Building Generational Wealth With Life Insurance

Building Generational Wealth With Life Insurance - Generational wealth is about building foundations. In 2021, many financial advisors and estate planners are recommending a new way to pass down generational wealth—and it might not be what you expect. Here, we’ll explores how life insurance can become. Learn how to build generational wealth through life insurance and create a solid foundation for your family's financial future. Building generational wealth is a crucial goal for many families, as it provides a financial foundation that can support future generations. You might also choose to invest in a real estate investment trust (reit). Life insurance is one of the most effective, yet often overlooked, tools in building and preserving wealth across generations. Life insurance is often overlooked as a tool for wealth transfer, but it can be a powerful way to provide financial security for future. In particular, goheen recommends creating this portfolio via life insurance, noting that many physicians are unaware of how they can effectively leverage it. Iul is a type of life insurance policy that offers a unique way to build wealth while providing a death benefit to your beneficiaries. In 2021, many financial advisors and estate planners are recommending a new way to pass down generational wealth—and it might not be what you expect. In 2022, black families held $15 for every $100 held by white families. Life insurance is a powerful tool for building and transferring wealth to future generations. Here at expressive wealth, we empower you to find clarity around your family’s financial future and build generational wealth to carry your legacy forward. Generational wealth goes beyond just. You might also choose to invest in a real estate investment trust (reit). Our commitment to your wealth journey includes listening intently, placing your interests first, and crafting a multigenerational wealth plan that represents your family’s priorities. Life insurance is one of the most effective, yet often overlooked, tools in building and preserving wealth across generations. Beyond the accumulation phase.🎙️ welcome to the life insurance financial edu. A policy can cover more than just a funeral, but mortgages,. You might also choose to invest in a real estate investment trust (reit). However, you need to realize that any amount you still owe on a loan backed up by your life insurance will be taken out of the payout to your beneficiaries if you pass away before. Building generational wealth is a crucial goal for many families, as it. Life insurance is a powerful tool for building and transferring wealth to future generations. In this episode, we explore building generational wealth with infinite banking: However, buying entire buildings isn’t the only way to build generational wealth from real estate. A policy can cover more than just a funeral, but mortgages,. For those who want to know. Learn how to build generational wealth through life insurance and create a solid foundation for your family's financial future. In particular, goheen recommends creating this portfolio via life insurance, noting that many physicians are unaware of how they can effectively leverage it. Generational wealth is about building foundations. In this episode, we explore building generational wealth with infinite banking: Generational. Life insurance is one of the most effective, yet often overlooked, tools in building and preserving wealth across generations. You might also choose to invest in a real estate investment trust (reit). For some individuals, it’s about giving the gift of greater financial security or freedom — strengthening a foundation that already exists. For many people, a focus is on. Iul is a type of life insurance policy that offers a unique way to build wealth while providing a death benefit to your beneficiaries. The disparity in wealth between white and black households is stark. In 2022, black families held $15 for every $100 held by white families. However, buying entire buildings isn’t the only way to build generational wealth. You might also choose to invest in a real estate investment trust (reit). Our commitment to your wealth journey includes listening intently, placing your interests first, and crafting a multigenerational wealth plan that represents your family’s priorities. Iul is a type of life insurance policy that offers a unique way to build wealth while providing a death benefit to your. You might also choose to invest in a real estate investment trust (reit). In 2022, black families held $15 for every $100 held by white families. Life insurance is often overlooked as a tool for wealth transfer, but it can be a powerful way to provide financial security for future. Life insurance is a way to build wealth by using. Through strategic investing and comprehensive financial planning, we guide your path to. Life insurance is one of the most effective, yet often overlooked, tools in building and preserving wealth across generations. For many people, a focus is on building generational wealth, and that goes beyond simply building up a retirement fund or a stock portfolio to pass on to their. You might also choose to invest in a real estate investment trust (reit). As you create your plan for building generational wealth, consider the following tips. Through strategic investing and comprehensive financial planning, we guide your path to. Iul is a type of life insurance policy that offers a unique way to build wealth while providing a death benefit to. Life insurance is a way to build wealth by using a life insurance policy as a transfer strategy to your next generation. A policy can cover more than just a funeral, but mortgages,. For some individuals, it’s about giving the gift of greater financial security or freedom — strengthening a foundation that already exists. However, you need to realize that. Beyond the accumulation phase.🎙️ welcome to the life insurance financial edu. Generational wealth goes beyond just. In 2021, many financial advisors and estate planners are recommending a new way to pass down generational wealth—and it might not be what you expect. It’s life insurance, but here’s the. For some individuals, it’s about giving the gift of greater financial security or freedom — strengthening a foundation that already exists. Building generational wealth is a crucial goal for many families, as it provides a financial foundation that can support future generations. Iul is a type of life insurance policy that offers a unique way to build wealth while providing a death benefit to your beneficiaries. Life insurance is a powerful tool for building and transferring wealth to future generations. Learn how to build generational wealth through life insurance and create a solid foundation for your family's financial future. The first method to build generational wealth. We help you plan for your future with a keen focus on your goals and generational impact. In this episode, we explore building generational wealth with infinite banking: For many people, a focus is on building generational wealth, and that goes beyond simply building up a retirement fund or a stock portfolio to pass on to their heirs. The disparity in wealth between white and black households is stark. Here at expressive wealth, we empower you to find clarity around your family’s financial future and build generational wealth to carry your legacy forward. A policy can cover more than just a funeral, but mortgages,.Life Insurance For Generational Wealth Building SmartWealth Financial

Let's Explore Building Generational Wealth using Indexed Universal Life

Building Generational Wealth with Life Insurance Canada Protection Plan

How To Build Generational Wealth Using Life Insurance Geminia Life

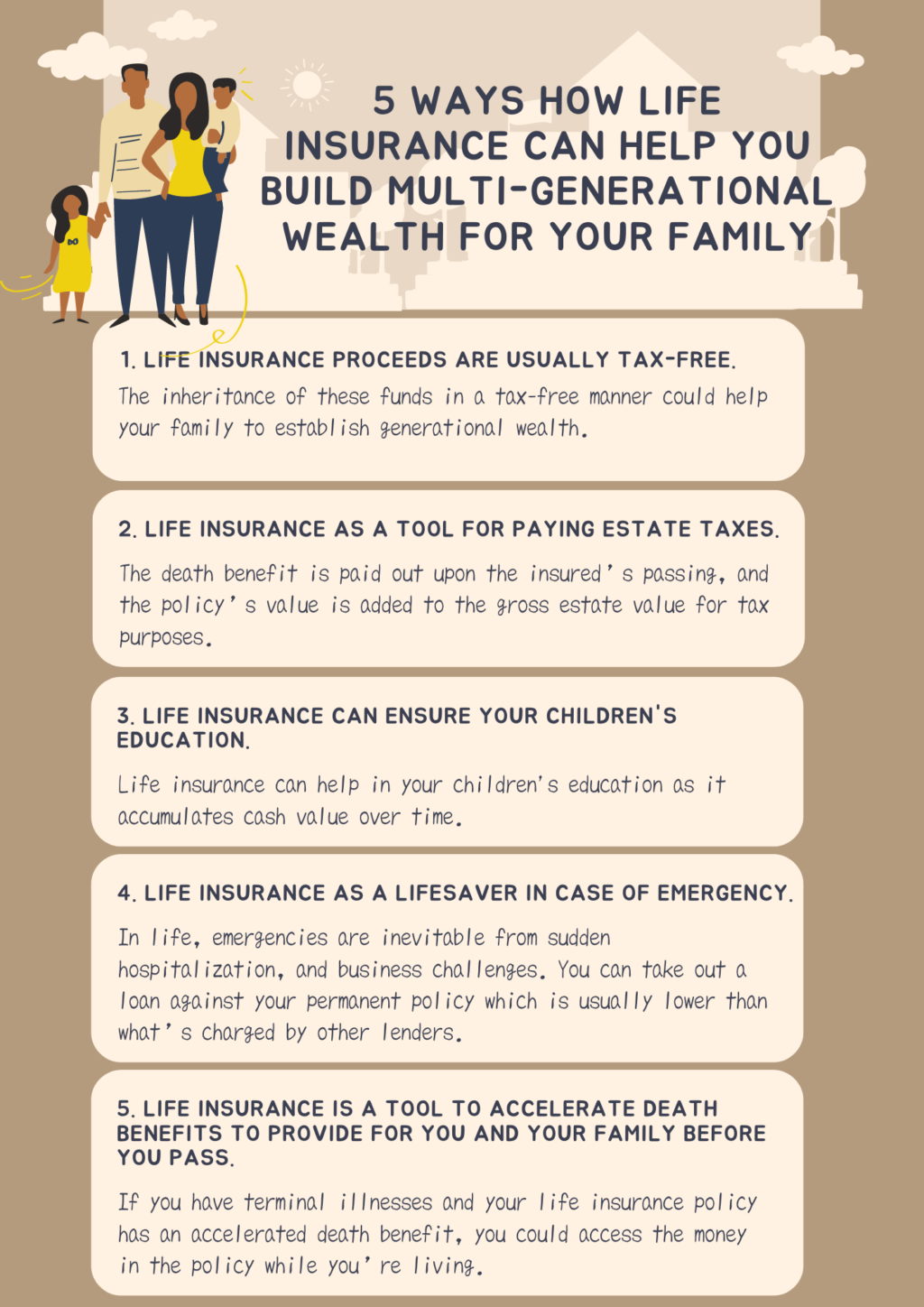

5 Ways How Life Insurance Can Help You Build MultiGenerational Wealth

MoneyValue Creating Generational Wealth. Term life insurance quotes

Building Generational Wealth with Life Insurance A Powerful Strategy

How to Build Generational Wealth Leave a Lifetime Legacy Paradigm Life

15 The Rockefeller Life Insurance Strategy for Building Multi

How To Build Generational Wealth Part 2 Life Insurance A Tale of

However, You Need To Realize That Any Amount You Still Owe On A Loan Backed Up By Your Life Insurance Will Be Taken Out Of The Payout To Your Beneficiaries If You Pass Away Before.

For Those Who Want To Know.

Understanding The Racial Wealth Gap.

In Particular, Goheen Recommends Creating This Portfolio Via Life Insurance, Noting That Many Physicians Are Unaware Of How They Can Effectively Leverage It.

Related Post: