Building Accounting

Building Accounting - Accounting for building assets is a critical aspect of financial. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. The carrying amount is the. Learn depreciation methods, lease treatment, & track performance. Paragon cpas and advisors to personal and business clients providing tax planning, audit, and strategic business services. Master best practices for accurate & insightful financial reporting. Proper categorization and recording of these costs ensure an accurate representation of the asset’s value and compliance with accounting standards. Build accounting is a premier accounting, bookkeeping, tax, and payroll business based in chicago. Ias 16, ‘property, plant and equipment’ includes guidance on how to account for property carried at cost. Buildings will be depreciated over their useful lives by debiting the. Construction accounting is a vital discipline that extends beyond the traditional bounds of financial management. Unlike land, buildings are depreciable. Ias 16 applies to property (that is, buildings) held for use in the production or supply of. Proper categorization and recording of these costs ensure an accurate representation of the asset’s value and compliance with accounting standards. Understand the fundamentals of building accounting, including capitalization, improvements, and cost allocation. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. What is the buildings account? Build accounting is a premier accounting, bookkeeping, tax, and payroll business based in chicago. Also, when preparing a balance sheet for your intermediate accounting class, make sure you. Buildings are a significant asset for any business, and they can be depreciated over time. The buildings account is a fixed asset account that contains the carrying amount of the buildings owned by an entity. Ias 16, ‘property, plant and equipment’ includes guidance on how to account for property carried at cost. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. Accounting for building assets is a critical aspect of. Here’s a structured overview of the. At accounting freedom (accounting services for businesses), we have been working with clients throughout illinois and wisconsin for over 35 years and understand that no business is the. Buildings will be depreciated over their useful lives by debiting the. We handle bookkeeping, payroll, and cash. Proper categorization and recording of these costs ensure an. Like land, buildings are also known as real property assets. Also, when preparing a balance sheet for your intermediate accounting class, make sure you. Understand the fundamentals of building accounting, including capitalization, improvements, and cost allocation. It’s the backbone of successful construction project. We handle bookkeeping, payroll, and cash. Proper categorization and recording of these costs ensure an accurate representation of the asset’s value and compliance with accounting standards. Here’s a structured overview of the. Ias 16, ‘property, plant and equipment’ includes guidance on how to account for property carried at cost. It’s the backbone of successful construction project. Like land, buildings are also known as real property assets. The accountant will need to determine the useful life of the building and the depreciation method. Also, when preparing a balance sheet for your intermediate accounting class, make sure you. Servicing clients in the united states, latin america, european. Unlike land, buildings are depreciable. Like land, buildings are also known as real property assets. Buildings are a significant asset for any business, and they can be depreciated over time. The buildings account is a fixed asset account that contains the carrying amount of the buildings owned by an entity. We handle bookkeeping, payroll, and cash. Building accounting refers to the unique accounting needs and financial management practices of companies in the construction industry. Proper. Buildings will be depreciated over their useful lives by debiting the. Building accounting refers to the unique accounting needs and financial management practices of companies in the construction industry. Build accounting is a premier accounting, bookkeeping, tax, and payroll business based in chicago. Ias 16, ‘property, plant and equipment’ includes guidance on how to account for property carried at cost.. Learn depreciation methods, lease treatment, & track performance. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. Also, when preparing a balance sheet for your intermediate accounting class, make sure you. Here’s a structured overview of the. Servicing clients in the united states, latin america, european. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. Buildings will be depreciated over their useful lives by debiting the. Learn how to accurately record building purchases in accounting journals, covering deposits, closing costs, mortgages, and depreciation adjustments. Understand the fundamentals of building accounting, including capitalization, improvements, and cost. Understand the fundamentals of building accounting, including capitalization, improvements, and cost allocation. We handle bookkeeping, payroll, and cash. While our chicago roots are as deep as the city’s pizza, we proudly work with. Build accounting is a premier accounting, bookkeeping, tax, and payroll business based in chicago. Buildings are a significant asset for any business, and they can be depreciated. Here’s a structured overview of the. Accounting for assets under construction. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. Buildings are a significant asset for any business, and they can be depreciated over time. Learn depreciation methods, lease treatment, & track performance. What is the buildings account? Ias 16, ‘property, plant and equipment’ includes guidance on how to account for property carried at cost. Master best practices for accurate & insightful financial reporting. Learn how to accurately record building purchases in accounting journals, covering deposits, closing costs, mortgages, and depreciation adjustments. The accountant will need to determine the useful life of the building and the depreciation method. The carrying amount is the. Servicing clients in the united states, latin america, european. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. Like land, buildings are also known as real property assets. Construction accounting is a vital discipline that extends beyond the traditional bounds of financial management. Under generally accepted accounting principles (gaap), your accounting has to track the carrying amount of fixed assets, such as buildings, equipment and vehicles.Sage 50 Construction Accounting Support Sage Support

Construction Accounting Methods Account Junction

accounting solutions for the main office and the home office QBLA

Construction Accounting 101 A Basic Guide for Contractors

How to Do Construction Accounting The Ultimate Guide

Construction Accounting A Guide for Contractors Flynn & Co

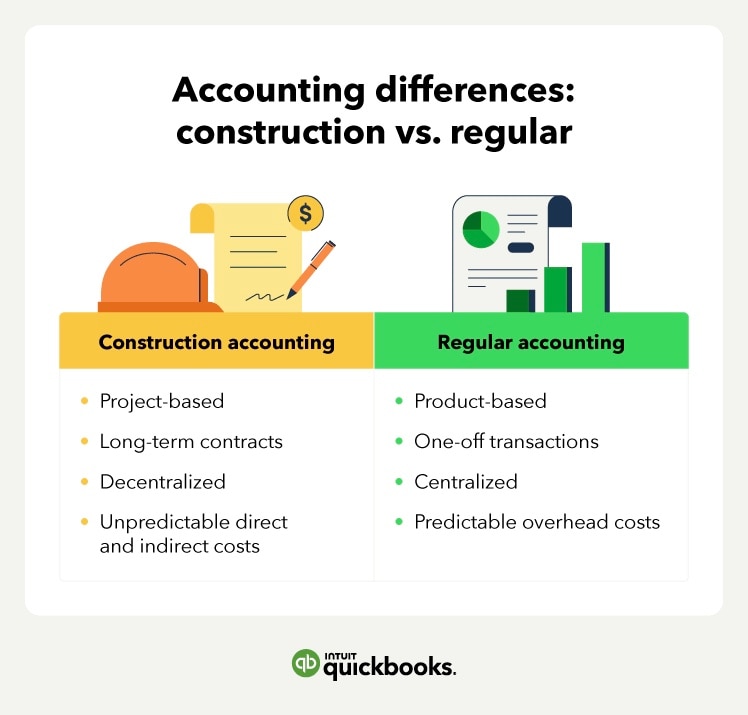

Construction accounting for busy contractors Quickbooks

Basics of Construction Accounting Day 2

Construction Accounting Basics for Every Contractor Blog

Construction Accounting 101 Choose the Right Method NetSuite

At Accounting Freedom (Accounting Services For Businesses), We Have Been Working With Clients Throughout Illinois And Wisconsin For Over 35 Years And Understand That No Business Is The.

While Our Chicago Roots Are As Deep As The City’s Pizza, We Proudly Work With.

It’s The Backbone Of Successful Construction Project.

The Buildings Account Is A Fixed Asset Account That Contains The Carrying Amount Of The Buildings Owned By An Entity.

Related Post:

-1920w.jpg)