Building Improvement Depreciation

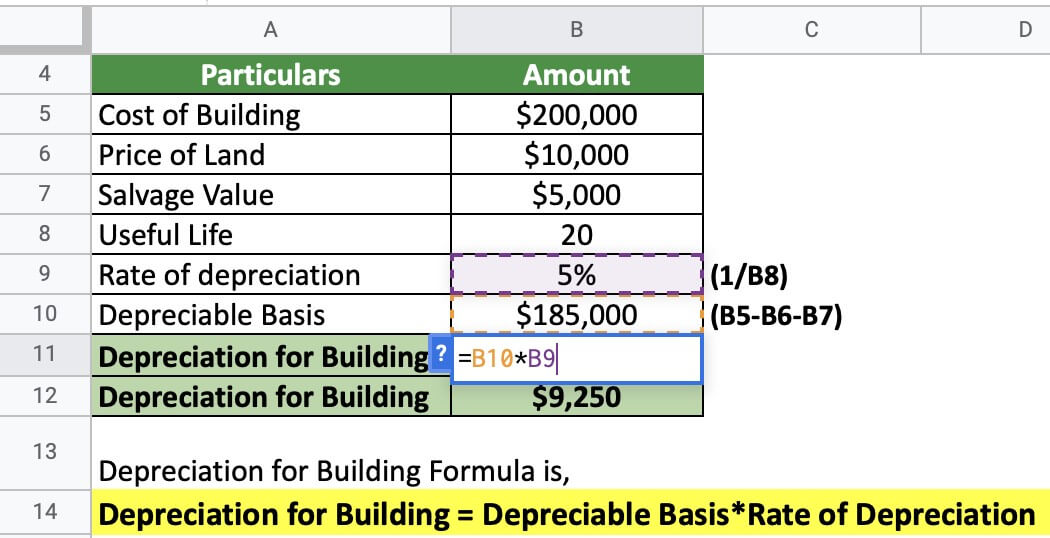

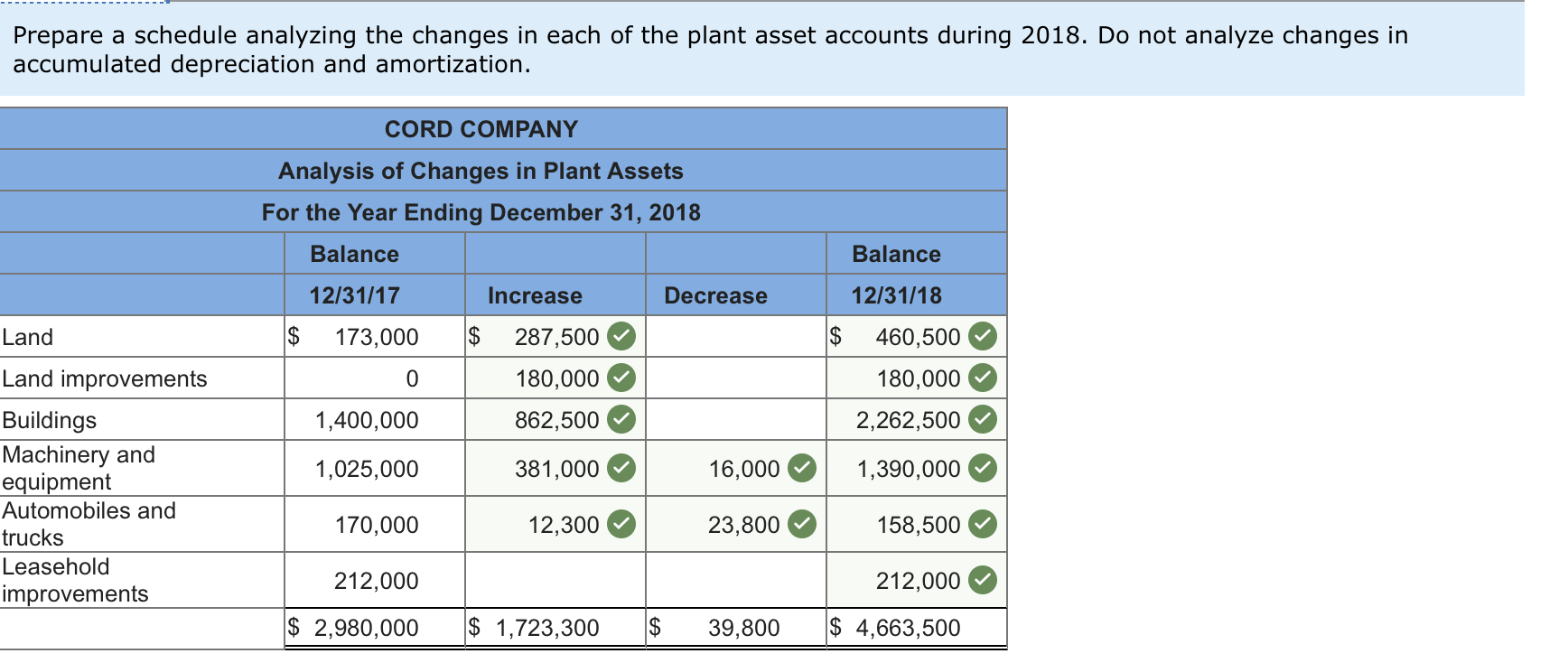

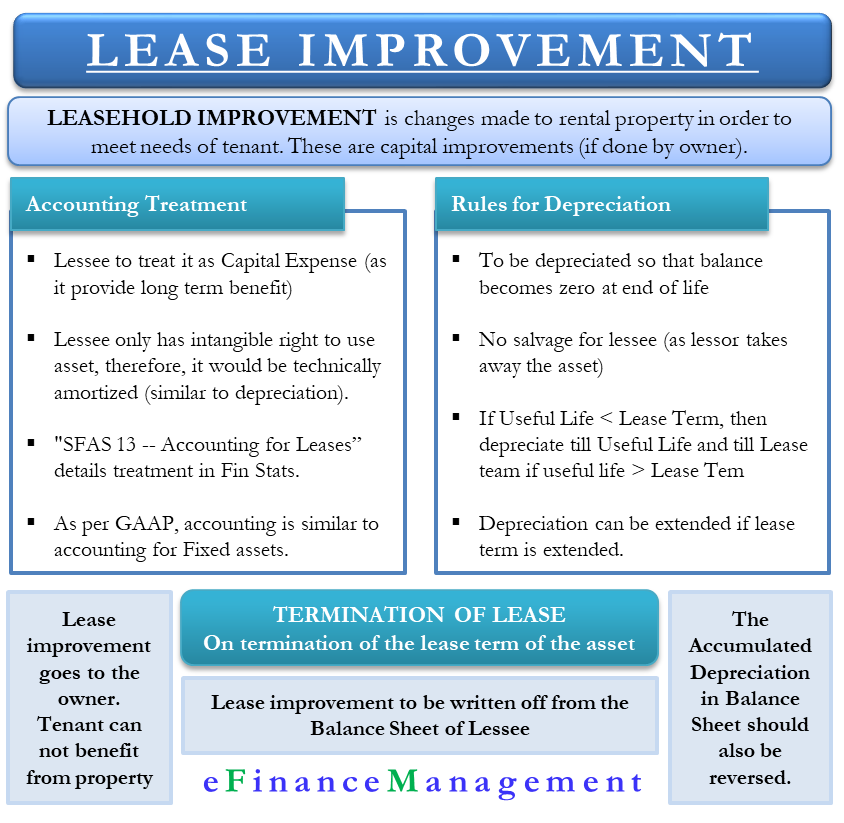

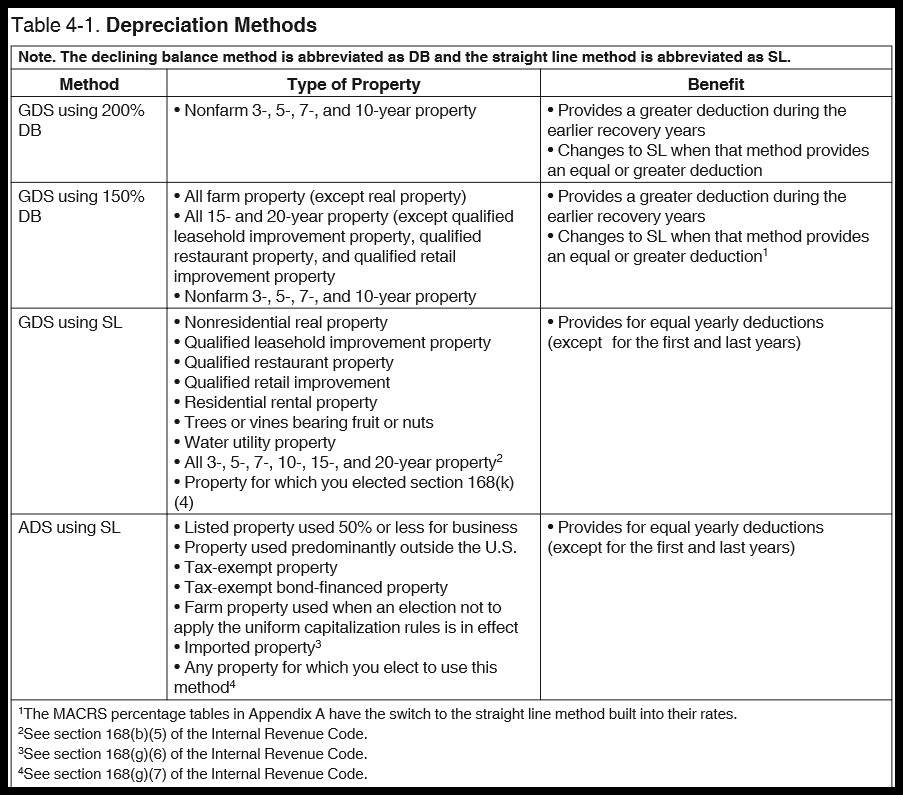

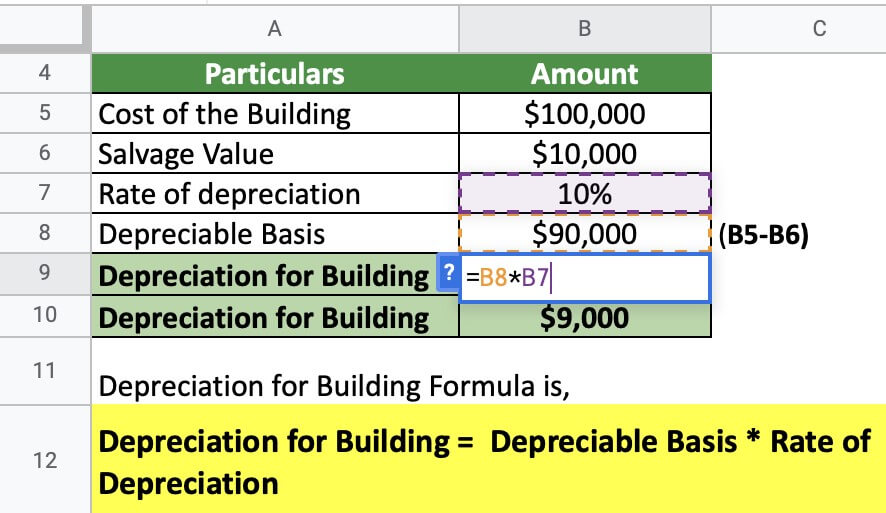

Building Improvement Depreciation - The cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation; Establish a baseline value and. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Taxpayers are required to separately identify the value of. However, if the cost is for a betterment to the property, to restore the. This process helps manage your tax liabilities more. Learn about what types of improvements are considered qualified improvement property, the bonus depreciation rate for qip, and changes enacted by the cares act. Understanding depreciation in rental property. Irs regulations and guidance explain how to take advantage. Take a look at the most common tax deductions that are overlooked by landlords. You generally deduct the cost of repairing business property in the same way as any other business expense. Frequently asked questions about energy efficient home improvements and residential clean energy property credits — qualifying residence. Irs regulations and guidance explain how to take advantage. Federal tax law regards the cost of certain improvements that leaseholders or owners make to the interior space of nonresidential buildings as a capital expense. Establish a baseline value and. For income tax purposes, every dollar shifted from land value to improvement value yields permanent tax benefits. Ive got a client replacing the roof and hvac ducting. Understanding depreciation in rental property. In taxable year 2024, x. The tcja permanently increases the maximum. The total improvements you made this year are handled as though you. Depreciation allows you to distribute the cost of the improvement across its useful life through a tax deduction over several years. The tax code does allow landlords to deduct a certain amount of. This process helps manage your tax liabilities more. Establish a baseline value and. They must be capitalized and depreciated. The cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation; The cost of major improvements is not deductible all in one year. A building depreciation rate is the percentage at which the value of a building decreases over time due to factors like aging, wear and tear, and. However, if the cost is for a betterment to the property, to restore the. Depreciation allows you to distribute the cost of the improvement across its useful life through a tax deduction over several years. The cost of major improvements is not deductible all in one year. To summarize, as the law currently reads, real estate qualified improvement property is. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. The tax code does allow landlords to deduct a certain amount of. The cost of major improvements is not deductible all in one year. However, if the cost is for a betterment to the property, to restore the. Learn how to assess depreciation timelines for capital. So the first thing you need to do if you own commercial real estate is separate out the cost of the land from the cost of the improvements (buildings) on the land. Taxpayers are required to separately identify the value of. Bonus depreciation and section 179 deductions offer additional tax benefits. But, under irs cost segregation guidelines, a significant portion. Ive got a client replacing the roof and hvac ducting. The cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation; If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser amount of time? Bonus depreciation, under irc section 168(k), allows businesses to. Qip is generally defined as any improvement made to the interior portion of a nonresidential building any time after the building was placed in service. A building depreciation rate is the percentage at which the value of a building decreases over time due to factors like aging, wear and tear, and obsolescence. For income tax purposes, every dollar shifted from. You generally deduct the cost of repairing business property in the same way as any other business expense. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Ive got a client replacing the roof and hvac ducting. Establish a baseline value and. The cares act corrected an error that had made qualified improvement property ineligible. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. This process helps manage your tax liabilities more. The cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation; Establish a baseline value and. However, if the cost is for a betterment to the property, to restore the. They must be capitalized and depreciated. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Frequently asked questions about energy efficient home improvements and residential clean energy property credits — qualifying residence. A building depreciation rate is the percentage at which the value of a building decreases over time due to factors like aging, wear. They must be capitalized and depreciated. You generally deduct the cost of repairing business property in the same way as any other business expense. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. The total improvements you made this year are handled as though you. Learn about what types of improvements are considered qualified improvement property, the bonus depreciation rate for qip, and changes enacted by the cares act. Irs regulations and guidance explain how to take advantage. Learn how to assess depreciation timelines for capital improvements, distinguishing between real and personal property, and improvements versus repairs. Taxpayers are required to separately identify the value of. For income tax purposes, every dollar shifted from land value to improvement value yields permanent tax benefits. Establish a baseline value and. Understanding depreciation in rental property. In taxable year 2024, x. Qip is generally defined as any improvement made to the interior portion of a nonresidential building any time after the building was placed in service. The cost of major improvements is not deductible all in one year. Bonus depreciation and section 179 deductions offer additional tax benefits. “building improvements” are capital events that materially extend the useful life of a building or increase the value of a building by at least 25 percent of the original life period or.Depreciation for Building Definition, Formula, and Excel Examples

Popular Depreciation Methods To Calculate Asset Value Over The Years

Solved Depreciation methods and useful lives Buildings—150

Bonus Depreciation 2024 Leasehold Improvements Lorna Sigrid

MACRS Depreciation Tables & How to Calculate

Difference between Depreciation and Obsolescence Value of Building

Methods of Depreciation Formulas, Problems, and Solutions Owlcation

What is Property Depreciation? Property Calculator

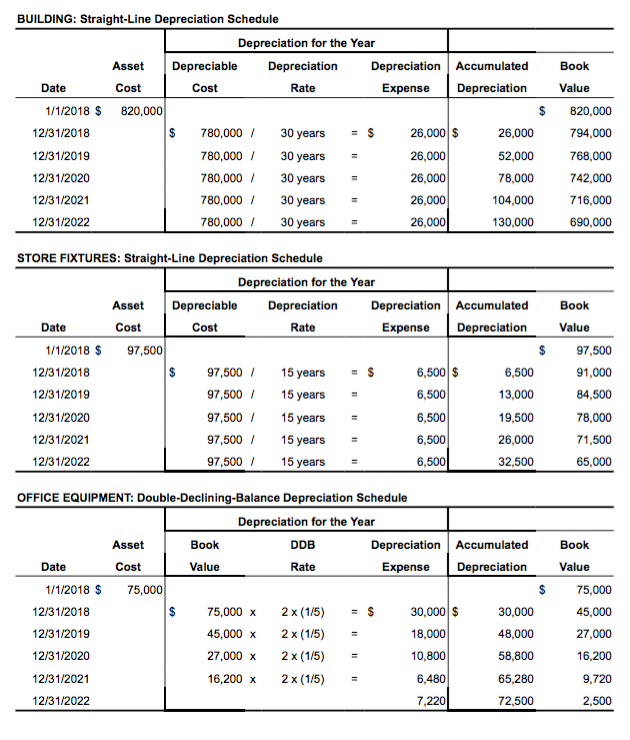

Solved BUILDING StraightLine Depreciation Schedule

Depreciation for Building Definition, Formula, and Excel Examples

A Building Depreciation Rate Is The Percentage At Which The Value Of A Building Decreases Over Time Due To Factors Like Aging, Wear And Tear, And Obsolescence.

The Tcja Permanently Increases The Maximum.

However, If The Cost Is For A Betterment To The Property, To Restore The.

So The First Thing You Need To Do If You Own Commercial Real Estate Is Separate Out The Cost Of The Land From The Cost Of The Improvements (Buildings) On The Land.

Related Post: