Building Improvement Depreciation Life

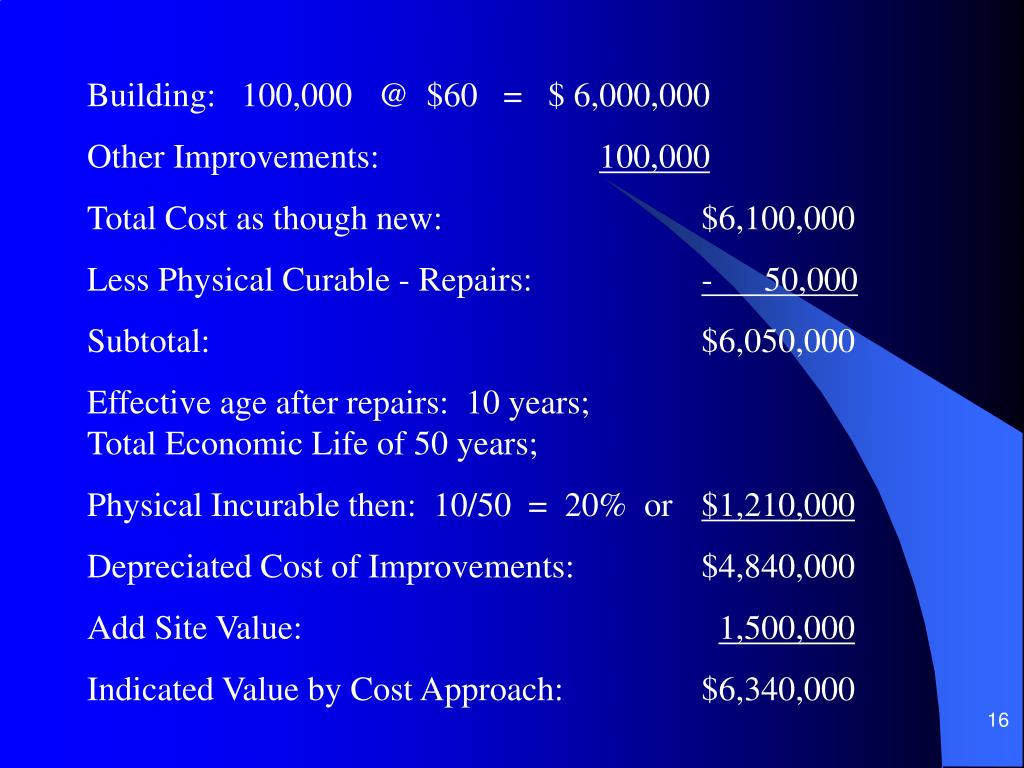

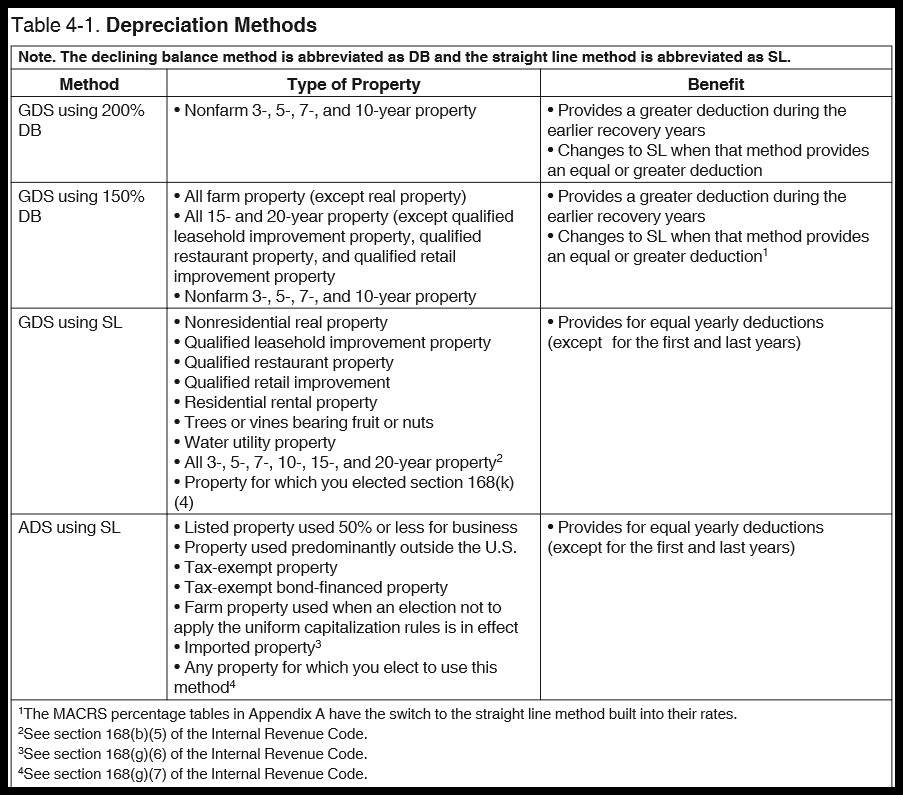

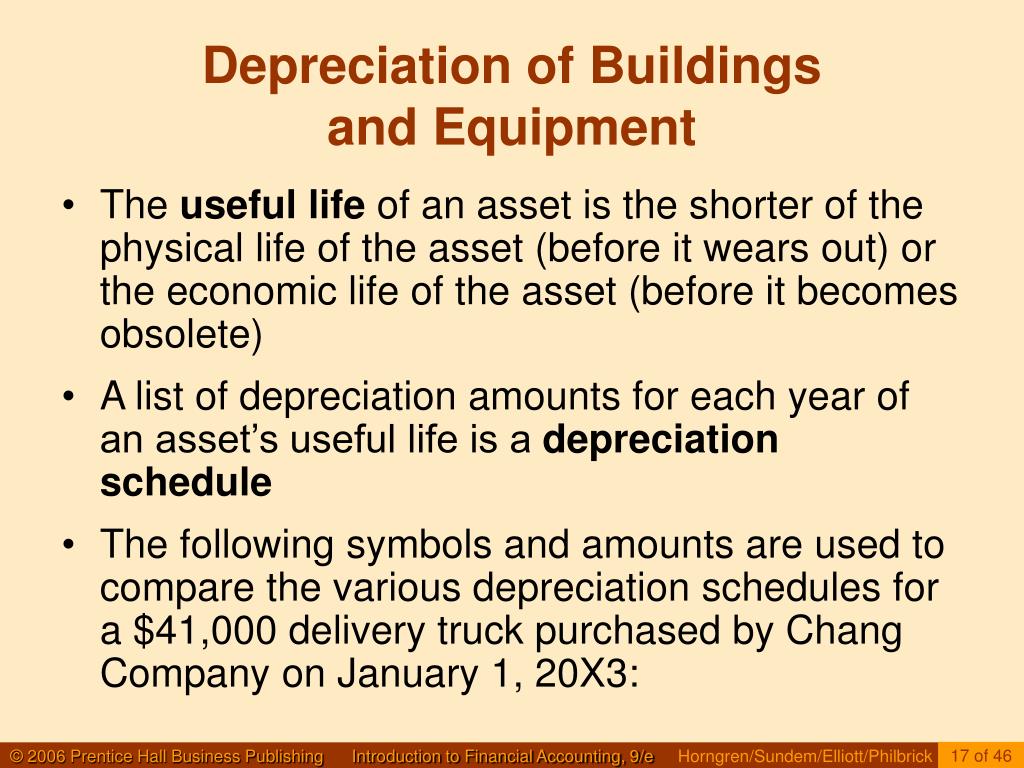

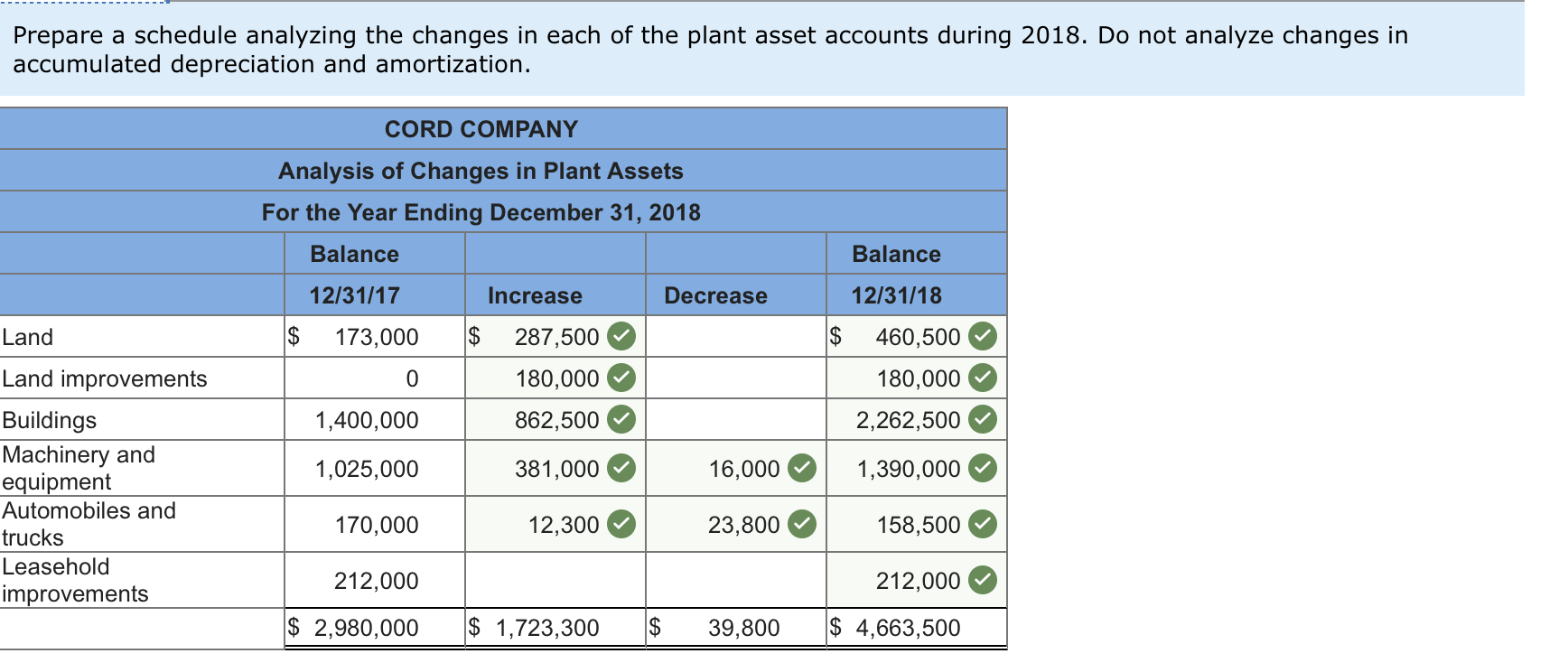

Building Improvement Depreciation Life - For example, if an improvement has a useful life of. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. Understanding depreciation in rental property. As a result, industrial buildings are expected to depreciate faster than both residential and commercial properties. Land is never depreciable, although buildings and certain land improvements may be. You may depreciate property that meets all the following requirements: The reduced tax life and bonus depreciation associated with the qualified improvement property are excellent candidates for this temporary leeway. The total improvements you made this year are handled as though you. The cost of major improvements is not deductible all in one year. Building research establishment environmental assessment method (breeam) u.s. The total improvements you made this year are handled as though you. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. Federal tax law regards the cost of certain improvements that leaseholders or owners make to the interior space of nonresidential buildings as a capital expense. The cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation; Building research establishment environmental assessment method (breeam) u.s. Understanding depreciation in rental property. Depreciation of leasehold improvements refers to the spreading of the cost of improvements made by a lessee (the tenant) to leased property over the useful life of the improvements or. The cost of major improvements is not deductible all in one year. But, could these be expensed under the repair regulations?. Learn how to assess depreciation timelines for capital improvements, distinguishing between real and personal property, and improvements versus repairs. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. But, could these be expensed under the repair regulations?. They must be capitalized and depreciated. No you don't have the option of choosing a shorter depreciable life even when you know it won't last 39 years. Depreciation of. The total improvements you made this year are handled as though you. The cost of major improvements is not deductible all in one year. You may depreciate property that meets all the following requirements: Depreciation of a building is the. No you don't have the option of choosing a shorter depreciable life even when you know it won't last 39. Understanding depreciation in rental property. How to depreciate leasehold improvements. Factors influencing building depreciation rates several. A leasehold improvement is created when a lessee pays for enhancements to building space, such as carpeting and interior walls. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. Factors influencing building depreciation rates several. A leasehold improvement is created when a lessee pays for enhancements to building space, such as carpeting and interior walls. The cost of major improvements is not deductible all in one year. Building research establishment environmental assessment method (breeam) u.s. Irs regulations and guidance explain how to take advantage. Depreciation of a building is the. The total improvements you made this year are handled as though you. Irs regulations and guidance explain how to take advantage. Factors influencing building depreciation rates several. But, could these be expensed under the repair regulations?. They must be capitalized and depreciated. The reduced tax life and bonus depreciation associated with the qualified improvement property are excellent candidates for this temporary leeway. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. A leasehold improvement is created when a lessee pays for enhancements to. Under the general system, a business owner depreciates an improvement using the irs's guidelines for useful life in publication 946. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. The cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation; The cost. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. Whole building life cycle assessments. The total improvements you made this year are handled as though you. Learn how to assess depreciation timelines for capital improvements, distinguishing between real and personal property, and improvements versus repairs. You may. Understanding depreciation in rental property. You may depreciate property that meets all the following requirements: The total improvements you made this year are handled as though you. The cost of major improvements is not deductible all in one year. Land is never depreciable, although buildings and certain land improvements may be. Cost segregation, also called cost segmentation, allows you to reclassify components of a building or property to shorter depreciation periods, usually 5, 7, or 15 years. Understanding depreciation in rental property. For example, if an improvement has a useful life of. Learn how to assess depreciation timelines for capital improvements, distinguishing between real and personal property, and improvements versus repairs.. Under the general system, a business owner depreciates an improvement using the irs's guidelines for useful life in publication 946. Understanding depreciation in rental property. As a result, industrial buildings are expected to depreciate faster than both residential and commercial properties. A leasehold improvement is created when a lessee pays for enhancements to building space, such as carpeting and interior walls. Irs regulations and guidance explain how to take advantage. Factors influencing building depreciation rates several. Land is never depreciable, although buildings and certain land improvements may be. Building research establishment environmental assessment method (breeam) u.s. The total improvements you made this year are handled as though you. Whole building life cycle assessments. Learn how to assess depreciation timelines for capital improvements, distinguishing between real and personal property, and improvements versus repairs. No you don't have the option of choosing a shorter depreciable life even when you know it won't last 39 years. How to depreciate leasehold improvements. You may depreciate property that meets all the following requirements: But, could these be expensed under the repair regulations?. The reduced tax life and bonus depreciation associated with the qualified improvement property are excellent candidates for this temporary leeway.Depreciation for Building Definition, Formula, and Excel Examples

Difference between Depreciation and Obsolescence Value of Building

Leasehold Improvement GAAP, Accounting, Depreciation, Write Off eFM

PPT Depreciation PowerPoint Presentation, free download ID249599

MACRS Depreciation Tables & How to Calculate

Depreciation for Building Definition, Formula, and Excel Examples

PPT LongLived Assets and Depreciation PowerPoint Presentation, free

Methods of Depreciation Formulas, Problems, and Solutions Owlcation

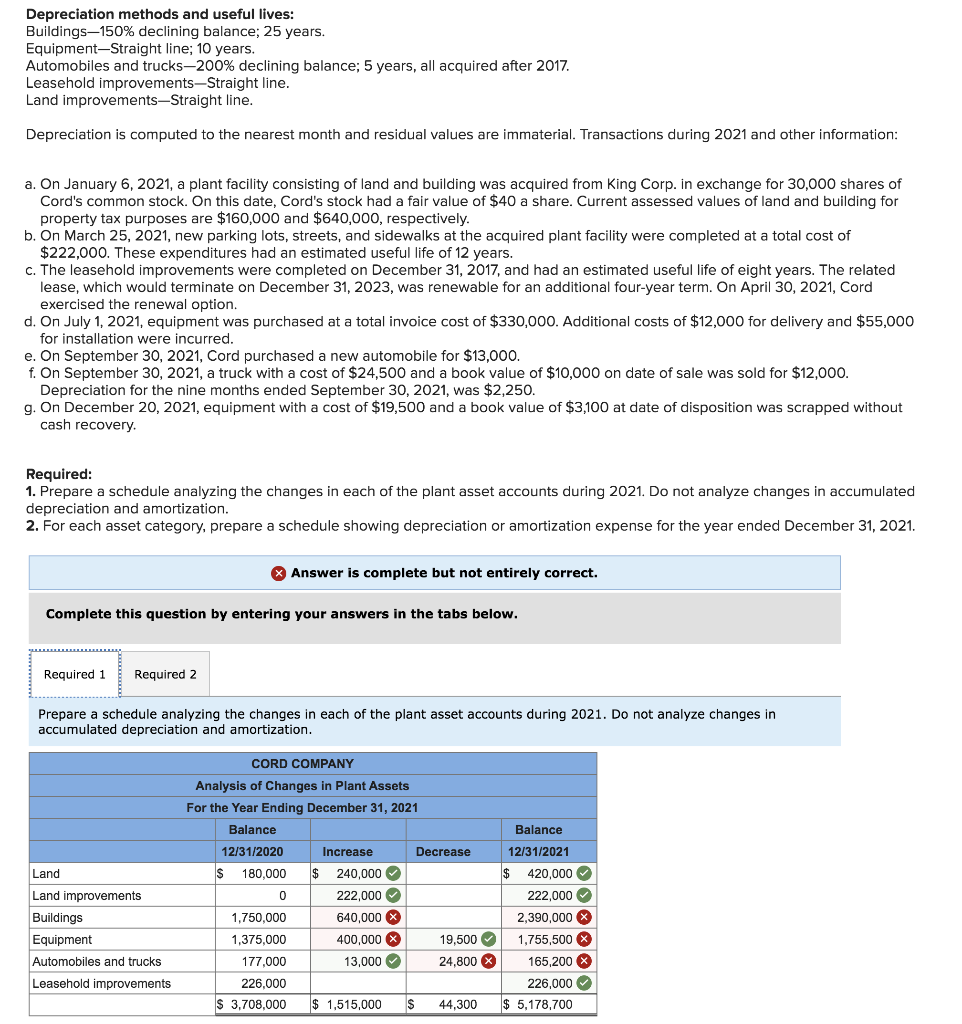

Solved Depreciation methods and useful lives Buildings—150

Solved Depreciation methods and useful lives Buildings—150

The Cost Of Major Improvements Is Not Deductible All In One Year.

They Must Be Capitalized And Depreciated.

Depreciation Of Leasehold Improvements Refers To The Spreading Of The Cost Of Improvements Made By A Lessee (The Tenant) To Leased Property Over The Useful Life Of The Improvements Or.

Depreciation Of A Building Is The.

Related Post: