Building Insurance Cost

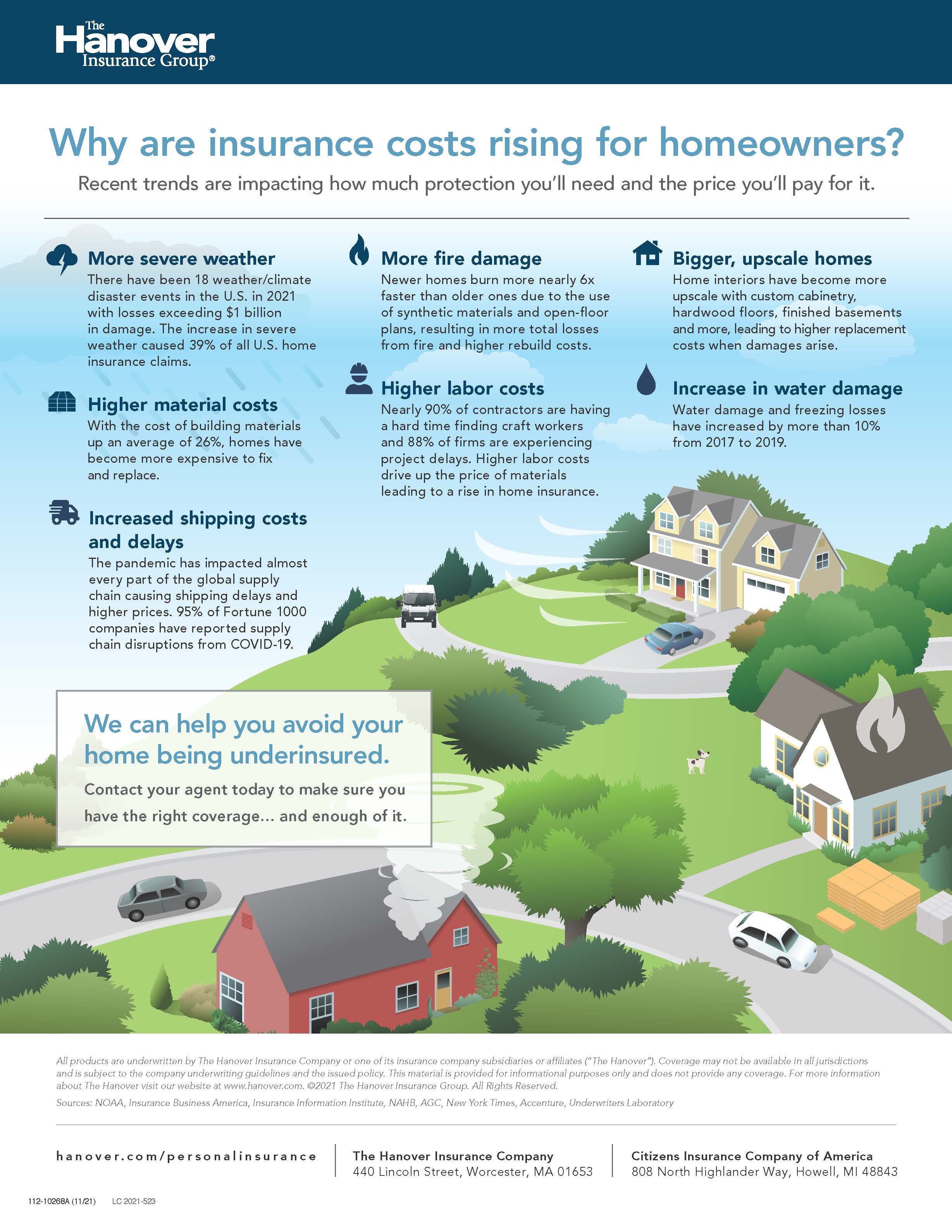

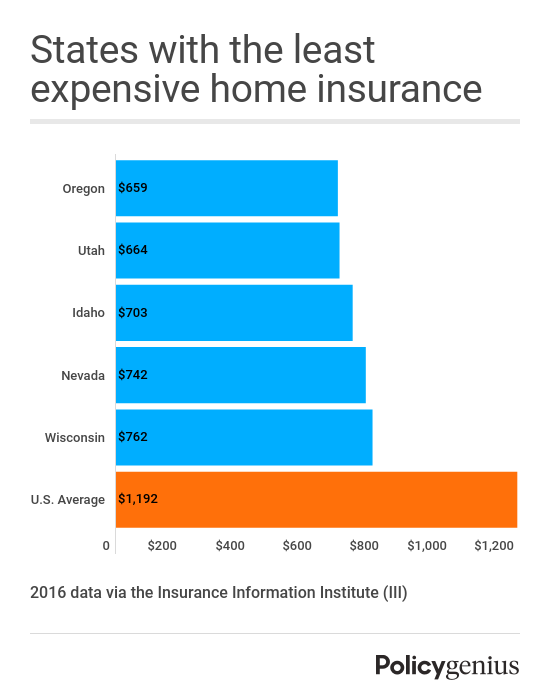

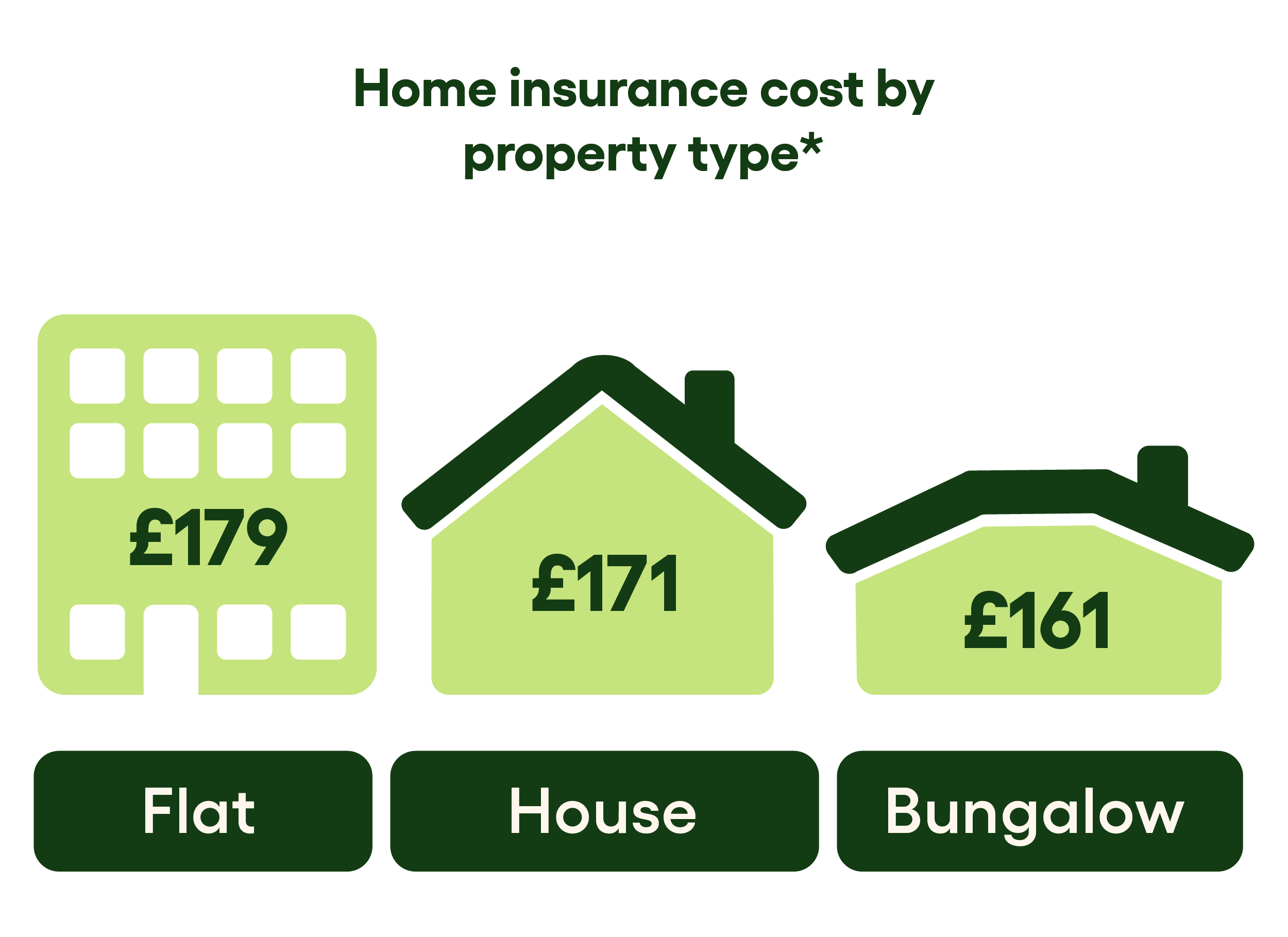

Building Insurance Cost - Calculate your costs based on where you live and other factors. Our homeowners insurance cost calculator can give you an estimate of what you might pay for your policy based on factors specific to you and your home. Rates vary by individual factors, but homeowners insurance premiums can cost more than $2,000 per year. The bailout will likely lead to higher insurance premiums for california homeowners. From 2020 to 2023, those costs have increased by 33%, rising from $1,902 per year to $2,530, based on research by. Home insurance estimates are $1,516 per year for a typical home. New research reveals that rising insurance costs, reckless building, regulatory inaction, and big banks' fossil fuel investments are driving a dangerous cycle that jeopardizes. Home insurance in chicago can be pricey, with an average cost of $2,682 for $300,000 in dwelling coverage. The average home insurance cost in the u.s. The disaster is expected to further. To help our customers plan for their dreams and recover from the unexpected by providing the perfect products according to individual needs. By answering a few questions about your net worth, deductible preference, and the cost to rebuild your home and replace your belongings, our property insurance calculator can estimate home. It’s usually more expensive to buy building and contents insurance as two separate policies. The average annual premium for homeowners insurance in the united states is $1,406 per year or about $117 per month. Before the la blazes destroyed more than 12,000 buildings. The move will likely lead to higher costs for households across the state, and may push more insurers to leave, intensifying a home insurance crisis. This is above the national average, which is $2,258 for the. What's the average cost of homeowners insurance? One size won’t fit all with home. Learn how choosing replacement cost in your home insurance policy protects you against financial gaps after a disaster, so you can rebuild without worry. Home insurance in chicago can be pricey, with an average cost of $2,682 for $300,000 in dwelling coverage. Rate data from quadrant information services suggests that, on average, a policy with a. This all contributes to rising home insurance premiums. One size won’t fit all with home. Before the la blazes destroyed more than 12,000 buildings. How much does home insurance cost? Find out how to calculate your home insurance cost before comparing quotes with moneysupermarket. The disaster is expected to further. Our homeowners insurance cost calculator can give you an estimate of what you might pay for your policy based on factors specific to you and your home. New research reveals that rising insurance costs,. Home insurance estimates are $1,516 per year for a typical home. The disaster is expected to further. Rising insurance costs were already a growing concern across the us, but california’s devastating wildfires could be the tipping point. The bailout will likely lead to higher insurance premiums for california homeowners. To help our customers plan for their dreams and recover from. Is $2,601 annually, or $217 monthly for $300,000 in dwelling coverage, but these rates vary based on where you live. Our homeowners insurance cost calculator can give you an estimate of what you might pay for your policy based on factors specific to you and your home. The average annual premium for homeowners insurance in the united states is $1,406. The move will likely lead to higher costs for households across the state, and may push more insurers to leave, intensifying a home insurance crisis. Rate data from quadrant information services suggests that, on average, a policy with a. The disaster is expected to further. Find out how to calculate your home insurance cost before comparing quotes with moneysupermarket. Rising. The average annual premium for homeowners insurance in the united states is $1,406 per year or about $117 per month. From 2018 to 2022, consumers living in the. This is above the national average, which is $2,258 for the. The disaster is expected to further. Rising insurance costs were already a growing concern across the us, but california’s devastating wildfires. From 2018 to 2022, consumers living in the. Rising insurance costs were already a growing concern across the us, but california’s devastating wildfires could be the tipping point. Home insurance estimates are $1,516 per year for a typical home. The average home insurance cost in the u.s. That way, you’ll know if the quote. Our average homeowners insurance cost is based on a policy with $300,000 in dwelling coverage and liability and a $1,000 deductible, using nationwide data. Listen to this article · 5:26. This is above the national average, which is $2,258 for the. 59% of zebra customers visiting this page believe they are. Homeowners insurance costs are rising fast across the nation,. One size won’t fit all with home. Rate data from quadrant information services suggests that, on average, a policy with a. That way, you’ll know if the quote. Moneygeek's homeowners insurance calculator can help you quickly estimate the cost of your insurance coverage with no personal info — whether you’re considering insurance. The average home insurance cost in the u.s. Rising insurance costs were already a growing concern across the us, but california’s devastating wildfires could be the tipping point. From 2020 to 2023, those costs have increased by 33%, rising from $1,902 per year to $2,530, based on research by. Rates vary by individual factors, but homeowners insurance premiums can cost more than $2,000 per year. By building deep. 59% of zebra customers visiting this page believe they are. That way, you’ll know if the quote. One size won’t fit all with home. Home insurance in chicago can be pricey, with an average cost of $2,682 for $300,000 in dwelling coverage. To raise premiums and factor in. From 2018 to 2022, consumers living in the. It’s usually more expensive to buy building and contents insurance as two separate policies. The move will likely lead to higher costs for households across the state, and may push more insurers to leave, intensifying a home insurance crisis. Home insurance estimates are $1,516 per year for a typical home. The average home insurance cost in the u.s. Rate data from quadrant information services suggests that, on average, a policy with a. What's the average cost of homeowners insurance? New research reveals that rising insurance costs, reckless building, regulatory inaction, and big banks' fossil fuel investments are driving a dangerous cycle that jeopardizes. By answering a few questions about your net worth, deductible preference, and the cost to rebuild your home and replace your belongings, our property insurance calculator can estimate home. The bailout will likely lead to higher insurance premiums for california homeowners. Our homeowners insurance cost calculator can give you an estimate of what you might pay for your policy based on factors specific to you and your home.Why are insurance costs rising for homeowners? The Hanover Insurance

Average Building Insurance Cost For 3 Bedroom House Bedroom Poster

The Average Cost Of Building Insurance In 2023 What You Need To Know

Cost of Insurance 3 Best things should know

Average Cost of Home Insurance 2022 NimbleFins

How much does home insurance cost?

How much does building insurance cost?

Insurance costs more than six times greater for wood frame buildings

How Much Does Builders Risk Insurance Cost? Commercial Insurance

Average Cost of Commercial Building Insurance UK 2021 NimbleFins

Listen To This Article · 5:26.

This All Contributes To Rising Home Insurance Premiums.

Our Average Homeowners Insurance Cost Is Based On A Policy With $300,000 In Dwelling Coverage And Liability And A $1,000 Deductible, Using Nationwide Data.

Before The La Blazes Destroyed More Than 12,000 Buildings.

Related Post: