Building Construction Insurance

Building Construction Insurance - Want to see how much we can save you? What is contractors’ all risk insurance? Lr windsor offers free, comparative quotes on builders risk insurance from multiple insurance carriers so you can get the best possible rate. Protect properties during construction with builders risk insurance. When your reputation, along with the successful completion of your projects, is on the line, you want to be confident you have the comprehensive protection you need. Serving clients in illinois, wisconsin, indiana, arizona, colorado. You might make a mistake during construction, causing damage to a client’s property. Property, liability and workers’ compensation. It’s also a safety net against potential financial losses. Covered property includes buildings under construction (including foundations); Contractors’ all risk insurance is a comprehensive insurance policy designed to protect construction projects against physical. Want to see how much we can save you? Construction project insurance is a category of insurance coverage designed to protect stakeholders involved in a construction project. However, by providing them with products and services, you also expose them to potential harm. Lr windsor offers free, comparative quotes on builders risk insurance from multiple insurance carriers so you can get the best possible rate. What is contractors’ all risk insurance? Materials on site, in transit, or at temporary storage locations; Covered property includes buildings under construction (including foundations); A good contractors insurance policy contains. Someone might get hurt visiting your warehouse. Contractors’ all risk insurance is a comprehensive insurance policy designed to protect construction projects against physical. Builder risk insurance is a critical type of construction insurance that protects your construction project from unforeseen losses during the building phase. It also helps protect the equipment you use in construction. Want to see how much we can save you? The insurance company's. At its core, construction insurance covers three major areas: What is contractors’ all risk insurance? Someone might get hurt visiting your warehouse. Covered property includes buildings under construction (including foundations); You run a business to serve people’s needs. This type of insurance covers general contractors, subcontractors, developers, homeowners and lenders. Our experts explain the differences in coverage, cost, and requirements across construction insurance policies. Welcome to our dedicated illinois construction insurance programs, strategically designed to cater to the unique needs of businesses in the bustling chicago area. It also helps protect the equipment you use in construction. Contractors’. Builder risk insurance is a critical type of construction insurance that protects your construction project from unforeseen losses during the building phase. Lr windsor offers free, comparative quotes on builders risk insurance from multiple insurance carriers so you can get the best possible rate. Builder’s risk insurance protects property and construction materials during a construction or renovation project. A good. Nationwide offers construction insurance for customers in most states across the us. Contractors’ all risk insurance is a comprehensive insurance policy designed to protect construction projects against physical. Protect your construction projects through every phase, from groundbreaking to ribbon cutting. This type of insurance covers general contractors, subcontractors, developers, homeowners and lenders. Lr windsor offers free, comparative quotes on builders. Construction project insurance is a category of insurance coverage designed to protect stakeholders involved in a construction project. Nationwide offers construction insurance for customers in most states across the us. When your reputation, along with the successful completion of your projects, is on the line, you want to be confident you have the comprehensive protection you need. Property insurance protects. Property, liability and workers’ compensation. Protect properties during construction with builders risk insurance. Our experts explain the differences in coverage, cost, and requirements across construction insurance policies. Builder’s risk insurance protects against perils such as fire, wind, theft, vandalism, and certain types of water damage. Covered property includes buildings under construction (including foundations); Builder’s risk insurance covers property on construction sites when it’s. Construction project insurance is a category of insurance coverage designed to protect stakeholders involved in a construction project. Construction insurance refers to a set of insurance policies designed to protect construction businesses from potential risks. Property, liability and workers’ compensation. What is contractors’ all risk insurance? It also helps protect the equipment you use in construction. Protect your construction projects through every phase, from groundbreaking to ribbon cutting. Property, liability and workers’ compensation. What is contractors’ all risk insurance? You might make a mistake during construction, causing damage to a client’s property. You might make a mistake during construction, causing damage to a client’s property. A good contractors insurance policy contains. Builder’s risk insurance protects against perils such as fire, wind, theft, vandalism, and certain types of water damage. This type of insurance covers general contractors, subcontractors, developers, homeowners and lenders. Nationwide offers construction insurance for customers in most states across the. At its core, construction insurance covers three major areas: Covered property includes buildings under construction (including foundations); Someone might get hurt visiting your warehouse. It’s also a safety net against potential financial losses. What is contractors’ all risk insurance? However, by providing them with products and services, you also expose them to potential harm. There are many different types of construction insurance products to understand and consider for your next project. Builder’s risk insurance covers property on construction sites when it’s. Protect your construction projects through every phase, from groundbreaking to ribbon cutting. The insurance company's large catalogue of insurance products includes not only construction insurance, but also auto insurance, homeowners insurance, life insurance, umbrella insurance, and much more. Construction project insurance is a category of insurance coverage designed to protect stakeholders involved in a construction project. Contractors’ all risk insurance is a comprehensive insurance policy designed to protect construction projects against physical. What is general liability insurance for contractors? It also helps protect the equipment you use in construction. This type of insurance covers general contractors, subcontractors, developers, homeowners and lenders. When your reputation, along with the successful completion of your projects, is on the line, you want to be confident you have the comprehensive protection you need.Types of Construction Insurance

Building Construction Insurance ALIGNED Insurance Brokers

Course of construction insurance. A complete guide

Constructions Risk Certificate of Insurance

Building Construction Insurance Requirements in Australia

Builders Risk Insurance Course of Construction Insurance AFIG

Insurance for construction and engineering projects

What is Construction Insurance?

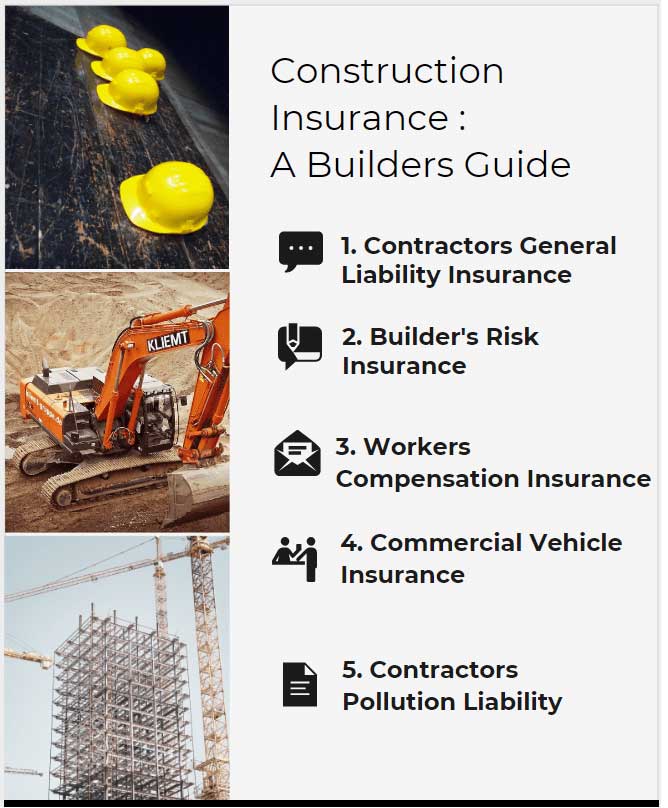

Construction Insurance A Builders Guide

8 Types of Construction Insurance to Protect Your Business, Property

Materials On Site, In Transit, Or At Temporary Storage Locations;

Serving Clients In Illinois, Wisconsin, Indiana, Arizona, Colorado.

Want To See How Much We Can Save You?

Welcome To Our Dedicated Illinois Construction Insurance Programs, Strategically Designed To Cater To The Unique Needs Of Businesses In The Bustling Chicago Area.

Related Post: