Building Cost Estimator For Insurance

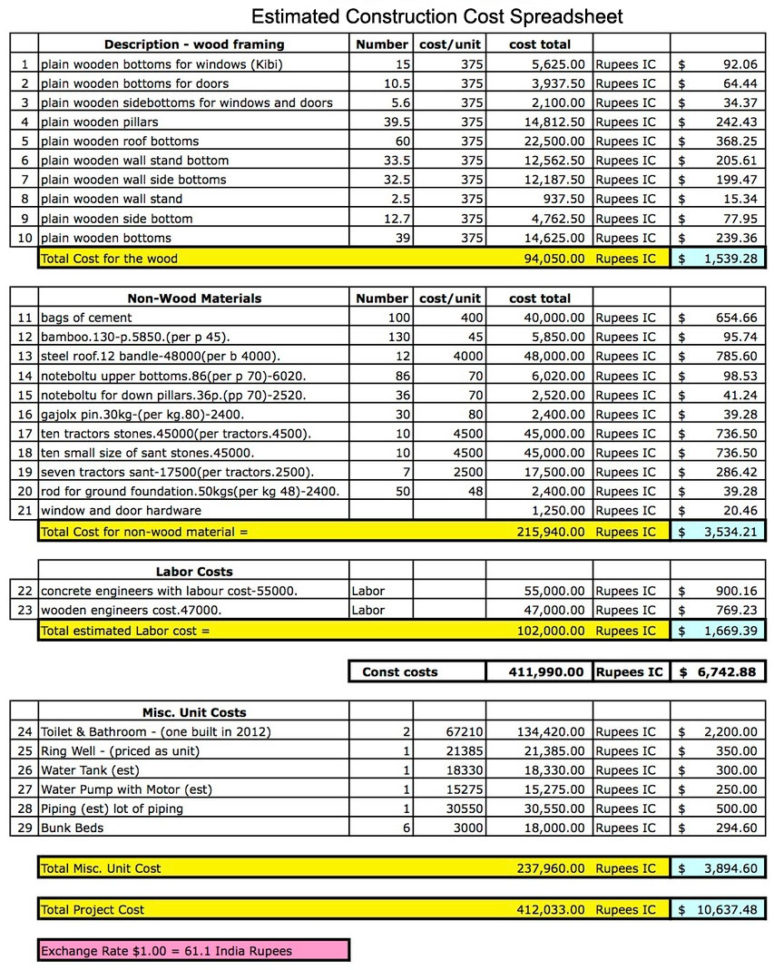

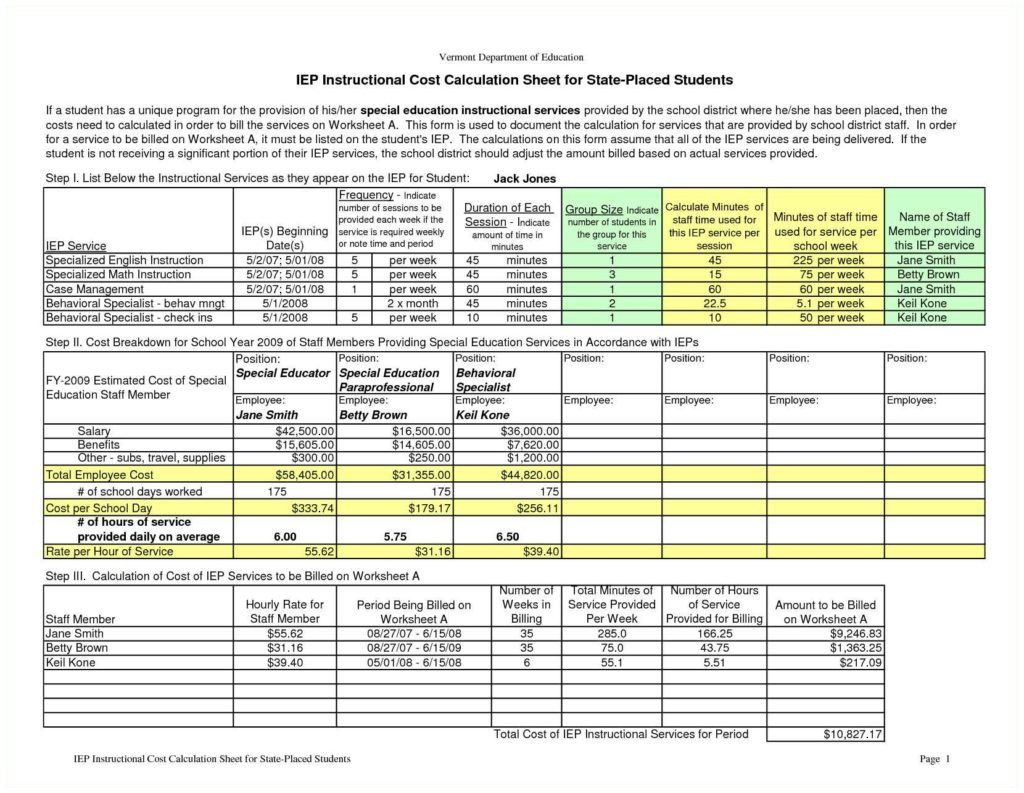

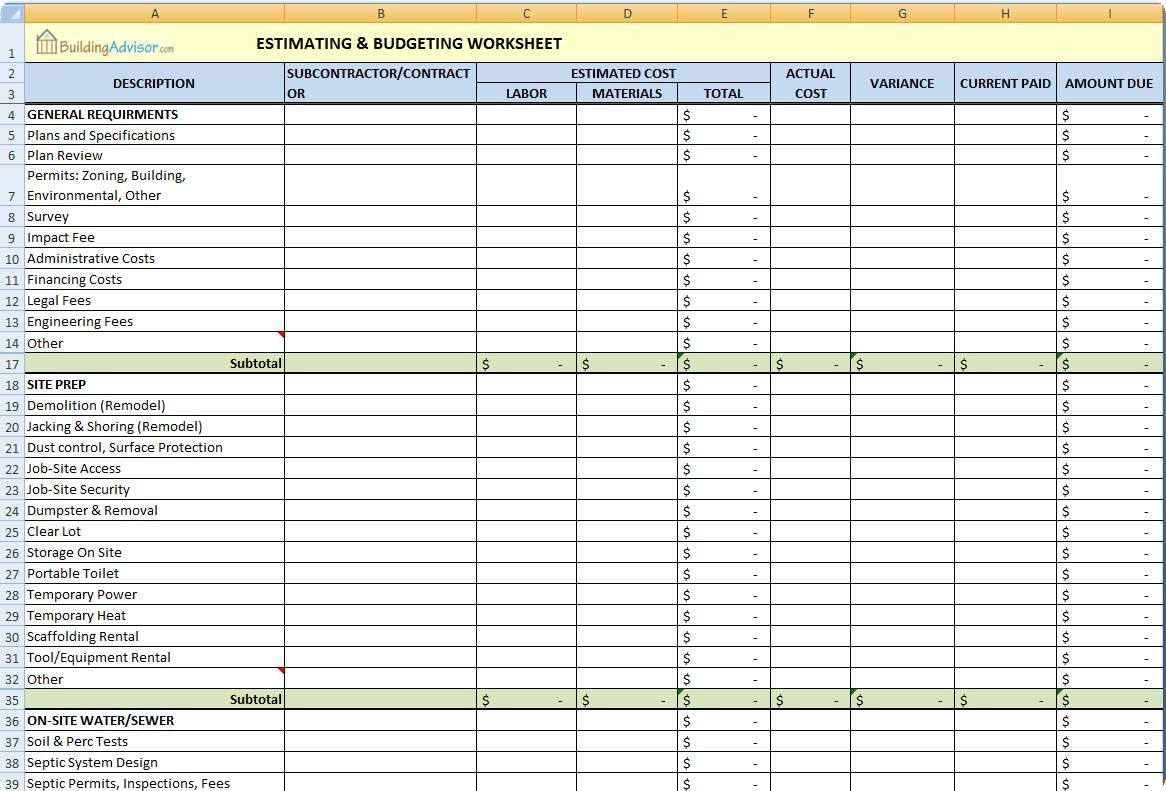

Building Cost Estimator For Insurance - Builders risk insurance is essential for protecting structures, materials, and labor during construction from various risks like fire, theft, and severe weather. But how is home insurance calculated? When you purchase home insurance, an insurer typically uses specialized software to estimate replacement cost to determine an appropriate dwelling coverage limit. Our homeowners insurance calculator helps you estimate your home insurance costs by using the average rate among insurers in your zip code. Is $2,601 annually, or $217 monthly for $300,000 in dwelling coverage, but these rates vary based on where you live. Get detailed breakdowns for materials, labor, and overhead for any building project. Enter the total floor area of your building project in square feet. If you like what you see, you can get a detailed quote tailored to your business. How much insurance you need for a home depends on different factors. Use next’s tool to get a basic estimate of your commercial property insurance costs. Get detailed breakdowns for materials, labor, and overhead for any building project. Our homeowners insurance calculator helps you estimate your home insurance costs by using the average rate among insurers in your zip code. To estimate your home's replacement cost: Enter the total floor area of your building project in square feet. Add the cost for major parts of. How much insurance you need for a home depends on different factors. Use next’s tool to get a basic estimate of your commercial property insurance costs. It's important to consult with an insurance professional to determine an adequate replacement cost estimate. Zillow has 10 photos of this $328,990 3 beds, 2 baths, 1,672 square feet single family home located at 64 melogold dr, ormond beach, fl 32174 mls #1209054. In contrast, a brick or concrete building will cost on average $150 to replace. In contrast, a brick or concrete building will cost on average $150 to replace. Multiply your home's square footage by the average cost per square foot to build a home in your area. Builders risk insurance is essential for protecting structures, materials, and labor during construction from various risks like fire, theft, and severe weather. Is $2,601 annually, or $217. It's important to consult with an insurance professional to determine an adequate replacement cost estimate. Replacement cost can be calculated by multiplying your home’s square footage by your area’s average construction cost per square foot. Specify the total number of floors your building will have, including basements and. Many insurance companies provide access to web. Zillow has 10 photos of. But how is home insurance calculated? Replacement cost can be calculated by multiplying your home’s square footage by your area’s average construction cost per square foot. The average home insurance cost in the u.s. If you like what you see, you can get a detailed quote tailored to your business. Many insurance companies provide access to web. If you like what you see, you can get a detailed quote tailored to your business. Pay an average rate of $2,285 per year for $300,000 in dwelling coverage (as of october 2024). But how is home insurance calculated? Insurance companies use a replacement cost estimator tool to figure out your estimated replacement cost, but you can also estimate it. Our homeowners insurance cost calculator can give you an estimate of what you might pay for your policy based on factors specific to you and your home. You may also use online tools, get an. How much insurance you need for a home depends on different factors. When you purchase home insurance, an insurer typically uses specialized software to estimate. Insurance companies use a replacement cost estimator tool to figure out your estimated replacement cost, but you can also estimate it on your own. Add this tool to your favorites It's important to consult with an insurance professional to determine an adequate replacement cost estimate. Multiply your home's square footage by the average cost per square foot to build a. The average home insurance cost in the u.s. Zillow has 10 photos of this $328,990 3 beds, 2 baths, 1,672 square feet single family home located at 64 melogold dr, ormond beach, fl 32174 mls #1209054. Get detailed breakdowns for materials, labor, and overhead for any building project. Builders risk insurance is essential for protecting structures, materials, and labor during. But how is home insurance calculated? Is $2,601 annually, or $217 monthly for $300,000 in dwelling coverage, but these rates vary based on where you live. Specify the total number of floors your building will have, including basements and. By answering a few questions about your net worth, deductible preference, and the cost to rebuild your home and replace your. Include all floors and usable spaces. Many insurance companies provide access to web. Specify the total number of floors your building will have, including basements and. Add the cost for major parts of. Calculate accurate construction costs with our free estimator. The average home insurance cost in the u.s. Add this tool to your favorites How much insurance you need for a home depends on different factors. Our homeowners insurance cost calculator can give you an estimate of what you might pay for your policy based on factors specific to you and your home. Builders risk insurance is essential for protecting. But how is home insurance calculated? Is $2,601 annually, or $217 monthly for $300,000 in dwelling coverage, but these rates vary based on where you live. If you like what you see, you can get a detailed quote tailored to your business. Include all floors and usable spaces. Add this tool to your favorites Our homeowners insurance cost calculator can give you an estimate of what you might pay for your policy based on factors specific to you and your home. By answering a few questions about your net worth, deductible preference, and the cost to rebuild your home and replace your belongings, our property insurance calculator can estimate home. Builders risk insurance is essential for protecting structures, materials, and labor during construction from various risks like fire, theft, and severe weather. Specify the total number of floors your building will have, including basements and. Pay an average rate of $2,285 per year for $300,000 in dwelling coverage (as of october 2024). The average home insurance cost in the u.s. Get detailed breakdowns for materials, labor, and overhead for any building project. How much insurance you need for a home depends on different factors. Our homeowners insurance calculator helps you estimate your home insurance costs by using the average rate among insurers in your zip code. Insurance companies use a replacement cost estimator tool to figure out your estimated replacement cost, but you can also estimate it on your own. Replacement cost can be calculated by multiplying your home’s square footage by your area’s average construction cost per square foot.Construction Estimate Template Free Download Example of Spreadshee

Example Of Building Cost Estimator Spreadsheet Quote Template inside

Home Building Insurance Calculator A Comprehensive Guide Modern

Insurance Restoration Sample Construction Estimate Material Takeoff

Commercial Insurance Replacement Cost Estimator Financial Report

Building Cost Spreadsheet Template Uk —

Insurance Restoration Sample Construction Estimate Material Takeoff

Insurance Replacement Cost Estimator Financial Report

Insurance Building Cost Estimator Financial Report

Insurance Building Cost Estimator Financial Report

It's Important To Consult With An Insurance Professional To Determine An Adequate Replacement Cost Estimate.

Multiply Your Home's Square Footage By The Average Cost Per Square Foot To Build A Home In Your Area.

You May Also Use Online Tools, Get An.

In Contrast, A Brick Or Concrete Building Will Cost On Average $150 To Replace.

Related Post: