Building Credit For Business

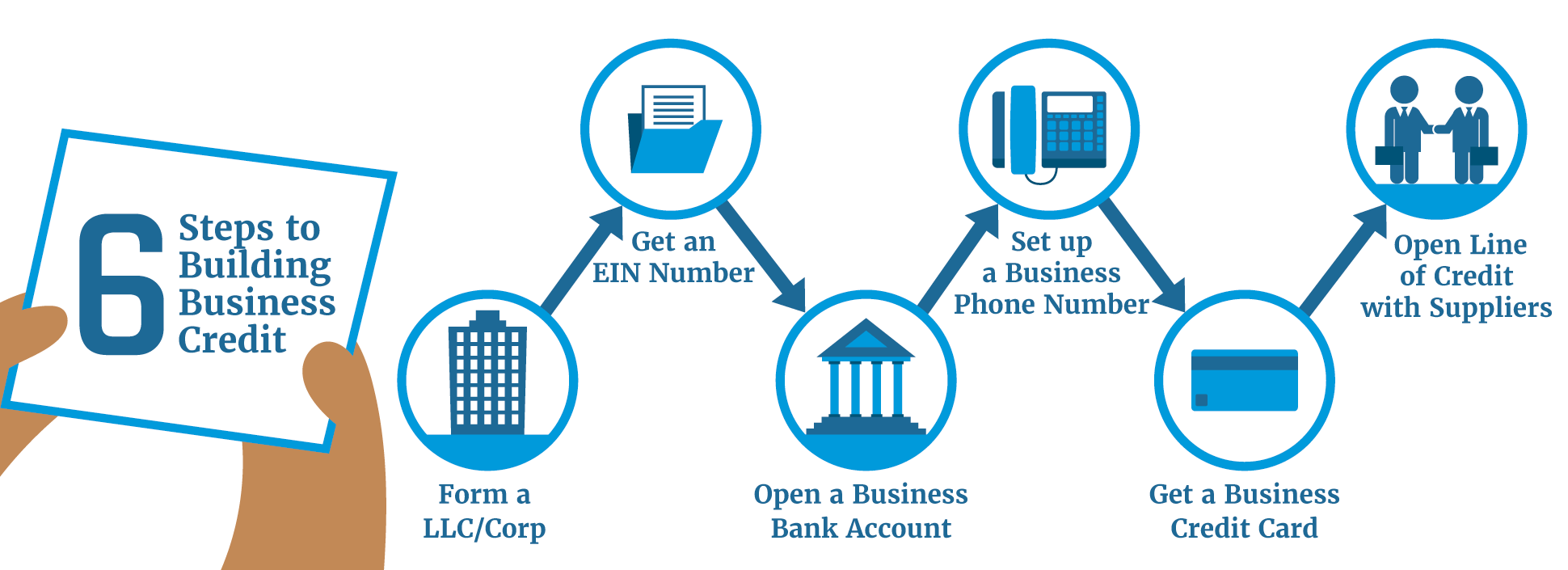

Building Credit For Business - Getting a business credit score can help your business establish itself. It can also help you negotiate supply. Common mistakes to avoid when building business credit. Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Best vendor accounts to build business credit fast. Building business credit can benefit your small business in many ways. Here’s everything you need to know. Take these steps to establish and build a solid credit rating for your company. Credit history and startups without established financial track records. These financial institutions are featured in our rate research: Key steps to building business credit involve choosing the right business structure, obtaining a federal tax id number, opening a business bank account, establishing credit with. Consistent responsible credit use is key; Building business credit can benefit your small business in many ways. Establishing an llc and building strong business credit can help your business qualify for a wider range of small business loan options. To qualify for the best business financing, you need to have a solid. These financial institutions are featured in our rate research: Build strong business credit by registering your business, getting a duns number,. These cards are particularly useful for immigrant business owners building u.s. Alliant credit union, ally bank, amerant bank, america first credit union, american express national bank,. By doing so, you not only. New businesses don’t have an established financial history that lenders can use to verify their risk. Common mistakes to avoid when building business credit. Best vendor accounts to build business credit fast. Build strong business credit by registering your business, getting a duns number,. Key steps to building business credit involve choosing the right business structure, obtaining a federal tax. This article provides a concise guide outlining the key steps on how to build. Build strong business credit by registering your business, getting a duns number,. Business credit builder accounts can help you build business credit, and they are often available to startups, as well as business owners with limited or poor personal credit. A solid business credit profile can. A solid business credit profile can open doors to. It typically takes about three years to build satisfactory credit; Understanding how to build business credit is vital as it can be used to secure loans, lines of credit, and other financial assistance to help your business grow. About the money basics guide serieswelcome to the ncua’s money basics guide to. Building business credit can benefit your small business in many ways. Consistent responsible credit use is key; Boosting your business credit can help open doors for more funding opportunities, such as increasing your eligibility for small business loans, working capital loans (like business. Building business credit is like laying the groundwork for future success. Establishing business credit is a pretty. It’s not just about getting a loan when you’re in a pinch. These financial institutions are featured in our rate research: Building up your business credit works in a similar fashion to your personal credit score, but there are some notable differences. Alliant credit union, ally bank, amerant bank, america first credit union, american express national bank,. Building business credit. Alliant credit union, ally bank, amerant bank, america first credit union, american express national bank,. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! Let’s look at the ten essential steps to setting. The first step toward building business credit is to establish your business legally as. It typically takes about three. Taking on debt and managing credit comes with risks. Build strong business credit by registering your business, getting a duns number,. It can also help you negotiate supply. Establishing business credit is a pretty straightforward process of following steps to create a business profile with federal and state agencies where you plan to do business, and with the. About the. Take advantage of opportunities and feel confident knowing you could have additional funds on hand with a wide range of business lines of credit. Key steps to building business credit involve choosing the right business structure, obtaining a federal tax id number, opening a business bank account, establishing credit with. The first step toward building business credit is to establish. Common mistakes to avoid when building business credit. Alliant credit union, ally bank, amerant bank, america first credit union, american express national bank,. Strong business credit can make it easier or less expensive to get certain types of financing, business. Knowing how to build business credit will make it easier to get small business loans and convince suppliers to extend. Common mistakes to avoid when building business credit. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! By doing so, you not only. Boosting your business credit can help open doors for more funding opportunities, such as increasing your eligibility for small business loans, working capital loans (like business. Building good business. Taking on debt and managing credit comes with risks. It can also help you negotiate supply. Best vendor accounts to build business credit fast. The money basics guides are a series of learning. Boosting your business credit can help open doors for more funding opportunities, such as increasing your eligibility for small business loans, working capital loans (like business. Here’s everything you need to know. It’s not just about getting a loan when you’re in a pinch. Understanding how to build business credit is vital as it can be used to secure loans, lines of credit, and other financial assistance to help your business grow. Instant access to the credit your business. Credit history and startups without established financial track records. Building business credit can benefit your small business in many ways. From understanding how business credit scores and reports are originated, to employing best practices for building up a strong business credit report, the experian blueprint is here to. About the money basics guide serieswelcome to the ncua’s money basics guide to building and maintaining credit! The first step toward building business credit is to establish your business legally as. Take advantage of opportunities and feel confident knowing you could have additional funds on hand with a wide range of business lines of credit. Here are some of the common business credit mistakes.Build Credit for Your EIN and unlock your access to large credit lines

How To Build Credit For Your Business Behalfessay9

5 Tips to Build Your Business Credit

How To Build Business Credit? GoKapital

How to Build Business Credit Fast The 10 Best Ways AMP Advance

How to Build Business Credit for a Small Business

How to Build Business Credit 7 Expert Tips to Build Credit Fast (2024)

How To Build Credit For Your Business Behalfessay9

Why Building Credit for Your Business is Crucial as an Owner

How to Build Business Credit For Your Small Business (Part 2) in 2021

New Businesses Don’t Have An Established Financial History That Lenders Can Use To Verify Their Risk.

It Typically Takes About Three Years To Build Satisfactory Credit;

Establishing And Managing Business Credit Can Help Your Company Secure Financing When You Need It And With Better Terms.

Consistent Responsible Credit Use Is Key;

Related Post: