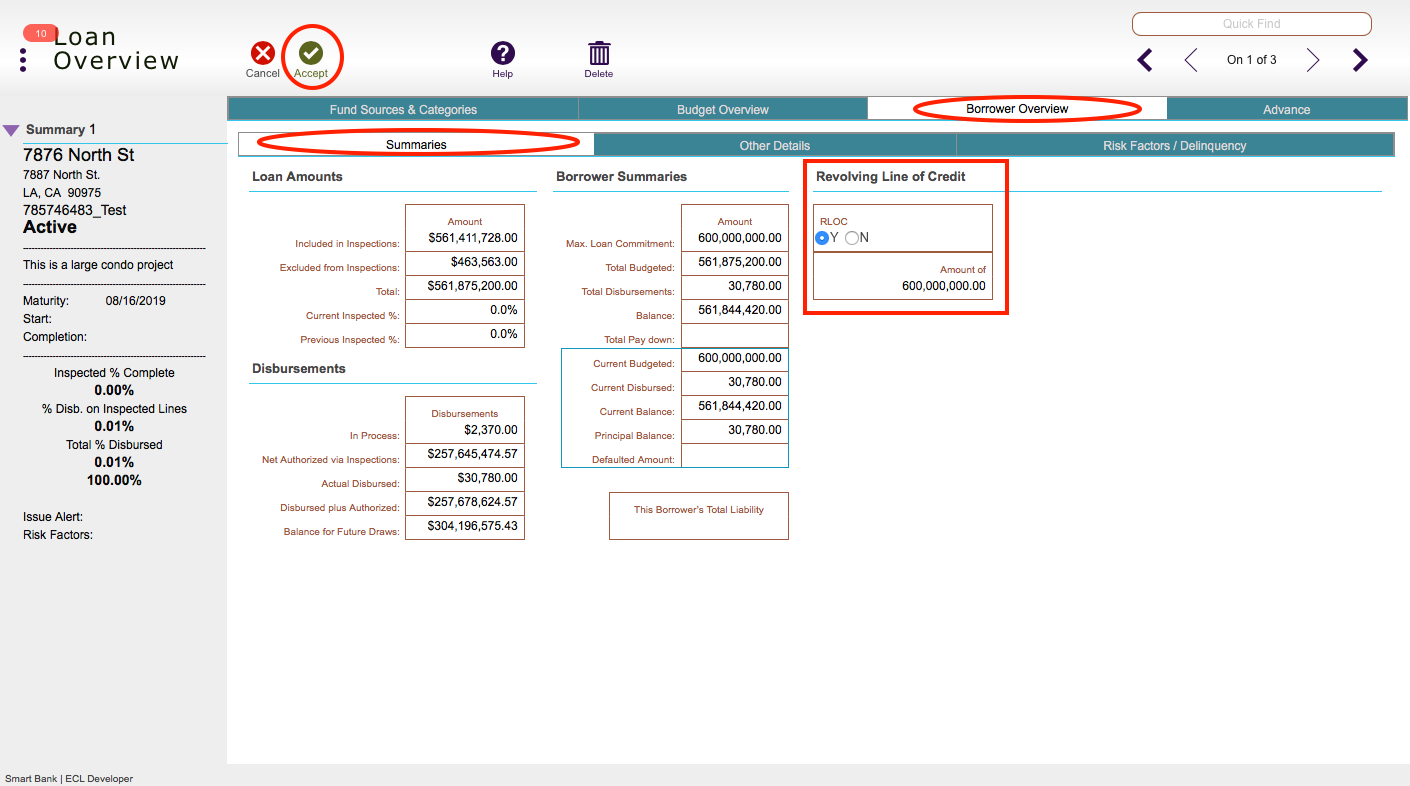

How to add a Revolving Line of Credit (Builder Line) ECL Help Desk

Kikoff Credit Builder Line of Credit Review 2022 US News

Real Estate Investments with a Line of Credit Wealth Builders by

A Construction Line Of Credit Or A General Business Line Of Credit Is A Valuable Financial Tool That Can Help You Build And Grow Your Business.

Businesses Can Use A Construction.

A Construction Line Of Credit Mirrors A Credit Card's Functionality, Offering Ongoing Access To Capital For Construction Companies To Execute Projects.

A Line Of Credit Is Designed To Be A Relatively Long Term Lending Arrangement That Enables A Builder’s Goal To Make A Profit By Completing And Selling Properties.

Related Post: