Builder Loan Rates

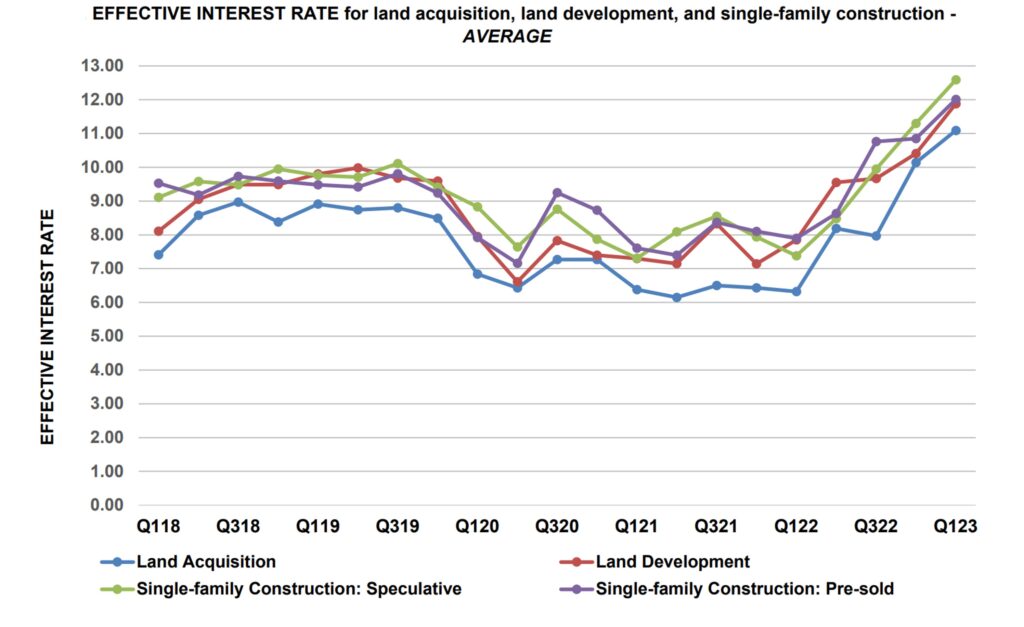

Builder Loan Rates - Search for new communities today. Cnbc select has picked the best lenders for construction loans in various categories. Finance up to 90% of the cost of construction or appraised value, whichever is lower (restrictions may apply). As of 2024, studies show that the. Interest rates on construction loans are variable, meaning they can change throughout the loan term. Aside from the various costs that can be included in the loan and the repayment timeline, there. Learn more about deciding if you should use your homebuilder’s preferred lender. Our competitive construction loan rates and flexible terms help you create a custom financing option that fits your goals and budget. Before delving into the specifics of loan types and how they might work for you, there are some commonalities shared by all real estate construction loans, including: Construction loan rates generally range between 9.75 and 11.5%, depending on the lender. Private mortgage insurance (pmi) and other expenses; Aside from the various costs that can be included in the loan and the repayment timeline, there. Construction loan rates generally range between 9.75 and 11.5%, depending on the lender. You also can often use this money to purchase. Enjoy permanent financing option with low down payment. Unlike traditional mortgages, these loans have. Available to indiana and kentucky. Housing market was already struggling under the weight of high mortgage interest rates, a low supply of existing homes for sale and historically high home prices. Mortgage rates have remained stubbornly high over the past two years,. Joshua tadian at rate (nmls #1842112) chicago, il 60613 assists you with low cost home purchase, mortgage refinance and fast closings. Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a home. Our competitive construction loan rates and flexible terms help you create a custom financing option that fits your goals and budget. On the whole, building is normalizing, but higher rates will. 1 subject to credit approval. Mortgage rates have remained stubbornly. Military service members and their families. Construction loan rates are typically higher than primary mortgage rates and other loan types. Current construction loan rates can fluctuate based on market conditions, the borrower’s financial history, and the project specifics. Mortgage rates have remained stubbornly high over the past two years,. Construction loans let future homeowners borrow money to purchase materials and. Unlike traditional mortgages, these loans have. It’s important to have a good grasp of construction loan rates when you’re going through the home construction process. Aside from the various costs that can be included in the loan and the repayment timeline, there. You also can often use this money to purchase. To help you find the right financing, forbes advisor. Before delving into the specifics of loan types and how they might work for you, there are some commonalities shared by all real estate construction loans, including: Construction loan rates are typically higher than primary mortgage rates and other loan types. As of 2024, studies show that the. To help you find the right financing, forbes advisor compiled a short. As of 2024, studies show that the. Cnbc select has picked the best lenders for construction loans in various categories. Finance up to 90% of the cost of construction or appraised value, whichever is lower (restrictions may apply). Housing market was already struggling under the weight of high mortgage interest rates, a low supply of existing homes for sale and. But in general, construction loan rates are typically around 1 percent. Search for new communities today. Finance up to 90% of the cost of construction or appraised value, whichever is lower (restrictions may apply). Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a home. Unlike traditional mortgages, these loans have. Our competitive construction loan rates and flexible terms help you create a custom financing option that fits your goals and budget. It’s important to have a good grasp of construction loan rates when you’re going through the home construction process. Private mortgage insurance (pmi) and other expenses; Mortgage rates have remained stubbornly high over the past two years,. Interest rates. Cnbc select has picked the best lenders for construction loans in various categories. Apply online for expert recommendations with real interest rates and payments. Available to indiana and kentucky. It’s important to have a good grasp of construction loan rates when you’re going through the home construction process. To help you find the right financing, forbes advisor compiled a short. Our competitive construction loan rates and flexible terms help you create a custom financing option that fits your goals and budget. Military service members and their families. Construction loans let future homeowners borrow money to purchase materials and pay for labor necessary to build a home. Unlike traditional mortgages, these loans have. Aside from the various costs that can be. To help you find the right financing, forbes advisor compiled a short list of the best construction loan lenders with manageable down payment requirements, a range of loan. Mortgage rates have remained stubbornly high over the past two years,. Learn more about deciding if you should use your homebuilder’s preferred lender. Construction loan rates are typically higher than primary mortgage. Learn more about deciding if you should use your homebuilder’s preferred lender. On the whole, building is normalizing, but higher rates will. To help you find the right financing, forbes advisor compiled a short list of the best construction loan lenders with manageable down payment requirements, a range of loan. Unlike traditional mortgages, these loans have. Current construction loan rates can fluctuate based on market conditions, the borrower’s financial history, and the project specifics. Enjoy permanent financing option with low down payment. New construction, on the other hand, is more likely to offer buydowns on cheaper homes. Apply online for expert recommendations with real interest rates and payments. Finance up to 90% of the cost of construction or appraised value, whichever is lower (restrictions may apply). Housing market was already struggling under the weight of high mortgage interest rates, a low supply of existing homes for sale and historically high home prices. Joshua tadian at rate (nmls #1842112) chicago, il 60613 assists you with low cost home purchase, mortgage refinance and fast closings. Available to indiana and kentucky. Our loans feature competitive interest rates and adaptable terms to meet the diverse needs of our. You also can often use this money to purchase. Before delving into the specifics of loan types and how they might work for you, there are some commonalities shared by all real estate construction loans, including: Search for new communities today.Construction loan rates calculator RayaneLillith

Construction Loan Interest Rates NedaLennox

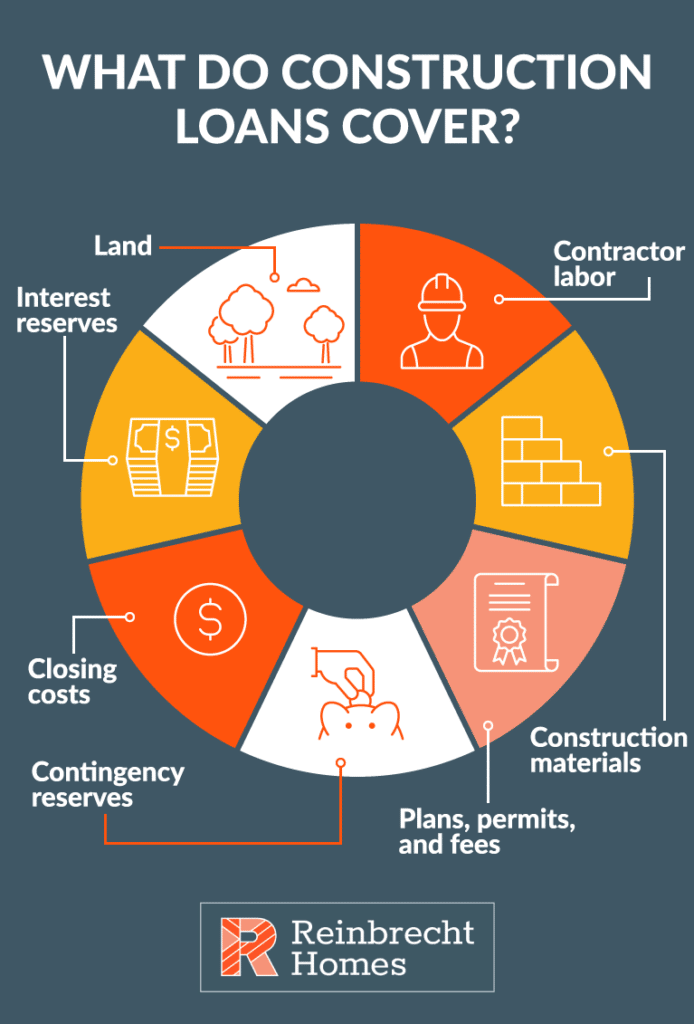

Construction Loans 101 Everything You Need To Know

Construction Loans 101 Everything You Need To Know

Construction Loans Rates Went Down! Our lender's construction rates

Rates on Development and Construction Loans Continue to Climb

Find the Best Construction Loan for Building Your Home and Save

Construction Loans 101 Everything You Need To Know

Guide to Home Construction Loans 2020

Construction Loan Rates Builders Capital

Private Mortgage Insurance (Pmi) And Other Expenses;

Construction Loans Let Future Homeowners Borrow Money To Purchase Materials And Pay For Labor Necessary To Build A Home.

As Of 2024, Studies Show That The.

Military Service Members And Their Families.

Related Post: