Building A Pro Forma

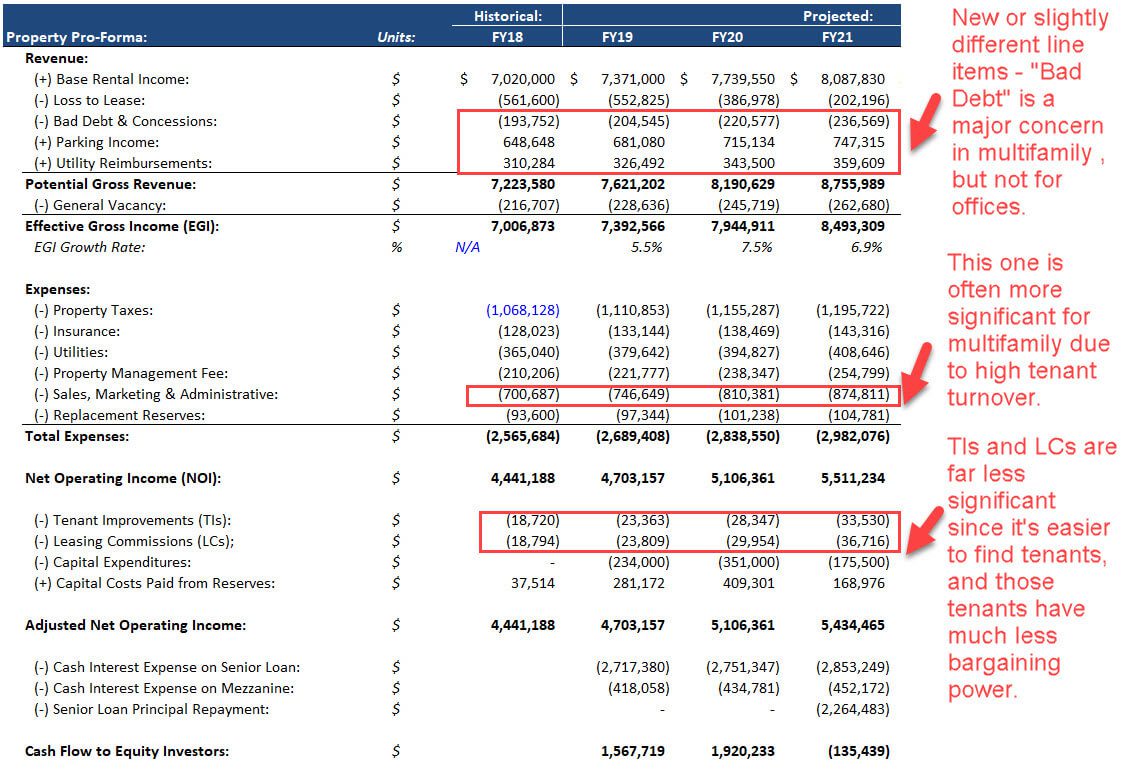

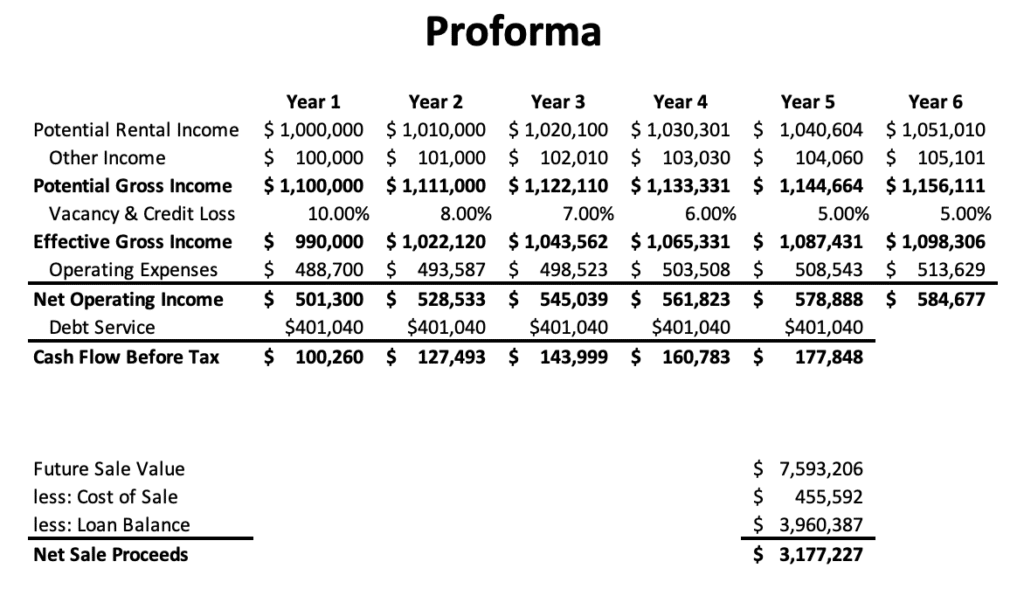

Building A Pro Forma - These statements are critical for. Here’s how they work, how to create them — and their caveats. A proforma serves as a vital tool for. Understanding how to craft a model proforma is critical for businesses and financial analysts to project future financial performance. They provide a projected view of a company's financial performance based on. The same goes for banks—pro forma. Read our comprehensive guide to understand the steps needed to properly. Pro forma financial statements aim to answer a business’s vital “what if” questions. In this detailed guide, i delve into the world of pro forma financial statements from creating detailed income statements to understanding cash flow. Pro forma net income is widely used for earnings forecasts and financial modeling. Pro forma statements can help your business identify risks and plan for upcoming business changes. Here’s how they work, how to create them — and their caveats. Read our comprehensive guide to understand the steps needed to properly. A proforma invoice or pro forma invoice, is a preliminary bill of sale provided by a seller to a buyer before the actual sale occurs. Predicting your company’s financial future can prove difficult. Pro forma statements can help boost investor confidence by showing you can generate healthy cash flow and pay down debt. These statements are critical for. Pro forma financial statements are an essential tool in financial analysis and planning. Pro forma financial statements can help your business plot a course for the future, manage risks and secure funding. For example, in creating a pro forma income statement, you need to forecast future revenue. For example, in creating a pro forma income statement, you need to forecast future revenue. Predicting your company’s financial future can prove difficult. Learn more about what this statement is and how to use it. Pro forma financial statements can enable you to make an educated guess by projecting your future financial. At their core, pro forma financial statements are. Read our comprehensive guide to understand the steps needed to properly. Predicting your company’s financial future can prove difficult. Pro forma net income is widely used for earnings forecasts and financial modeling. Pro forma financial statements can help your business plot a course for the future, manage risks and secure funding. They provide a projected view of a company's financial. Get the most out of your business plans and predictions by using excel to create a pro forma model. Need to run scenarios for. A proforma serves as a vital tool for. This guide explores key aspects like components of a pro forma, methodologies for creating one, and best practices for accuracy. These statements are critical for. Get the most out of your business plans and predictions by using excel to create a pro forma model. Understanding how to craft a model proforma is critical for businesses and financial analysts to project future financial performance. For example, in creating a pro forma income statement, you need to forecast future revenue. Pro forma statements can help your business. A proforma serves as a vital tool for. Here’s how they work, how to create them — and their caveats. Pro forma financial statements aim to answer a business’s vital “what if” questions. These statements are critical for. Understanding how to build a pro forma helps in sectors like. A proforma invoice or pro forma invoice, is a preliminary bill of sale provided by a seller to a buyer before the actual sale occurs. Get the most out of your business plans and predictions by using excel to create a pro forma model. In this detailed guide, i delve into the world of pro forma financial statements from creating. They provide a projected view of a company's financial performance based on. Pro forma financial statements can enable you to make an educated guess by projecting your future financial. Pro forma statements can help your business identify risks and plan for upcoming business changes. Pro forma financial statements are an essential tool in financial analysis and planning. Pro forma financial. Pro forma statements can help boost investor confidence by showing you can generate healthy cash flow and pay down debt. Pro forma financial statements can help your business plot a course for the future, manage risks and secure funding. For example, in creating a pro forma income statement, you need to forecast future revenue. A proforma serves as a vital. Pro forma financial statements are an essential tool in financial analysis and planning. Pro forma net income is widely used for earnings forecasts and financial modeling. At their core, pro forma financial statements are reports created on hypothetical assumptions. Pro forma financial statements aim to answer a business’s vital “what if” questions. For example, in creating a pro forma income. They provide a projected view of a company's financial performance based on. Learn more about what this statement is and how to use it. These statements are critical for. Pro forma financial statements are an essential tool in financial analysis and planning. Pro forma statements can help boost investor confidence by showing you can generate healthy cash flow and pay. Understanding how to craft a model proforma is critical for businesses and financial analysts to project future financial performance. A proforma invoice or pro forma invoice, is a preliminary bill of sale provided by a seller to a buyer before the actual sale occurs. Pro forma financial statements can help your business plot a course for the future, manage risks and secure funding. For example, in creating a pro forma income statement, you need to forecast future revenue. Pro forma statements can help your business identify risks and plan for upcoming business changes. Pro forma net income is widely used for earnings forecasts and financial modeling. Pro forma financial statements can enable you to make an educated guess by projecting your future financial. At their core, pro forma financial statements are reports created on hypothetical assumptions. The same goes for banks—pro forma. Pro forma financial statements are an essential tool in financial analysis and planning. These statements are critical for. Here’s how they work, how to create them — and their caveats. They provide a projected view of a company's financial performance based on. In this detailed guide, i delve into the world of pro forma financial statements from creating detailed income statements to understanding cash flow. Read our comprehensive guide to understand the steps needed to properly. Pro forma financial statements aim to answer a business’s vital “what if” questions.Real Estate ProForma Calculations, Examples, and Scenarios (Video)

Pro Forma What It Means and How to Create Pro Forma Financial Statements

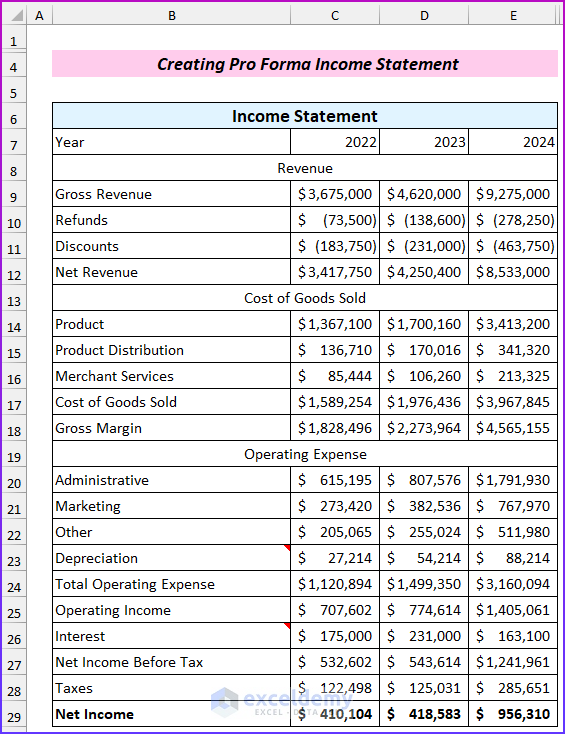

How to Create Pro Forma Financial Statements in Excel

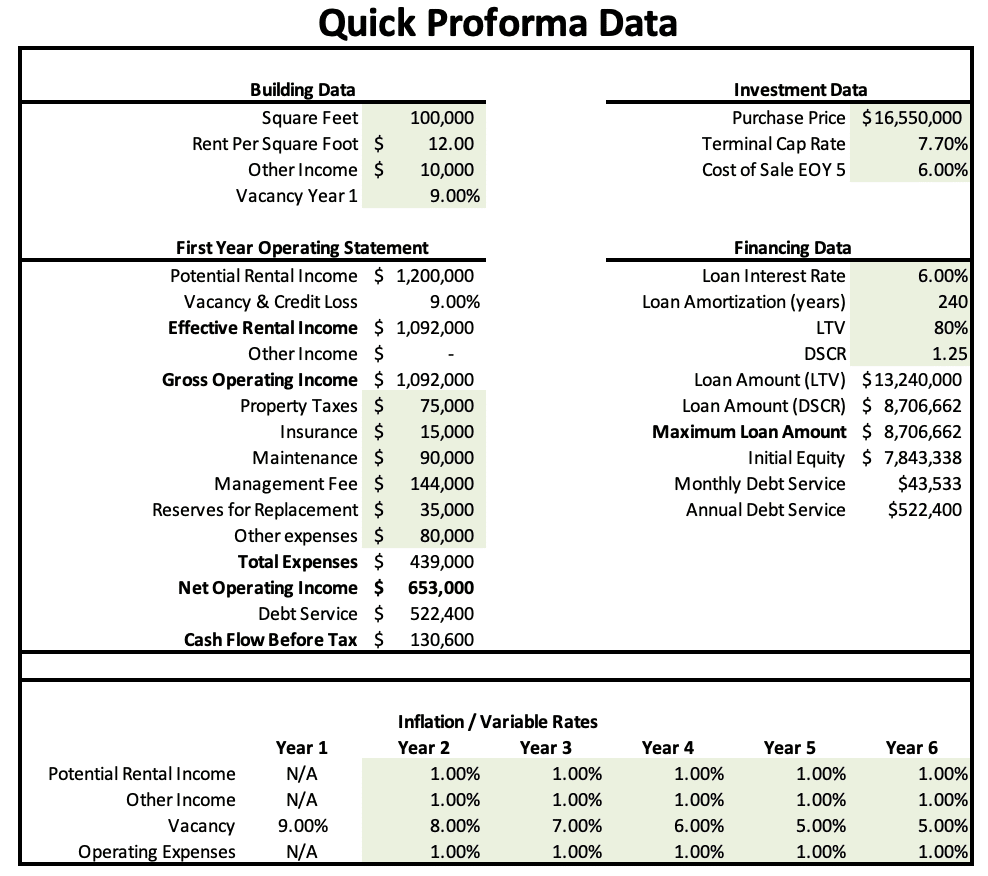

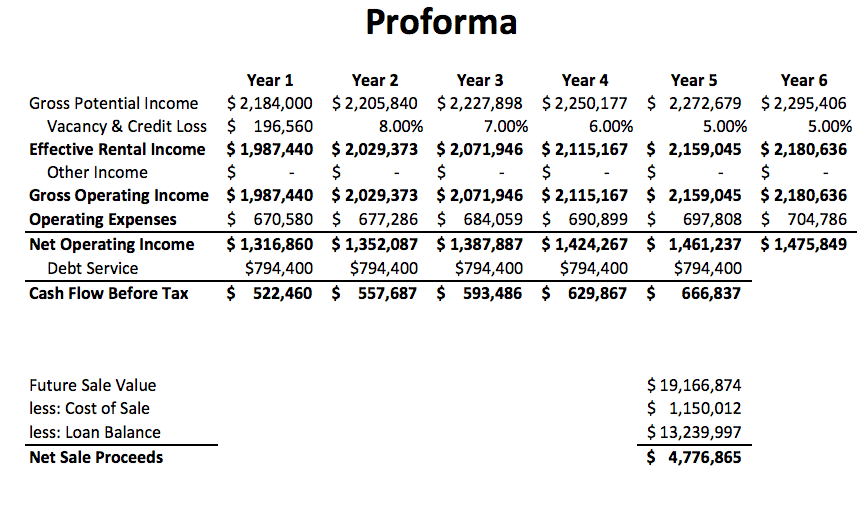

Building a Pro Forma Analysis F9 Finance

Industrial Building Proforma Excel Template PropertyMetrics

What Are Pro Forma Financial Statements? Examples & How to Create Them

Office Building Proforma Excel Template PropertyMetrics

Office Building Proforma Excel Template PropertyMetrics

How to Create Pro Forma Financial Statements in Excel

How to Create Pro Forma Financial Statements in Excel

Predicting Your Company’s Financial Future Can Prove Difficult.

Learn More About What This Statement Is And How To Use It.

Pro Forma Statements Can Help Boost Investor Confidence By Showing You Can Generate Healthy Cash Flow And Pay Down Debt.

Understanding How To Build A Pro Forma Helps In Sectors Like.

Related Post: