Building Business Credit Fast

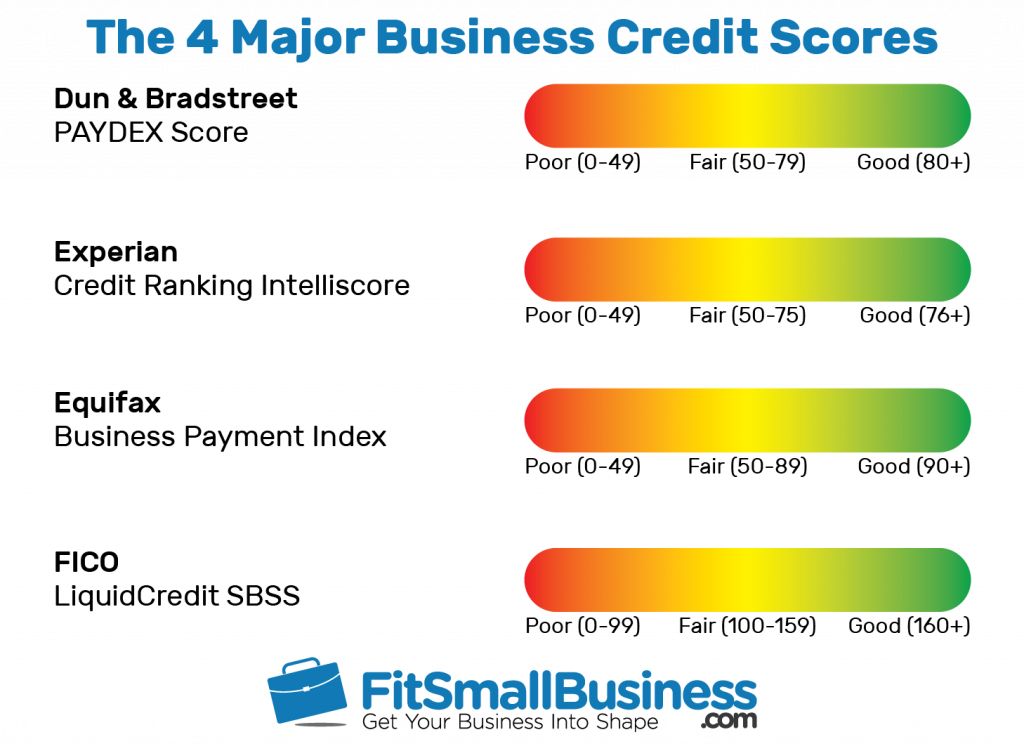

Building Business Credit Fast - Subscription services available for regular monitoring; A leader in sba lending to independent. Having a good business credit score will give you. Thanks to our nimble approach, companies can regain financial. The better your business credit score, the more likely you are to be accepted for financing and the more. It’s impossible to predict exact results since many. Lenders will likely check your business credit score. Building strong business credit is essential for the growth and stability of any small business. Building business credit fast requires strategic steps to establish your business credit history and improve your credit scores with the major business credit bureaus like dun & bradstreet,. Many businesses borrow capital to fund startup costs, grow their team and make substantial upgrades to their business. Budget for quarterly or monthly. Good business credit can help secure better financing options, lower interest rates,. We explore how to build business credit with these proven tactics. If you’re a new business or haven’t focused on credit yet, start with the basics: These are the first steps you need to take to establish business credit for your business. Your business must be a corporation or limited liability company (llc) to be assigned a business. It’s not just about getting a loan when you’re in a pinch. Thanks to our nimble approach, companies can regain financial. Many business owners have made significant progress building their business credit using the steps described below. Building strong business credit is essential for the growth and stability of any small business. Best vendor accounts to build business credit fast. Building strong business credit is essential for the growth and stability of any small business. Building business credit is like laying the groundwork for future success. Building business credit fast requires strategic steps to establish your business credit history and improve your credit scores with the major business credit bureaus like dun. Ready to build business credit fast? Best vendor accounts to build business credit fast. These are the first steps you need to take to establish business credit for your business. It’s impossible to predict exact results since many. A solid score (usually 650 or higher) signals that your business is financially healthy and has a good repayment history. Your business must be a corporation or limited liability company (llc) to be assigned a business. Credit history and startups without established financial track records. Lenders will likely check your business credit score. These are the first steps you need to take to establish business credit for your business. It’s not just about getting a loan when you’re in a. Ready to build business credit fast? Having a good business credit score will give you. A solid score (usually 650 or higher) signals that your business is financially healthy and has a good repayment history. We explore how to build business credit with these proven tactics. If you’re a new business or haven’t focused on credit yet, start with the. Budget for quarterly or monthly. The better your business credit score, the more likely you are to be accepted for financing and the more. We explore how to build business credit with these proven tactics. Subscription services available for regular monitoring; Thanks to our nimble approach, companies can regain financial. These cards are particularly useful for immigrant business owners building u.s. Building business credit fast requires strategic steps to establish your business credit history and improve your credit scores with the major business credit bureaus like dun & bradstreet,. A leader in sba lending to independent. Budget for quarterly or monthly. Many businesses borrow capital to fund startup costs, grow. Ready to build business credit fast? These are the first steps you need to take to establish business credit for your business. Building strong business credit is essential for the growth and stability of any small business. Credit history and startups without established financial track records. Lenders will likely check your business credit score. Credit history and startups without established financial track records. Building strong business credit is essential for the growth and stability of any small business. Lenders will likely check your business credit score. Good business credit can help secure better financing options, lower interest rates,. Major business credit bureaus like dun & bradstreet, equifax, and experian track these scores. Having a good business credit score will give you. Many businesses borrow capital to fund startup costs, grow their team and make substantial upgrades to their business. Major business credit bureaus like dun & bradstreet, equifax, and experian track these scores. Credit history and startups without established financial track records. It’s not just about getting a loan when you’re in. Thanks to our nimble approach, companies can regain financial. Subscription services available for regular monitoring; Building business credit is like laying the groundwork for future success. A solid score (usually 650 or higher) signals that your business is financially healthy and has a good repayment history. A leader in sba lending to independent. It’s impossible to predict exact results since many. Good business credit can help secure better financing options, lower interest rates,. A leader in sba lending to independent. Many businesses borrow capital to fund startup costs, grow their team and make substantial upgrades to their business. These cards are particularly useful for immigrant business owners building u.s. It’s not just about getting a loan when you’re in a pinch. Many business owners have made significant progress building their business credit using the steps described below. Major business credit bureaus like dun & bradstreet, equifax, and experian track these scores. If you’re a new business or haven’t focused on credit yet, start with the basics: Best vendor accounts to build business credit fast. In this article, you will learn about the steps you need to take to build your business credit quickly. Building strong business credit is essential for the growth and stability of any small business. Building business credit is like laying the groundwork for future success. A solid business credit profile can open doors to. Building business credit fast requires strategic steps to establish your business credit history and improve your credit scores with the major business credit bureaus like dun & bradstreet,. These are the first steps you need to take to establish business credit for your business.How to build business credit fast Travis Gensler

How to Build Business Credit 7 Expert Tips to Build Credit Fast (2024)

How To Build Business Credit Fast For Maximum Scalability

How to Build Business Credit in 7 Steps

How to Build Business Credit Fast The 10 Best Ways AMP Advance

How to Build Business Credit Fast in 5 Easy Steps

6 Tips To Build Your Business Credit Fast FundKite Business Funding

How to Build Credit Fast [Infographic]

How to Build Business Credit FAST YouTube

How to Build Business Credit Fast A Comprehensive Guide

Ready To Build Business Credit Fast?

Lenders Will Likely Check Your Business Credit Score.

Budget For Quarterly Or Monthly.

Having A Good Business Credit Score Will Give You.

Related Post:

![How to Build Credit Fast [Infographic]](https://tradelinesupply.com/wp-content/uploads/2019/05/fastest-ways-to-build-credit-Infographic-with-apostrophe-724x1024.png)