Builder Loan Interest Rate

Builder Loan Interest Rate - To complicate matters even further, home building loans typically have higher interest rates compared with just about any type of mortgage, whether it’s a fixed rate, adjustable rate or. Do you charge closing costs or other fees? For example, paying an extra 0.5 percent on a $200,000 construction. Construction loan rates generally range between 9.75 and 11.5%, depending on the lender. For a more advanced search, you can filter your results by loan type for 30 year fixed,. In addition to strategizing how to get the lowest interest rate, consider which loan will save you the most. Construction loan rates are based on the prime rate, which is currently around 7%. Are they fixed or variable? Standard residential mortgages require you to start making payments on both the principal and interest of the loan right away. An extended rate lock fee may apply. Interest rates on construction loans are variable, meaning they can change throughout the loan term. Standard residential mortgages require you to start making payments on both the principal and interest of the loan right away. Construction loan rates are typically higher than primary mortgage rates and other loan types. However, rates can vary depending on the lender, loan terms, and. Construction loan interest rates play a pivotal role in the financial aspects of your construction project. However, with a construction loan, you’ll typically. Do you charge closing costs or other fees? Simply enter your home location, property value and loan amount to compare the best rates. Longer rate lock periods may be required for things like new construction or a condo that needs board approval. What types of construction loans do you offer? Construction loans also tend to have higher interest rates than most home loans because they are considered to be more risky for lenders. What types of construction loans do you offer? Interest rates on construction loans are variable, meaning they can change throughout the loan term. For a more advanced search, you can filter your results by loan type for. For a more advanced search, you can filter your results by loan type for 30 year fixed,. They determine the amount of interest you'll pay over the life of the loan,. As of 2024, studies show that the average construction loan interest rate is between 9.75 and 11.5%. Before delving into the specifics of loan types and how they might. For a more advanced search, you can filter your results by loan type for 30 year fixed,. Construction loan interest rates play a pivotal role in the financial aspects of your construction project. Cnbc select has picked the best. But in general, construction loan rates are typically around 1 percent. Simply enter your home location, property value and loan amount. Fast and reliable loansspecial termsno minimum credit score97% approval rate In addition to strategizing how to get the lowest interest rate, consider which loan will save you the most. Are they fixed or variable? Cnbc select has picked the best. Construction loan rates are typically higher than primary mortgage rates and other loan types. Simply enter your home location, property value and loan amount to compare the best rates. What types of construction loans do you offer? For a more advanced search, you can filter your results by loan type for 30 year fixed,. Construction loan rates generally range between 9.75 and 11.5%, depending on the lender. For example, paying an extra 0.5 percent. But in general, construction loan rates are typically around 1 percent. Do you charge closing costs or other fees? When you lock your rate, we apply a. An extended rate lock fee may apply. Are they fixed or variable? What interest rates are available? When you lock your rate, we apply a. Longer rate lock periods may be required for things like new construction or a condo that needs board approval. Standard residential mortgages require you to start making payments on both the principal and interest of the loan right away. For a more advanced search, you can filter. When you lock your rate, we apply a. To complicate matters even further, home building loans typically have higher interest rates compared with just about any type of mortgage, whether it’s a fixed rate, adjustable rate or. For example, paying an extra 0.5 percent on a $200,000 construction. Construction loans also tend to have higher interest rates than most home. However, rates can vary depending on the lender, loan terms, and. Construction loan rates generally range between 9.75 and 11.5%, depending on the lender. This fintech company requires a minimum credit score of. Happy money offers the best personal loan for borrowers with bad credit, earning a moneygeek score of 94 out of 100. Refinance your construction loan to a. Interest rates on construction loans are variable, meaning they can change throughout the loan term. Refinance your construction loan to a lower rate; Fast and reliable loansspecial termsno minimum credit score97% approval rate Before delving into the specifics of loan types and how they might work for you, there are some commonalities shared by all real estate construction loans, including:. Simply enter your home location, property value and loan amount to compare the best rates. When you lock your rate, we apply a. Standard residential mortgages require you to start making payments on both the principal and interest of the loan right away. Before delving into the specifics of loan types and how they might work for you, there are some commonalities shared by all real estate construction loans, including: However, with a construction loan, you’ll typically. By covering some fees or offering an interest rate discount, a builder might free up enough of your own savings so that you can direct it toward a smaller down payment or even. Construction loan interest rates play a pivotal role in the financial aspects of your construction project. However, rates can vary depending on the lender, loan terms, and. Longer rate lock periods may be required for things like new construction or a condo that needs board approval. They determine the amount of interest you'll pay over the life of the loan,. But in general, construction loan rates are typically around 1 percent. Construction loan rates are based on the prime rate, which is currently around 7%. Do you charge closing costs or other fees? For example, paying an extra 0.5 percent on a $200,000 construction. How do construction loans work? Fast and reliable loansspecial termsno minimum credit score97% approval rateConstruction Loans 101 Everything You Need To Know

The Average Construction Loan Interest Rate A Comprehensive Guide

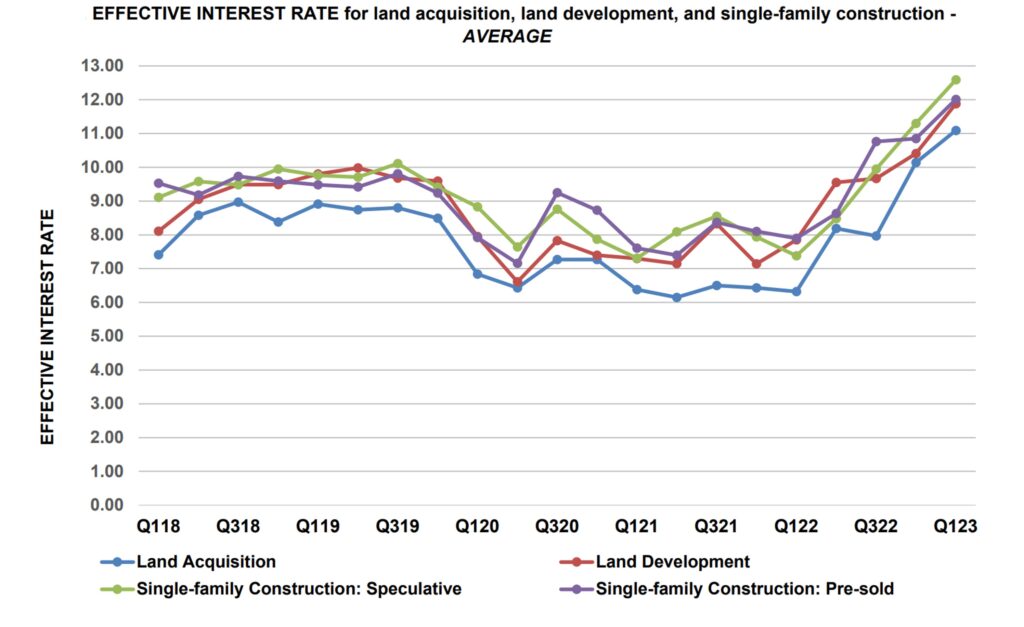

Rates on Development and Construction Loans Continue to Climb

Find the Best Construction Loan for Building Your Home and Save

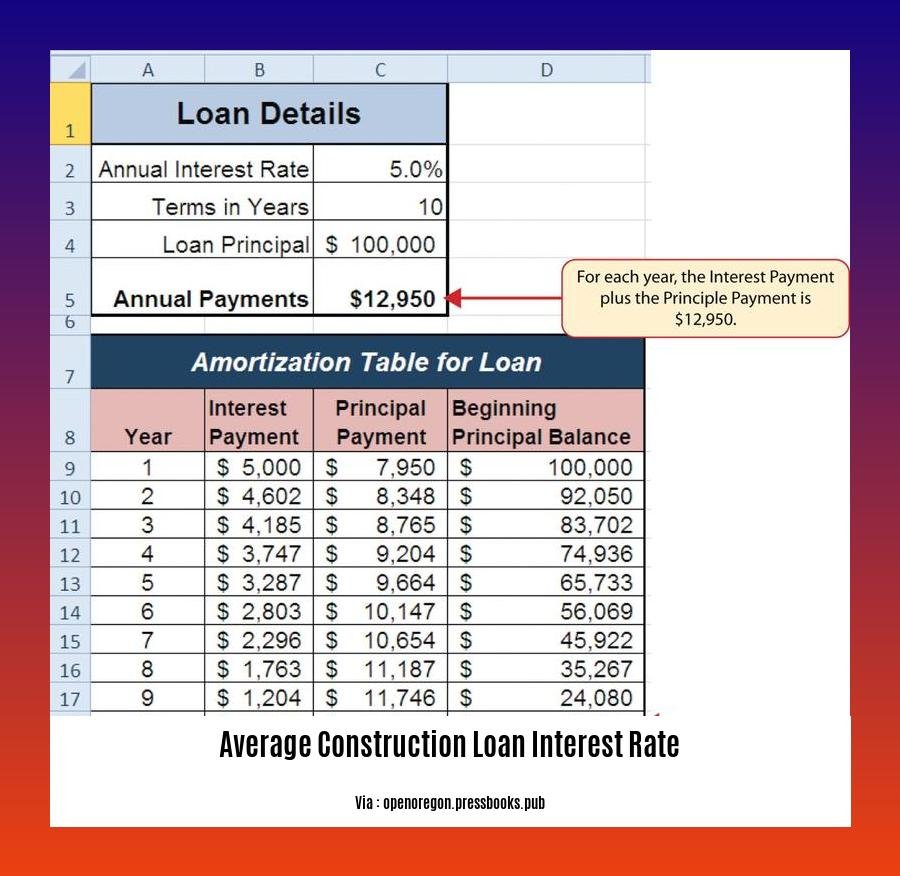

The Average Construction Loan Interest Rate A Comprehensive Guide

The Average Construction Loan Interest Rate A Comprehensive Guide

Construction loan rates calculator RayaneLillith

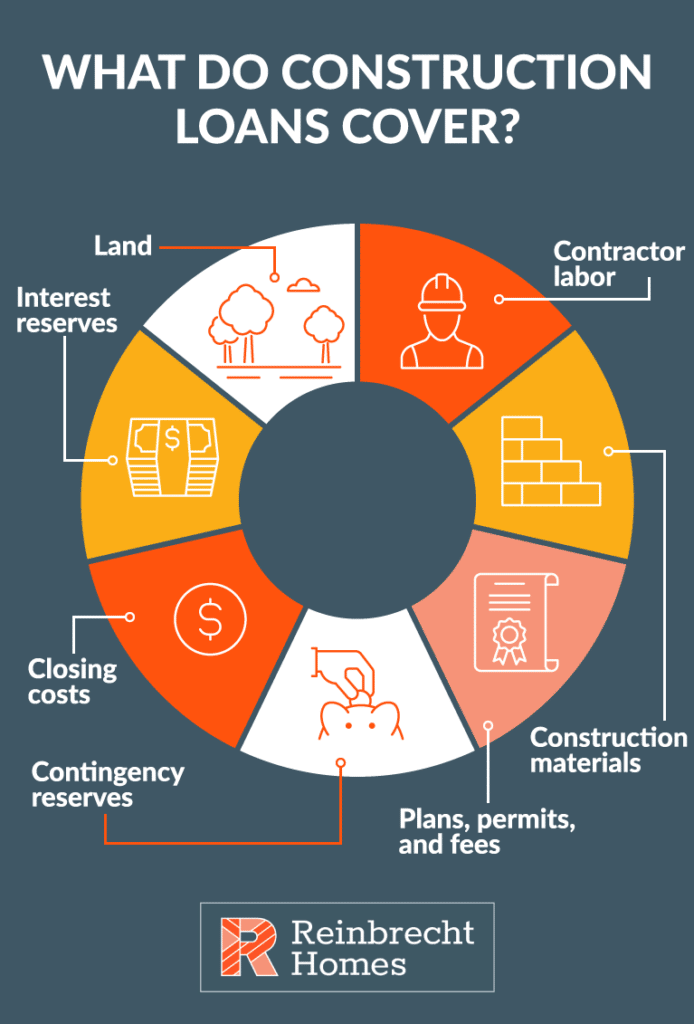

Construction Loans 101 Everything You Need To Know

Construction Loan Interest Rates NedaLennox

How to Build Your Dream Home

Search For New Communities Today.

Cnbc Select Has Picked The Best.

Interest Rates On Construction Loans Are Variable, Meaning They Can Change Throughout The Loan Term.

What Interest Rates Are Available?

Related Post: