Building Improvements Depreciation

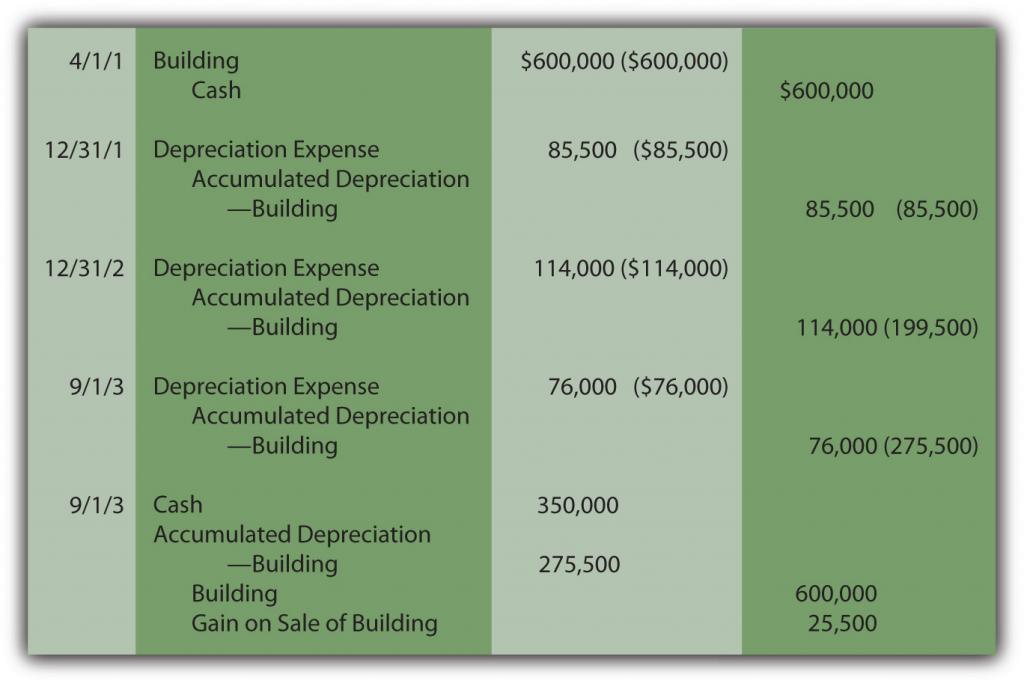

Building Improvements Depreciation - In taxable year 2024, x. This is because the law says you. Prior to that, the depreciation term was. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Ive got a client replacing the roof and hvac ducting. This process helps manage your tax liabilities more. Establish a baseline value and. Irs regulations and guidance explain how to take advantage. Yes, improvements are another category of assets that can be depreciated if they have a useful life longer than one year and are considered valuable assets to the business. Residential rental property is depreciated over a lengthy 27.5 years. The cares act correction made qip eligible for bonus depreciation, enabling accelerated cost recovery for building improvements. Establish a baseline value and. Qualified improvement property is generally eligible for bonus depreciation, allowing taxpayers to deduct up to 100% of the cost of assets up front. Irs regulations and guidance explain how to take advantage. Determining the depreciation life and timelines for capital improvements is crucial for businesses aiming to manage their assets effectively and optimize tax benefits. Federal tax law regards the cost of certain improvements that leaseholders or owners make to the interior space of nonresidential buildings as a capital expense. The cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation; They must be capitalized and depreciated. “building improvements” are capital events that materially extend the useful life of a building or increase the value of a building by at least 25 percent of the original life period or. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Yes, improvements are another category of assets that can be depreciated if they have a useful life longer than one year and are considered valuable assets to the business. Qualified improvement property is generally eligible for bonus depreciation, allowing taxpayers to deduct up to 100% of the cost of assets up front. This is because the law says you. Ive. The cares act correction made qip eligible for bonus depreciation, enabling accelerated cost recovery for building improvements. Residential rental property is depreciated over a lengthy 27.5 years. Qualified improvement property is generally eligible for bonus depreciation, allowing taxpayers to deduct up to 100% of the cost of assets up front. So the first thing you need to do if you. Calculating land and building values for tax purposes is a critical step toward maximizing your available tax deductions from depreciation. Understanding depreciation in rental property. The cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation; Qualified improvement property is generally eligible for bonus depreciation, allowing taxpayers to deduct up to 100% of the cost. Federal tax law regards the cost of certain improvements that leaseholders or owners make to the interior space of nonresidential buildings as a capital expense. Establish a baseline value and. They must be capitalized and depreciated. Ive got a client replacing the roof and hvac ducting. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. Unlike employee wages or utility bills, taxpayers do not get an immediate tax deduction for the purchase of a building. This process helps manage your tax liabilities more. Qualified improvement property is generally eligible for bonus depreciation, allowing taxpayers to deduct up to 100% of the cost of assets up front. The cost of major improvements is not deductible all. They must be capitalized and depreciated. “building improvements” are capital events that materially extend the useful life of a building or increase the value of a building by at least 25 percent of the original life period or. If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser. Determining the depreciation life and timelines for capital improvements is crucial for businesses aiming to manage their assets effectively and optimize tax benefits. Yes, improvements are another category of assets that can be depreciated if they have a useful life longer than one year and are considered valuable assets to the business. “building improvements” are capital events that materially extend. Prior to that, the depreciation term was. The cost of major improvements is not deductible all in one year. The cares act correction made qip eligible for bonus depreciation, enabling accelerated cost recovery for building improvements. Federal tax law regards the cost of certain improvements that leaseholders or owners make to the interior space of nonresidential buildings as a capital. Bonus depreciation may be retroactively. Ive got a client replacing the roof and hvac ducting. Yes, improvements are another category of assets that can be depreciated if they have a useful life longer than one year and are considered valuable assets to the business. Prior to that, the depreciation term was. Determining the depreciation life and timelines for capital improvements. The cost of major improvements is not deductible all in one year. Ive got a client replacing the roof and hvac ducting. Prior to that, the depreciation term was. So the first thing you need to do if you own commercial real estate is separate out the cost of the land from the cost of the improvements (buildings) on the. Determining the depreciation life and timelines for capital improvements is crucial for businesses aiming to manage their assets effectively and optimize tax benefits. The total improvements you made this year are handled as though you. Prior to that, the depreciation term was. If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser amount of time? Unlike employee wages or utility bills, taxpayers do not get an immediate tax deduction for the purchase of a building. The cares act corrected an error that had made qualified improvement property ineligible for bonus depreciation; Qualified improvement property is generally eligible for bonus depreciation, allowing taxpayers to deduct up to 100% of the cost of assets up front. But, under irs cost segregation guidelines, a significant portion of a building’s cost can. “building improvements” are capital events that materially extend the useful life of a building or increase the value of a building by at least 25 percent of the original life period or. Residential rental property is depreciated over a lengthy 27.5 years. Ive got a client replacing the roof and hvac ducting. Establish a baseline value and. A building depreciation rate is the percentage at which the value of a building decreases over time due to factors like aging, wear and tear, and obsolescence. Depreciation allows you to distribute the cost of the improvement across its useful life through a tax deduction over several years. This is because the law says you. Are generally restorations to your building property because they're replacements of major components or substantial structural parts of the building structure.How To Depreciate Capital Improvements To Rental Property David

Depreciation Recapture Definition ⋆ Accounting Services

Solved BUILDING StraightLine Depreciation Schedule

Difference between Depreciation and Obsolescence Value of Building

Depreciation for Building Definition, Formula, and Excel Examples

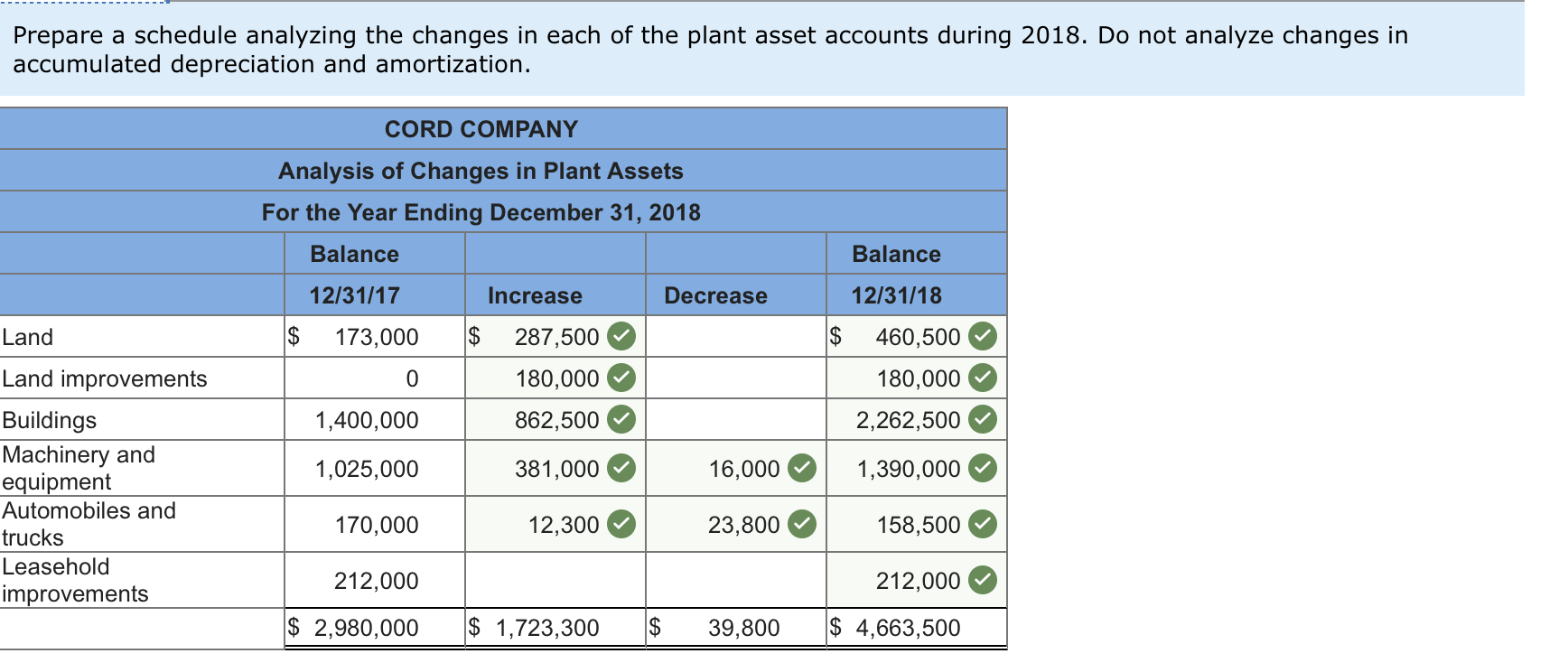

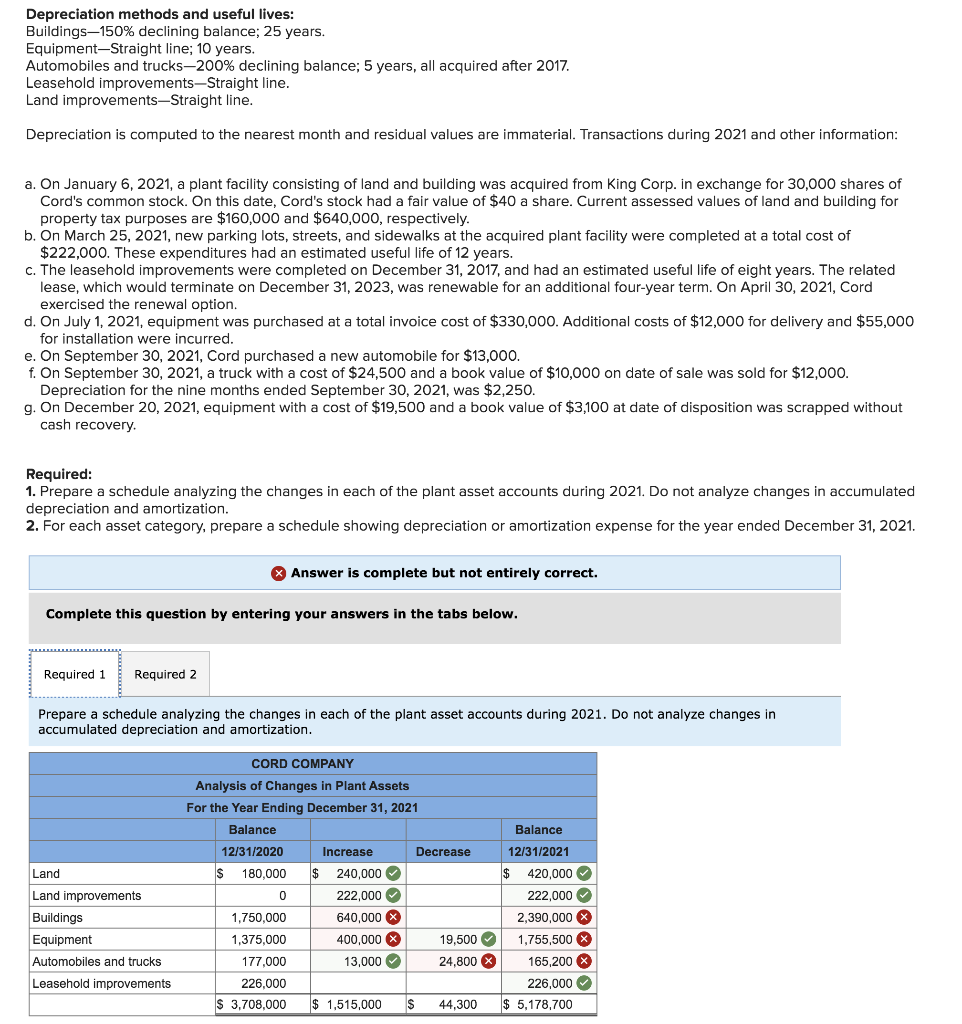

Solved Depreciation methods and useful lives Buildings—150

Solved Depreciation methods and useful lives Buildings—150

Depreciation for Building Definition, Formula, and Excel Examples

The Ultimate Guide To Understanding Leasehold Improvements

Building improvements now eligible for bonus depreciation Williams

Frequently Asked Questions About Energy Efficient Home Improvements And Residential Clean Energy Property Credits — Qualifying Residence.

Federal Tax Law Regards The Cost Of Certain Improvements That Leaseholders Or Owners Make To The Interior Space Of Nonresidential Buildings As A Capital Expense.

The Cares Act Correction Made Qip Eligible For Bonus Depreciation, Enabling Accelerated Cost Recovery For Building Improvements.

So The First Thing You Need To Do If You Own Commercial Real Estate Is Separate Out The Cost Of The Land From The Cost Of The Improvements (Buildings) On The Land.

Related Post: