Building In Accounting

Building In Accounting - Master your finances, impress investors, and reach your next milestone. Learn how to manage building assets effectively, covering depreciation, financial reporting, and tax implications. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. The buildings account is a fixed asset account that contains the carrying amount of the buildings owned by an entity. In the building products industry, the smart companies are looking down the road and devising ways to use m&a to buy the new capabilities that will define the industry’s future. The accountant will need to determine the useful life of the building and the depreciation method. Discover what you need to know about the systems for storing, organizing, and processing accounting information. Also, when preparing a balance sheet for your intermediate accounting class, make sure you. Like land, buildings are also known as real property assets. A construction company's tax accounting. “buildings” are structures that are permanently attached to the land, have a roof, are partially or completely enclosed by walls, and are not intended to be transportable or. Servicing clients in the united states, latin america, european. At build accounting, we go beyond financial peace of mind. The accounting treatment for building improvement processes can also be categorized into two broad categories: Like land, buildings are also known as real property assets. Renovation is the cost that company spends to modify the building and it will not increase the building’s useful life. In the building products industry, the smart companies are looking down the road and devising ways to use m&a to buy the new capabilities that will define the industry’s future. A construction company's tax accounting. They might keep on hand items such as building materials, supplies, personal protective equipment and tools. Accounting for assets under construction. Learn how proper accounting practices ensure accurate. The cost of a building includes not only the purchase price but also. Completed in 2024 in france. Understand the fundamentals of building accounting, including capitalization, improvements, and cost allocation. Capitalized building improvements, and expensed. Learn how proper accounting practices ensure accurate. Accounting for building assets is a critical aspect of financial. They might keep on hand items such as building materials, supplies, personal protective equipment and tools. Like land, buildings are also known as real property assets. It deals with the detailed financial management of construction projects,. Unlike land, buildings are depreciable. In this article, we will discuss best practices and walk you through the steps to. Under generally accepted accounting principles (gaap), your accounting has to track the carrying amount of fixed assets, such as buildings, equipment and vehicles. A construction company's tax accounting. Understand the fundamentals of building accounting, including capitalization, improvements, and cost allocation. Learn about the theory and practice of different kinds of auditing. Also, when preparing a balance sheet for your intermediate accounting class, make sure you. Discover what you need to know about the systems for storing, organizing, and processing accounting information. They might keep on hand items such as building materials, supplies, personal protective equipment and tools. Completed in 2024. The carrying amount is the. Unlike land, buildings are depreciable. Completed in 2024 in france. Build foundational knowledge in various aspects of taxation structures. A construction company's tax accounting. Build foundational knowledge in various aspects of taxation structures. Learn how proper accounting practices ensure accurate. Construction accounting is uniquely tailored to the construction industry. Fixed assets can be recorded within a number of classifications, including buildings, computer equipment, furniture and fixtures, and office equipment. A construction company's tax accounting. Brett isn't just a cpa, he's become a trusted advisor for my business. Buildings are a significant asset for any business, and they can be depreciated over time. It deals with the detailed financial management of construction projects,. In the building products industry, the smart companies are looking down the road and devising ways to use m&a to buy the. The accounting treatment for building improvement processes can also be categorized into two broad categories: The cost of a building includes not only the purchase price but also. Completed in 2024 in france. Buildings are a long term depreciable asset that is part of plant property and equipment. Build foundational knowledge in various aspects of taxation structures. The buildings account is a fixed asset account that contains the carrying amount of the buildings owned by an entity. Accounting for building assets is a critical aspect of financial. Completed in 2024 in france. Learn about the theory and practice of different kinds of auditing. Like land, buildings are also known as real property assets. The accounting treatment for building improvement processes can also be categorized into two broad categories: Learn how to accurately record building purchases in accounting journals, covering deposits, closing costs, mortgages, and depreciation adjustments. As building codes require more insulation and greater airtightness, moisture problems are becoming more common. Under generally accepted accounting principles (gaap), your accounting has to track the. The accounting treatment for building improvement processes can also be categorized into two broad categories: Understand the fundamentals of building accounting, including capitalization, improvements, and cost allocation. Discover what you need to know about the systems for storing, organizing, and processing accounting information. Accounting for assets under construction. The carrying amount is the. At build accounting, we go beyond financial peace of mind. The buildings account is a fixed asset account that contains the carrying amount of the buildings owned by an entity. In the building products industry, the smart companies are looking down the road and devising ways to use m&a to buy the new capabilities that will define the industry’s future. Brett isn't just a cpa, he's become a trusted advisor for my business. In some situations, the cost of meeting regulatory standards and compliance certifications is prohibitive, which results in reduced competition for. Renovation is the cost that company spends to modify the building and it will not increase the building’s useful life. As building codes require more insulation and greater airtightness, moisture problems are becoming more common. In this article, we will discuss best practices and walk you through the steps to. Paragon cpas and advisors to personal and business clients providing tax planning, audit, and strategic business services. A construction company's tax accounting. Learn how proper accounting practices ensure accurate.Future of accounting Building the next gen accounting firm

AIGALEO Accounting Offices building TRIANTOS Architecture

Building a strong accounting foundation for business

Importance of Relationship Building in Accounting Career

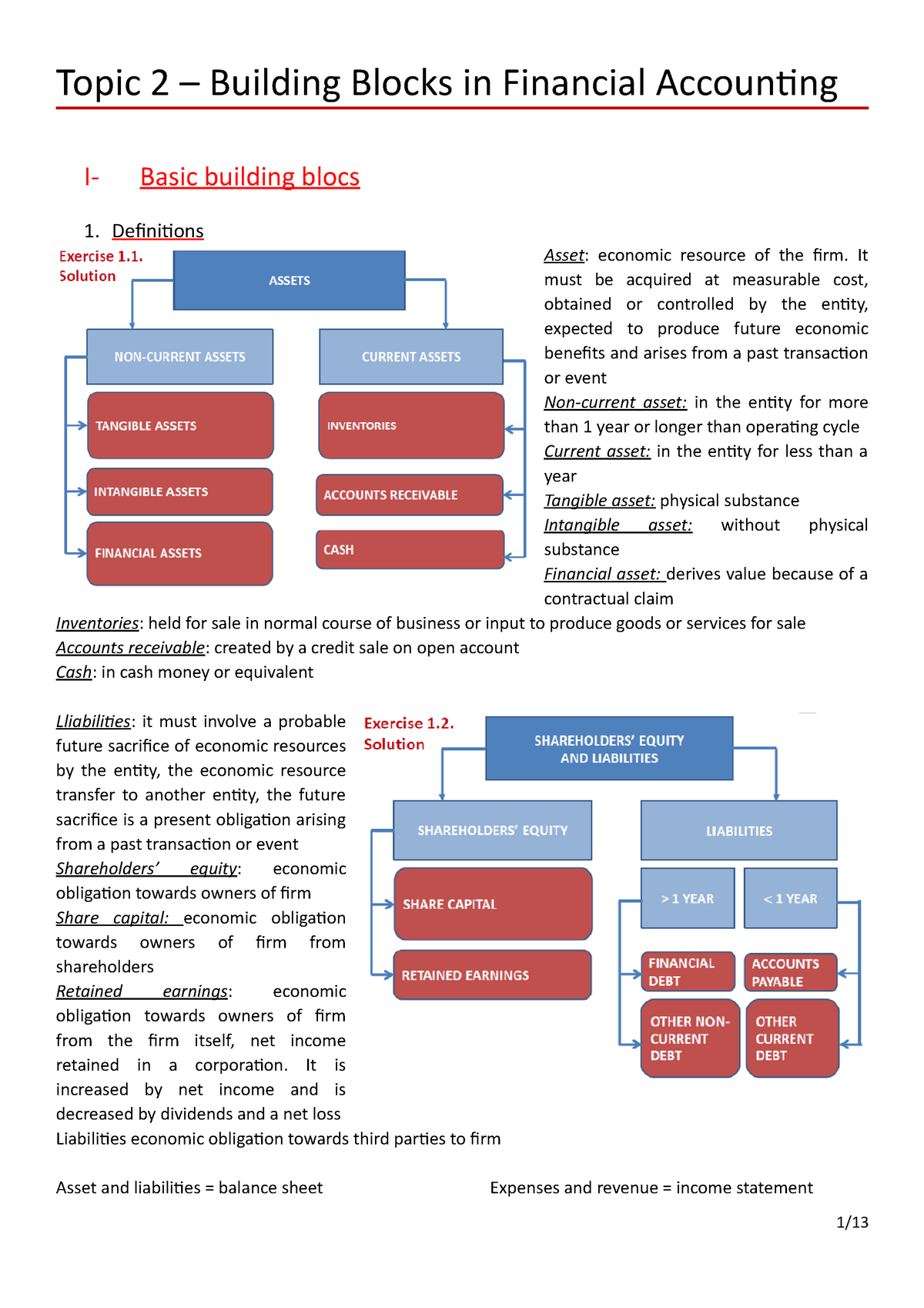

Topic 2 Building Blocks in Financial Accounting Topic 2 Building

accounting solutions for the main office and the home office QBLA

Accounting Firm Office Design

PPT Chapter 1 Accounting in action PowerPoint Presentation, free

Accounting Office Building

Importance of Relationship Building in Accounting Career

Construction Accounting Is Uniquely Tailored To The Construction Industry.

Like Land, Buildings Are Also Known As Real Property Assets.

So It Will Be Recorded As The Operating Expense.

Buildings Are Considered Real Property And Are Generally Depreciated Using The Straight Line Method.

Related Post: