Building Etf

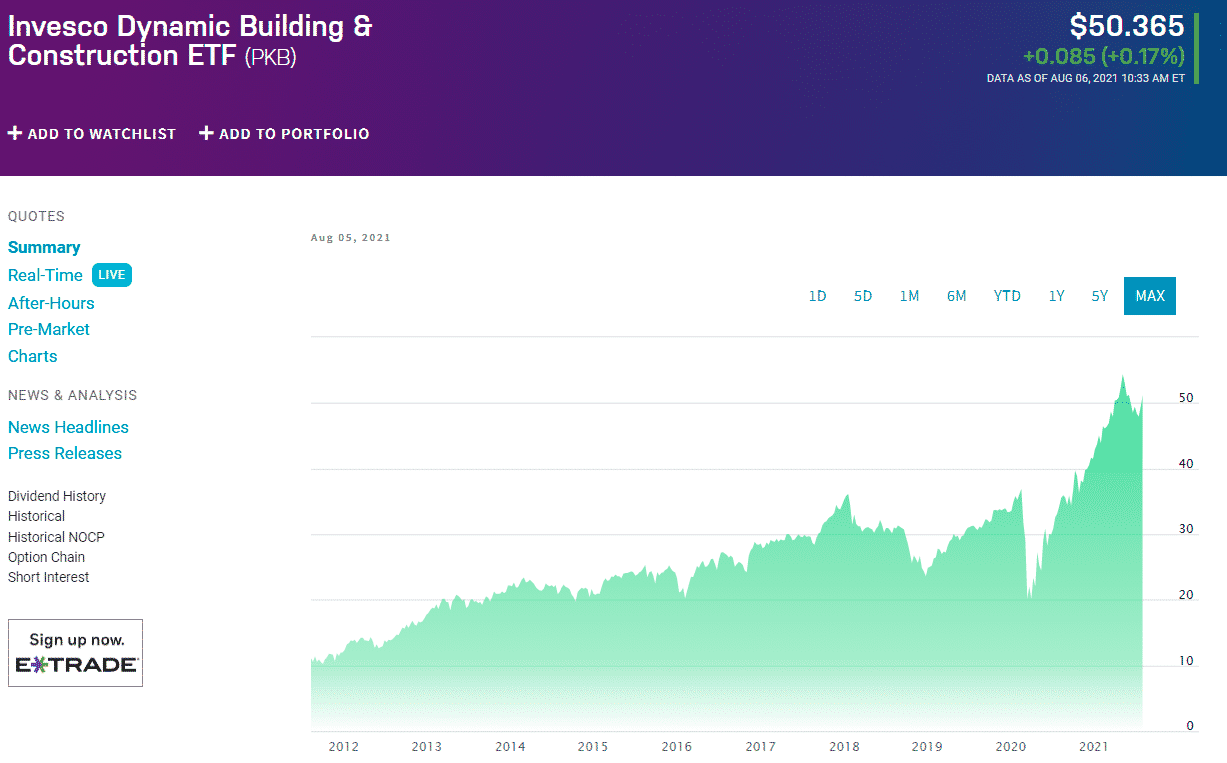

Building Etf - The firm’s largest fund is the. Invesco building & construction etf is a reasonable option for investors seeking to outperform the industrials etfs segment of the market. Growth and income etfsgrowth & income balanceactive transparent etfs Click on the tabs below to see more information on homebuilders etfs,. This etf offers exposure to the u.s. In such a background, here are a few housing etfs that investors may choose to play/avoid depending on market conditions. Target industries like tech or clean energy for specific opportunities. Strategic beta etfsleveraged inverse etfsinverse etfsleveraged etfs Click to see returns, expenses, dividends, holdings, taxes, technicals and more. Building on prior mckinsey research focused on black residents, 1 the state of black residents: One such fund is the ishares u.s. Construction and engineering etfs offer exposure to a basket of companies involved in various aspects of infrastructure development, including engineering services, building materials, and. This etf offers exposure to the u.s. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. The fund will normally invest at least 90% of its total assets in the. Target industries like tech or clean energy for specific opportunities. Spdr s&p homebuilders etf (xhb) the underlying s&p homebuilders select. The expense ratio of pave is 0.47% compared to the median of all other etfs which is 0.49%. However, there are other etfs in. Building on the success of gmo's existing etf lineup, bchi represents a strategic expansion of the firm's investment solutions for a global investor base. In addition to pure play. For investors looking for etfs to help them bet on housing momentum, there are plenty of options. The invesco building & construction etf (fund) is based on the dynamic building &. Pkb seeks to match the performance. The relevance of place to racial equity and outcomes,. The average expense ratio for etfs in building and construction is 0.50%. Flexible access to investment expertise. Growth and income etfsgrowth & income balanceactive transparent etfs The fund will normally invest at least 90% of its total assets in the. The invesco building & construction etf (fund) is based on the dynamic building & construction intellidex℠ index (index). In such a background, here are a few housing etfs that investors may choose to play/avoid depending on market conditions. Homebuilding industry, and as such offers exposure to. Managed by invesco, pkb has amassed assets over $419.78 million, making it one of the average sized etfs in the industrials etfs. Strategic beta etfsleveraged inverse etfsinverse etfsleveraged etfs Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. Home construction etf itb, invesco building & construction etf pkb. Building on prior mckinsey research focused on black residents, 1 the state of black residents: Learn everything you need to know about invesco building & construction etf (pkb) and how it ranks compared to other funds. Building on the success of gmo's existing etf lineup, bchi represents a strategic expansion of the firm's investment solutions for a global investor base.. However, there are other etfs in. Invesco building & construction etf is a reasonable option for investors seeking to outperform the industrials etfs segment of the market. Growth and income etfsgrowth & income balanceactive transparent etfs Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. (jutm), 6150195 (jfm). With 44 etfs traded on the us markets, goldman sachs etfs have total assets under management of $36.3 billion, according to etf.com data. Building on the success of gmo's existing etf lineup, bchi represents a strategic expansion of the firm's investment solutions for a global investor base. Building on prior mckinsey research focused on black residents, 1 the state of. Learn everything you need to know about invesco building & construction etf (pkb) and how it ranks compared to other funds. Growth and income etfsgrowth & income balanceactive transparent etfs L'adresse enregistrée de chacune de ces entités est the zig zag building, 70. One such fund is the ishares u.s. Home construction etf itb, invesco building & construction etf pkb. Click on the tabs below to see more information on homebuilders etfs,. Against this backdrop, below we detail a few homebuilding and construction etfs that could be up for gains. This etf is focused on the u.s. Spdr s&p homebuilders etf (xhb) the underlying s&p homebuilders select. Such improvement puts etfs like spdr s&p homebuilders etf xhb, ishares u.s. (jutm), 6150195 (jfm) et 792030 (jimg). Growth and income etfsgrowth & income balanceactive transparent etfs Managed by invesco, pkb has amassed assets over $419.78 million, making it one of the average sized etfs in the industrials etfs. This etf is focused on the u.s. Building on prior mckinsey research focused on black residents, 1 the state of black residents: 4 etfs are placed in the building & construction category. Against this backdrop, below we detail a few homebuilding and construction etfs that could be up for gains. The relevance of place to racial equity and outcomes,. This etf offers exposure to the u.s. The average expense ratio for etfs in building and construction is 0.50%. Homebuilders etfs invest in companies that operate in the residential home construction industry. Managed by invesco, pkb has amassed assets over $419.78 million, making it one of the average sized etfs in the industrials etfs. Click on the tabs below to see more information on homebuilders etfs,. Homebuilding industry, and as such offers exposure to a corner of the domestic economy that tends to be cyclical in nature. Grayscale files for a spot cardano etf. With 44 etfs traded on the us markets, goldman sachs etfs have total assets under management of $36.3 billion, according to etf.com data. Spdr s&p homebuilders etf (xhb) the underlying s&p homebuilders select. In addition to pure play. The fund will normally invest at least 90% of its total assets in the. One such fund is the ishares u.s. (jutm), 6150195 (jfm) et 792030 (jimg).The New Investor’s Guide to Building an ETF Portfolio Morningstar

Building Your ETF Portfolio How to Look for ETFs YouTube

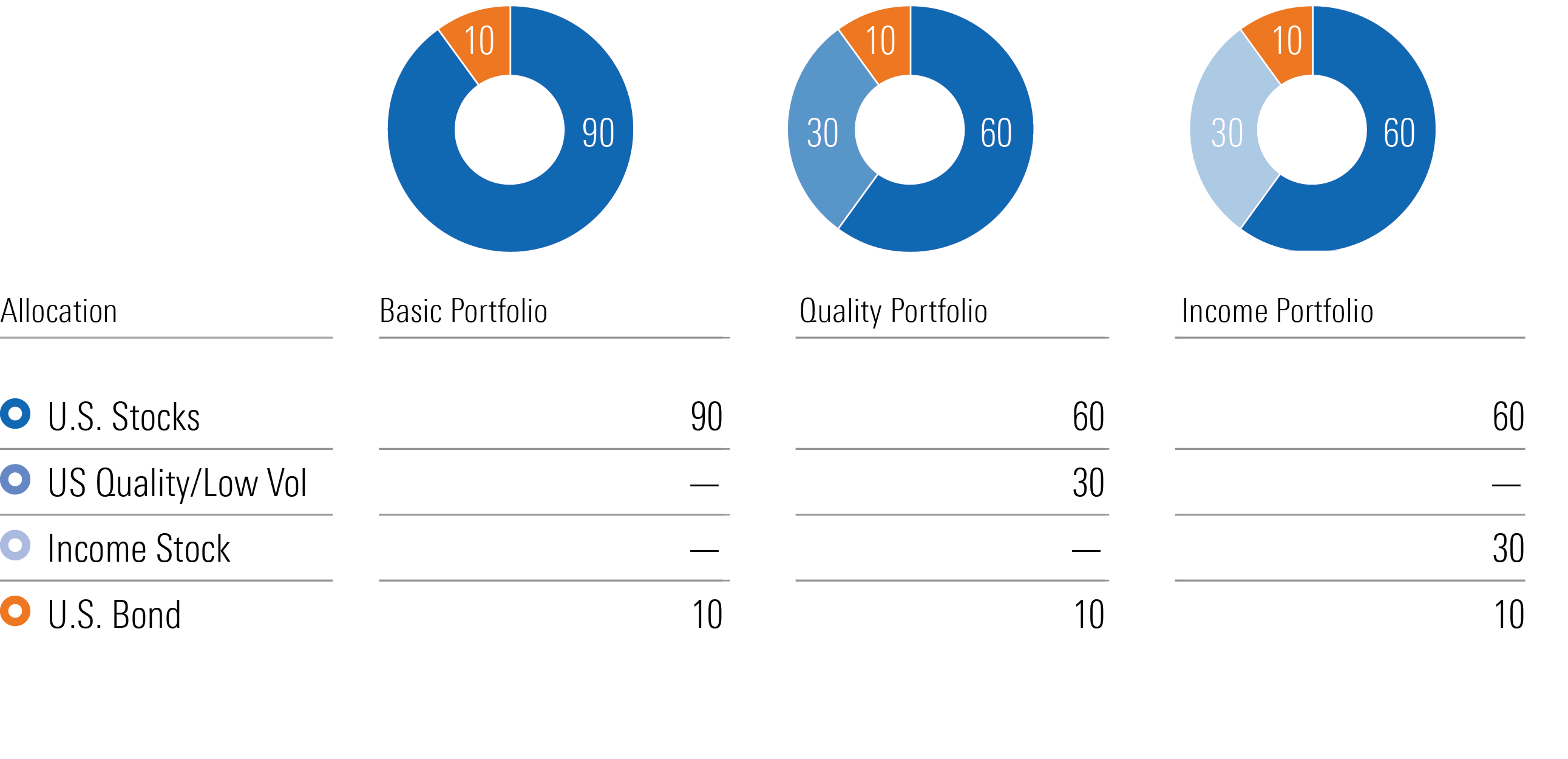

Building All ETF Diversified Portfolio WealthDesk

Whitepaper Building and Distributing an ETF

How to Build an ETF Portfolio

Best 5 Homebuilder ETFs ETFHead

Bitcoin ETFs Absorb 520 Million As Grayscale Outflows Reach New Low

Building ETF Vs Index Mutual Fund Portfolio Differences, Cost, Ease

ETFs 103 Building an ETF Portfolio with Horizons ETFs YouTube

How to Build an ETF Portfolio with 100! (Full Course on ETFs) YouTube

Building On Prior Mckinsey Research Focused On Black Residents, 1 The State Of Black Residents:

Growth And Income Etfsgrowth & Income Balanceactive Transparent Etfs

L'adresse Enregistrée De Chacune De Ces Entités Est The Zig Zag Building, 70.

However, There Are Other Etfs In.

Related Post: