Building Appraisal Methods

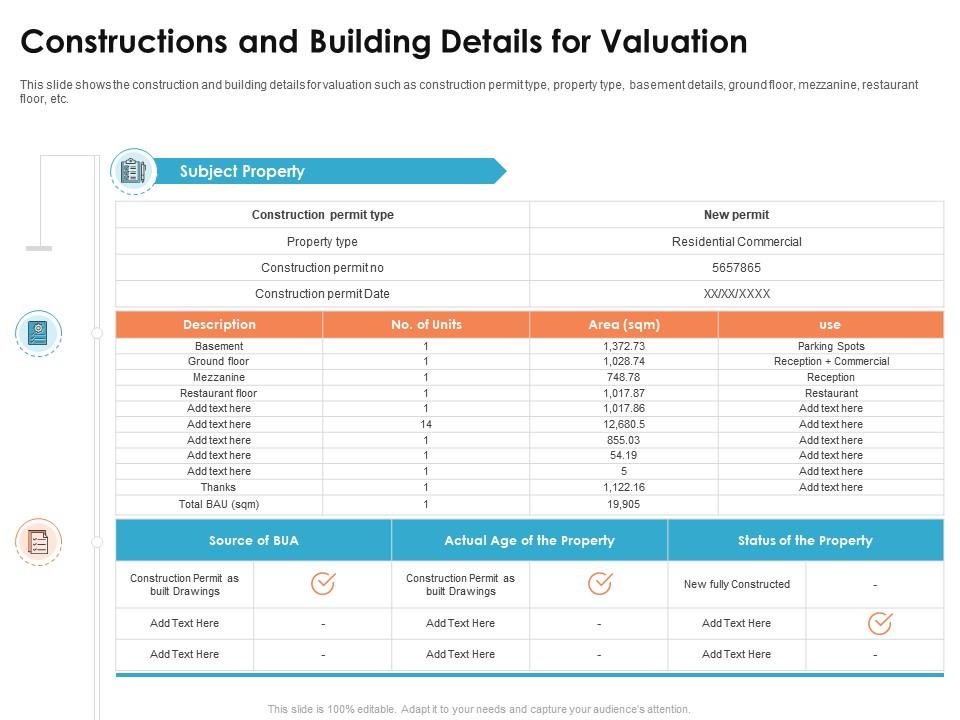

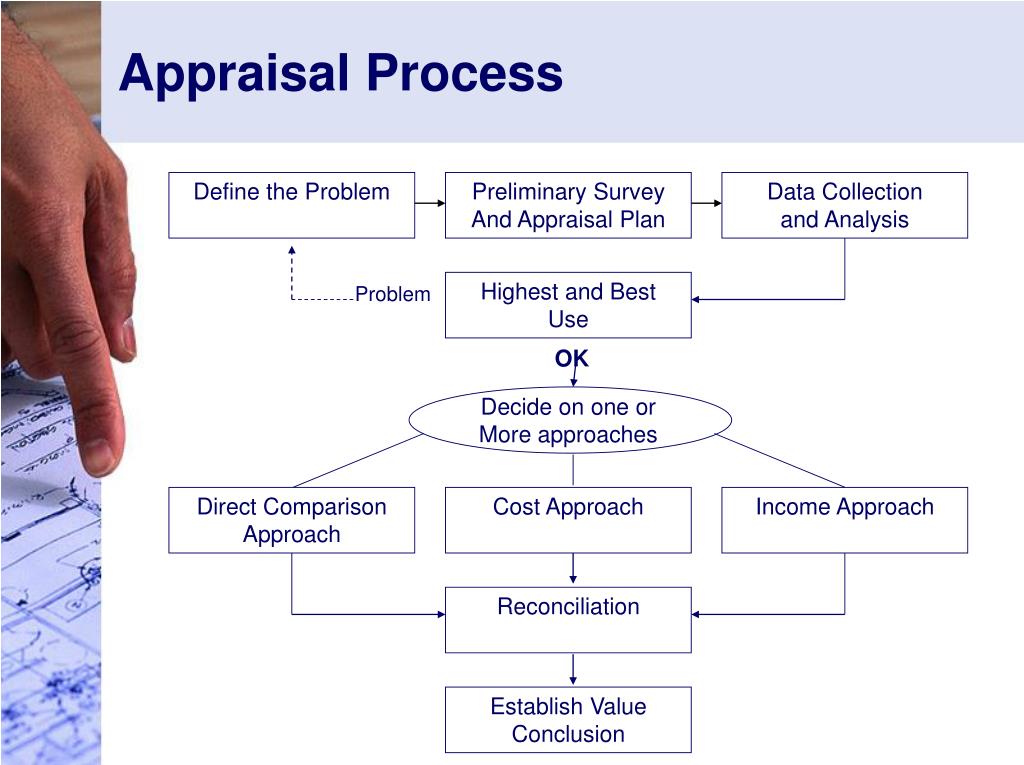

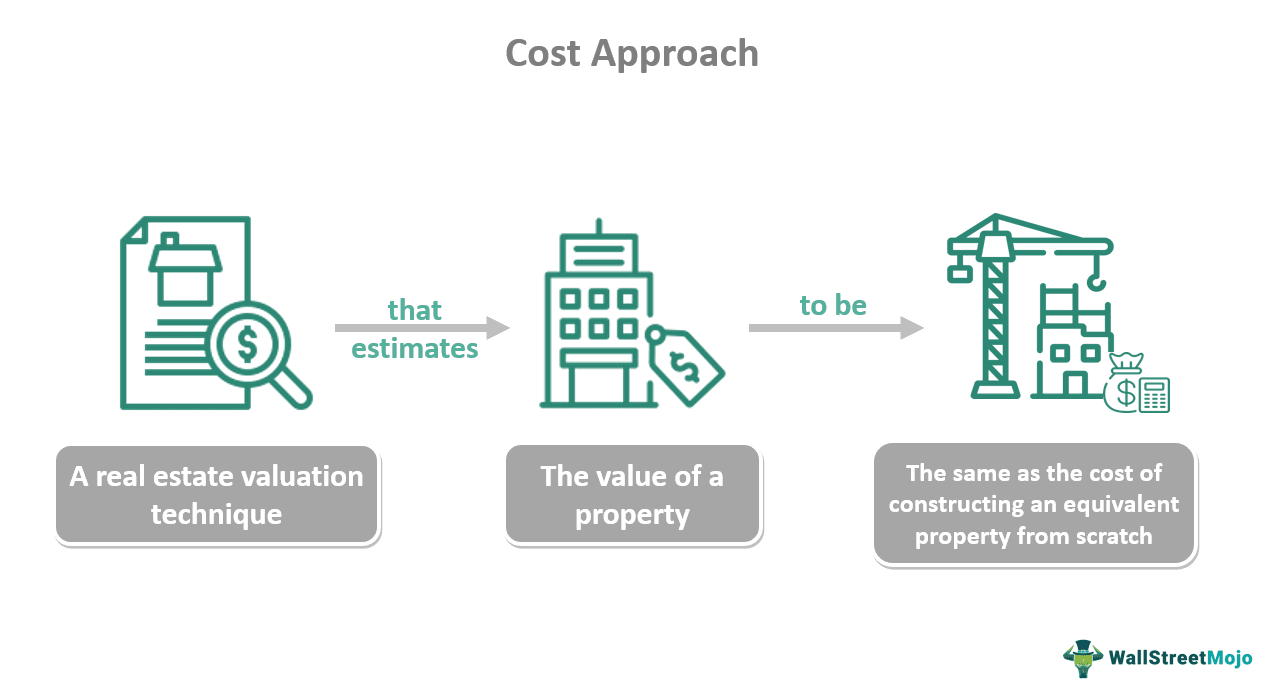

Building Appraisal Methods - From this guide to appraising a commercial property you will learn about three approaches to find out the market value of a business building and determine the worth of the. The cost approach, or replacement cost approach, incorporates the current value. Structures with different monetary worth will likewise be subject to different taxes. Apply the principles and concepts learned in basic appraisal principles. Appraising a property helps investors to understand if the price. Before devoting valuable time and resources to due diligence, and not to mention, deploying capital, assessing a property’s value is paramount. The mixed methods appraisal tool (mmat) was used to appraise included studies. Here is a deeper look at the most popular methods for commercial building appraisals. A commercial real estate appraiser, or cre appraiser, considers a number of factors to appraise a commercial property and determine its value. Types, benefits, costs and pitfalls. Discover the ins and outs of commercial property appraisal: Whether you’re an investor seeking to expand portfolio, a property. The mixed methods appraisal tool (mmat) was used to appraise included studies. Here is a deeper look at the most popular methods for commercial building appraisals. Is the listing price the seller is charging for a property viable based on your investment strategy? Structures with different monetary worth will likewise be subject to different taxes. Before devoting valuable time and resources to due diligence, and not to mention, deploying capital, assessing a property’s value is paramount. Learn how to boost property value and avoid appraisal mistakes. Apply the principles and concepts learned in basic appraisal principles. A professional appraiser will use the home inspection and current housing market. Discover the ins and outs of commercial property appraisal: The review adopted a narrative approach to synthesise the findings. A commercial real estate appraiser, or cre appraiser, considers a number of factors to appraise a commercial property and determine its value. Understanding these six appraisal methods is essential for anyone involved in commercial real estate. Building value affects all taxes,. Is the listing price the seller is charging for a property viable based on your investment strategy? Structures with different monetary worth will likewise be subject to different taxes. Appraising a property helps investors to understand if the price. Appraisers use the cost, income capitalization, and sales comparison approaches to evaluate commercial real estate. The mixed methods appraisal tool (mmat). Apply the principles and concepts learned in basic appraisal principles. Discover the ins and outs of commercial property appraisal: The sales comparison approach or comparison method, the income approach, and the cost. Structures with different monetary worth will likewise be subject to different taxes. After reviewing this brochure, you will understand the definition of a credible appraisal, the appraisal process,. From this guide to appraising a commercial property you will learn about three approaches to find out the market value of a business building and determine the worth of the. Is the listing price the seller is charging for a property viable based on your investment strategy? Appraisal and valuation are extremely important steps in any home buying and/or selling. From this guide to appraising a commercial property you will learn about three approaches to find out the market value of a business building and determine the worth of the. Is the listing price the seller is charging for a property viable based on your investment strategy? Building value affects all taxes, including health, property, and municipality. Learn how to. After reviewing this brochure, you will understand the definition of a credible appraisal, the appraisal process, elements of a credible appraisal, the importance of appraiser. The cost approach, or replacement cost approach, incorporates the current value. Structures with different monetary worth will likewise be subject to different taxes. Types, benefits, costs and pitfalls. Discover the ins and outs of commercial. Building value affects all taxes, including health, property, and municipality. A commercial real estate appraiser, or cre appraiser, considers a number of factors to appraise a commercial property and determine its value. Appraisers use the cost, income capitalization, and sales comparison approaches to evaluate commercial real estate. Whether you’re an investor seeking to expand portfolio, a property. Understanding these six. Types, benefits, costs and pitfalls. Learn how to boost property value and avoid appraisal mistakes. Is the listing price the seller is charging for a property viable based on your investment strategy? Before devoting valuable time and resources to due diligence, and not to mention, deploying capital, assessing a property’s value is paramount. The cost approach, or replacement cost approach,. A professional appraiser will use the home inspection and current housing market. Understanding these six appraisal methods is essential for anyone involved in commercial real estate. Appraising a property helps investors to understand if the price. Here is a deeper look at the most popular methods for commercial building appraisals. The cost approach, or replacement cost approach, incorporates the current. Types, benefits, costs and pitfalls. The review adopted a narrative approach to synthesise the findings. A commercial real estate appraiser, or cre appraiser, considers a number of factors to appraise a commercial property and determine its value. Whether you’re an investor seeking to expand portfolio, a property. Building value affects all taxes, including health, property, and municipality. The review adopted a narrative approach to synthesise the findings. Structures with different monetary worth will likewise be subject to different taxes. Appraisal and valuation are extremely important steps in any home buying and/or selling transaction. The mixed methods appraisal tool (mmat) was used to appraise included studies. A professional appraiser will use the home inspection and current housing market. From this guide to appraising a commercial property you will learn about three approaches to find out the market value of a business building and determine the worth of the. Building value affects all taxes, including health, property, and municipality. Is the listing price the seller is charging for a property viable based on your investment strategy? Appraisers use the cost, income capitalization, and sales comparison approaches to evaluate commercial real estate. After reviewing this brochure, you will understand the definition of a credible appraisal, the appraisal process, elements of a credible appraisal, the importance of appraiser. Learn how to boost property value and avoid appraisal mistakes. Before devoting valuable time and resources to due diligence, and not to mention, deploying capital, assessing a property’s value is paramount. Whether you’re an investor seeking to expand portfolio, a property. A commercial real estate appraiser, or cre appraiser, considers a number of factors to appraise a commercial property and determine its value. The sales comparison approach or comparison method, the income approach, and the cost. Here is a deeper look at the most popular methods for commercial building appraisals.Constructions And Building Commercial Real Estate Appraisal Methods Ppt

3 Types of Home Appraisals You Should Know New Venture Escrow

BUILDING APPRAISAL — DIVERSE INTERIOR ARCHITECTURE

Building appraisal

Methods Of Valuation Of A Building Daily Engineering

What Is Building Valuation Purposes of Building Valuation Building

The New Construction Appraisal (Everything You Need To Know)

Concepts of appraisal and appraisal methods PPT

PPT Real Estate Principles of Appraisal PowerPoint Presentation, free

Cost Approach What Is It, Appraisal, Formula,

Appraising A Property Helps Investors To Understand If The Price.

Apply The Principles And Concepts Learned In Basic Appraisal Principles.

Types, Benefits, Costs And Pitfalls.

Understanding These Six Appraisal Methods Is Essential For Anyone Involved In Commercial Real Estate.

Related Post: