Building Improvements Useful Life

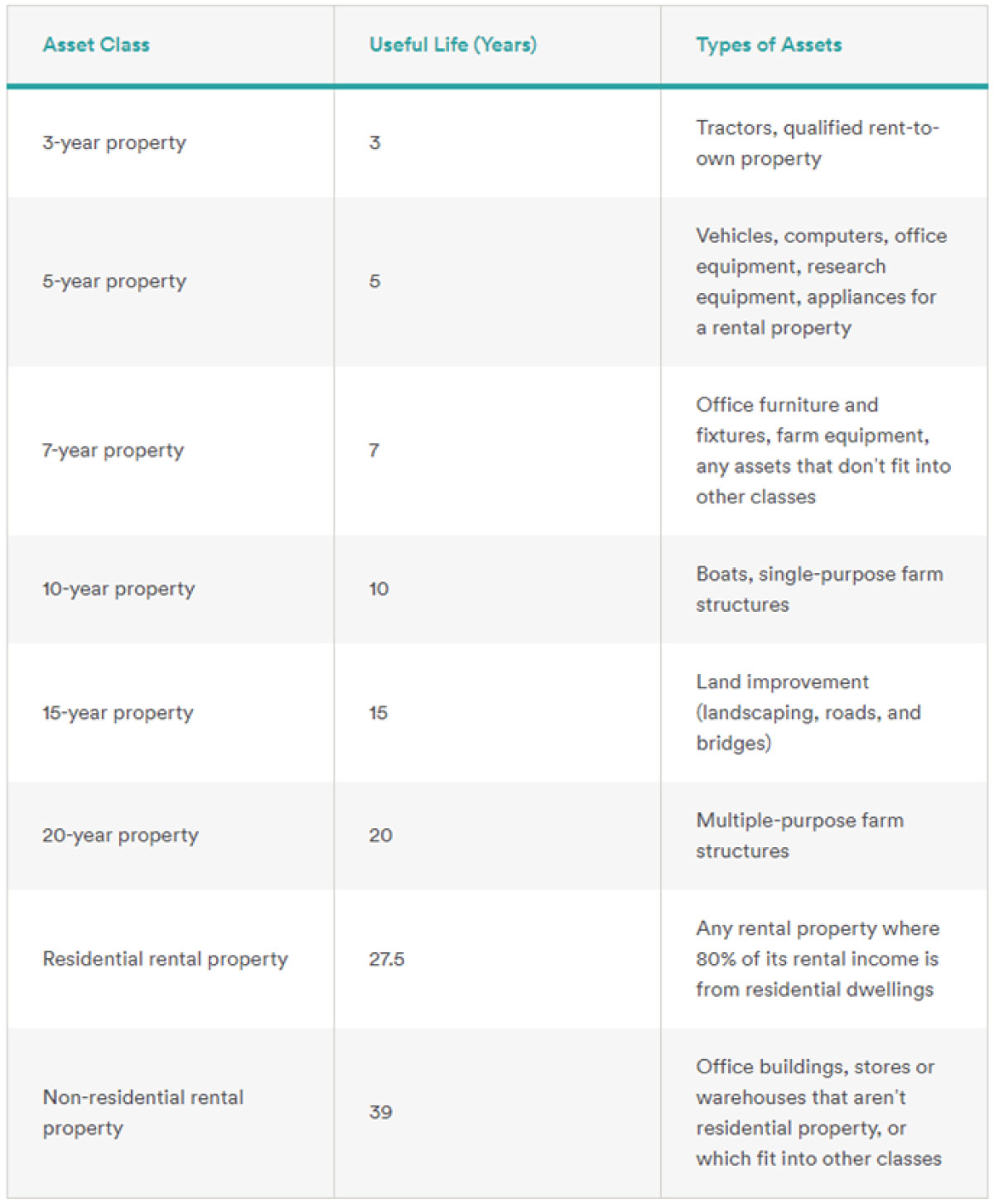

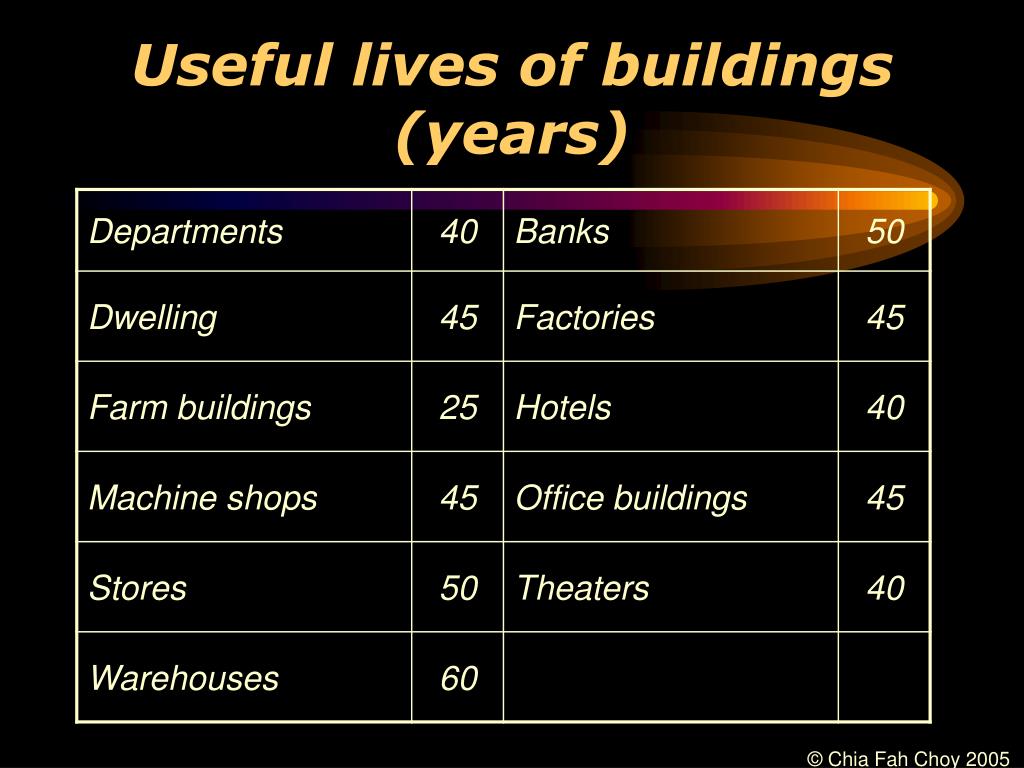

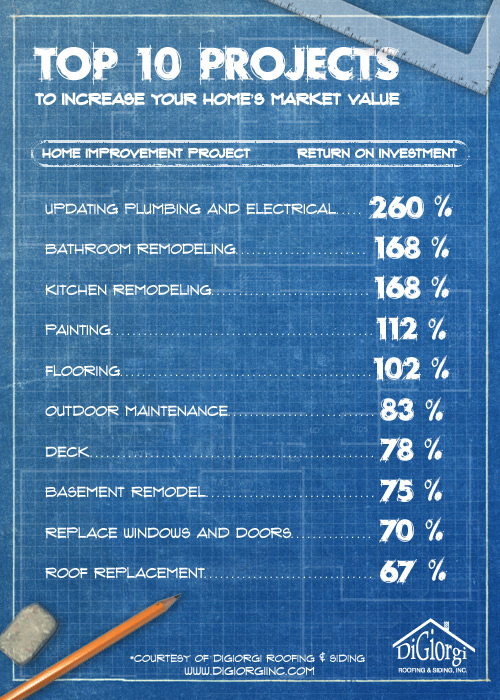

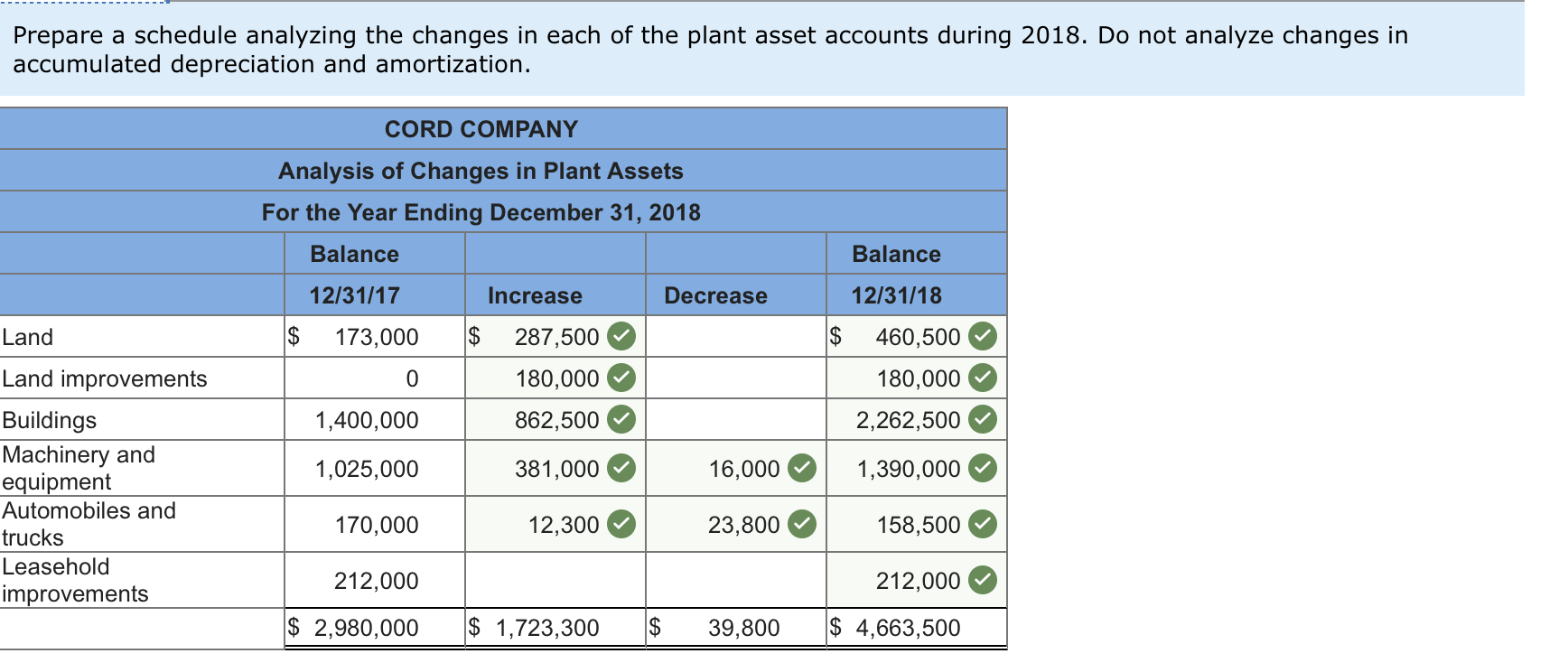

Building Improvements Useful Life - Depreciation allows you to distribute the cost of the improvement across its useful life through a tax deduction over several years. Demand, utility, scarcity, and transferability. If the improvement has a useful life, you report it as a capital asset, entering it in. Customized tenant improvements typically have a useful economic life of anywhere between five and 10 years depending on the installation. Such improvements can range from simple fixture. In the same manner, building improvements are categorized as capital expenditures that are targeted towards extending the useful life of the asset, or an expense. Learn how to assess depreciation timelines for capital improvements, distinguishing between real and personal property, and improvements versus repairs. Qualified improvement property (qip) is any improvement that is sec. This process helps manage your tax liabilities more. Typically, nonresidential buildings have a useful life of 39 years, and residential rental properties are depreciated over 27.5 years under gaap. Customized tenant improvements typically have a useful economic life of anywhere between five and 10 years depending on the installation. This corresponds to the average span of a. Often depreciated over 5 to 15 years, depending on the type of. Qualified improvement property (qip) is any improvement that is sec. This process helps manage your tax liabilities more. In the same manner, building improvements are categorized as capital expenditures that are targeted towards extending the useful life of the asset, or an expense. Here are some methods commonly used to estimate the useful life of buildings: It does not qualify as 15 year qualified improvement property. 1250 property made by the taxpayer to an interior portion of a nonresidential building placed in. To have value in the real estate market, a property must have the following four characteristics: Such improvements can range from simple fixture. By partnering with a facility services provider who understands leed qualifications, your building can lower energy costs, use less waste, and improve its property. Often depreciated over 5 to 15 years, depending on the type of. That is restricted to certain interior improvements. This is the simplest method, where the cost of the. “building improvements” are capital events that materially extend the useful life of a building or increase the value of a building by at least 25 percent of the original life period or. If you can't set a useful life on an improvement, you expense it rather than capitalize it. Depreciation allows you to distribute the cost of the improvement across. If the rental rises to the level of a. For example, if an improvement has a useful life of. Under gaap, you estimate the useful life of a building and use this as your recovery period. If the leasehold improvement is expected to have a useful life that is equal to or greater than the term of the lease, depreciate. Demand, utility, scarcity, and transferability. If the leasehold improvement is expected to have a useful life that is equal to or greater than the term of the lease, depreciate the asset over the term of the lease. Under gaap, you estimate the useful life of a building and use this as your recovery period. Depreciation allows you to distribute the. Customized tenant improvements typically have a useful economic life of anywhere between five and 10 years depending on the installation. For example, if an improvement has a useful life of. This corresponds to the average span of a. To have value in the real estate market, a property must have the following four characteristics: Whole building life cycle assessments. It does not qualify as 15 year qualified improvement property. Demand, utility, scarcity, and transferability. That is restricted to certain interior improvements. Depreciation allows you to distribute the cost of the improvement across its useful life through a tax deduction over several years. Such improvements can range from simple fixture. Customized tenant improvements typically have a useful economic life of anywhere between five and 10 years depending on the installation. Building research establishment environmental assessment method (breeam) u.s. Qualified improvement property (qip) is any improvement that is sec. These improvements increase functionality and property value. If the rental rises to the level of a. You can base your estimate on your previous experience or by estimates provided by qualified. Building research establishment environmental assessment method (breeam) u.s. This process helps manage your tax liabilities more. To have value in the real estate market, a property must have the following four characteristics: That is restricted to certain interior improvements. By partnering with a facility services provider who understands leed qualifications, your building can lower energy costs, use less waste, and improve its property. This process helps manage your tax liabilities more. In the same manner, building improvements are categorized as capital expenditures that are targeted towards extending the useful life of the asset, or an expense. Yes, it is. Typically, nonresidential buildings have a useful life of 39 years, and residential rental properties are depreciated over 27.5 years under gaap. Under gaap, you estimate the useful life of a building and use this as your recovery period. Whole building life cycle assessments. Depreciation of leasehold improvements refers to the spreading of the cost of improvements made by a lessee. Under gaap, you estimate the useful life of a building and use this as your recovery period. If the leasehold improvement is expected to have a useful life that is equal to or greater than the term of the lease, depreciate the asset over the term of the lease. That is restricted to certain interior improvements. “building improvements” are capital events that materially extend the useful life of a building or increase the value of a building by at least 25 percent of the original life period or. Often depreciated over 5 to 15 years, depending on the type of. To have value in the real estate market, a property must have the following four characteristics: Here are some methods commonly used to estimate the useful life of buildings: You can base your estimate on your previous experience or by estimates provided by qualified. Demand, utility, scarcity, and transferability. Under the general system, a business owner depreciates an improvement using the irs's guidelines for useful life in publication 946. In the same manner, building improvements are categorized as capital expenditures that are targeted towards extending the useful life of the asset, or an expense. Customized tenant improvements typically have a useful economic life of anywhere between five and 10 years depending on the installation. Leasehold improvement refers to modifications made to a rental property to tailor it to the specific needs of a tenant. If the rental rises to the level of a. This is the simplest method, where the cost of the building is. Typically, nonresidential buildings have a useful life of 39 years, and residential rental properties are depreciated over 27.5 years under gaap.Estimated Useful Lives of Building Components in Life cycle Cost

Determining the Useful Life of Assets and 5 Ways to Extend it

PPT Topic 4 Life Cycle Costing PowerPoint Presentation, free

EXPECTED USEFUL LIFE TABLE

Fixed Asset Useful Life Table CPCON (GAAP 2024)

Home Improvements That Add Value To Your Home Infographic Chicago

Estimated Useful Lives of Building Components in Life cycle Cost

gaap useful life table

Solved Depreciation methods and useful lives Buildings—150

What are the best home improvements for adding value to your property?

For Example, If An Improvement Has A Useful Life Of.

It Does Not Qualify As 15 Year Qualified Improvement Property.

Qualified Improvement Property (Qip) Is Any Improvement That Is Sec.

Depreciation Allows You To Distribute The Cost Of The Improvement Across Its Useful Life Through A Tax Deduction Over Several Years.

Related Post: