Building Improvements

Building Improvements - The cost of major improvements is not deductible all in one year. Fixed assets include vehicles, computers, furniture, buildings, land and machinery, among other items. A unit of property is improved if the cost is made for (1) a betterment to the unit of property; 1250 property made by the taxpayer to an interior portion of a nonresidential building placed in service after the date the building was placed in service. They must be capitalized and depreciated. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. The journal entry is debiting building improvement and credit accounts payable. Understand the irs rules on improvements including unit of property, betterments versus adaptions, and building systems. Or (3) an adaptation of the unit of property to a new or different use (regs. Qualified improvement property (qip) is any improvement that is sec. Fixed assets include vehicles, computers, furniture, buildings, land and machinery, among other items. If the building renovation increases the useful life or the benefit of building, for sure it will be recorded as the building improvement which is the fixed assets. When accounting for improvements to fixed assets, it is important to distinguish between building improvements and leasehold improvements. Or (3) an adaptation of the unit of property to a new or different use (regs. (2) a restoration of the unit of property; The total improvements you made this year are handled as though you purchased a new building. The cost of major improvements is not deductible all in one year. Building improvements are the responsibility of the asset owner, while leasehold improvements are the responsibility of. They must be capitalized and depreciated. Understand the irs rules on improvements including unit of property, betterments versus adaptions, and building systems. Taxpayers generally must capitalize amounts paid to improve a unit of property. The journal entry is debiting building improvement and credit accounts payable. They must be capitalized and depreciated. A unit of property is improved if the cost is made for (1) a betterment to the unit of property; (2) a restoration of the unit of property; When accounting for improvements to fixed assets, it is important to distinguish between building improvements and leasehold improvements. There are two categories of building improvements that are undertaken by companies. If the building renovation increases the useful life or the benefit of building, for sure it will be recorded as the building improvement which is the fixed assets. A unit. A building is a structure that is permanently attached to the land, is not infrastructure, and is not intended to be transportable or moveable. The total improvements you made this year are handled as though you purchased a new building. 1250 property made by the taxpayer to an interior portion of a nonresidential building placed in service after the date. Qualified improvement property (qip) is any improvement that is sec. If the building renovation increases the useful life or the benefit of building, for sure it will be recorded as the building improvement which is the fixed assets. The total improvements you made this year are handled as though you purchased a new building. There are two categories of building. The total improvements you made this year are handled as though you purchased a new building. Understand the irs rules on improvements including unit of property, betterments versus adaptions, and building systems. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. (2) a restoration of the unit of property;. Understand the irs rules on improvements including unit of property, betterments versus adaptions, and building systems. In this regard, it can be seen that building improvement can either be categorized as routine repairs and maintenance expense, or it can be classified as major structural changes within the organization. Qualified improvement property (qip) is any improvement that is sec. A building. A unit of property is improved if the cost is made for (1) a betterment to the unit of property; Or (3) an adaptation of the unit of property to a new or different use (regs. Building improvements are the responsibility of the asset owner, while leasehold improvements are the responsibility of. Fixed assets include vehicles, computers, furniture, buildings, land. If the building renovation increases the useful life or the benefit of building, for sure it will be recorded as the building improvement which is the fixed assets. Qualified improvement property (qip) is any improvement that is sec. Fixed assets include vehicles, computers, furniture, buildings, land and machinery, among other items. A unit of property is improved if the cost. The journal entry is debiting building improvement and credit accounts payable. Understand the irs rules on improvements including unit of property, betterments versus adaptions, and building systems. When accounting for improvements to fixed assets, it is important to distinguish between building improvements and leasehold improvements. (2) a restoration of the unit of property; A unit of property is improved if. The total improvements you made this year are handled as though you purchased a new building. Qualified improvement property (qip) is any improvement that is sec. Or (3) an adaptation of the unit of property to a new or different use (regs. Knowing the difference in gaap between making repairs to business property and capitalizing building improvements, for example, requires. Understand the irs rules on improvements including unit of property, betterments versus adaptions, and building systems. They must be capitalized and depreciated. Qualified improvement property (qip) is any improvement that is sec. Building improvements are the responsibility of the asset owner, while leasehold improvements are the responsibility of. The cost of major improvements is not deductible all in one year. A building is a structure that is permanently attached to the land, is not infrastructure, and is not intended to be transportable or moveable. The total improvements you made this year are handled as though you purchased a new building. When accounting for improvements to fixed assets, it is important to distinguish between building improvements and leasehold improvements. There are two categories of building improvements that are undertaken by companies. In this regard, it can be seen that building improvement can either be categorized as routine repairs and maintenance expense, or it can be classified as major structural changes within the organization. Guidance on establishing when costs for buildings and improvements must be capitalized at the university. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. The journal entry is debiting building improvement and credit accounts payable. Or (3) an adaptation of the unit of property to a new or different use (regs. Taxpayers generally must capitalize amounts paid to improve a unit of property. (2) a restoration of the unit of property;8 Home Improvements to Consider Before You Move In Total Mortgage Blog

Building Improvements

House building repairs and improvements Stock Photo Alamy

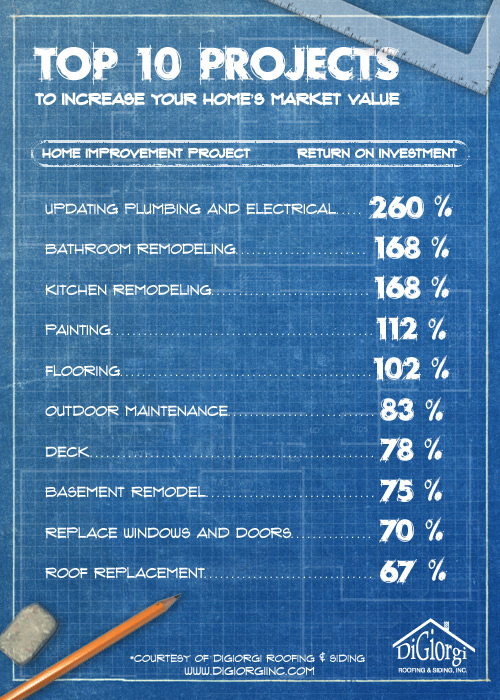

Home Improvements That Add Value To Your Home Infographic Chicago

House building repairs and improvements Stock Photo Alamy

Building Construction Process From Start To Finish ProEst

Remodeling Improvements on Existing Construction Stock Image Image of

What are the best home improvements for adding value to your property?

Building Improvement Resources

Commercial Building Improvements Photos and Premium High Res Pictures

A Unit Of Property Is Improved If The Cost Is Made For (1) A Betterment To The Unit Of Property;

Fixed Assets Include Vehicles, Computers, Furniture, Buildings, Land And Machinery, Among Other Items.

1250 Property Made By The Taxpayer To An Interior Portion Of A Nonresidential Building Placed In Service After The Date The Building Was Placed In Service.

If The Building Renovation Increases The Useful Life Or The Benefit Of Building, For Sure It Will Be Recorded As The Building Improvement Which Is The Fixed Assets.

Related Post: