Building Credit With Rent Payments

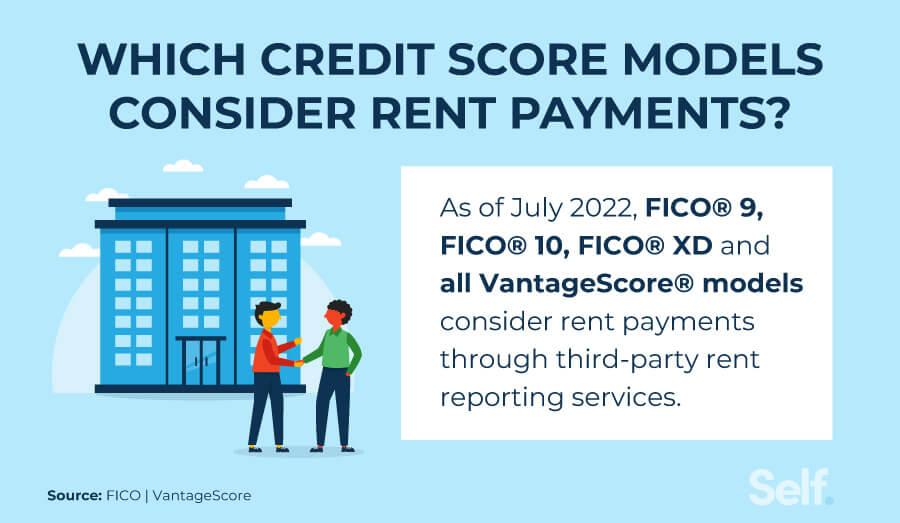

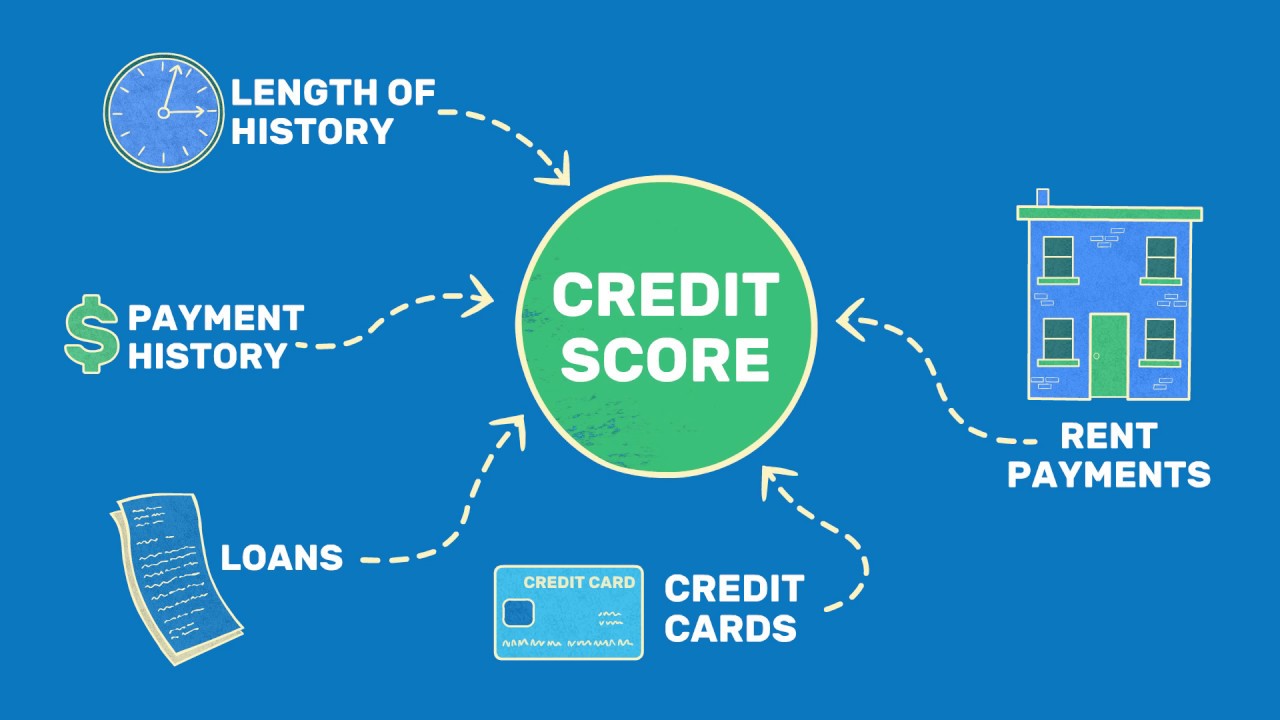

Building Credit With Rent Payments - The good news is, if you’re a renter, there are several ways. Rent reporting and credit builder account. As part of the consumer credit information panel (ccip), the cfpb purchased deidentified data maintained by a national consumer reporting company on rental housing. Pay bills on time consistently (using reminders if necessary), maintain credit card utilization at 30% or less, and. Learn more about when your rent may be reported to credit bureaus. A higher credit score may increase your odds of future loan approval and more favorable lending terms. When enrolled in rent reporting services, each punctual payment made becomes a step towards enhancing one’s credit score. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. That is, as long as your rent payments are being reported to the major credit bureaus — equifax®, experian®, and transunion®. Reporting your rent payments helps build credit and may help increase your credit score. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. You may be able to build credit by paying your rent on time, but it’s not as common as you might think. He offers three key recommendations for building credit: Credit renters is a unique service that converts your rent payment into a revolving line of credit. This won’t happen automatically, though. A higher credit score may increase your odds of future loan approval and more favorable lending terms. Paying rent can be a path to build credit. You need a certified data furnisher who can report your. With this, you're able to make payments on your rent monthly, while your good payment. This elevated credit standing can then unlock a. Learn more about when your rent may be reported to credit bureaus. The good news is, if you’re a renter, there are several ways. With this, you're able to make payments on your rent monthly, while your good payment. This won’t happen automatically, though. Rent reporting and credit builder account. Paying rent can be a path to build credit. This elevated credit standing can then unlock a. With this, you're able to make payments on your rent monthly, while your good payment. One underutilized way to boost your financial future is to build credit with rent payments. A higher credit score may increase your odds of future loan approval and. Here’s how it works and how you can benefit greatly over time. Paying rent can be a path to build credit. Reporting your rent payments helps build credit and may help increase your credit score. He offers three key recommendations for building credit: Credit renters is a unique service that converts your rent payment into a revolving line of credit. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. Reporting your rent payments helps build credit and may help increase your credit score. When enrolled in rent reporting services, each punctual payment made becomes a step towards enhancing one’s credit score. The good news is, if you’re a renter, there are several ways.. The good news is, if you’re a renter, there are several ways. One underutilized way to boost your financial future is to build credit with rent payments. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. That is, as long as your rent payments are being reported to the major credit bureaus —. This elevated credit standing can then unlock a. Reporting your rent payments helps build credit and may help increase your credit score. More than half (51 percent) of the. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. Credit renters is a unique service that converts your rent payment into a revolving line. Credit renters is a unique service that converts your rent payment into a revolving line of credit. A higher credit score may increase your odds of future loan approval and more favorable lending terms. The good news is, if you’re a renter, there are several ways. That is, as long as your rent payments are being reported to the major. This elevated credit standing can then unlock a. As part of the consumer credit information panel (ccip), the cfpb purchased deidentified data maintained by a national consumer reporting company on rental housing. Learn more about when your rent may be reported to credit bureaus. To obtain assistance through the housing choice voucher (hcv) program, as administered by the chicago housing. With this, you're able to make payments on your rent monthly, while your good payment. You may be able to build credit by paying your rent on time, but it’s not as common as you might think. Pay bills on time consistently (using reminders if necessary), maintain credit card utilization at 30% or less, and. One underutilized way to boost. Learn more about when your rent may be reported to credit bureaus. With this, you're able to make payments on your rent monthly, while your good payment. That is, as long as your rent payments are being reported to the major credit bureaus — equifax®, experian®, and transunion®. He offers three key recommendations for building credit: As part of the. This won’t happen automatically, though. Get your rent payments reported to all three credit bureaus for free, or pay a monthly. You need a certified data furnisher who can report your. To obtain assistance through the housing choice voucher (hcv) program, as administered by the chicago housing authority (cha), prospective renters in chicago must earn a low income. He offers three key recommendations for building credit: A higher credit score may increase your odds of future loan approval and more favorable lending terms. Reporting your rent payments helps build credit and may help increase your credit score. Pay bills on time consistently (using reminders if necessary), maintain credit card utilization at 30% or less, and. When enrolled in rent reporting services, each punctual payment made becomes a step towards enhancing one’s credit score. One underutilized way to boost your financial future is to build credit with rent payments. The good news is, if you’re a renter, there are several ways. This elevated credit standing can then unlock a. That is, as long as your rent payments are being reported to the major credit bureaus — equifax®, experian®, and transunion®. Here’s how it works and how you can benefit greatly over time. More than half (51 percent) of the. Learn more about when your rent may be reported to credit bureaus.Building Credit for Your Renters & How to Report Rent Payments to the

Does Paying Rent Build Credit? [2023 Guide]

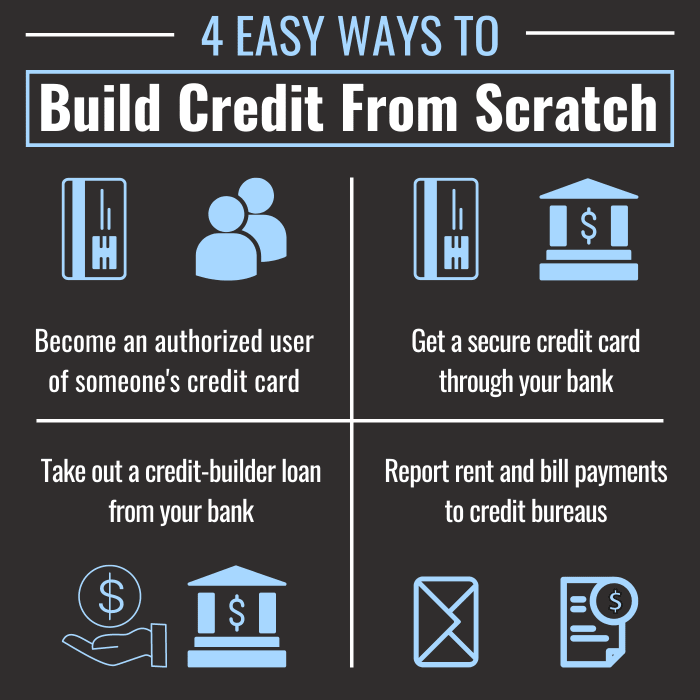

4 Ways to Safely Build Credit When You Have None TheStreet

Does Paying Rent Build Credit? Self. Credit Builder.

How To Build Credit Quickly By Reporting Your Rent YouTube

How to build credit by paying rent? Leia aqui Does paying rent add to

6 Best Rent Reporting Services Build Credit With Rent 2024

Is rent reporting worth it? Leia aqui Does good rental history help

Build Your Credit by Reporting Past Rent Payments

Do Rent to Own (RTO) Payments Help Build My Credit? The Renters Best

Credit Renters Is A Unique Service That Converts Your Rent Payment Into A Revolving Line Of Credit.

Rent Reporting And Credit Builder Account.

You May Be Able To Build Credit By Paying Your Rent On Time, But It’s Not As Common As You Might Think.

With This, You're Able To Make Payments On Your Rent Monthly, While Your Good Payment.

Related Post:

![Does Paying Rent Build Credit? [2023 Guide]](https://res.cloudinary.com/apartmentlist/image/fetch/f_auto,q_auto,t_renter_life_article/https://images.ctfassets.net/jeox55pd4d8n/5tMPWtcXGinWWVVhMLwQDG/7067863e820c172ffd880eb1ccd2c873/Why_Report_Rental_Payments_.png)