Building Debit Or Credit

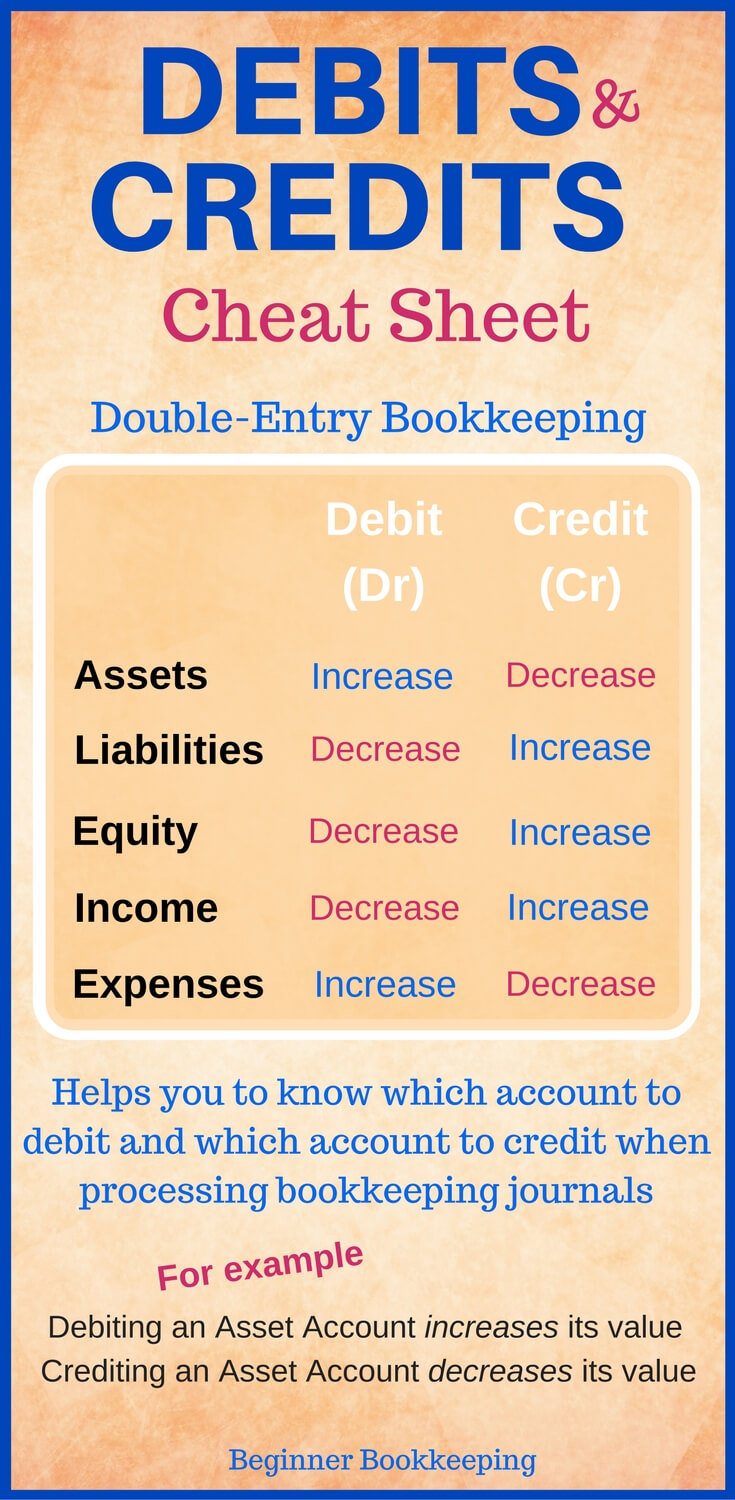

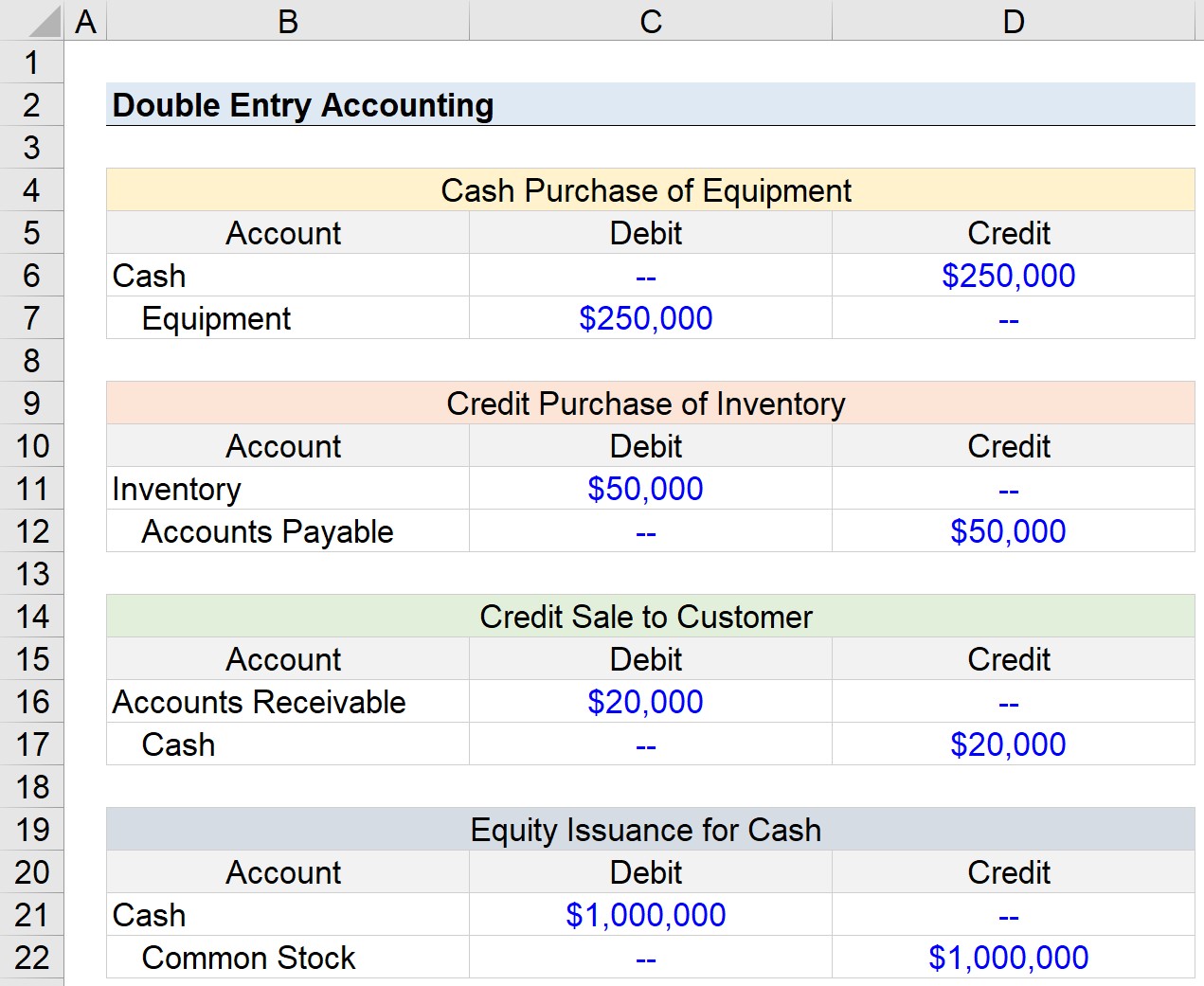

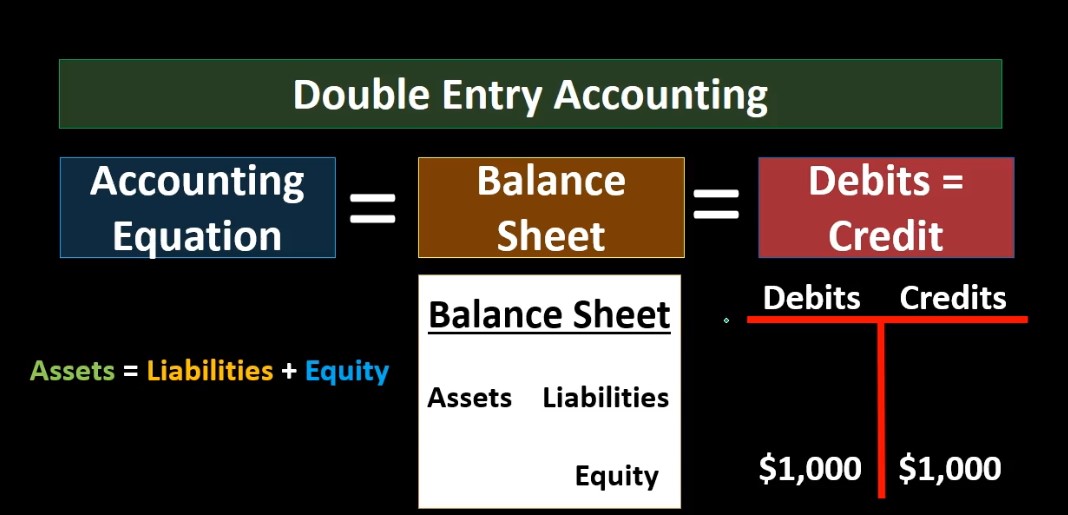

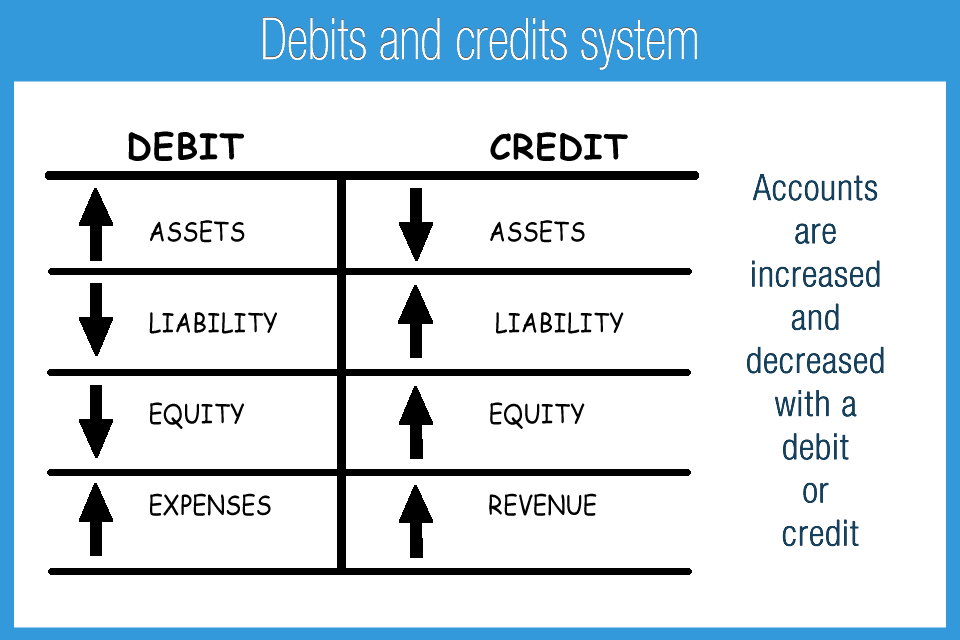

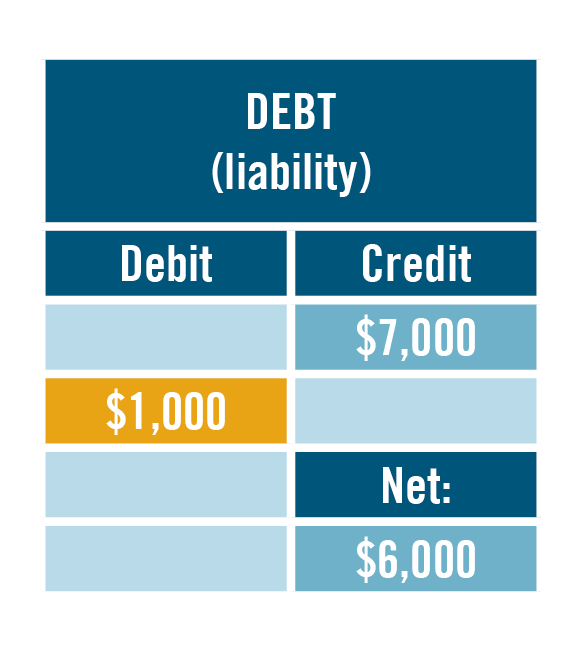

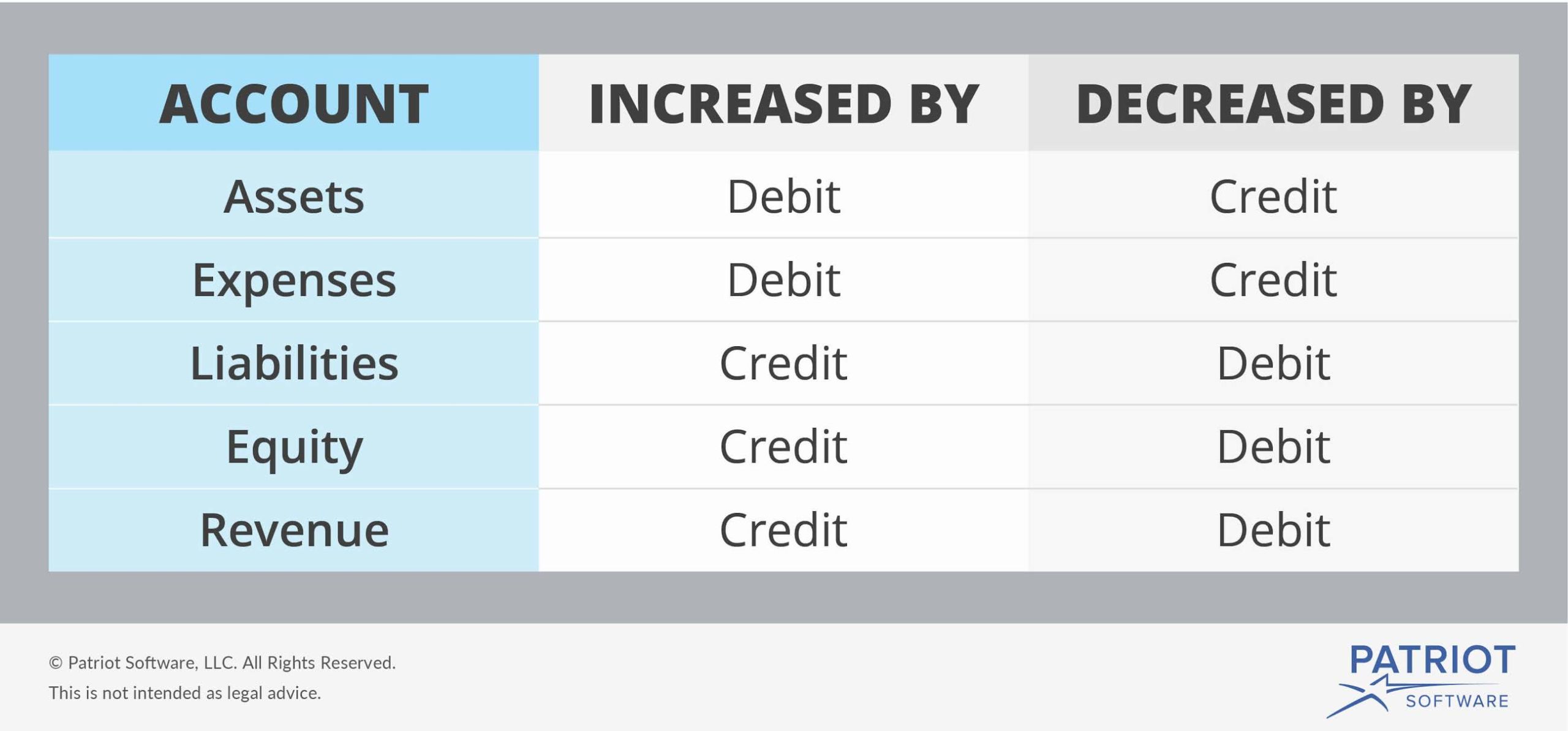

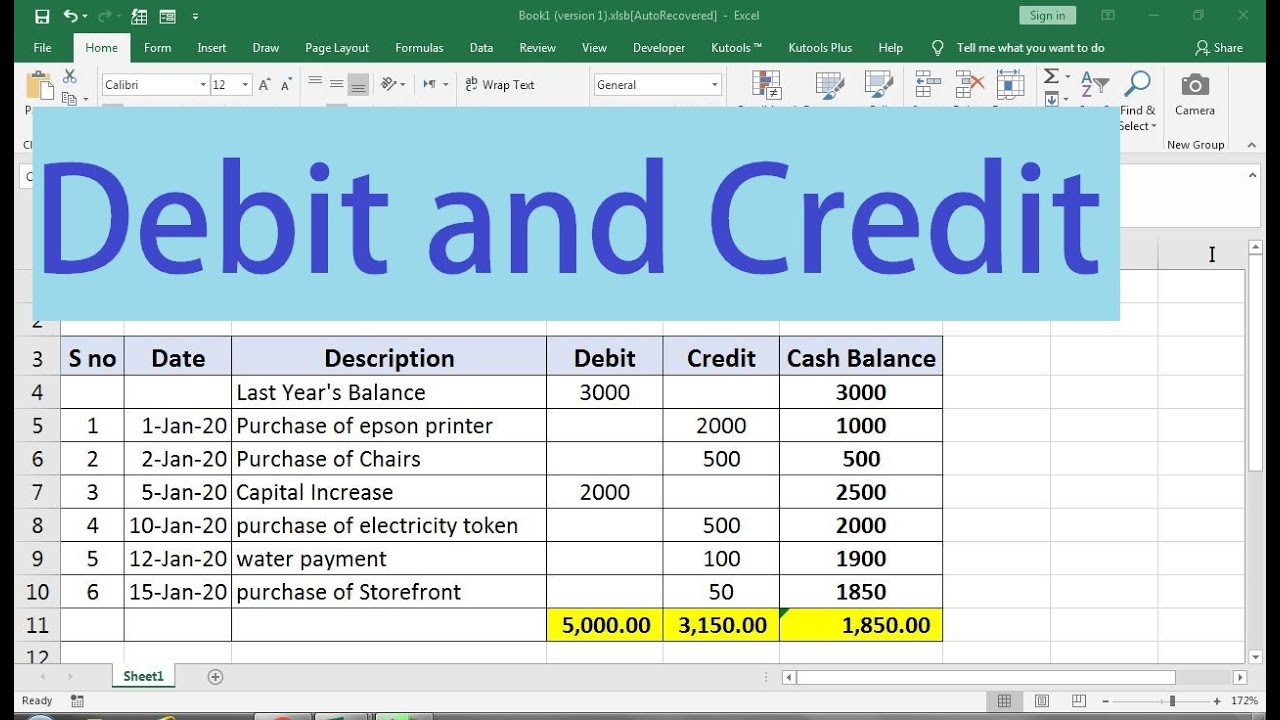

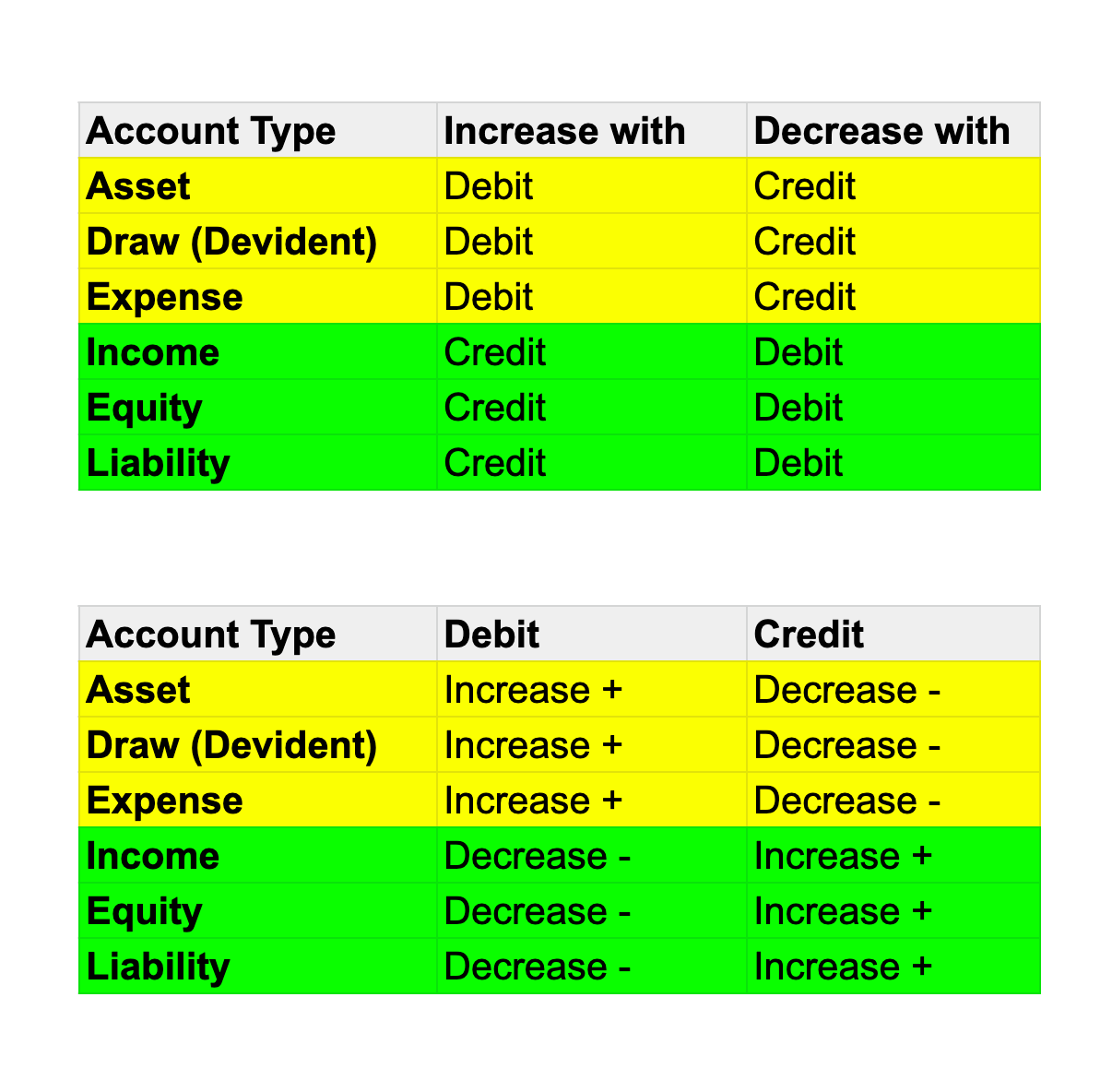

Building Debit Or Credit - Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. 95 rows examples of accounts and debit/credit rules. Debit pertains to the left side of an account, while credit refers to the right. What you need to know. Asset accounts normally have debit balances. In accounting, debits and credits are the fundamental building blocks for recording financial transactions. At kindred credit union, we believe a debit card is more than just a way to pay or access your cash—it helps provide people financial independence and security. Some services like cred.ai can let you use a debit card and build credit at the same time. The amount in every transaction must be entered in one account as. Each account has a debit and credit side. They may appear challenging, but understanding debits and credits is. What you need to know. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. 95 rows examples of accounts and debit/credit rules. Asset accounts normally have debit balances. Some services like cred.ai can let you use a debit card and build credit at the same time. Some debit cards are set up to help you build credit. Debit pertains to the left side of an account, while credit refers to the right. A debit in an accounting entry will decrease an equity or liability account. The amount in every transaction must be entered in one account as. Even so, building credit is crucial — it can determine much of what you’re able to do (and buy) in adulthood, from renting a place to live to financing a car or an education — so. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. Debits and credits are crucial to recording transactions on a balance. While assets, liabilities and equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction. Debit pertains to the left side of an account, while credit refers to the right. Even so, building credit is crucial — it can determine much of what you’re able to do (and buy). Learn all about them in our breakdown. The difference between debits and credits lies in how they affect your various business accounts. While assets, liabilities and equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction. A debit in an accounting entry will decrease an equity or liability. What are the rules of debit and credit? Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. Debits and credits are used in a company’s bookkeeping in order for its books to balance. What you need to know. Each account has a debit and credit side. A debit in an accounting entry will decrease an equity or liability account. Some services like cred.ai can let you use a debit card and build credit at the same time. Even so, building credit is crucial — it can determine much of what you’re able to do (and buy) in adulthood, from renting a place to live to financing. The amount in every transaction must be entered in one account as. Both debit and credit come with their unique sets of pros and cons that businesses should consider before deciding which one works best for them. Each account has a debit and credit side. Some debit cards are set up to help you build credit. Debits increase asset or. Debits and credits are terms used by bookkeepers and accountants when recording transactions in the accounting records. What are the rules of debit and credit? Both debit and credit come with their unique sets of pros and cons that businesses should consider before deciding which one works best for them. 95 rows examples of accounts and debit/credit rules. How do. Each account has a debit and credit side. Learn all about them in our breakdown. Debits and credits are terms used by bookkeepers and accountants when recording transactions in the accounting records. Some services like cred.ai can let you use a debit card and build credit at the same time. Debits increase asset or expense accounts and decrease liability, revenue. Debits and credits are terms used by bookkeepers and accountants when recording transactions in the accounting records. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. The difference between debits and credits lies in how they affect your various business accounts. 95 rows examples of accounts and debit/credit rules. Both debit and credit come with their. A debit in an accounting entry will decrease an equity or liability account. Debits and credits are used in a company’s bookkeeping in order for its books to balance. They may appear challenging, but understanding debits and credits is. What you need to know. While assets, liabilities and equity are types of accounts, debits and credits are the increases and. In accounting, debits and credits are the fundamental building blocks for recording financial transactions. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. Both debit and credit come with their unique sets of pros and cons that businesses should consider before deciding which one works best for them. While assets, liabilities and equity are types of accounts, debits and credits are the increases and decreases made to the various accounts whenever a financial transaction. The difference between debits and credits lies in how they affect your various business accounts. How do you tell an asset from a liability? What are the rules of debit and credit? Learn all about them in our breakdown. Debits and credits are used in a company’s bookkeeping in order for its books to balance. At kindred credit union, we believe a debit card is more than just a way to pay or access your cash—it helps provide people financial independence and security. Some debit cards are set up to help you build credit. The amount in every transaction must be entered in one account as. What you need to know. A debit in an accounting entry will decrease an equity or liability account. Debits and credits are crucial to recording transactions on a balance sheet. Debit pertains to the left side of an account, while credit refers to the right.Debits and Credits

accounting liability debit credit 3 best methods to remember debits

Debits & Credits 205 Accounting Instruction, Help, & How To

What is Debit and Credit? Explanation, Difference, and Use in Accounting

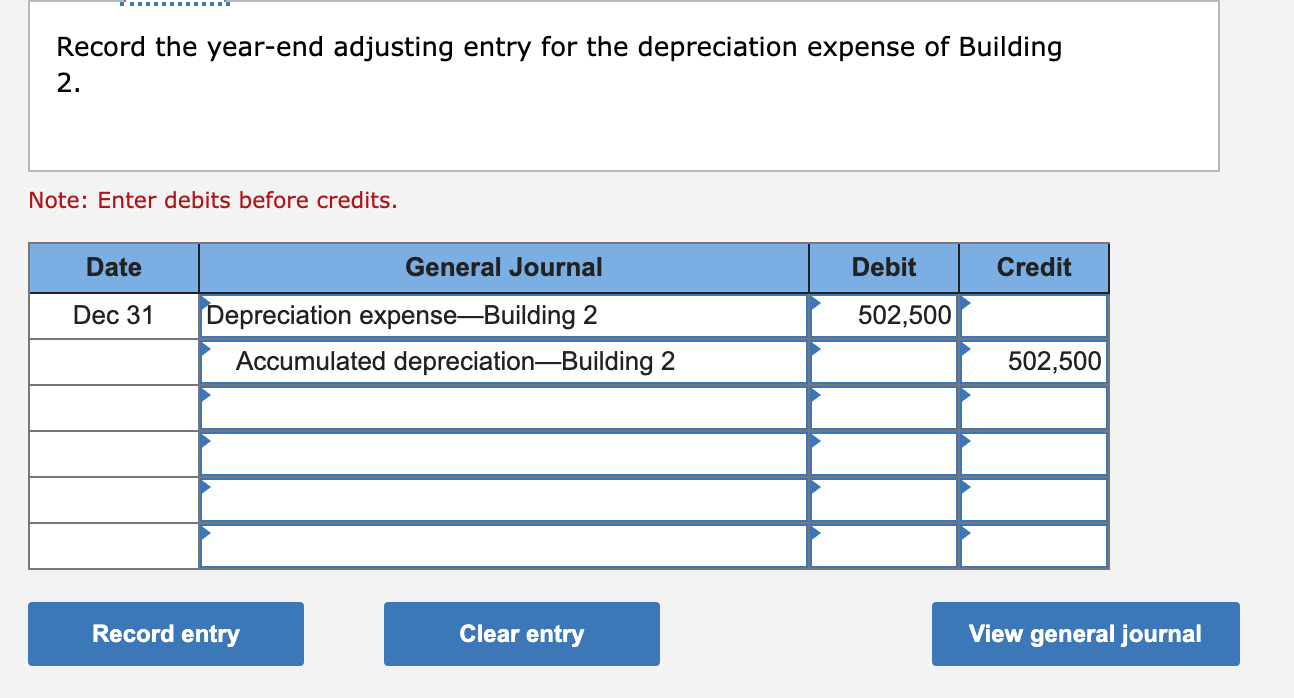

Solved Required information Problem 83A Asset cost

Accounting 101 Debit and Credits Carr, Riggs & Ingram CPAs and Advisors

Accounting Basics Debits and Credits

how to make debit and credit sheet in excel YouTube

Debit vs. credit in accounting Guide with examples for 2024

accounting debit and credit chart Debit and credit cheat sheet

Asset Accounts Normally Have Debit Balances.

They May Appear Challenging, But Understanding Debits And Credits Is.

Even So, Building Credit Is Crucial — It Can Determine Much Of What You’re Able To Do (And Buy) In Adulthood, From Renting A Place To Live To Financing A Car Or An Education — So.

Some Services Like Cred.ai Can Let You Use A Debit Card And Build Credit At The Same Time.

Related Post: