Building A Dividend Portfolio

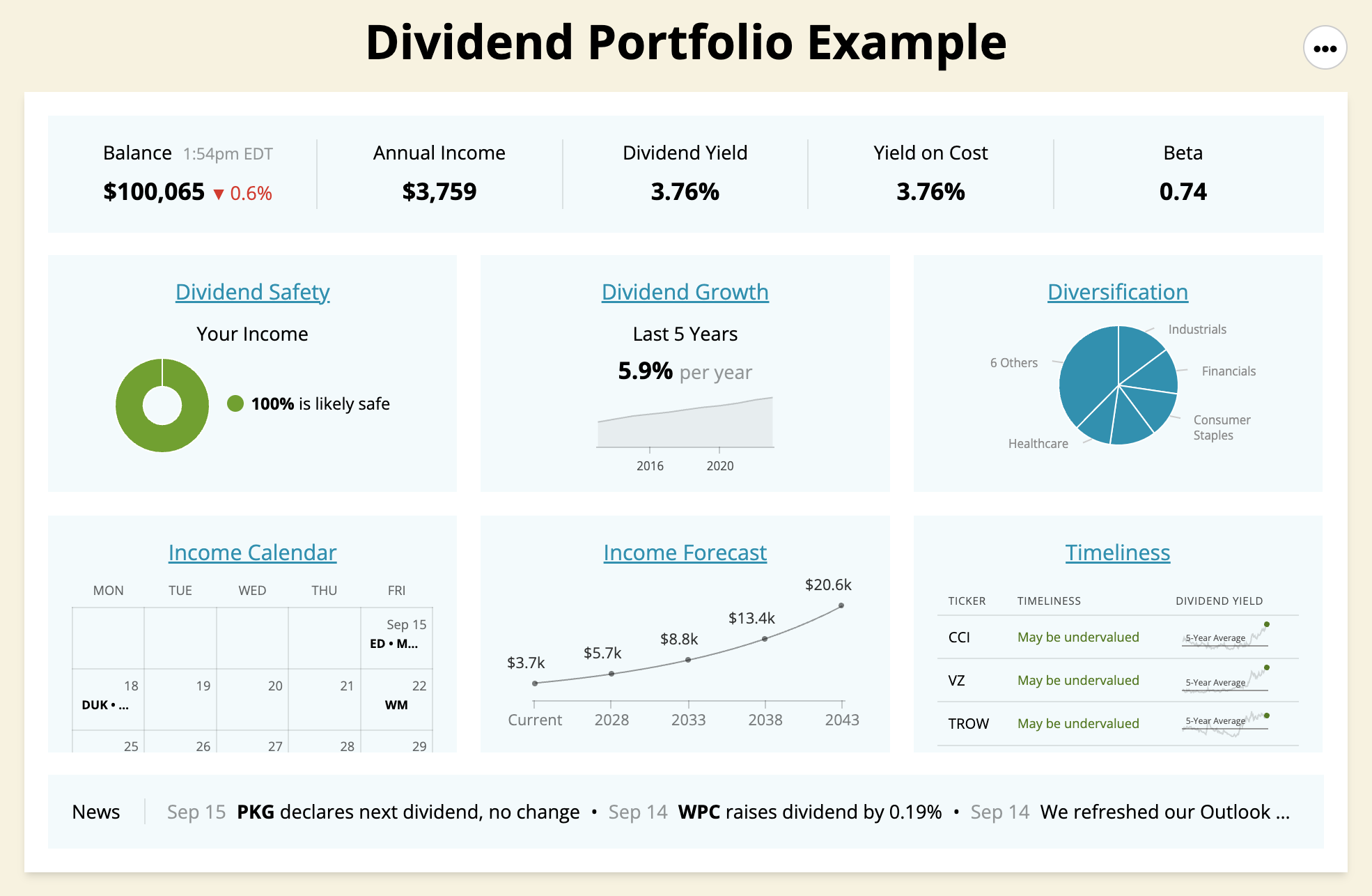

Building A Dividend Portfolio - Building a dividend portfolio starts with an understanding of the key risk factors that influence a portfolio’s returns and volatility, beginning with how many stocks to own. However, you can create a diversified portfolio with tools like chatgpt, suredividend.com,. To do so, you’ll look for companies with a history of consistent dividend payments and growth. Explore dividend stocks to produce income 5. Here's what you need to know to build a dividend portfolio. There is a specific investment style that takes full advantage of the unique math behind compound returns. Doing so ensures a reduced risk level, thereby elevating the likelihood. Your goals should reflect both your cash flow needs and broader life. Investing early allows for strategic, exciting choices in a market that often rewards consistency over. Developing a dividend investment strategy is crucial as you build a dividend portfolio. This means knowing your risk tolerance level, choosing the right investment vehicle, researching. Many of the best investment professionals run concentrated portfolios. “building a forever portfolio is challenging because life isn’t static — family needs, career. These companies are typically well. Doing so ensures a reduced risk level, thereby elevating the likelihood. There is a specific investment style that takes full advantage of the unique math behind compound returns. Dividend growth investing is a strategy that focuses on investing in companies that consistently increase their dividends over time. It is called dividend growth investing. Build a robust dividend portfolio through careful research and analysis. Investing early allows for strategic, exciting choices in a market that often rewards consistency over. Many of the best investment professionals run concentrated portfolios. Identifying your income goals as a dividend investor is a crucial first step in building a successful portfolio. His portfolio includes a combination of dividend stocks, etfs and funds, such as spdr s&p 500 etf trust (nasdaq:spy), pfizer inc. Build a robust dividend portfolio through careful research and analysis. Adjust your. Here's what you need to know to build a dividend portfolio. It takes a lot of research and planning to build a $100,000 dividend stock portfolio. There is a specific investment style that takes full advantage of the unique math behind compound returns. Adjust your portfolio over time. “building a forever portfolio is challenging because life isn’t static — family. There is a specific investment style that takes full advantage of the unique math behind compound returns. Your goals should reflect both your cash flow needs and broader life. Building a dividend portfolio starts with an understanding of the key risk factors that influence a portfolio’s returns and volatility, beginning with how many stocks to own. However, you can create. It takes a lot of research and planning to build a $100,000 dividend stock portfolio. Building a dividend portfolio starts with an understanding of the key risk factors that influence a portfolio’s returns and volatility, beginning with how many stocks to own. His portfolio includes a combination of dividend stocks, etfs and funds, such as spdr s&p 500 etf trust. “building a forever portfolio is challenging because life isn’t static — family needs, career. Building a dividend portfolio starts with an understanding of the key risk factors that influence a portfolio’s returns and volatility, beginning with how many stocks to own. It takes a lot of research and planning to build a $100,000 dividend stock portfolio. Build a robust dividend. Adjust your portfolio over time. These companies are typically well. By building a strong dividend stock portfolio, investors can enjoy steady, passive income while potentially growing their wealth over time. To do so, you’ll look for companies with a history of consistent dividend payments and growth. Build a robust dividend portfolio through careful research and analysis. Identifying your income goals as a dividend investor is a crucial first step in building a successful portfolio. Doing so ensures a reduced risk level, thereby elevating the likelihood. It is called dividend growth investing. Here's what you need to know to build a dividend portfolio. By building a strong dividend stock portfolio, investors can enjoy steady, passive income while. His portfolio includes a combination of dividend stocks, etfs and funds, such as spdr s&p 500 etf trust (nasdaq:spy), pfizer inc. Developing a dividend investment strategy is crucial as you build a dividend portfolio. Explore dividend stocks to produce income 5. There is a specific investment style that takes full advantage of the unique math behind compound returns. This means. To do so, you’ll look for companies with a history of consistent dividend payments and growth. By building a strong dividend stock portfolio, investors can enjoy steady, passive income while potentially growing their wealth over time. Here's what you need to know to build a dividend portfolio. These companies are typically well. Your goals should reflect both your cash flow. Building a dividend portfolio brings joy, especially during its initial phase. There is a specific investment style that takes full advantage of the unique math behind compound returns. Here's what you need to know to build a dividend portfolio. Developing a dividend investment strategy is crucial as you build a dividend portfolio. Doing so ensures a reduced risk level, thereby. It is called dividend growth investing. This means knowing your risk tolerance level, choosing the right investment vehicle, researching. Doing so ensures a reduced risk level, thereby elevating the likelihood. “building a forever portfolio is challenging because life isn’t static — family needs, career. Here's what you need to know to build a dividend portfolio. Your goals should reflect both your cash flow needs and broader life. Many of the best investment professionals run concentrated portfolios. Adjust your portfolio over time. Dividend growth investing is a strategy that focuses on investing in companies that consistently increase their dividends over time. It takes a lot of research and planning to build a $100,000 dividend stock portfolio. Building a dividend portfolio starts with an understanding of the key risk factors that influence a portfolio’s returns and volatility, beginning with how many stocks to own. Developing a dividend investment strategy is crucial as you build a dividend portfolio. Investing early allows for strategic, exciting choices in a market that often rewards consistency over. However, you can create a diversified portfolio with tools like chatgpt, suredividend.com,. Explore dividend stocks to produce income 5. His portfolio includes a combination of dividend stocks, etfs and funds, such as spdr s&p 500 etf trust (nasdaq:spy), pfizer inc.How to Build a Dividend Portfolio

How to Build a Dividend Portfolio

Dividend Portfolio What is & How to Create Your Dividend Portfolio

Dividend Portfolio What is & How to Create Your Dividend Portfolio

Dividend Portfolio What is & How to Create Your Dividend Portfolio

How to Build a Dividend Portfolio Infographic Millionaire Mob

How to Build a Dividend Portfolio

How to build a dividend portfolio a dividend portfolio allocation strategy

How to Build a Dividend Portfolio

How to Build a Dividend Portfolio

There Is A Specific Investment Style That Takes Full Advantage Of The Unique Math Behind Compound Returns.

Build A Robust Dividend Portfolio Through Careful Research And Analysis.

To Do So, You’ll Look For Companies With A History Of Consistent Dividend Payments And Growth.

By Building A Strong Dividend Stock Portfolio, Investors Can Enjoy Steady, Passive Income While Potentially Growing Their Wealth Over Time.

Related Post: