Building Contractors Insurance Requirements

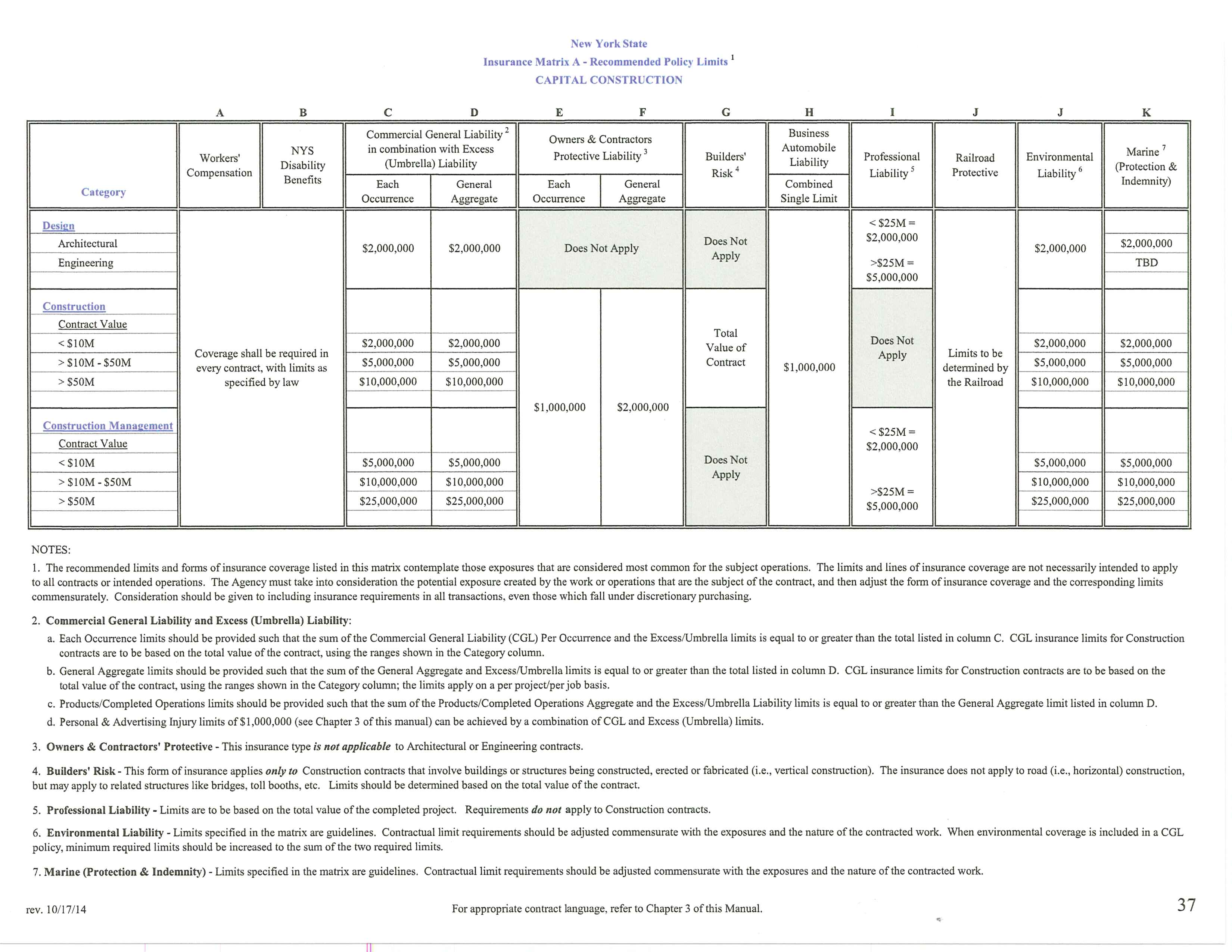

Building Contractors Insurance Requirements - Contractors’ all risk insurance is a comprehensive insurance policy designed to protect construction projects against physical. These are some of the biggest benefits of a bop for construction businesses. Learn what’s required to get a general contractor license and insurance in illinois, and some specifics for chicago. In this comprehensive guide we cover the insurance and bonding requirements for contractors of all types. Insurance plays a crucial role in managing risks and ensuring the successful completion of any construction project. Builder’s risk insurance protects against perils such as fire, wind, theft, vandalism, and certain types of water damage. Different types of policies are used to protect businesses and owners from specific risks or losses. Proof of general liability insurance and workers compensation insurance is also required during the application. These requirements may include minimum. Only one general contractor is allowed on the. Construction insuranceis a category of insurance policies that can provide coverage for contractors, property owners, and projects under construction. Professional liability insurance is a specialized type of construction insurance designed to protect contractors from claims related to errors, omissions, or negligence during. Advertising to do building work without a contractor license in advance is as illegal as actually doing such work, and all illegal operators are prosecuted to the fullest extent prescribed in the. These are some of the biggest benefits of a bop for construction businesses. Ensuring you have the appropriate general contractor insurance requirements is critical. Learn about the coverages, limits, and endorsements that commonly appear in construction contracts, what they mean, and how often they’re required. Get help to protect your business. General contractors (gcs), often referred to as “paper contractors,” are professionals who oversee construction projects and typically subcontract. Proof of general liability insurance and workers compensation insurance is also required during the application. Learn why insurance and bonding is needed. Proof of general liability insurance and workers compensation insurance is also required during the application. In this comprehensive guide we cover the insurance and bonding requirements for contractors of all types. Only one general contractor is allowed on the. Here are some of the. When it comes to construction contractor insurance requirements, some are an actual legal obligation. Small business insurance for restaurants; General contractors (gcs), often referred to as “paper contractors,” are professionals who oversee construction projects and typically subcontract. Insurance plays a crucial role in managing risks and ensuring the successful completion of any construction project. Builder’s risk insurance protects against perils such as fire, wind, theft, vandalism, and certain types of water damage. Insurance policy. Insurance is an essential safety net in commercial construction. Standard coverage encompasses buildings and. Here are some types of insurance a contractor should have or consider getting: These are some of the biggest benefits of a bop for construction businesses. It protects contractors and subcontractors. A licensed and insured general contractor is required for most types of building construction, rehabilitation, and demolition work in chicago. Coverage typically includes the building under. When it comes to construction contractor insurance requirements, some are an actual legal obligation. Professional liability insurance is a specialized type of construction insurance designed to protect contractors from claims related to errors, omissions,. Here are some of the. Here are some types of insurance a contractor should have or consider getting: These requirements may include minimum. As a contractor or construction company, understanding the necessary insurance requirements is crucial to protect your business from potential liabilities. This article delves into the key types of insurance. Contractors’ all risk insurance is a comprehensive insurance policy designed to protect construction projects against physical. In this comprehensive guide we cover the insurance and bonding requirements for contractors of all types. Coverage typically includes the building under. Standard coverage encompasses buildings and. Insurance plays a crucial role in managing risks and ensuring the successful completion of any construction project. Different types of policies are used to protect businesses and owners from specific risks or losses. In this comprehensive guide we cover the insurance and bonding requirements for contractors of all types. Construction insuranceis a category of insurance policies that can provide coverage for contractors, property owners, and projects under construction. Small business insurance for construction companies; Standard coverage encompasses. These requirements may include minimum. General contractors (gcs), often referred to as “paper contractors,” are professionals who oversee construction projects and typically subcontract. Furthermore, many construction projects require contractors to fulfill specific insurance requirements before commencing work. These are some of the biggest benefits of a bop for construction businesses. Discover what we stand for. General contractors (gcs), often referred to as “paper contractors,” are professionals who oversee construction projects and typically subcontract. Builders mutual provides insurance coverage and safety education exclusively to the construction industry. Professional liability insurance is a specialized type of construction insurance designed to protect contractors from claims related to errors, omissions, or negligence during. These requirements may include minimum. This. Coverage typically includes the building under. Here are some types of insurance a contractor should have or consider getting: Discover what we stand for. In this comprehensive guide we cover the insurance and bonding requirements for contractors of all types. That is, if you’re working in the construction industry, you are legally. In illinois, not all contractors are required to obtain a specific license. Builders mutual provides insurance coverage and safety education exclusively to the construction industry. As a contractor or construction company, understanding the necessary insurance requirements is crucial to protect your business from potential liabilities. This is where building contractors’ insurance requirements come in. This article delves into the key types of insurance. Different types of policies are used to protect businesses and owners from specific risks or losses. That is, if you’re working in the construction industry, you are legally. Here are some of the. Instead, licensing requirements vary based on your specific trade and location. Standard coverage encompasses buildings and. These are some of the biggest benefits of a bop for construction businesses. These requirements may include minimum. Learn about the coverages, limits, and endorsements that commonly appear in construction contracts, what they mean, and how often they’re required. Contractors’ all risk insurance is a comprehensive insurance policy designed to protect construction projects against physical. Builder’s risk insurance protects against perils such as fire, wind, theft, vandalism, and certain types of water damage. Discover what we stand for.Insurance Requirements Fredonia.edu

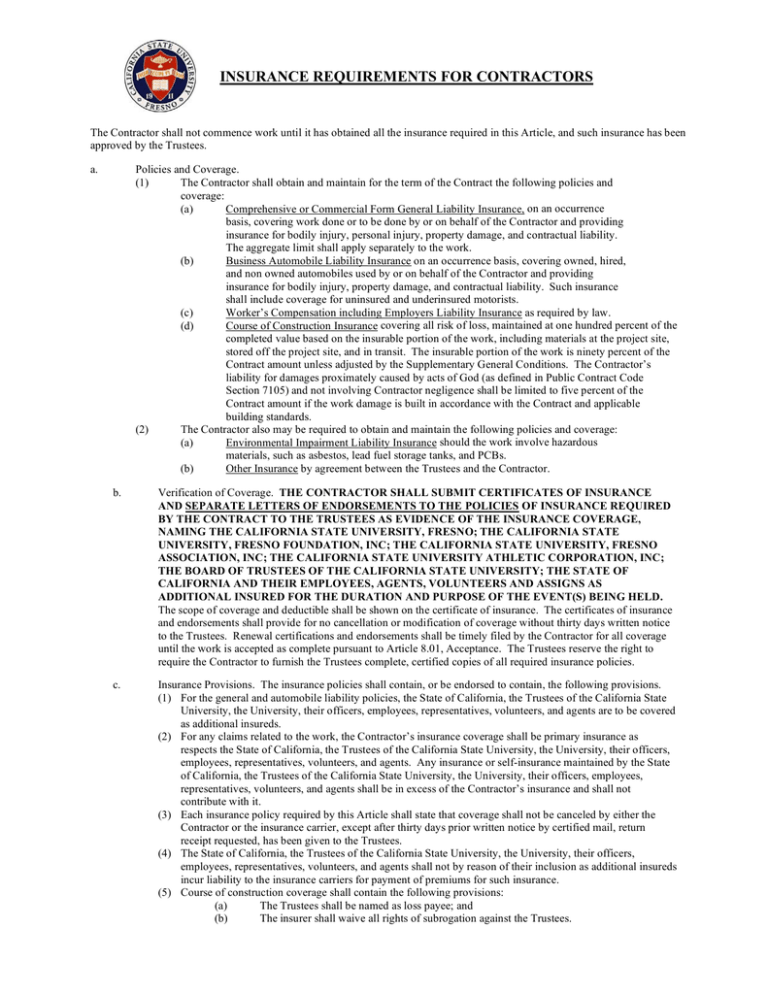

INSURANCE REQUIREMENTS FOR CONTRACTORS

Building Construction Insurance Requirements in Australia

PPT Risk Transfer PowerPoint Presentation, free download ID521230

Contractor Insurance Requirements Exhibitor Appointed Contractor

8 Types of Construction Insurance to Protect Your Business, Property

Contractor Insurance Types, Costs & Coverages in 2025

Summary of typical construction insurance coverage. Download

Certificate of Insurance Requirements

Insurance Requirements Paxton Construction

Small Business Insurance For Construction Companies;

General Contractors (Gcs), Often Referred To As “Paper Contractors,” Are Professionals Who Oversee Construction Projects And Typically Subcontract.

Professional Liability Insurance Is A Specialized Type Of Construction Insurance Designed To Protect Contractors From Claims Related To Errors, Omissions, Or Negligence During.

Coverage Typically Includes The Building Under.

Related Post: