Builder Pays Closing Costs

Builder Pays Closing Costs - How much are closing costs? Buyers usually cover several closing. How much are closing costs? Builder incentives of 2 percent to 3 percent are common, says joanne stucky, a realtor at realty executives in las vegas. Can you negotiate who pays closing costs? Buyers should ask, “two to three percent of what?” because some builders offer 2 percent to 3 percent of the home’s base price, others offer 2 percent to 3 percent of the total sale price and still. Typically, closing costs range from 2% to 5% of the home's purchase price, but this can vary based on location and the specifics of the sale. This percentage should give you a general idea of how. Many lenders will not let a buyer receive more than a 3% credit toward closing costs. However, it’s not all on you—sometimes builders will offer to cover a portion of closing costs, especially if you’re working with their preferred lender or during certain. On $200,000, that sum is $6,000. For a $300,000 home, that means anywhere from. Do home builders pay closing costs? According to closingcorp, the average closing costs required to buy a home in the us was $3,860 (without transfer taxes) in 2021. The good news is that many home builders offer financing incentives as a method to pay closing costs in order to offset, or even lower, the loan’s overall costs. Typically, closing costs range from 2% to 5% of the home's purchase price, but this can vary based on location and the specifics of the sale. While the homebuyer is typically responsible for covering closing costs, there are cases in which a lender or home builder will. Among the costs of selling a home, you can expect to pay real estate agent commissions and closing fees plus capital gains taxes if their profit exceeds irs exclusion limits. Qualified landowners who choose madison homebuilders can save thousands on building a new home because with us, there is no down payment or construction loan, and we pay up to. Many lenders will not let a buyer receive more than a 3% credit toward closing costs. This percentage should give you a general idea of how. Among the costs of selling a home, you can expect to pay real estate agent commissions and closing fees plus capital gains taxes if their profit exceeds irs exclusion limits. Buyers should ask, “two to three percent of what?” because some builders offer 2 percent to 3 percent of the. How much are closing costs? On $200,000, that sum is $6,000. This percentage should give you a general idea of how. Do home builders pay closing costs? The associated real estate costs can get. For a $300,000 home, that means anywhere from. The good news is that many home builders offer financing incentives as a method to pay closing costs in order to offset, or even lower, the loan’s overall costs. The associated real estate costs can get. This percentage should give you a general idea of how. For example, on a $400,000 home,. In most cases, the homebuyer is responsible for paying the closing costs on a new build home. Typically, closing costs range from 2% to 5% of the home's purchase price, but this can vary based on location and the specifics of the sale. How much are closing costs? The good news is that many home builders offer financing incentives as. How much are closing costs? In this guide, we'll delve into the intricacies of new construction closing costs, exploring key terms, potential expenses, and strategies to manage them effectively. Among the costs of selling a home, you can expect to pay real estate agent commissions and closing fees plus capital gains taxes if their profit exceeds irs exclusion limits. Do. On $200,000, that sum is $6,000. The good news is that many home builders offer financing incentives as a method to pay closing costs in order to offset, or even lower, the loan’s overall costs. Typically, closing costs range from 2% to 5% of the home's purchase price, but this can vary based on location and the specifics of the. Closing costs on new construction and resale homes typically run between 3% and 5% of the home’s purchase price. According to closingcorp, the average closing costs required to buy a home in the us was $3,860 (without transfer taxes) in 2021. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. The good news is. Among the costs of selling a home, you can expect to pay real estate agent commissions and closing fees plus capital gains taxes if their profit exceeds irs exclusion limits. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. While the homebuyer is typically responsible for covering closing costs, there are cases in which. According to closingcorp, the average closing costs required to buy a home in the us was $3,860 (without transfer taxes) in 2021. It's generally to your advantage. Most buyers pay between 2% and 5% of their home’s purchase price in closing costs. Typically, closing costs range from 2% to 5% of the home's purchase price, but this can vary based. Can you negotiate who pays closing costs? Many lenders will not let a buyer receive more than a 3% credit toward closing costs. In this guide, we'll delve into the intricacies of new construction closing costs, exploring key terms, potential expenses, and strategies to manage them effectively. Among the costs of selling a home, you can expect to pay real. For example, on a $400,000 home, closing costs might range from. Many lenders will not let a buyer receive more than a 3% credit toward closing costs. However, it’s not all on you—sometimes builders will offer to cover a portion of closing costs, especially if you’re working with their preferred lender or during certain. Closing costs on new construction and resale homes typically run between 3% and 5% of the home’s purchase price. How much are closing costs? This percentage should give you a general idea of how. In most cases, the homebuyer is responsible for paying the closing costs on a new build home. Closing costs typically range between 2% to 5% of the home’s purchase price for buyers. While the homebuyer is typically responsible for covering closing costs, there are cases in which a lender or home builder will. Typically, closing costs range from 2% to 5% of the home's purchase price, but this can vary based on location and the specifics of the sale. The associated real estate costs can get. Do home builders pay closing costs? How much are closing costs? Builder incentives of 2 percent to 3 percent are common, says joanne stucky, a realtor at realty executives in las vegas. Among the costs of selling a home, you can expect to pay real estate agent commissions and closing fees plus capital gains taxes if their profit exceeds irs exclusion limits. On $200,000, that sum is $6,000.Who Pays Closing Costs In A Real Estate Transaction? FortuneBuilders

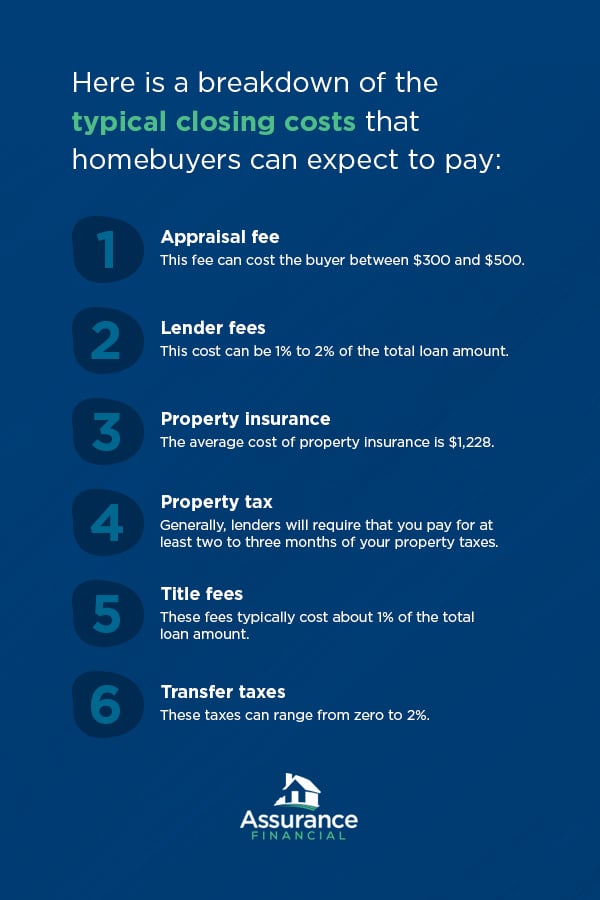

How to Estimate Closing Costs Assurance Financial

Who Pays Closing Costs On A New Construction Home?

Do Home Builders Pay Closing Costs? Norman, OKC

Moving to Pensacola, Florida New & Affordable Home Tour Builder Pays

Who Pays Closing Costs In A Real Estate Transaction? FortuneBuilders

Closing Costs for the Buyer of a New Construction Home

Do Home Builders Pay Closing Costs and What Are They?

Closing Costs Real estate infographic, Buying first home, Real estate

How Long Does It Take To Sell A Home? FortuneBuilders

Buyers Usually Cover Several Closing.

Can You Negotiate Who Pays Closing Costs?

Most Buyers Pay Between 2% And 5% Of Their Home’s Purchase Price In Closing Costs.

The Good News Is That Many Home Builders Offer Financing Incentives As A Method To Pay Closing Costs In Order To Offset, Or Even Lower, The Loan’s Overall Costs.

Related Post: